Definitely time to start nibbling at the miners. But keep the long term perspective.

FWIW - Gold should head back up Monday after Chinese return to the market from their Golden Week Holiday.

Gold may drop a little lower to the 50 week area ($1235 ish) . GDX finding support at 400 day exponential MA, historically a support area for the miners. Full sto and Macd starting to look up on gdx also, would assume anywhere between 21 and 22 looks like the bottom to me

MUX is a good example of how a mining company should be structured and managed. Our potential resources exceed theirs. Medinah’s structure and management is the problem. I believe with great leadership we can eventually get to and exceed their performance. No offense to Goodin but he is not or never will be a Rob McEwen.

Apples to oranges though. We’re essentially nothing more than a massively diluted holding company at this point, whereas MUX is a bonafide producer? While I love Rob McEwen, we simply need an ethical skeleton crew to manage things from here on out.

I know this spot is for discussion of other mining stock investments, but if anyone is interested in another sector which is starting to pick up you might want to check out medical marijuana. I’m all-in on our two little mining plays here but It would make me feel good just to learn that someone here had made some money on this rising sector. The following are the stocks I’m aware of so far.

I get an investment letter that believes that TRTC and CBDS are looking like the potential blue chips at this time, but please do your own DD before investing. I personally have no money invested in any of the following stocks. (It’s all in MDMN & CDCH).

TWMJF

OGRMF

TRTC

APHQF

MSRT

AERO

CANN

CBDS

More results from Barkerville (T:BGM). I hope some of you who contacted me bought over the last 2 days when it dropped to $0.54 (Can) when gold got hit on Thursday/Friday. IT’s bounced back in 2 days to $0.66

BGM-16-503: **11.62 g/t (0.34 oz/t) Au over 6.2**0 metres including 16.22 g/t (0.47 oz/t) Au over 3.60 metres

BGM-16-506: **10.74 g/t (0.31 oz/t) Au over 4.50** metres including 12.95 g/t (0.38 oz/t) Au over 3.50 metres

BGM-16-509: 38.35 g/t (1.12 oz/t) Au over 1.70 metres including 62.10 g/t (1.81 oz/t) Au over 0.50 metres

BGM-16-512: **6.05 g/t (0.18 oz/t) Au over 12.60** metres including 11.51 g/t (0.34 oz/t) Au over 4.70 metres

BGM-16-514: 192.50 g/t (5.61 oz/t) Au over 2.17 metres

BGM-16-517: **15.15 g/t (0.44 oz/t) Au over 5.60** metres including 32.41 g/t (0.95 oz/t) Au over 1.55 metres

BGM-16-518: 19.51 g/t (0.57 oz/t) Au over 3.00 metres including 41.10 g/t (1.20 oz/t) Au over 1.00 metres

BGM-16-522: **24.64 g/t (0.72 oz/t) Au over 4.00** metres including 35.75 g/t (1.04 oz/t) Au over 2.60 metresOT: Very hot sector!

Just for fun (boredom) I found the following that shows percent gain in descending order for these companies:

Green Leaf Innovations Inc. (GRLF) 1545%

JNS Holding Corp (JNSH) 1235%

RVUE Holdings Inc (RVUE) 770%

Cannabis Science, Inc. (CBIS) 630%

SpectraSCIENCE, Inc. (SCIE) 500%

MyECheck, Inc. (MYEC) 477%

GOOD TRADERS FORUM 473%

Vape Holdings Inc. (VAPE) 465%

Element Global Inc. (ELGL) 439%

Textmunication Holdings Inc. (TXHD) 421%

Buildablock Corp. (BABL) 415%

Nutritional High International Inc. (SPLIF) 413%

WallStreet Surfers 381%

FutureLand Corp. (FUTL) 375%

Novus Acquisition and Development Corp (NDEV) 369%

Boreal Water Collection Inc (BRWC) 367%

Ascent Solar Technologies (ASTI) 363%

PharmaCyte Biotech Inc. (PMCB) 347%

Cannabix Technologies Inc. (BLOZF) 327%

Arcis Resources Corporation (ARCS) 323%

World Moto Inc. (FARE) 318%

IDGlobal Corp. (IDGC) 300%

FROGGER’S HIDEOUT 300%

Integrated Freight Corp. (IFCR) 294%

SNM Global Holdings (SNMN) 273%

MediaTechnics (MEDT) 270%

IFAN Financial Inc. (IFAN) 262%

American Green Inc. (ERBB) 259%

CannaGrow Holdings, Inc (CGRW) 253%

United Cannabis Corp. (CNAB) 247%

ORIONS Money Stocks 242%

Dewmar International BMC Inc. (DEWM) 238%

Sunedison, Inc. (SUNEQ) 238%

SPY Technical Analysis (SPY) 237%

Baltia Air Lines, Inc. (BLTA) 236%

Vapor Group Inc. (VPOR) 232%

Wanderport Corp. (WDRP) 229%

DD Support Board and Fraud Research Team 226%

Neah Power Systems, Inc. (NPWZ) 225%

SMA Alliance, Inc. (SMAA) 225%

Dovarri, Inc. (DVAR) 224%

Supreme Pharmaceuticals Inc. (SPRWF) 223%

Canopy Growth Corp. (TSX:CGC) 219%

$$$$$$$~MARIJUANA~ PLAYS~&~BIG~MOMO/PROMO PLAYS~$$ 209%

Service Team (SVTE) 208%

GrowLife, Inc. (PHOT) 203%

Medical Marijuana, Inc. (MJNA) 203%

Cel-Sci (CVM) 200%

22nd Century Group (XXII) 200%

Nano Mobile Healthcare Inc. (VNTH) 196%

Not an endorsement for any of the above stocks. Just thought it interesting what so many in this other sector have done.

Did I miss something? Are we growing marijuana on the ADL now? I’m okay with it as long as we monetize it - legally of course.

They’re expecting a boom in pot sales as Medinah shareholders try to calm their nerves and pass the time

Now THAT’S Funny

Three month high in gold reached today, so far. Got to love the move going on with the miners and streamers!

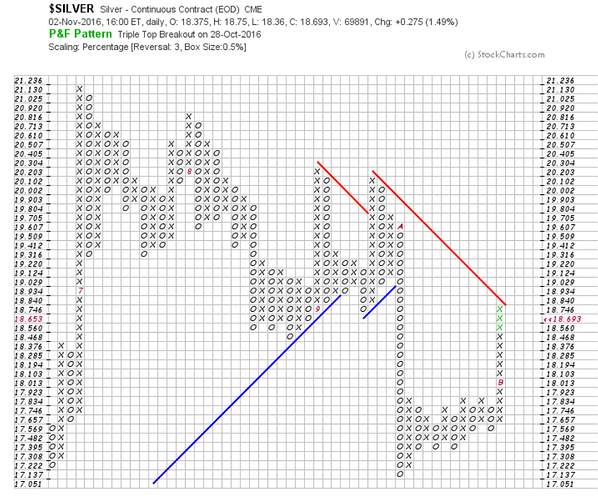

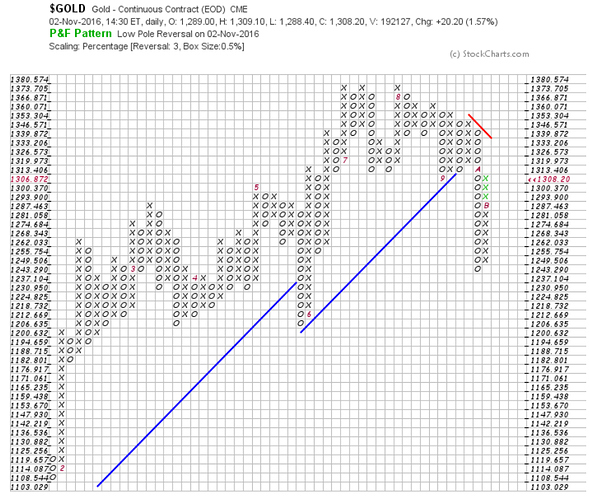

Addendum to the above post. Short term moves are great opportunities for traders. For longer term investments, some like to use P&F charts to determine trends, especially reversals. Generally, P&F chart users are looking for trend confirmations. To me, it looks like we may have a while to wait before trend reversals for the PMs are confirmed. P&F charts do not show timelines shown on most traditional charts. On the below charts, I have changed the standard scale of price movement to .5%. Hoping you may find the following useful, if not just interesting. For anyone interested, there is a lot of information concerning use of P&F charts shown here: Introduction to Point & Figure Charts [ChartSchool]

http://www.gowebcasting.com/conferences/2016/11/02/precious-metals-summit/day/1

All of the presentations from the Precious Metals Summit in Colorado taking place today and tomorrow.

Copper is on an absolute rip:

Since 2011, copper has been almost absolutely correlated with the wider commodity indices. But now copper broke out of its formation (before the election) and is ripping higher while oil just dropped into the $40’s and other commodities are not doing anything special.

Why?

That is a good question. Copper has often been a good pin-hole view into things going on inside China as well as a commodity price measuring stick. Jeffery Snider speculates this is due to ongoing problems China is having with the slowly collapsing Eurodollar (“dollar”) funding market. In other words, the collapse of the dollar as the international reserve currency. (a topic many talk about but few really understand the ‘how’ focusing instead on an easier topic of U.S. Treasuries held by foreign countries and selling of those etc.)

Could copper being pointing to a surge in inflation pressures coming our way from China instead of the punishing deflationary pressures we have been receiving since 2011? In other words, will all the other commodities now ‘catch up’? Maybe. It bears watching.

Could this be type of anticipation of a Trump victory and his promised $1T deficit financed spend on ‘infrastructure’? This approach is very similar to what China has been doing since 2008 and has been returning to in 2016. Yes, could be. Anticipation or not, the idea of fiscal (deficit) spending for infrastructure looks like it will go mainstream now that the U.S. is likely to proceed. This could put a big lift under commodity prices as everyone tries to stimulate their way out of the post-Great Recession blues. As China has shown however, there are only so many government built bridges to nowhere and ghost cities you can build and only so many real jobs results. But this could be another 4 or 5 year ‘phase’ in this ongoing crisis. It looks great at the beginning, all that shiny new stuff, but eventually the bill comes due.

What is Dr. Copper telling us? Something.

This occurred btw, with a dollar which was strengthening, which is the opposite of the expected.

Trump has caused a big dollar dip. If this continues to fall it could fuel further commodity / copper gains.

Thanks as always, CHG! Any thoughts on PMs in general now that the election is behind us?

Some recent developments on Inventus Mining (V.IVS or GNGXF) which I’m currently invested in and follow closely…

Last Friday, they announced the retirement of their CEO Wayne Whymark…nothing controversial. In his place they appointed current Director Stefan Spears, who is also Manager of Special Projects for McEwen Mining.

Then today the stock was halted in order to announce for the following news:

Inventus Announces Proposed Transaction To Consolidate100% Ownership in the Pardo Joint Venture

TORONTO, ONTARIO (Nov. 9, 2016) - Inventus Mining Corp. (TSX VENTURE: IVS)(“Inventus” or the “Company”)is pleased to announce that it has entered into a binding arm’s length letter agreement to acquire from Endurance Gold Corp. (“Endurance”) their 35.5% interest in the Pardo Joint Venture in exchange for the issuance of 25,500,000 common shares of the Company and a cash payment of $75,000. As a result of this transaction, if completed, Inventus will own 100% of the assets comprising the Pardo Joint Venture. The property is subject to a pre-existing 3% net smelter return royalty, of which 1.5% can be purchased for $1.5 million at any time.

“Consolidating the Pardo property is a highly strategic transaction for Inventus, it will allow us to act quickly to explore and potentially delineate the gold mineralization at the property. I believe, as do our major shareholders, that Pardo is an excellent exploration target with substantial merit,” said Stefan Spears, Chairman and CEO.

The Pardo Joint Venture property has a surface area of approximately 33 square km, the surrounding property (already 100% owned by Inventus) is approximately 137 square km, for a total project area of 170 square km covering the target paleoplacer geology.

The purchase is subject to regulatory approval, definitive documentation and closing. The transaction is expected to close on or before November 30, 2016. The current arbitration process between Endurance and Inventus has been suspended without prejudice and will terminate on closing of the transaction.

Endurance does not currently own any securities of the Company. Immediately following the transaction, Endurance will own 25,500,000 common shares of the Company representing 25.4% of the issued and outstanding common shares, which is a “Control Person” as that term is defined in the policies of the TSX Venture Exchange. The creation of a new Control Person requires approval by the “disinterested vote” of the shareholders which will be sought by way of written consents of shareholders holding in excess of 50% of the issued and outstanding common shares of the Company. The common shares will be acquired by Endurance for investment purposes, and depending on market and other conditions, it may from time to time in the future increase or decrease its ownership, control or direction over securities of the Company through market transactions, private agreements, or otherwise.

About Inventus Mining Corp.

Inventus is a mineral exploration company focused on the world class mining district of Sudbury, Ontario. Our principal asset is the Pardo Paleoplacer Gold Project located 65 km northeast of Sudbury. Pardo is the first important paleoplacer gold discovery found in North America. Inventus’ significant share owners include renown gold investorsRob McEwen, Eric Sprott, and Osisko Gold Royalties, as well as the former Chairman and CEO Wayne Whymark. Visithttp://www.inventusmining.com for more information.

This is a significant development for Inventus as their JV with Endurance has been the source of significant delays and arbitration. They lost this past summer’s opportunity to perform bulk sampling due to disputes with Endurance and a year ago they lost an entire season of exploration due to arbitration over the JV.

Getting Endurance out of the way now paves the way for Inventus to explore the Pardo paleoplacer property on their own terms and move this company forward.

While they are currently undergoing a shallow drill program to identify potential mineralization zones, I don’t expect much to occur until next summer when they can undergo a bulk sampling program. The Canadian winter severely hampers exploration. And the nature of the paleoplacer deposit is that the mineralization is at surface and traditional drill sampling has proven to be erratic, uneventful and unreliable in identifying targets, whereas channel sampling has been quite successful.

Copper is up another 4% this morning to $2.55

Gold is up 20% for the year. This will put copper just below that level for 2016.

So far no other commodities are showing the same short term behavior - EXCEPT IRON. What is going on?

Below is a chart for the $CRB commodity index. You can see that it has basically been flat for the year. So has copper until the last week of October. I thought at that time it was about to break out down. But it has done just the opposite.

You can see in the middle chart that since 2011, copper has just followed along (or led) the $CRB index. So this is the first major divergence in 5 years. The big question, will other commodities follow for all out commodity price inflation. So far oil is hanging tight.

It is very likely this is related to China internals and the ongoing shuffling of officials and the announcement that they will keep the Chinese economy growing at 7% come hell or high water, that is, more credit expansion and more construction, or stated another way, ‘forget rebalancing the economy to be consumer oriented, just keep building infrastructure and use lots of copper, iron, and concrete’

In addition, in the 24 hours since the U.S. election, I have heard ‘infrastructure bill’ over a dozen times. Trump was suggesting $1T for infrastructure before the election. It is coming probably in the first 90 days.

I think this is the expectation that the world is about to go on a significant building binge. This is ‘fiscal stimulus’ required because ‘monetary stimulus’ is worn out and has not worked.

In response basic material prices are going up in anticipation of major demand.