Congrats on Hecla! HL is a proven company that has been around a long time. It has done well since bottoming this past spring and broke through it’s MA 50 late in summer crossing the MA 200 mid Oct. It has a nice history and chart doing very well when the PMs do well. Many of the Gold and Silver miners have done particularly well recently in the face of current economic and political uncertainty. The producing miners are much more predictable and cyclical in nature than the speculative miners that may have spectacular breakouts on occasion. Charts are very useful for both producing and speculative miners. The caveat with charts is that everyone should do exhaustive research (Due Diligence) before investing in anything. That’s a hard learned lesson for most that have ventured to post on this forum, including me. There is no denying that there have been far too many bumps on the road to prosperous investing in the PM miners.

Commodity markets tend to run largely in economic and seasonal cycles, but PM trend cycles are much less predictable, a good reason to diversify investments. Favorable times to be a buyer or seller is the responsibility of each individual based on their own DD and risk/reward decisions.

Producing miners with mineable mineral reserves and economic viability will do well over time. The longer-term charts are very useful for determining trends, but they do not tell the whole story.

I debated whether to post this on the main thread, but decided this was a better forum for those who may be interested. I decided to do some reading, perhaps learning something of value along the way, rather than watching paint dry on the main thread. The long article referenced applies to the mining sector in general. The various parts of the article discuss factors affecting the Junior Miners, and more specifically of interest the speculative exploration stage miners. Perhaps a few on this thread would benefit by applying information gleaned from reading the article to more profitable future investments.

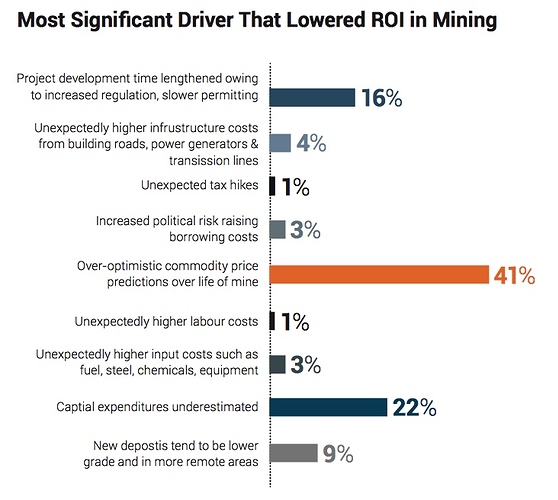

In an ROI Roundtable titled “ Mistakes of the Past ” the following quote (pg10) exemplifies what is discussed and shown in the table that follows:

More specifically, they selected as the two drivers that most significantly lowered ROI in recent years as, “over-optimistic commodity price predictions over the life of a mine” and “capital expenditures underestimated."

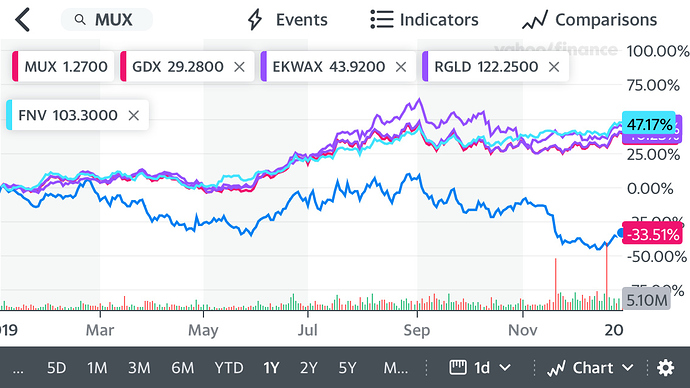

Also of interest are a couple of quotes extracted and appearing on page 9, 12 & 13 for those investing long and short term in MUX, FWIW. I do hold a sizeable core position in MUX as I have disclosed earlier in this this forum’s thread.

ROB MCEWEN

There is a lot of mystery in all the metrics. But there’s the excitement the industry offers investors when there’s a stronger metal market and this industry roars. And then no one is really sitting on the sidelines and looking at ROI.

The cyclical nature is one element, but there’s also the ease of entry of getting into the industry. It doesn’t take a lot of money to get in, and so we have a lot of entrants at various points when money’s plentiful. And so we’ll get a boom/bust mentality.

Right now we’re capital constrained, so that’s adding the discipline to the market. I think the investment dealers seduced the industry into believing there was an endless source of money and they’d give it to you on a handshake almost, and you’d go build.

But I don’t think we had the project management skills because as the money owed in, it just begged for bigger and bigger operations and there weren’t a lot of people that had built a billion-dollar mine. And then there are all sorts of moving parts that if someone delays you by a day, suddenly you have trouble.

MODERATOR

Some clever person should hold on to some of their bullion Is this pie in the sky, Rob, or is this

feasible? How long do you go without tselling your gold?

ROB MCEWEN

It’s possible, but it depends on your operating budgets. At Red Lake we had 67% gross margins, 34% net margins. And we were rivalling pharmaceutical companies at that point. But not a lot of the industy is in that position.

And thresholds are important, those barriers. You don’t make yourself popular with investment bankers. If you’re exercising this discipline in not pushing out a lot of stock, you might not get as much following in the marketplace.

There are several additional quotes from Rob McEwen that occur in the finishing pages of the report. I’ve already made this post much longer than intended, so I’ll finish with one last quote in the final chapter of the report titled The Way Forrward (pg 20):

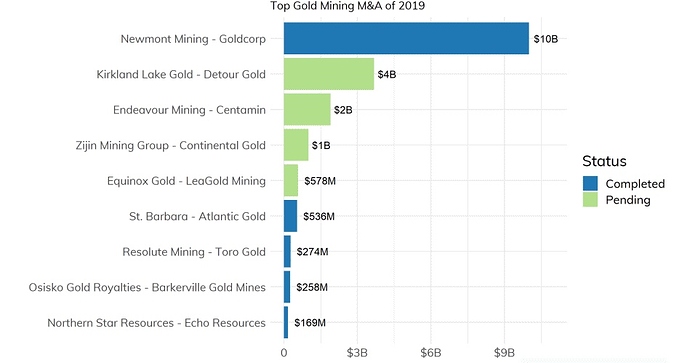

Our survey respondents said the best paths for mining management to follow to significantly increase ROI are: better financial discipline in deciding which projects to develop (47%); better cost estimation in feasibility studies 20%); and better financial discipline in mergers and acquisitions (10%).

Our Roundtable participants point with some urgency to human resources issues in the years ahead, especially with regards to proper succession planning; better recruitment and training of new graduates; and creating a more welcoming work culture for women, aboriginals and young people.

I’ll end the quotes here. I know this post may not interest many looking for the next “hot stock” to invest in. Personally, I found the discussion in the research report to be quite useful and informative in allowing me to better influence informed decisions as I rebalance my portfolio for the year ahead. It is my wish that all here enjoy a happy and prosperous future in the years ahead and avoid the mistakes of past investments. The entire report may be found here:

https://www.glaciermedia.ca/sites/default/files/PwCFinalReport.pdf