It’s been a long time since anyone has mentioned Artemis, one of the earliest Pilbara plays that received a great deal of attention on this thread.(Rod gave it a mention on Charts for Metals and Stocks last October.) I still have a position so I check it from time to time. Here is some recent news that may be of interest:

Platina Resources - ASX Announcements

28 April 2021Drilling starts at Munni Munni Project, one of Australia’s largest undeveloped palladium deposits.

Drilling is underway at Platina Resources’ part-owned Munni Munni Project near Karratha in Western Australia, host to one of Australia’s largest undeveloped palladium deposits and endowments of platinum, gold and rhodium.

Platina controls a 30% interest in the project while partner Artemis Resources Limited (ASX:ARV) has the remaining 70% and is operator.

The palladium price has climbed to a record high over US$2,900 per ounce, more than a 50% rise from a year ago. Gold and rhodium prices have also performed very strongly over the last 12 months.

“Given the significant increase in the price of palladium, gold and rhodium during the last year, this has enhanced the number of options available to create value from the project,” said Platina Managing Director, Mr Corey Nolan.

“Platina is working very constructively with Artemis to assess a number of mutually beneficial options to realise value from the project.”

(https://www.platinaresources.com.au/wp/wp-content/uploads/2021/04/PGM_Munni-Munni_28-Apr-21.pdf)

Artemis Resources - ASX Announcement

29 April 2021Paterson Central – Exploration Programme Update Highlights

• Advanced planning is now underway to test all high priority exploration targets at Paterson Central - Apollo, Atlas, Juno, Voyager and Enterprise.

• Juno and Voyager targets located approximately 9km N of Apollo and have now been prioritised and appear related to a NE-SW striking magnetic feature that transects the nearby Budgiedown magnetic anomaly held by Rio Tinto.

• All these targets are interpreted to sit within the same geological and structural corridor as the Havieron gold-copper discovery that is now under development.

• Apollo and Atlas are to be drilled first and continue to be the highest priority targets coincident with structural, geophysical and geochemical anomalies located ~3km to the NW and N of Havieron and are adjacent to and straddle a major N-S fault that transects Havieron.

• No further drilling planned at Nimitz because assays now received did not return significant gold values to warrant further drilling at this stage.

• Exploration Incentive Scheme (EIS) grant of $150,000 for co-funded diamond drilling has just been awarded to Artemis from the Government of Western Australia for the drilling of the Enterprise targets.

• Several key regional exploration projects are located in the immediate vicinity and adjacent to the Artemis Paterson Central tenement, and the Company notes that the 2021 drilling season is now underway;

o Greatland Gold recently announced the commencement of a drilling campaign under Juri JV with Newcrest.

o Rio Tinto’s Budgiedown and Dekka targets are situated within 7km of the Juno and Voyager targets.

o Newcrest / Greatland Havieron JV drill programmes to grow existing resources and explore for additional orebodies within the confines of the Havieron Mining Licence, surrounded on three sides by Artemis.

(https://wcsecure.weblink.com.au/pdf/ARV/02368424.pdf)

March 2021 Quarterly Report

30 April 2021

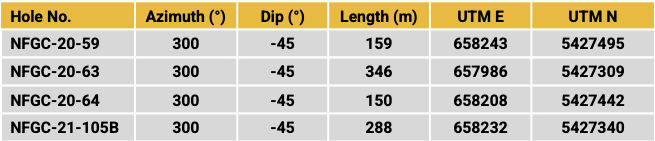

HighlightsSummary of Drilling at Carlow Castle

The March Quarterly results include the final assays from the Q4 2020 42-hole multi-drill program and all of the assay results from the Q1 2021 55-hole RC program, with the final assays received 21 April 2021.

Following a multifaceted drilling strategy, these two drilling campaigns at Carlow Castle have returned a number of significant results, which continues to highlight the potential of the deposit.

(https://wcsecure.weblink.com.au/pdf/ARV/02369503.pdf)

also see:

(Paterson Central Gold Copper Project – Artemis Resources)