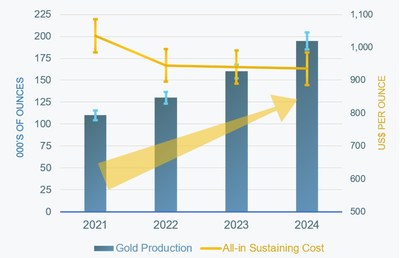

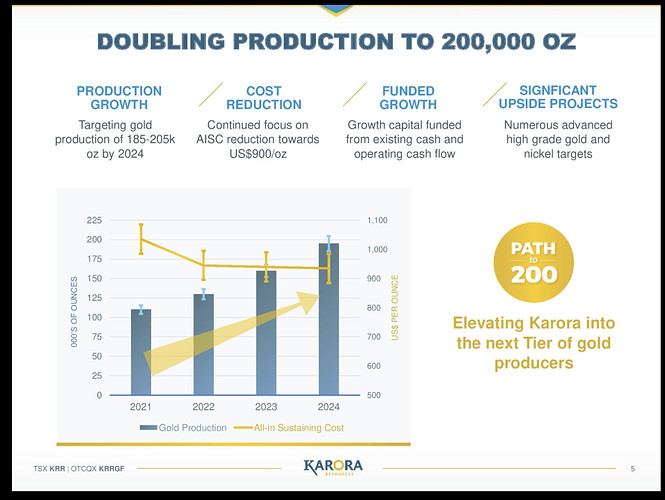

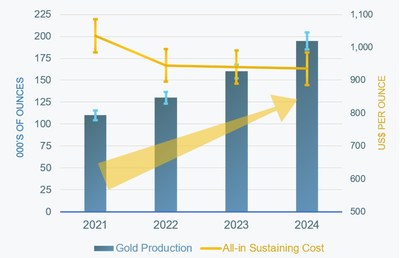

Karora Announces Three Year Production Guidance and Organic Growth Plan to Double Gold Production to 185,000 - 205,000 oz by 2024

Highlights:

- Three-year production and cost guidance doubling consolidated gold production to 185,000 – 205,000 ounces by 2024 at AISC of US$885-US$985 per ounce.

- Significant expansion of Karora’s primary asset, Beta Hunt, will see underground production increased to 2.0 Mtpa by 2024 through the addition of a second decline.

- Phase II expansion of Higginsville processing plant, increasing throughput to 2.5 Mtpa by 2024. Phase I expansion to 1.6 Mtpa from 1.4 Mtpa currently underway.

- Growth plan is organically funded through operating cash flows and current cash balance (end of Q1 2021 - C$76.7 million).

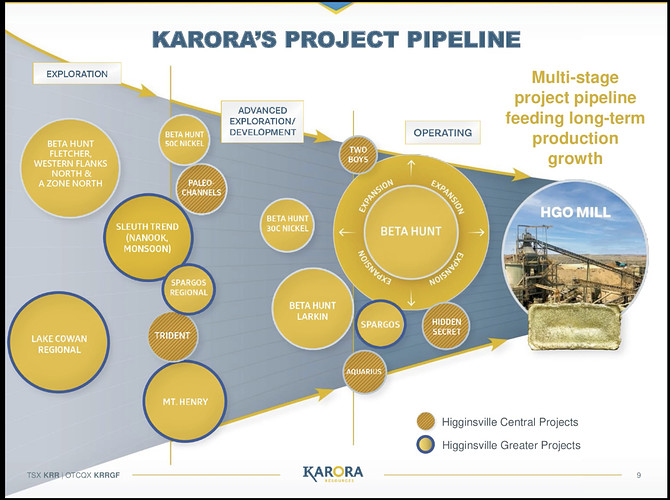

- Multiple upside projects identified that are expected to enhance growth profile beyond the current plan. These include the high grade Larkin Zone and high grade 30C & 50C nickel troughs at Beta Hunt as well as district scale potential at Higginsville.

- New, higher confidence Spargos Mineral Resource estimate, focused on near-term open pit mining. Measured and Indicated Mineral Resource estimate of 1.08 Mt at 3.0 g/t (105,000 ounces) and 0.4 Mt at 3.2 g/t (45,000 ounces) of Inferred Mineral Resource.

- Spargos deposit remains open at depth, both along strike and down-dip with significant exploration potential identified by a recent Karora geological review.

- Potential for valuation re-rating as Karora transitions into the next tier of gold producers with increased scale, margins and potential investor interest.

TORONTO, June 28, 2021 /CNW/ - Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to announce its multi-year consolidated growth plan to double gold production from 99,249 ounces in 2020 to a range of 185,000 – 205,000 ounces in 2024 at an All-in Sustaining Cost (“AISC”) of US$885 – US$985 per ounce.

As detailed in this news release, the growth plan will be driven by an expansion of Beta Hunt underground mine production to 2.0 Mtpa by 2024, from 0.8 Mtpa recorded in 2020. Increased production from Beta Hunt will be complemented by the Spargos Reward and Higginsville Central areas, with Spargos expected to begin mining ore in Q3 2021. This tonnage will be processed by the Higginsville mill, which will be expanded to a capacity of 2.5Mtpa by 2024 (Phase II), an increase from the current Phase I expansion to 1.6Mtpa from 1.4Mtpa that is currently underway.

Table 1 – Consolidated Multi-Year Guidance to 2024

| Production & Costs |

|

2021 |

2022 |

2023 |

2024 |

| Gold Production |

Koz |

105 - 115 |

120 – 140 |

150 – 170 |

185 - 205 |

| All-in sustaining costs |

US$/oz |

985 - 1,085 |

900 – 990 |

890 – 990 |

885 - 985 |

| Capital Investments |

|

|

|

|

|

| Sustaining Capital |

A$ (M) |

5 - 6 |

8 – 13 |

11 – 16 |

18 - 23 |

| Growth Capital |

A$ (M) |

40 - 46 |

45 – 55 |

47 – 57 |

30 - 40 |

| Exploration & Resource |

|

|

|

|

|

| Development |

A$ (M) |

20 - 23 |

21 – 24 |

22 – 25 |

20 – 23 |

- 2021 Guidance, which was announced in January 2021 (see Karora news release dated January 19, 2021), is unchanged. This production guidance through 2024 is based on the 2020 year-end Mineral Reserves and Mineral Resources announced on December 16, 2020.

- The Capital Investment amounts listed above, which the Corporation expects to fund with cash on hand and cashflow from operations, includes the capital required during the applicable periods to expand the capacity of the Higginsville mill to 2.5 Mtpa. See below for further detail regarding this expansion.

- The material assumptions associated with the expansion of Beta Hunt mining production rate to 2.0 Mtpa in 2024 include the addition of a second ramp decline system driven parallel to the ore body, ventilation and other infrastructure that is required to support these areas, and an expanded trucking fleet. The Capital Investment amounts listed above, which the Corporation expects to fund with cash on hand and cashflow from operations, include the capital required during the applicable periods to fund this production expansion. See below for further detail regarding this expansion.

- The Corporation’s guidance assumes targeted mining rates and costs, availability of personnel, contractors, equipment and supplies, the receipt on a timely basis of required permits and licenses, cash availability for capital investments from cash balances, cash flow from operations, or from a third-party debt financing source on terms acceptable to the Corporation, no significant events which impact operations, such as COVID-19, nickel price of US$16,000 per tonne, as well as an A$ to US$ exchange rate of 0.78 and A$ to C$ exchange rate of 0.91. Assumptions used for the purposes of guidance may prove to be incorrect and actual results may differ from those anticipated. See below “Cautionary Statement Concerning Forward-Looking Statements”.

- Exploration expenditures include capital expenditures related to infill drilling for Mineral Resource conversion, capital expenditures for extension drilling outside of existing Mineral Resources and expensed exploration. Exploration expenditures also includes capital expenditures for the development of exploration drifts.

- Capital expenditures exclude capitalized depreciation.

- AISC guidance includes general and administrative costs and excludes share-based payment expense.

- See “Non-IFRS Measures” set out at the end of this news release.

- See “Risk Factors” described on page 29 of the Corporation’s MD&A dated March 19, 2021.

Figure 1: 2021 to 2024 Growth and Cost Profile

Paul Huet, Chairman and CEO of Karora commented, "I am extremely pleased to announce our organic growth plan, which includes a three-year ranged guidance profile that is based on Karora’s 2020 year-end Mineral Reserves and Mineral Resources announced on December 16, 2020.

Our new growth plan doubles our ounce output, reduces costs and increases margins over three years. We are in a very strong position to deliver this plan funded from our current cash balance of almost $80 million and cash flow from operations during this period. Based on this robust plan, we also intend to refinance our existing $30 million debt facility to provide us with further flexibility over the coming years along with materially reducing our interest costs.

This growth plan to increase gold production from 99,249 ounces in 2020 to a range of 185,000 to 205,000 ounces in 2024 is, importantly, driven via the expansion of our primary asset - Beta Hunt. Over the past two years, we have optimized, improved and executed extremely well across our operations, with Beta Hunt leading these efforts. During this period, we have delivered seven consecutive quarters of reliable and robust production despite operational, weather and pandemic-related challenges. I am extremely proud of our operational accomplishments during this period, and as an operator at heart myself, I am very confident in our ability to deliver on this growth plan.

In addition to the Beta Hunt underground expansion and Higginsville mill expansion to 2.5Mtpa, we have several exciting projects that we expect will provide upside beyond the growth plan we are announcing today. If we are able to unlock the value in these projects, and I am confident we will, they will significantly enhance what is an already impressive path forward for Karora.

These additional opportunities include our plan to deliver a maiden resource estimate of the Larkin Zone, which will form part of our 2021 consolidated Mineral Resource and Mineral Reserve update. Based on drilling results to date, Larkin has the potential to increase grades above and beyond the current growth plan numbers. Furthermore, the potential future by-product nickel credits associated with the Beta Hunt 30C and high grade 50C nickel trough discoveries provide further upside opportunity, the latter having the potential to be higher grade than our current nickel Measured and Indicated Mineral Resource of 561 kt at 2.9% for 16,100 tonnes of nickel. We now have an exploration team dedicated to these high priority nickel areas at Beta Hunt. As we will continue to drill these zones and receive assays, we will update the market with developments.

On the subject of drilling, our 2021 program continues to deliver on the untapped exploration potential across our land package including Beta Hunt, Higginsville Central, Spargos and Lake Cowan. To date in 2021 we have completed 57,968 metres of our planned 68,500 metre exploration drilling program. In the first half of the year, drilling at Beta Hunt was focused on resource definition while drilling at Higginsville was more directed towards greenfields exploration, the bulk of which is associated with the Lake Cowan reconnaissance program. We are currently compiling and analyzing these results ahead of targeting our next phase of drill targets.

Lastly, I would like to acknowledge the very hard work of our entire team required to deliver this growth plan on time and on budget despite numerous external challenges. I know they are as excited as I am to get to work on executing this plan. Together we are confident it’s going to be an exciting journey ahead."

Higginsville Mill Expansion

Central to Karora’s growth plan is the expansion of the Higginsville mill as part of the Corporation’s hub and spoke model. The Phase I expansion of the mill from 1.4 million tonnes per annum (Mtpa) to 1.6 Mtpa is well under way, for relatively modest capital expenditure of approximately A$3 million.

The Phase II mill expansion is expected to reach a throughput rate of 2.5 Mtpa by 2024 at a total capital expenditure of A$50 million, as noted in our existing technical report dated January 29, 2021. It is expected that this A$50 million spend will be incurred from mid-2022 through mid-2023.

The key areas included in the Phase II mill expansion are the installation of a new semi-autogenous grinding (SAG) mill and motor and the associated extension of the conveyor system. The existing quaternary crusher will be repurposed as a pebble crusher in the SAG mill circuit while the existing ball mill, recently upgraded gravity circuit and elution columns will be reused in the expanded plant. Additional trash screens for filtering wet media, carbon in leach (CIL) tanks and a new thickener will be installed on the back end of the mill.

Once completed, the mill expansion would provide optionality to blend Paleo channel material with material from the Corporation’s other operating mines.

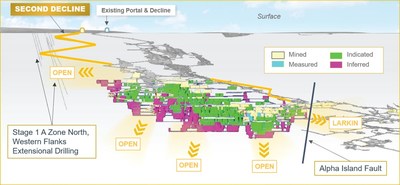

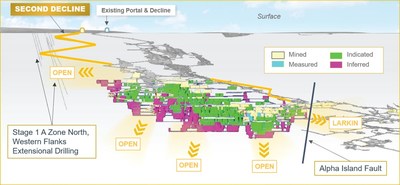

Beta Hunt Mine Expansion

The Beta Hunt Mine expansion represents the backbone of Karora’s growth plan and is expected to approximately double the production capacity of the mine from the current rate of approximately 75,000-85,000 tonnes per month (tpm) to 160,000 – 170,000 tpm by the end of 2024.

Karora commissioned Hatch Ltd. to investigate materials handling options for increased production rates at Beta Hunt. After extensive review of each option, and Karora’s significantly improved mining and hauling efficiencies, the Corporation selected the addition of a second decline and expanded trucking fleet to increase mining throughput at Beta Hunt. The addition of a second decline will best leverage the significant experience of the Beta Hunt underground mining team which have delivered outstanding operational improvements since the restart of operations in 2019.

The new decline will duplicate the current single access into the mine intersecting the existing workings 240 vertical metres below the surface. The decline is positioned adjacent to the up plunge extensions of current mining zones which will allow for gold mining operations concurrently with driving the decline – a distinct advantage. Increased mine development rates and expansion of the underground mining fleet will support the decline construction along with primary ventilation upgrades.

Figure 2: Beta Hunt Mine – Oblique Long section looking Northeast highlighting position of second decline

Note: Mineral Resources as of September 30, 2020. For scale, Mineral Resources shown cover a strike length of 2.5 kilometres.

Higginsville Central and Spargos Gold Project

The Higginsville Central “high grade core” and Spargos Gold Project are expected to provide a stable source of mill feed including a mix of feed from open pit and underground operations. Both brownfields restarts and new projects including Two Boys, Aquarius and Trident will complement the feed from the Spargos open pit and underground.

Aquarius

Pre-production works for the Aquarius mine commenced in the second quarter of 2021 with the final box cut, portal establishment and commencement of decline development to occur in the third quarter of 2021. The box cut has been positioned to provide most economical and practical access to the underground ore blocks and to intersect supergene ore close to the surface. These blocks will be mined as the box cut advances and will help offset overall development costs. Development of the decline will continue throughout the third and fourth quarter with initial level development ore expected late in the fourth quarter of 2021 and stope production starting shortly thereafter. The Aquarius deposit remains open along strike and at depth with follow up drilling to be carried out from the lateral underground development which will provide optimal drill bay locations.

Figure 3: Aquarius Mine box cut

Two Boys

Karora began mine re-entry works at Two Boys underground in the second quarter of 2021 following dewatering of the historical operations. Rehabilitation will continue throughout the third quarter of 2021 in conjunction with development to access remnant and new ore blocks. Initial conditions encountered at Two Boys have met, and in many places exceeded expectations. A revised development and stope production plan is currently being updated to include recent face samples (5-10 g/t), surface drilling and re-mapping of historic workings. Drilling is also underway into surface mineralization adjacent to Two Boys which could extend into the upper levels of Two Boys underground, previously not considered in the mine plan.

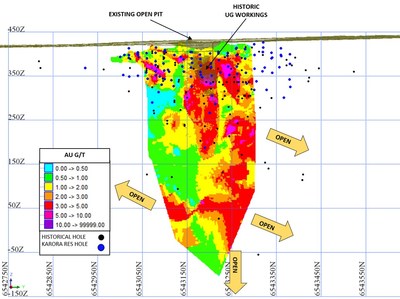

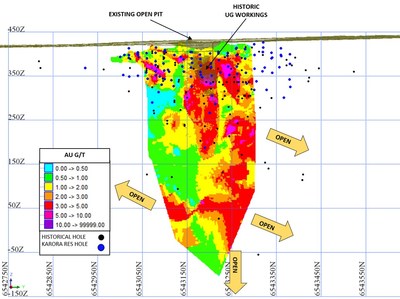

Spargos Gold Project Mineral Resource

Karora is also pleased to provide its initial Spargos Mineral Resource ahead of commencing mining in the third quarter. The new Resource presents a 15% increase in ounces but also a higher confidence basis from which to commence mining activities compared to the historic Corona Resources Mineral Resource estimate (Corona Resources news release “Resource Estimate Update for Spargos Reward Project Eastern Goldfields Western Australia’ dated on February 26, 2020”). The infill and resource definition drilling efforts completed by Karora, totalling 13,377 metres, were focused on delineating the near-term open pit mining opportunity for which initial pre- development activities have been underway since the first quarter of 2021. As such, significant step-out potential exists beyond the current estimate, particularly at depth where down-plunge and down-dip extensions remain virtually untested.

The initial Karora Spargos Mineral Resource includes the results of 138 Resource Definition holes and 375 surface grade control holes.

Table 2: Spargos Gold Deposit Mineral Resource Estimate as at June 24, 2021

Mineral Resource Measured Indicated Measured & Indicated Inferred

Kt g/t Koz Kt g/t Koz Kt g/t Koz Kt g/t Koz

Spargos 1.2.3.4.5 241 2.4 19 836 3.2 86 1,077 3.0 105 401 3.5 45

| 1. |

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves. |

| 2. |

The Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is also no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling, or into Mineral Reserves once economic considerations are applied. Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding |

| 3. |

Gold Mineral Resources are reported using a 0.5 g/t Au cut-off grade above 300mRL, and 1.6g/t Below 300mRL |

| 4. |

Mineral Resources described here are based on information compiled by Graham de la Mare, Principal Resource Geologist for Karora Resources. Graham de la Mare is an employee of KRR and is a Fellow of the Australian Institute of Geoscientists (FAIG, 1056). |

| 5. |

This Mineral Resource estimate may be materially affected by legal, political, environmental and other risks. |

| 6. |

Mineral Resource Estimate as of June 24, 2021. |

An extensive geological review completed by Karora exposed how little drill testing exists for underground mineralization below the 300mRL (150 m below surface) outside of the Mineral Resource. The northern margin is constrained by just three historic holes (including two wedges). These holes are considered to have missed the high grade plunging shoot positions which remain open at depth down plunge. The southern margin of the Mineral Resource is limited by a single historic hole and is considered virtually untested.

The northern and southern strike extensions of the Spargos Mineral Resource are also poorly tested by historic drilling and represent a significant underground growth opportunity. As such, the Resource remains open in both directions.

The next stage of exploration drilling will be focused on extending high grade gold mineralization outside the margins of the current Mineral Resource and at depth to further define the potential for a high grade underground operation at Spargos. High grade results announced in November 2020, including SPRC0026: 29.8 g/t over 19.0 metres, including 99.5 g/t over 5.0 metres, SPRC0012: 27.3 g/t over 15.0 metres, including 168.0 g/t over 1.3 metres and SPRC0019: 8.0 g/t over 19.0 metres, including 20.6 g/t over 2.0 metres (see Karora news release dated November 18, 2020), highlight the potential for the discovery of additional high grade shoots which have the potential to positively impact future mined grades.

Figure 4: Longsection looking west showing Spargos Mineral Resource represented by block model average grade across the width of the lode s

Note: All drilling (excluding surface grade control) is shown as pierce points. Interpreted north plunging high grade shoots remain open at depth

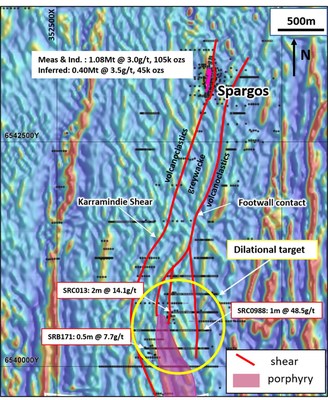

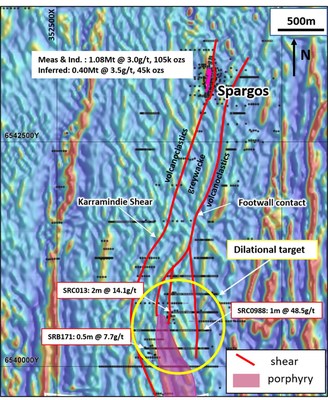

Potential to regionally grow the existing deposit outside of the immediate extensions of the Mineral Resource has also been identified. Interpretation completed by the Company’s site-based exploration team has targeted a mineralized position associated with a porphyry controlled dilational target (pressure shadow) 1.5 kilometres south of the Spargos deposit. This target is associated with historical, near surface downhole drill intersections including 14.1 g/t over 2 metres from 5 metres (SRC013), 7.7 g/t over 0.5 metres from 44 metres (SRB171) and 48.5 g/t over 1 metre from 2 metres (SR0988) reported by Corona Resources Limited. A qualified person of the Corporation has not completed sufficient work to verify such historic drill results. However, the Corporation believes that such drilling and analytical results were completed to industry standard practices. The information provides an indication of the exploration potential of the Spargos deposit but may not be representative of expected results.

Figure 5: Aeromag image covering eastern margin of the Spargos Project. Image shows interpreted position of prospective shears and structural target 1.5km south of the Spargos Reward deposit.

Further Exploration and Development Potential

Beta Hunt

Drilling on the Larkin trend was recently completed with drilling totalling 47 holes for 9,362 metres. Assays remain pending for the latest holes. Resource modelling on the Larkin Zone is expected to commence in the third quarter, with an initial Larkin Mineral Resource expect to be included in Karora’s 2021 consolidated Mineral Resource and Mineral Reserve update. The 30C Nickel Trough -– the first new nickel discovery at Beta Hunt in 13 years - sits approximately 5 to 10 metres above the Larkin Gold Zone has returned some strong nickel grades such as 7.7% nickel over 1.3 metres (BE30-009) and 8.6% nickel over 1.0 metre (BE30-010) (See Karora news release dated September 10, 2020).

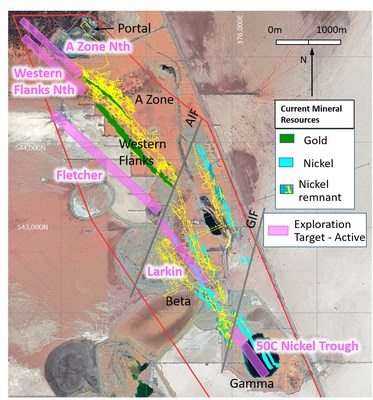

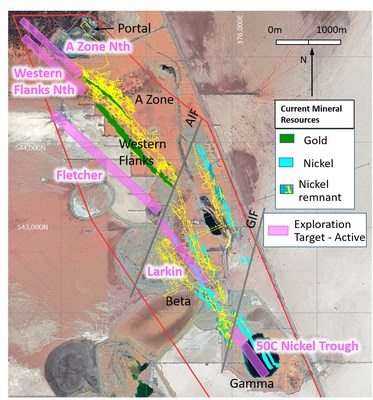

Drilling underground is active on four exploration targets – A Zone North, Western Flanks North, Fletcher and the 50C Nickel Trough (Figure 6). Three drill rigs are engaged to undertake the planned drilling: one surface multipurpose RC/diamond rig and two underground rigs. A fourth rig is due to commence drilling in the third quarter and will be dedicated to accelerating underground drilling for the 50C nickel trough where high grade nickel was recently discovered, including G50-22-005E which intersected 11.6% nickel over 4.6 metres, included 18.4% nickel over 2.2 metres (see Karora news release dated April 6, 2021). All four targets represent potential extensions to existing Mineral Resources or known mineralization and have potential to add significant value to the Beta Hunt operation.

Figure 6: Beta Hunt plan view showing active exploration drill targets

Higginsville

Higginsville exploration is currently focused on assessing the results of drilling and interpretative work completed in the first half of 2021 before proceeding on the next stage of regional drilling.

At Lake Cowan, all aircore drilling results have now been received and are being analyzed for the next phase of targeting work. The highlight from the drilling was an intersection of 1.35 g/t over 50 metres, including 3.64 g/t over 16 metres, north of the existing Monsoon prospect (see Karora news release dated February 8, 2021). In 2016, intercepts of 11.4 g/t over 50 metres in hole SPBC0313 and 6.4 g/t over 38 metres in hole SPC0320 were reported at the Monsoon prospect by S2 Resources (see S2 Resources news release dated July 21, 2016). A qualified person of the Corporation has not completed sufficient work to verify such historic drill results. However, the Corporation believes that such drilling and analytical results were completed to industry standard practices. The information provides an indication of the exploration potential of this deposit but may not be representative of expected results.

Monsoon and Monsoon North are part of the Sleuth Trend which is interpreted as part of the Zuleika Shear Zone - a regionally prospective structure that, along with subsidiary faults, controls the bulk of the Higginsville Central gold deposits (2 million ounces)1, extending 55 kilometres north to Cave Rocks (0.5 million ounces)1, 70 kilometres north to Mount Marion (0.7 million ounces)1 and 110 kilometres north to Kundana (6 million ounces)1. CSA Global Mining Industry Consultants have been commissioned to undertake a 3D targeting desktop study focusing on the Sleuth Trend area of the Lake Cowan Project with the aim of producing high quality and prospectivity-ranked targets for follow-up drilling.

At Higginsville Central, the focus remains on resource definition with current drilling aimed at extending and upgrading existing Mineral Resources at the Two Boys and Aquarius deposits. Additional drilling is also planned for the Fairplay and Trident deposits later this year.

- Estimated gold production ounces