Hey, great to see you post here again CHG.

I have faith, although the mining started on the ADL is unconventional, the efforts will eminently be successful.

I do have a starter position in Hot Chile … keeping an eye on it.

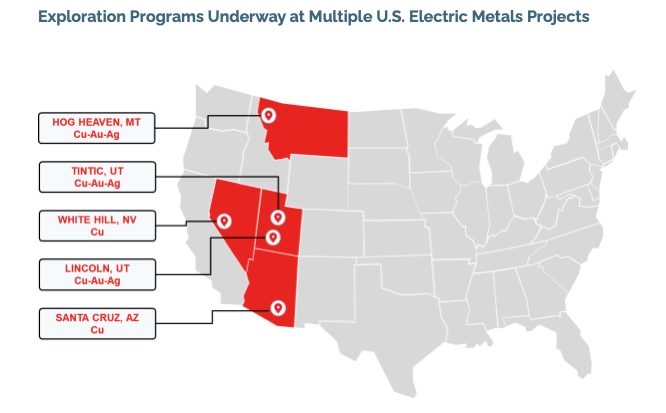

A lot of things are connected or interconnected. I still have a lot of highly speculative plays that lead me to companies that later JV or acquire them (like Hog Heaven , Cu-Ag-Au Project Montana – JV’d with IE.V). TheRod introduced NOVO & Bob Moriarty in September 2018 and Hurricane_Rick, in 2020 again mentioned NOVO, Bob Moriarty, and also LIO.V. I definitely took note and started acquiring a large position in Lion One the past couple of years. I’m quite sure others did as well. It pays to pay attention to the regulars on this board. Especially the ones much smarter than me! lol

Sadly, Covid put an end to much of the posting. I’d like to see it return. Perhaps I’ll mention more on LOMLF (LIO.V) in a later post, as the company anticipates their 1st gold pour in Oct. They are a very advanced company with great infrastructure and new deposits under exploration. But I stray from my main topic here today.

With so much uncertainty I’m less reliant on the smaller more speculative plays in my portfolio, many are in the red but should do OK in time. A few of my favorites in the less speculative near term and more developed categories include in no particular order: NFGC (NFG.v), PAAS, WPM, LUGDF, OROCF, LOMLF, CCJ, AEM, OR, SAND. Yes, I have positions in all tickers mentioned here. Don’t get me wrong; there is still risk in all of these, but they are worth doing the DD to see if they fit into your investment style and meet most of your investment goals in the much-touted commodity Bull reportedly starting. I still have many of the more speculative plays I’ve mentioned in the past and have added a few of the more popular ones not mentioned here today. You know, the heavily promoted ones that are drilling and showing some very large AU & AG deposits over the past few years. There are so many good plays out there. Perhaps a few reading here will start posting some of their favorites again.

My favorite CU play is Ivanhoe Mining, and unlike Hot Chili Limited, has a very large Mkt Cap at $10.8B (C$14.73B). If you’re not familiar with it you can read about it here and see the company video:

IVPAF (IVN.V) has two huge CU projects in the Democratic Republic of Congo (DRC). The Kamoa-Kakula Copper Mine is primarily a joint venture mostly with Ivanhoe Mines (39.6%), Zijin Mining Group (39.6%), and the DRC government. Kamoa-Kakula is gearing up to become the second largest copper complex globally. It is also projected to be the world’s highest-grade major copper mine. It is in a rapid expansion phase. Also, Ivanhoe Mines indirectly owns 64% of the Platreef Project, a tier-one discovery of platinum-group metals (palladium, platinum, rhodium ) , nickel, copper and gold mine project in South Africa.

Their investment with BHP in I-Pulse Technology (private company) intrigued me greatly.

From this clip and associated links:

(Animation of the plant confirmation)

And

(BHP, I-Pulse and I-ROX Enter into Strategic Collaboration to Advance New Applications of I-Pulse Technology) a private company

I’m also acquiring a position in Ivanhoe Electric (IE:TO) that has a great future and story to match.

steely-gray chalcocite, 80% copper by weight

(https://ivanhoeelectric.com/site/assets/files/6234/typhoon.jpg?30l5k2)

(https://www.ipulse-group.com/sites/ipulse-group.com/files/images/MineralExploration-main.png)

(Ivanhoe Electric Inc. | Overview)

So much ground to cover here, I’ll just provide the above links to explore.

GLTA

EZ