A few days old, but thought it worth posting for those who may be interested.

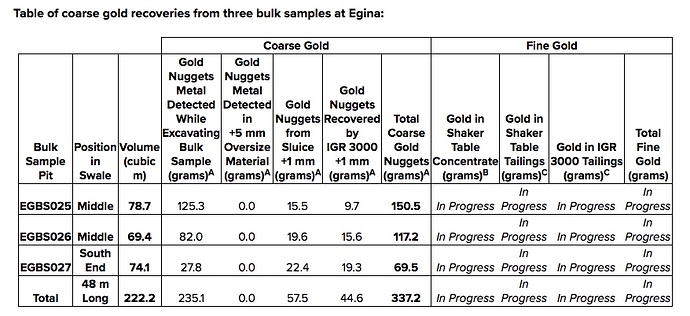

Positive Coarse Gold Recoveries From Recent Bulk Samples at Novo’s Egina Project

VANCOUVER, B.C., Oct. 09, 2019 (GLOBE NEWSWIRE) – Novo Resources Corp. (“ Novo ” or the “ Company ”) (TSX-V: NVO; OTCQX: NSRPF) is pleased to announce it has recovered significant coarse gold from trenching and bulk sampling at its Egina gold project, Western Australia. Recent results further confirm Novo’s view that surface gravels covering the vast erosional terrace at Egina have the potential to host a gold deposit. Novo currently controls approximately 2,000 sq km of prospective erosional terrace.

Novo’s most recent trench, Trench 4, is oriented north-south and situated approximately 70 metres west of Trench 1 and its associated bulk samples discussed in the Company’s news releases dated August 13, 2019 (https://www.novoresources.com/news-media/news/display/index.php?content_id=360) and August 22, 2019 (https://www.novoresources.com/news-media/news/display/index.php?content_id=361). Three bulk samples collected adjacent to Trench 4 yielded 337.2 grams of coarse, natural gold nuggets from 222.2 cubic metres of lag gravel.

Highlights:

-

Metal detecting and gravity processing of 222.2 cubic metres of surface lag gravels yielded a total of 337.2 grams of coarse, natural gold nuggets ( please refer to below table of results and Figure 1 for sample locations ).

-

Bulk sample EGBS025 contained a single gold nugget weighing 86.3 grams, the largest yet recovered from the 2019 field season.* Novo considers these results very encouraging because the weight of recovered gold excluding this one outlier nugget is 250.9 grams. Many alluvial gold deposits display grades significantly below one gram per cubic metre.

-

All gold discussed in this news release is coarser than one mm and potentially amenable to low cost “dry” extraction methods such as eddy current separators and mechanical sorters. Novo discussed favorable preliminary test results using eddy current separators on Egina gold nuggets in a Company news release dated September 16, 2019 (https://www.novoresources.com/news-media/news/display/index.php?content_id=363).

-

Bulk sampling was undertaken across a 48-m wide nugget-rich zone within a broad topographic depression, or swale, identified by ground penetrating radar.

-

Additional trenching and bulk sampling is currently underway and will continue until the end of 2019.

-

This nugget is not necessarily indicative or representative of mineralization at the Egina project.

Notes:

A – Gold purity has been assessed at Egina and falls within a range of 89% - 95%.

B – Based on whole sample assays.

C – Back-calculated from assayed sub-samples.

“We are pleased to see consistently gold-rich gravels in the swale at Egina,” commented Dr. Quinton Hennigh, president and chairman of Novo. “We now have seven bulk samples from this target that have yielded, in aggregate, 629.6 grams of coarse, natural gold nuggets from 504.1 cubic metres of surface lag gravels. Over the remainder of this year, we plan to undertake sufficient trenching to outline an area that can be subjected to test bulk extraction and processing next year.”

Novo’s current Egina program is focusing on identifying terrace gravels that can be subjected to bulk extraction and processing tests next year. In conjunction with its field activities, Novo is also currently examining various types of equipment that can be used for continuous gravel excavation, mobile “dry” gold processing and immediate environmental reclamation methodology that could be field tested next year.

In addition to the three samples discussed above, a fourth bulk sample, EGBS024, was collected adjacent to Trench 4 near it southern terminus. Although the trench immediately adjacent to EGBS024 yielded eight detectable nuggets, two of which were in the range of 1-5 grams, no detectable nuggets were found while excavating EGBS024. Processing yielded 3.7 grams of nuggets from 96.3 cubic metres of gravel. The contrast in nugget yield between the trench and bulk sample is illustrative of the irregular distribution of gold in these gravels.

Bulk samples discussed in this news release were collected from pits approximately 4 m wide and 16 m long under the supervision of Novo personnel. Depth of pits varies from about 1-1.5 metres. Sandy soil overburden was generally stripped prior to gravel extraction. Some underlying bedrock material was excavated along with gold-bearing gravels to ensure capture of gold on the bedrock interface. Each sample was excavated in lifts approximately 20-30 cm thick. Every lift was detected for gold nuggets by Novo personnel prior to removal, and the location and weight of each nugget was recorded without limitation prior to being securely stored. Bulk sample gravel was transported to Novo’s Station Peak camp where it was processed through the Company’s IGR 3000 gravity gold plant. Various concentrates and tailings from the IGR 3000 plant are currently being analyzed to evaluate fine grain gold. Once these results have returned, the fine gold contribution will be added to the coarse gold tally. X-ray fluorescence analysis of nuggets indicates purities ranging from 89-95%. Densities of gravels vary widely generally ranging between about 1.4-2.1 tonnes per cubic metre. Unlike hard rock gold deposits, alluvial gold deposit grades are commonly reported in grams per cubic metres.

Dr. Quinton Hennigh, P. Geo., the Company’s president, chairman, and a director, and a qualified person as defined by National Instrument 43-101, has approved the technical contents of this news release.

About Novo Resources Corp.

Novo’s focus is to explore and develop gold projects in the Pilbara region of Western Australia, and Novo has built up a significant land package covering approximately 13,000 sq km with varying ownership interests. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com

On Behalf of the Board of Directors,

Novo Resources Corp.

“Quinton Hennigh”

Quinton Hennigh

President and Chairman

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-looking information

Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, statements as to planned exploration activities and the expected timing of the receipt of results. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the mineral resource industry as well as the performance of services by third parties.

Figure 1:

A PDF accompanying this announcement is available at: http://ml.globenewswire.com/Resource/Download/69d7faf1-7e0b-463a-b329-992ad359d22f

![]()