KRR has been on a tear the last couple of months. They are hitting on all cylinders and that is being reflected in the share price. I took profits (approximately 15% of my position) at 5.45 on Friday. I think there is still some more short-term upside, but I wanted to lock in some profits.

Karora Resources: After A 59% Run, There Is Still Plenty Of Upside

Jan. 03, 2023 1:31 AM ETKarora Resources Inc. (KRR:CA), KRRGF22 Comments29 Likes

Summary

- We are already seeing the impact of the Lakewood mill, as Karora had record gold production of 38,437 ounces in Q3 2022.

- The bonus, and the double bonus.

- The fair relative value for KRRGF is almost 2x its current price. A $1 billion market cap wouldn’t be a stretch, assuming the company hits its targets.

- I’ve been particularly impressed with Paul Huet, Chairman and CEO of Karora. He is passionate about the company and has continually delivered.

- Looking for a portfolio of ideas like this one? Members of The Gold Edge get exclusive access to our subscriber-only portfolios. Learn More »

claffra

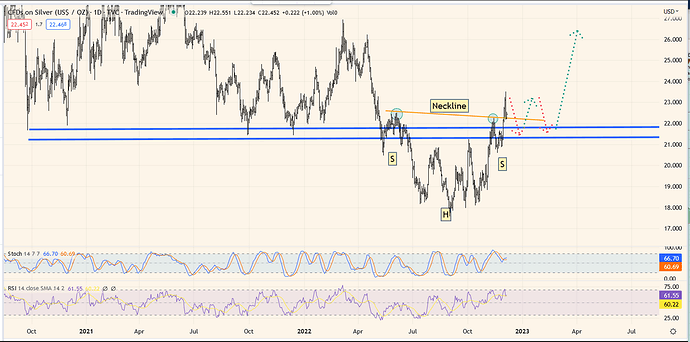

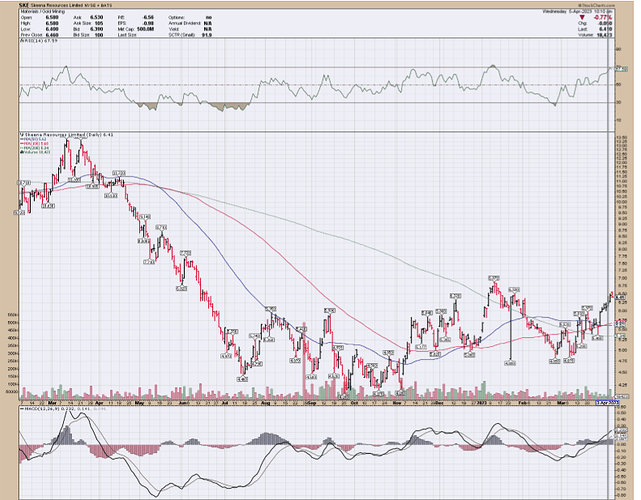

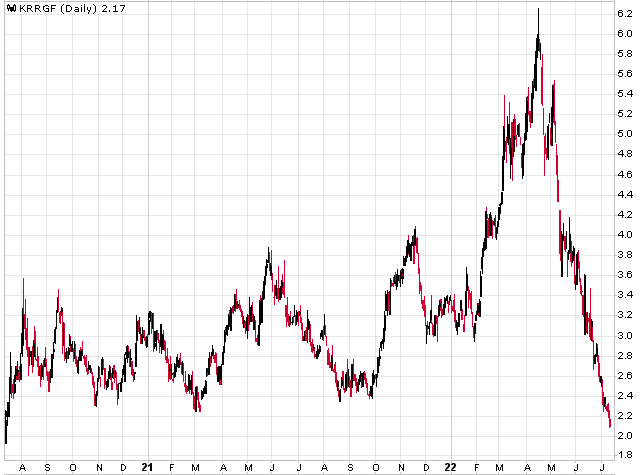

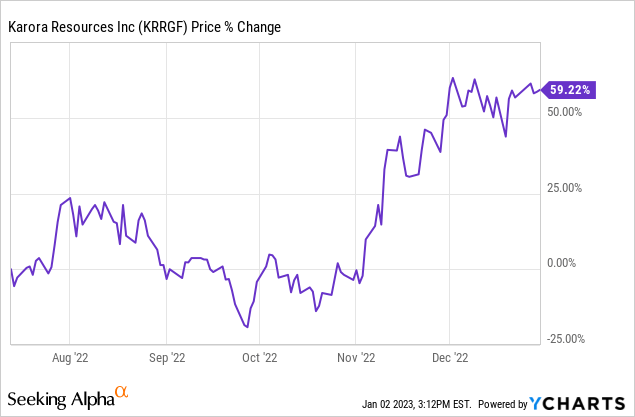

In July 2022, I added Karora Resources (OTCQX:KRRGF) to The Gold Edge portfolio as shares had lost 65% of their value from their peak hit less than three months prior and were trading around $2.20. As the chart below reflects, the stock had basically gone straight down. But there were many interesting layers to the Karora story, and I saw an incredibly bullish outlook. So much so that I put KRRGF in my top 10 list of gold stocks a few months ago.

Today, shares are trading at $3.45. But despite the almost 60% increase, I still see substantial upside to the stock.

Data by YCharts

Let’s examine all of these layers.

A Brief Overview of Karora And Its Assets

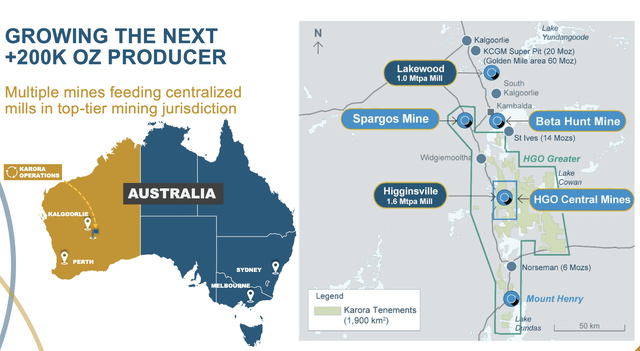

First, a top-down look at Karora. The company is based in Canada, but 100% of its production comes from Western Australia, or more specifically, the prolific Norseman-Wiluna Greenstone Belt, which hosts world-class gold orebodies, including the KCGM super pit, St Ives, Golden Mile, Norseman, and South Kalgoorlie. This belt also hosts world-class nickel deposits.

Karora has a sizable land package in the region, with several mines in production and two mill facilities. The Beta Hunt mine is the flagship operation, while the Higginsville Gold Operation (or HGO) consists of the HGO Central mines and Spargos mine. The Higginsville mill is capable of processing 1.6 million tonnes of ore per annum. Karora was looking to increase the size of the mill to 2.6 Mtpa as they expanded the Beta Hunt mine, but CapEx inflation this year negatively impacted the cost. The original quote for the expansion in 2021 was A$60 to A$65 million; by early 2022, the initial cost had increased substantially and was closer to A$120 million. The sag mill went from A$4.3 million to over A$12 million. Not only did CapEx surge, but the timing was also pushed back from Q4 2023 to 2024 (with no firm completion date). Karora hit the pause button on the mill expansion as it knew the price tag and delay weren’t acceptable. However, an opportunity arose last summer, as Karora was able to purchase the nearby Lakewood mill for A$80 million. Not only was Lakewood already processing ore, but Beta Hunt is 20 km closer to Lakewood compared to the Higginsville mill.

Karora Resources

So Karora was able to increase its milling capacity to 2.6 Mtpa at a far cheaper price than expanding the Higginsville mill, it didn’t have to wait 1.5-2.0 years for the expansion to be complete, and Lakewood was a closer distance to Beta Hunt. The cherry on top is that recoveries at the Lakewood mill are slightly higher compared to Higginsville.

The Huge Impact Of Lakewood

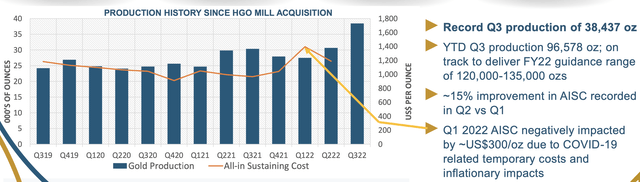

We are already seeing the impact of the Lakewood mill, as Karora had record gold production of 38,437 ounces in Q3 2022, trouncing the previous record set in Q2 2022 by 25%. Meanwhile, all-in sustaining costs dropped 10% QoQ to US$1,069 per ounce. Most gold miners are experiencing rising cost in the current high inflation environment, but not Karora, as AISC are flat to declining compared to 2019-2021.

Karora Resources

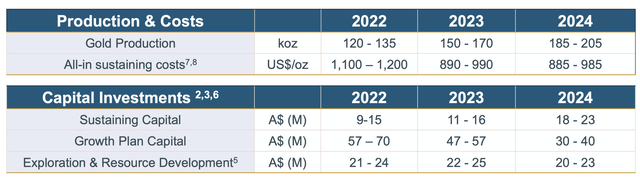

Rising production and lower cost is a trend expected to continue over the next few years, as Karora expects output to climb from 120,000-135,000 ounces of gold in 2022 to 150,000-170,000 ounces in 2023 and increase even further in 2024. AISC is expected to drop to sub-US$1,000 per ounce as production rises.

Karora Resources

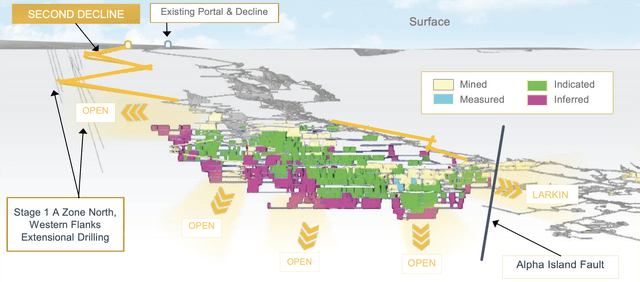

Most of this increase in production will come from the Beta Hunt mine. Karora has taken the operation from 30,000 tonnes per month to 100,000 tonnes per month with a single decline, and now they are trying to repeat that success with a second decline, which will increase tonnage from 1 million tpa to 2 million tpa. Interestingly, the company is already above 1.2 million tpa with a single decline. The second decline is in development and should be complete by Q1 2023, which is sooner than the previous mid-2023 completion date. It’s also coming in under budget. When the second decline is finished, Karora will get rid of one of the major bottlenecks of the operation. And it has the milling capacity now as well.

Karora Resources

Karora also recently announced the hiring of a new COO who was GM of the St Ives gold mine and took the operation from 300,000 ounces of production to 390,000 ounces and reduced all-in cost by 28%, all while improving safety. St Ives is literally next door to Beta Hunt.

Let’s dive into the Beta Hunt mine a bit more because it’s an incredibly interesting story.

Beta Hunt — A Deep Dive

It’s Not Just Gold

Beta Hunt was an underground nickel mine for 40 years. There is 400+ km of underground development already in place, which would cost over A$2 billion at current development prices. All of the grey-shaded areas in the diagram above are the existing infrastructure.

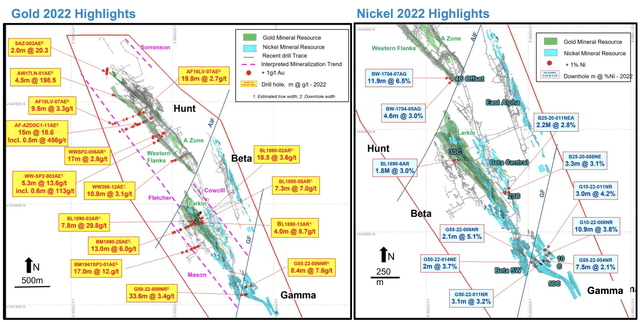

What’s a very rare feature of Beta Hunt is that it hosts both gold and nickel resources in separate adjacent mineralized zones. The focus was always on the nickel resources, as most of the gold was low-grade. However, several years ago, Karora discovered coarse gold at Beta Hunt, which had bonanza-grade. There were only a modest amount of resources—not enough gold to build a sustainable mine—but the production of coarse gold provided cash flow and kickstarted aggressive exploration at Beta Hunt.

Since then, gold resources have grown considerably, with almost 2 million M&I and Inferred ounces at Beta Hunt as of January 31, 2022, or more than 4x the amount compared to 4-5 years ago. The grade is low at just 2.6 g/t, but these are wide zones of mineralization that are amenable to bulk mining.

Karora continues to intercept new wide zones of mineralization at Beta Hunt, many of which are well above the current resource grade. At Larkin, 29.8 g/t over 7.8 meters was intercepted. Drill results from the new Mason zone just west of Larkin have confirmed gold mineralization over a 300-meter strike length, with one hole intercepting 12.0 g/t over 17.0 meters. This is such a large system of underground tunnels that Karora can easily explore and find gold that is sometimes just 20-25 meters from the current infrastructure and could be brought into production quickly for just a small amount of development CapEx. But there are two sides to this Beta Hunt story, as Karora is also seeing incredible nickel exploration success. While the gold is mostly lower grade, the nickel is high-grade. The 4C Offset discovery included an intercept of 6.5% Ni over 11.9 meters, and this zone is only 25 meters from existing development at Western Flanks.

Karora Resources

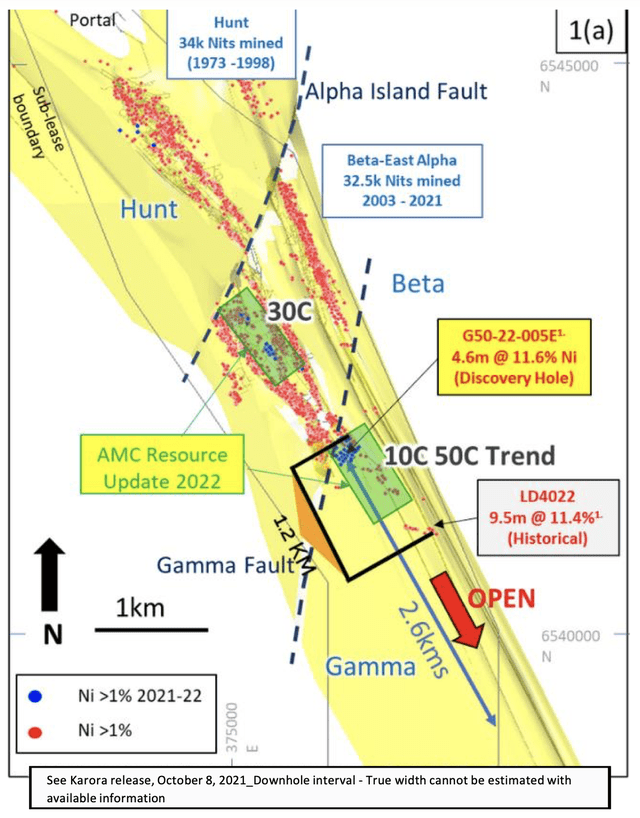

If you will notice the Gamma fault in the diagram below. All nickel that was mined at Beta Hunt years ago hit the Gamma fault and then stopped. Nickel prices were depressed at the time, and the company mining it hit the fault, tried to drill through the fault, but there wasn’t any nickel. What happened was the fault shifted the nickel up 80 meters. Karora put a tunnel in the area in 2021 and started drilling upwards and hit nickel in all 26 holes drilled. Like with gold, nickel resources at Beta Hunt have increased substantially, with the resource occurring in two main blocks, the Beta Block and Gamma Block. Continuous nickel mineralization has been defined over 800 meters in strike length at the 50C trend, and usually these trends don’t stop until there is a fault, so this area has the potential to extend 2.6 km in strike length. What’s even more interesting is the company says, “there hasn’t been a case at Beta Hunt where there is nickel and not gold below it.”

Karora Resources

The second decline provides access to the nickel as well, and Karora expects a significant increase in nickel production at Beta Hunt beginning in 2023.

The Positive Economics Of The Nickel Resources

A recent PEA on the current Beta Hunt nickel mineral resource estimated an 8-year mine life that would produce 9,435 payable nickel tonnes at a net AISC of A$16,946 per tonne of nickel sold (US$12,371 per tonne). On a by-product basis, AISC per ounce of gold could be reduced by A$80 to A$100 per ounce thanks to the nickel credits, with potential for even greater by-product credits as the nickel resource base grows.

The cost to ramp up the nickel production is estimated at just A$7 million in year one, as this is a “mine within a mine” and benefits from the shared, or dual-purpose, infrastructure.

BHP (BHP) just opened a nickel concentrator 4-5km away from Beta Hunt, and BHP has an offtake agreement with Tesla (TSLA) to supply Tesla with nickel, a key metal used to manufacture Tesla’s batteries. Karora has an agreement with BHP on nickel, as the BHP facility is right on their doorstep. In other words, Karora has a home for all of the nickel it produces.

A Huge Demand Increase Expected For Nickel Over The Next Decade, And Current Dwindling Supply

About 70% of the world’s nickel production is consumed by the stainless steel sector, while batteries account for 5%. However, demand from the battery sector is expected to surge, and 35% of total nickel demand could come from batteries by the end of the decade.

BHP expects demand for nickel in batteries will increase by 500% over the next decade, and anticipates that “demand for nickel in the next 30 years will be 200% to 300% of the demand in the previous 30 years.”

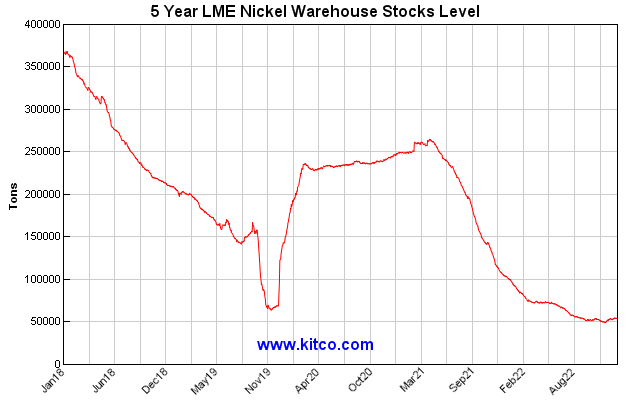

Meanwhile, LME nickel stocks are at exceedingly low levels.

Kitco

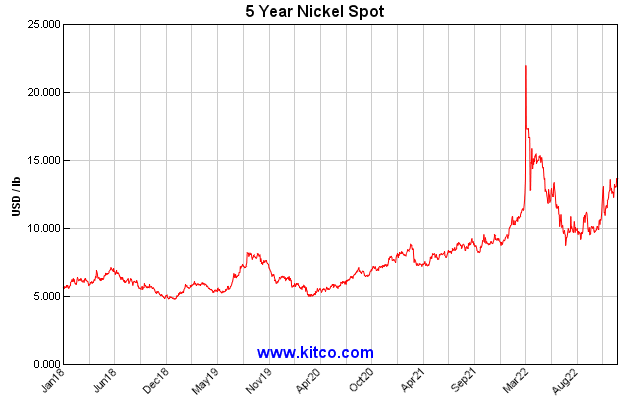

And the nickel spot price is starting to turn up again and remains in a multi-year uptrend.

Kitco

Beta Hunt has tremendous leverage to nickel, as a 20% increase in the nickel price results in a ~60% increase in NPV and ~130% increase in IRR.

The company says it best:

Karora is now in a very unique position, boasting strong gold production growth coupled with outstanding nickel by-product potential over the next several years – an enviable position to be in.

Nickel is the bonus, and then there is still the coarse gold at Beta Hunt.

Coarse Gold At Beta Hunt, The Double Bonus

In August, Karora announced a new high-grade coarse gold discovery at the mine, which contributed 2,436 ounces of gold last quarter. The company isn’t relying on this bonanza-grade ore to reach production targets, as these are only “periodic coarse gold injections,” and Karora still had record gold production last quarter even without this coarse gold. However, the coarse gold production is considered a sweetener and increases the cash flow and overall value of Beta Hunt.

Exploration Upside At Other Targets That Add More Value To The Story

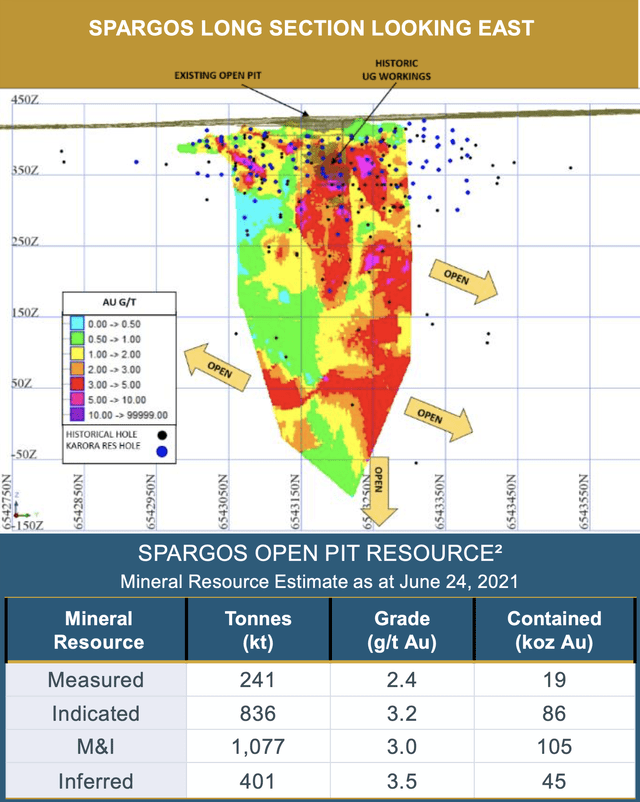

I’ve focused heavily on Beta Hunt, as that’s the central part of the story, but there are also some interesting exploration results coming out of Higginsville, specifically the Spargos gold mine.

First ore from the high-grade open-pit at Spargos was delivered to mill in Q4 2021, and production continues to ramp up at the mine.

There were only just over 100,000 ounces of gold at Spargos as of June of last year, but the open-pit grade is off-the-charts at 3 g/t. Limited drilling at depth and along strike have occurred at the mine and there appears to be potential strong upside as multiple recent drill results have returned very high-grade gold intercepts within 100 meters of surface and across 400 meters of strike length, including 29.8 g/t over 19.0 meters (which included an interval of 99.5 g/t over 5.0 meters) and 27.3 g/t over 15.0 meters (which included 168.0 g/t over 1.3 meters).

Karora Resources

Valuation

Karora has maintained an exceptionally strong balance sheet with just over C$56 million of cash and C$40 million of debt at the end of Q3 2022. The company has no need to raise equity in the near future, as all of its growth is self-funded.

The market cap of the company is ~US$598 million. I’m projecting US$75 million of pre-tax free cash flow in 2023 and US$125 million in 2024 at $1,750 gold, based on the production and AISC estimates from the company. I expect that the 2024 run-rate will be sustainable over the longer-term, and that doesn’t include any upside from nickel.

With this level of cash flow and considering the company has some exceptional margins and the safe jurisdiction it operates, the fair relative value for KRRGF is almost 2x its current price. A $1 billion market cap wouldn’t be a stretch, but this valuation assumes that the company hits its targets.

The share price has rebounded aggressively from the September 2022 lows, but KRRGF remains almost 50% below its peak back in April of last year. I still think the stock is a strong buy, albeit more speculative than other more diversified and better-established gold producers. Karora is an up-and-comer.

A Final Note

I’ve been particularly impressed with Paul Huet, Chairman and CEO of Karora. He is passionate about the company and has continually delivered. He has turned Karora into one of the best stories in this sector, or maybe I should say one of the most intriguing. I will reserve the “best” characterization for when the company delivers on future targets.

Huet is one of the reasons why I’m taking a chance on KRRGF.

Karora Resources Stock: Still Plenty Of Upside (TSX:KRR:CA) | Seeking Alpha

Easy, Elrac, et al,

What gold stocks do you like the best heading into 2023? Ideally a company like KRR that is undervalued, producing, managing AISC, and has reserves or potential reserves to sustain and grow.

Looking for new, relative safe companies with upside

Thanks for the writeup Rick, I appreciate it! Knew there was a reason it was my biggest holding. I to flipped some for profit. My next biggest holding is NFG. I’m currently checking out PRYM as Pierre

Lassonde has been buying it .(believe he owns 4.2 million share so he’s in the 3% to 10% group) Haven’t bought any yet

Rick,

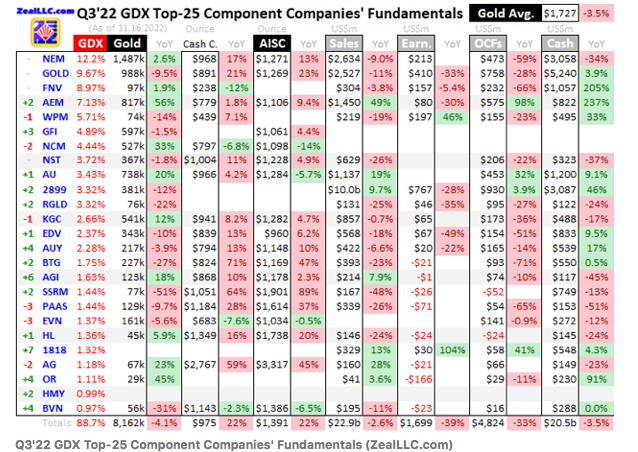

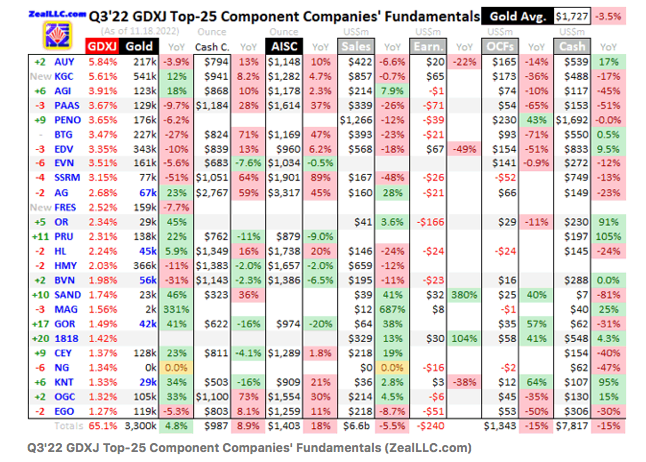

I’m spread out all over the place on the miners. I don’t think any can compare to Karora, but I’m very biased, as it’s my largest single holding and treated me very well. There aren’t many pure plays, but there are a few explorers I like. I may have completely different investment goals since I look for long term, and actually like both gold and silver plays. I don’t mind getting in too early and having to hold a year or more while I accumulate incrementally. Skeena is a favorite larger position. The 50 DMA has just crossed the 100 DMA and price has just crossed the 200DMA. It will be interesting to see how NFG plays out. KGC acquired Great Bear and has made excellent progress in it’s drilling program. The Company plans to declare an initial mineral resource estimate in early 2023 which should create more interest. I actually like HCHDF for a number of reasons with the 50 DMA just crossing 100 DMA and consider it under priced. There are a number of explorer silver plays I like, several in Nevada and elsewhere. Not quick in and out plays, but definitely long term safer plays are the larger companies. If your time horizon is longer, AEM, WPM, etc, I’m going to leave out so many I like! I’m beginning to like the whole PM mining space with far too many to try picking a single stock out, and I have positions in most of the streamers and many mid tiers and a few majors… How about I just post a couple recent annotated chart projections I ran across and the GDX & GDXJ top 25 …

Rick,

Everone wants to make a profit, but you know everyone has individual investment goals that differ on immediate and long term constraints. There will be many winners this year, so I know we all want to concentrate on those. I don’t really have any one best play, but from the GDX & GDXJ year over year winners are hinted at, but the last two years really destroyed the utility of charts for many of the miners. Individual “stories” are plentiful on the drillers and explorers. TR reposted a list from 2021 I made before he started the Charts for Metals and Stocks 2022. I’ll repost here, but just as there are many winners, my list also has some losers, so caveat emptor - everyones to do their own DD to fit their investment style. I haven’t updated this list at all but still have positions in the majority of them:

Speculative Stocks

(watchlist – add on opportunity)

| Stock | P/E | Mkt Cap |

|---|---|---|

| BKRRF | -3.22 | 48.2M |

| DOLLF | -10.3 | 44.6M |

| GPL | -5.35 | 78.9M |

| IRVRF | -14.9 | 63.2M |

| IVS.V | -13.51 | 27,2M |

| LTHHF | -23.1 | 127.4M |

| MLLOF | -5.47 | 8.0M |

| NRGOF | -3.57 | 10.9M |

| SKE | -5.23 | 652M |

| SLVRF | -21 | 70.7M |

| ESKYF | -17.5 | 326M |

| LAB.V | -26.5 | 71.3M |

| NKOSF | -27 | 56.4M |

| SSVR.V | -9.45 | 58.9M |

| SSVRF | -9.5 | 46.4M |

| RRSSF | 44.7 | 575.4M |

Stocks for Accumulation (Value? presently under 200 MA?)

| Stock | P/E | Mkt Cap | Div |

|---|---|---|---|

| ATUSF | 14.7 | 587M | 1.37% |

| BTG | 8.81 | 4.0B | 4.23% |

| FSM | 11.3 | 1.1B | |

| FTCO | 5.9 | 151M | 4.66% |

| GOLD | 16.7 | 33B | 1.4%% |

| JAGGF | 5.4 | 240M | 5.8% |

| NEM | 23.8 | 48.1B | 3.65% |

| NSR | 34.3 | 433.5M | 1% |

| RGLD | 4.05 | 6.7B | 1.18% |

| VALE | 3.51 | 66.8B | 19.8% |

Dividend & Spec?

| Stock | P/E | Mkt Cap | Div |

|---|---|---|---|

| FUND | 2.89 | 253M | 8.70% |

| IBM | 26.7 | 124B | 4.60% |

| JBSAY | 4.75 | 14.8B | 8.70% |

| MMP | 11.41 | 10.1B | 8.70% |

| URA | 1.26B | 5.40% |

Wildcards (mostly full positions) long-term holds

AUMC

ARV.AU

KRRGF

MDMN

NFGC

OROCF

SAND

SKE

WPM

Karora Announces Record Annual Gold Production of 133,836 ounces and Record Gold Sales of 132,047 ounces in 2022

TORONTO, Jan. 11, 2023 /CNW/ - Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to announce record annual consolidated 2022 gold production of 133,836 ounces from its Beta Hunt and Higginsville mines in Western Australia. Gold sales were also a record, totaling 132,047 ounces during 2022. For the fourth quarter of 2022, gold production was very strong at 37,258 ounces and sales were 39,849 ounces.

Prime Mining came out with some results today. Interesting property FWIW

Hi Rick

I have been adding the past month to my positions in the the companies below that have significant announcements today. I have a longer time horizon, primarily due to the expectation of a cyclic PM boom lasting several years.

EZ

Karora Resources Announces Significant Increases in Beta Hunt Gold Mineral Resources and Gold Mineral Reserves

Highlights:

- Gold Measured and Indicated Mineral Resources increased by 20% to 1.35 million ounces

- Gold Inferred Mineral Resource increased by 34% to 1.05 million ounces

- Gold Proven and Probable Mineral Reserve increased by 12% to 538,000 ounces

TORONTO, Feb. 13, 2023 /CNW/ - Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) (“Karora” or the “Corporation”) is pleased to announce Gold Measured and Indicated (“M&I”) Mineral Resource, net of depletions, at its flag ship Beta Hunt Mine has increased by 20% and the Inferred Mineral Resources have increased by 34%. The update is highlighted by the net additions to the Western Flanks zone of 146,000 ounces in Measured and Indicated Resources and 338,000 ounces of Inferred Mineral Resources. Gold Proven and Probable Reserves also increased by 12%, or 56,000 ounces, to 538,000 ounces. Both resources and reserves have an effective date of September 30, 2022.

Also see (longer term investments):

Kinross Gold Announces Robust Initial Mineral Resource of 2.7 Moz. Indicated and 2.3 Moz. Inferred for Great Bear Project

TORONTO, Feb. 13, 2023 (GLOBE NEWSWIRE) – Kinross Gold Corporation (TSX: K, NYSE: KGC) (“Kinross” or the “Company”) is pleased to announce an initial mineral resource estimate for its 100% owned Great Bear project located in Ontario, Canada.

The initial mineral resource estimate consists of 2.737 Moz. of indicated resources and 2.290 Moz. of inferred resources. The Company’s initial open pit and underground mineral resource estimate is set out in the table below. …

(https://www.kinross.com/news-and-investors/news-releases/press-release-details/2023/Kinross-announces-robust-initial-mineral-resource-of-2.7-Moz.-indicated-and-2.3-Moz.-inferred-for-Great-Bear-project/default.aspx)B2Gold Corp. Announces Acquisition of Sabina Gold & Silver Corp.

VANCOUVER, British Columbia, Feb. 13, 2023 (GLOBE NEWSWIRE) – B2Gold Corp. (TSX: BTO, NYSE MKT: BTG, NSX: B2G) (“B2Gold”) and Sabina Gold & Silver Corp (“Sabina”) are pleased to announce that the parties have entered into a definitive agreement (the “Agreement”) pursuant to which B2Gold has agreed to acquire all of the issued and outstanding shares of Sabina (the “Transaction”). …

… Strategic Rationale for B2Gold

Adds a high grade, fully permitted, construction ready gold project in Nunavut, Canada :

- A March 2021 Updated Feasibility Study on the Goose project outlined a 15-year life of mine, producing an average of 223,000 ounces of gold per year (average annual production of 287,000 ounces over first five years) from 3.6 million ounces of Mineral Reserves averaging 5.97 grams per tonne (g/t) gold.

- The Goose project has been significantly de-risked with 97% of procurement complete, pre-stripping having begun at the Echo pit, and 100% of plant site civil works completed.

- Will leverage B2Gold’s in-house construction and global logistics teams, with specific expertise in remote, cold weather environments (including winter ice road construction and operation) from constructing the Julietta and Kupol mines in Russia as part of B2Gold’s predecessor company, Bema Gold.

Enhanced operational and geographic diversification by combining B2Gold’s stable production base with a high grade, advanced development asset in a Tier-1 mining jurisdiction:

- Scarcity of high grade, long life, construction ready gold development projects located in mining friendly jurisdictions with meaningful production scale.

- With an estimated average head grade of ~6.0 g/t gold, the Goose project ranks among the highest-grade undeveloped gold projects globally.

- B2Gold will have production and development assets spanning four continents and located in both established mining jurisdictions and high growth emerging economies, serving to mitigate collective operational and geopolitical risk.

Significant untapped exploration potential across an 80 km belt :

- At the Goose project, all deposits (Goose, Echo, Umwelt, Llama, and Nuvuyak) are open along the eight kilometres of iron formation, providing considerable potential for mine life extension.

- At the George project (~50 km from the Goose project), over 20 km of iron formation (nearly triple the iron formation length of the Goose project) represents a highly prospective area to expand existing mineral resources.

- Over 40 targets have been identified at the George project for follow-up drilling.

- B2Gold is planning a significant exploration campaign for the district over the next few years.

Opportunity to optimize the development of the Back River Gold District with a stronger balance sheet:

- Potential to increase production in first five years of the mine life through accelerated development of the underground mine at the Goose project.

- B2Gold to complete optimization studies on various project initiatives which could improve long-term economics by allocating more capital up-front.

Immediately and meaningfully grows B2Gold’s attributable Mineral Reserves and Mineral Resources base:

- Attributable Proven & Probable Mineral Reserves increase by 66% to 9.0 million gold ounces.

- Attributable Measured & Indicated Mineral Resources increase by 52% to 18.5 million gold ounces.

- Attributable Inferred Mineral Resources increase by 63% to 7.4 million gold ounces.

Leverages B2Gold’s strong financial position and robust free cash flow generation to develop the Back River Gold District, with the potential for long-term tax synergies :

- Upon completion of the Transaction, it is anticipated that B2Gold would develop the Back River Gold District without further equity dilution to B2Gold shareholders.

- Development of the district offers the potential for long-term tax benefits from B2Gold’s Canadian tax pools.

(B2Gold - A Low-Cost International Senior Gold Producer | News)

A name that hasn’t been dropped in a while is Mux. I checked it out this morning seeing that Gold has been moving up and it’s trading over $7.00 a share. I remember a year ago it was under $1.00 nice move upward. TR you still in on this one?

No sir I sold it years ago and never looked back. After the reaming I took last year on a few others I’ve decided to delete all the mining symbols from my list (except MDMN/AURN) and stick to what I can day trade and make consistent money at.

The reason its trading at 7.00 is because there was RS 10:1 to stay listed on the NYSE.

Lots of projects moving forward across many mining companies.

Anyone else have a favorite stock to keep an eye on?

This news on Skeena caught my eye and should move SKE up long term:

Hochschild pulls plug on Skeena’s Snip option

Held by Skeena, Snip consists of one mining lease and eight mineral claims totalling 4 546 ha in the Tahltan Territory. Skeena acquired Snip from Barrick Gold in 2017.

The former Snip mine produced about one-million ounces of gold from 1991 until 1999 at an average gold grade of 27.5 g/t. Since then, the project has been improved with the recent construction of nearby infrastructure and substantially higher gold prices.

(https://www.miningweekly.com/article/hochschild-pulls-plug-on-skeenas-snip-option-2023-04-05)

Nice timing with gold up big today. KRR is one of my few holdings where I have 100% confidence in it and always swing trade around my core position. Still undervalued.

Anyone invested in Lithium beware of Nationalization!

Why Are Lithium Stocks LTHM, SQM, ALB, LAC Down Today?

Mining lithium in Chile may be getting more complicated

2h ago · By Samuel O’Brient, InvestorPlace Financial News Writer

- Big news out of Chile is sending lithium stocks crashing today.

- Chilean President Gabriel Boric is introducing a plan to nationalize the country’s lithium industry.

- This development could mean complications for electric vehicle (EV) producers.

The lithium industry is bracing for a crushing blow. Chile is one of the world’s largest producers of lithium, second only to Australia. Now, though, the country may be gearing up to nationalize the industry.

Chilean President Gabriel Boric plans on moving forward with an initiative to nationalize the country’s lithium industry. Under this new policy, international lithium mining companies would be forced to negotiate any new contracts with Chile. As this would likely cut into their profit margins, it isn’t good news for the industry.

Lithium stocks are down across the board today as markets react to this development. This comes amid rising speculation that lithium prices could be on the verge of rebounding.

(Why Are Lithium Stocks LTHM, SQM, ALB, LAC Down Today? | InvestorPlace)

Hi HR,

Been a few months since you posted this. Tomorrow’s FOMC may bring some surprises for whatever your favorite mining stocks are.

Yes, KRR is still a favorite, and like Elroc I have a very large position in NFG. Eric Sprott has quite a few investments in Newfoundland that he’s talked about as recently as yesterday. Perhaps you’ve already listened to it. It’s given me some interesting things to look at about other stock positions I have that are not in Newfoundland. I especially like the prospective plays in Nevada that are on sale now.

Gander Newfoundland had the mining conference yesterday where Eric Sprott was the Keynote speaker. His talk was very informative, gave me a new insight on the myriad positions I have in various other gold and silver stocks besides just NFG. I only listened to they Keynote address, so I don’t know what was in the 1st half hour, but Eric starts at about the 35 minute mark for any one interested. I highly recommend taking time to watch it as it applies to many of the precious metal miners and their profits based on grade and volume.

(https://www.youtube.com/watch?v=4mfPCPf_NF8&list=PL_i21kubdZSje7KbOFPB_lvvVpj-mUmNC&index=3)

Let me know if you have some additional favorite stocks other than KRR and NFG as many are undervalued and should do extremely well over the next couple of years.

Hey Easy If I can chirp in, I hold a nice position in KRR at $2.85 so up well but like you I think this will do well in the future holding long for now may add a little more, NFG bought small position but in the hole on it I think I should average down but there are some other good opportunities I like WRLG & ARIS which I just took a position on, I’m looking at BWCG, EQX and BTO love to hear your thoughts?

Taff,

I’m flattered you’d ask me my opinion on West Red Lake Gold Mines. I was totally unaware of it until you brought it up. I’ll be adding it to my watch list. I only took a brief look at it last night. For me, the chart is a negative to my investment style due to it having already doubled from it’s current 100MA after some very positive PRs. Long term I think it will do very well. (https://investingnews.com/innspired/resource-exploration-red-lake-district-ontario/)

Reminds me of the hype and enthusiasm we had on the Pilbara some years ago when I bought the precursor of KRR for 0.19. We’re in a very unique time with an impending recession where investors need to be cautious at the same time precious metals are in the early stages of what promises to be a historic cyclic Bull market. I think the action today across much of the gold and silver equities is validation that if gold is going to expected highs ($2300?), in general it is premature to be vacating your positions of miners before highs have fully peaked. I do trade around cores positions where I have oversized positions.

Did you watch the Sprott Keynote Address? Sprott starts out around the 23:30 mark showing a few graphs from 1999 to 2011. He comments the Nasdaq declined 77.4%, SPX went down 57.7%, Citi Group -98.2% (did an RS), Fannie Mae -99.6% … the point being we live in a complex financial world full of risks and uncertainties. GM went down 97.1% between 2007 and 2009, whereas Gold from 1999 to 2011 was up 525%. Pay attention to the the macro view.

That should give a sense of the opportunity we are presently in concerning the gold and precious metal equities. Between 2000-2011 the HUI went up 1708 %. The only equity I have like that, which is also up 1700% right now, is De Grey Mining.

DeGrey’s high value is driven by its size, grade continuity and growth potential, 1.3 g/t gold for 10.6 million ounces open pittable. A 10.6 million ounce Mineral Resource was just defined that includes the Mallina Gold Project, (8.5 million ounces from the Hemi discovery). I agree KRR should do well into the future as a steady producer, if a major doesn’t take it out prematurely. I’ve done well with a few buy out acquisitions by the majors, most recently Great Bear that gave me a nice position in Kinross, and a while back in Kirkland Lake Gold that positioned me in Agnico Eagle.

I see NFG primarily as an explorer at this point expanding it’s resources and may well be taken out in the future by a major, or perhaps JV with one. I do have a position in B2Gold that is basically even. I expect both to perform for long term gains. EQX I have a small starter position in. ARIS I haven’t looked at yet.

Regarding BWCG, as I already said, I was totally unaware of it until you mentioned it. It has a few strong negatives having just financed about 50M shares at C.20-.24 and options at 0.35 expiring in 2 years. It has nearly doubled from it’s current 100MA. Do you have a long time horizon? Frank Giusta participated in the financing taking 10M shares. I wouldn’t be in a rush to take a position here just because of how hard it spiked with recent news, but it is certainly worthy of watch list, and I may take a starter position in the .30s if it drifts there. Also has potential with it’s MRE on it’s Niblack property of an indicated Mineral Resource of 5.85 million tonnes at 0.94% Copper, 1.83 g/t Gold, 1.73% Zinc, and 29 g/t Silver. It has some early hi grade gold properties it just acquired also, so there’s much time to watch it grow and add incrementally picking up shares on dips with all the volatility. JMO

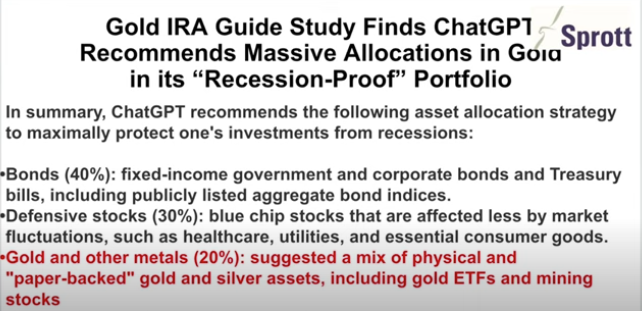

Chat GPT did come on the main thread a while back. Realize that this AI behemoth contains the entire internet of human knowledge to draw upon in forming it’s responses. Did you catch this graphic in the Sprott keynote address? I did finally watch the whole thing and was impressed that the PMs comprise only about 1% of investments! What would it take to reach 20%?

For fun, I did a quick Chat GPT on BWCG and got this rather generic response that I think you get on most any gold or silver miner these day.

FWIW: this is the question I asked, “Evaluate for potential investment in Blackwolf Copper and Gold Ltd, including risks.”

As an AI language model, I don’t have access to current financial or market data beyond my knowledge cutoff of 2021, and I cannot provide investment advice. However, I can provide some general information about the potential investment in Blackwolf Copper and Gold Ltd, as well as some risks to consider.

Blackwolf Copper and Gold Ltd is a mineral exploration company that is focused on the exploration and development of copper and gold deposits in Canada. The company’s main project is the Niblack copper-gold-silver-zinc project located in southeast Alaska. The company is relatively small, and its success is tied to the success of its exploration and development activities.

Potential investment considerations:

Exploration potential: The Niblack project is in the exploration phase, and there is potential for significant discoveries of copper and gold deposits. If successful, the project could significantly increase the value of the company.

Positive market conditions: Copper and gold prices have historically been volatile but have been on the rise recently. As demand for these metals continues to grow, Blackwolf Copper and Gold Ltd could benefit from favorable market conditions.

Experienced management: The company has an experienced management team with a track record of successful mineral exploration and development.

However, investing in a mineral exploration company like Blackwolf Copper and Gold Ltd carries some risks, including:

Exploration risks: Mineral exploration is a high-risk, high-reward activity, and there is no guarantee that the Niblack project will yield commercially viable deposits of copper and gold.

Market risks: The price of copper and gold can be volatile and can be affected by a range of factors, including economic conditions, geopolitical events, and supply and demand imbalances.

Regulatory risks: Mineral exploration and development are subject to a range of regulatory requirements, including environmental and safety regulations. Changes in regulations or an inability to obtain necessary permits could impact the company’s operations and financial performance.

Operational risks: The company’s ability to successfully explore and develop mineral deposits depends on a range of factors, including access to capital, technical expertise, and project management capabilities.

It is important to conduct thorough research and analysis before making any investment decisions, and to consult with a financial advisor to evaluate the potential risks and rewards associated with investing in Blackwolf Copper and Gold Ltd.

As you can see, you need to do your own DD, and define what your investment goals are, short, medium and long term and what you are willing to risk given your financial situation. I like the big producing miners for balance and stability, mid-tiers for growth potential, streamers for low risk and steady long-term income, and speculative equities for huge potential gains with commensurate risks of loss. Caution advised in these incredibly unpredictable times, but I do think there is a global currency war in progress that will result in a long PM commodity Bull. I like to keep an eye on what the BRICS countries are doing. (Disappointed, no-one except CS has posted to that thread I thought would be of interest.) It does not look good for the future of the US dollar, but does look like the PM equities/commodities will benefit. I do see BWCG did retrace this morning, but I’ll just keep an eye on it for now. I have other opportunities with all this volatility and my spec portfolio is rather full.

GLTA

EZ

Do you have time to do a little productive research? It seems like things are a bit slow on the main thread, so I thought it might benefit those that are looking for other opportunities to post something that may be of interest. Last Friday I sat in on a webinar I found quite interesting:

Precious Metal Royalty Conference - Triple Flag - Sandstorm Gold - Gold Royalty

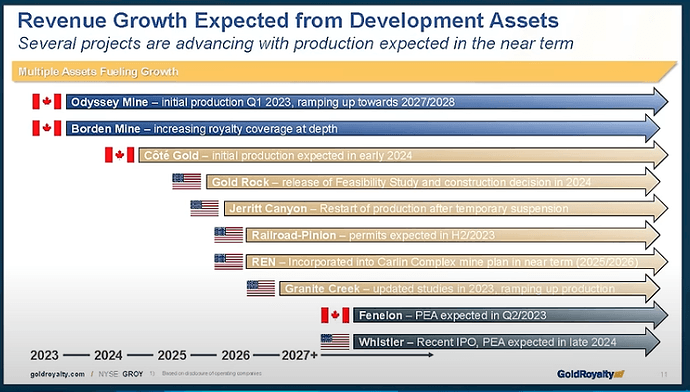

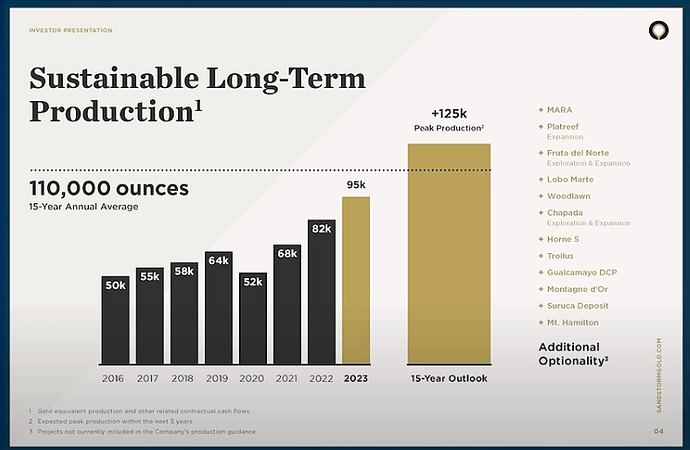

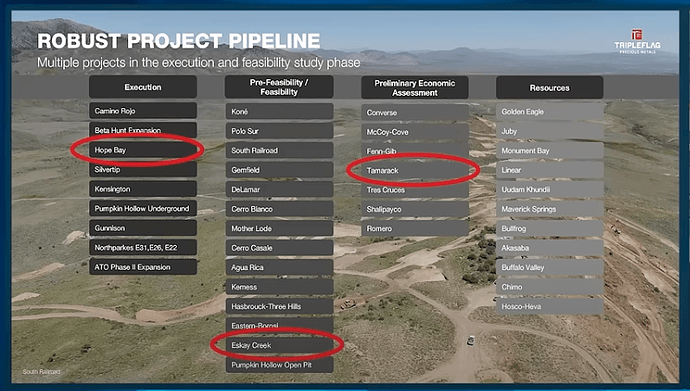

(https://www.youtube.com/watch?v=wI-KtNSYmkc)

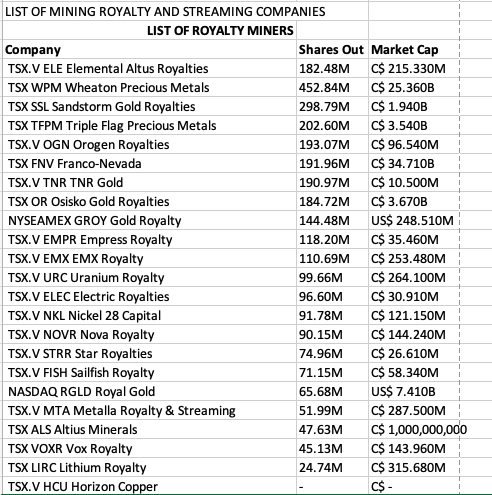

In my previous post I mentioned I like investing in a variety of mining categories; “I like the big producing miners for balance and stability, mid-tiers for growth potential, streamers for low risk and steady long-term income, and speculative equities for huge potential gains with commensurate risks of loss.“ GROY, SAND and TFPM were the individual companies highlighted in this conference. After watching the above presentation, I have started picking up a few shares of Triple Flag which has a large portfolio of assets in different stages of development, 29 of which are paying. I also liked the quick overview of many of the pipeline companies providing streaming royalties long term to the highlighted companies…

GROY

SAND

TFPM

Yes, I do have positions, now, in all three of the above mentioned Royalty/Streaming companies. If this area is of interest, you may gather additional investment ideas by doing DD from selected companies on this list.

(List of Royalty and Streaming Mining Companies - Junior Mining Network)

GLTA

EZ