Lots of insider buying at RNX the last couple days:

Yes, I think this company is very well run, they are bringing on some great people who are now investing. Very surprised its under .50 right now but still with everything going on in the world they are holding up quite well, I have been adding to my position daily. GL

Rick Rule’s informal informational video from home location from March 30, 2020:

He discusses the repercussion of CCP Coronavirus in the Gold COMEX market. Towards 47’50” is a discussion on the gold streamers in generalities only, not as recommendations. He mentions that the Top Tier Streamers (WPM, FNV) may have as much as an 80% margin of profit with their income. 2nd Tier, or Hybrid Royalty/Explorer streamers (OR, RGLD) are good, but do not have as great a profit margin as the bigger or best Top Tier. The Tertiary Streaming companies RR mentions as an example are SAND, APS.L and ALS.TO.

Mines Shutting Down, COMEX to Settle in Cash? | Rick Rule

The virus pandemic is not only ravaging our personal lives, but also impacting business globally, causing many mines to cease operations. At the same time, crisis financial interventions are motivating even “Reluctant Preppers” to seek shelter for their funds in precious metals, resulting in a demand spike which is cleaning out the supply chain of physical gold & silver. Rick Rule, CEO of Sprott Asset Management, returns to Liberty and Finance / Reluctant Preppers to answer viewer’s questions at this time of a “Black Swan” event colliding with the top of the credit cycle and unprecedented volatility in the major markets and precious metals.

https://www.youtube.com/watch?v=1nRozyhisik&feature=youtu.be

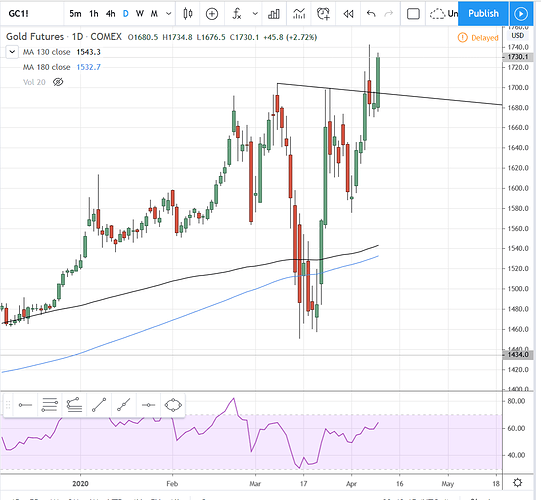

Gold futures breaking out of a very nice, very large inverted head & shoulders. Projected target is to $1943.00.

I know there were a few people involved in MUX McEwen mining, what everyone’s opinion on this company now seems like a good entry point, thank you

I’m not the heavy DD guy like most here, but it always seemed like a better than average investment based upon what I have read from those who shared their knowledge here. I’ve got 25k shares at about 1.59 basis, so there’s that. I’ll probably add another 5k shares if it dips back into the .70’s. I hadn’t been paying a lot of attention to it or I would have added in the .50s.

Yeah, I’m in on MUX with a nice load at 1.72, bwahahahaha!

But I also own some May options with a $1.00 strike - so they’re coming back alive!

On the other hand, I have an even nicer load of ELY Gold Royalties at .28 and am liking it more and more.

Those are the last two “minerals” investments I’ll ever make … really … maybe.

I was looking at ELY a long time ago will have another look, MUX has potential over $2 but might be a longer hold. Cheers

I’m not as bullish on MUX as I once was…not that there is anything terribly wrong with the company, I just see higher upside in other companies. MUX has had its challenges as other gold miners do (AISC, need to replenish reserves, etc.), but they’ll be fine. Rob McEwen is one of the best CEOs in the industry, so I have no problem hitching a ride on his coattails. However, MUX has not followed the price of gold like other miners/explorers have and that gets discouraging. So when the price dropped I was less inclined to average down. I think Novo Resources has a much higher upside than MUX. I see Novo as the next KL. I also like RNX which we’ve discussed on this board. RNX is undervalued in my opinion I believe that situation should correct itself once Covid-19 is behind us and the market.

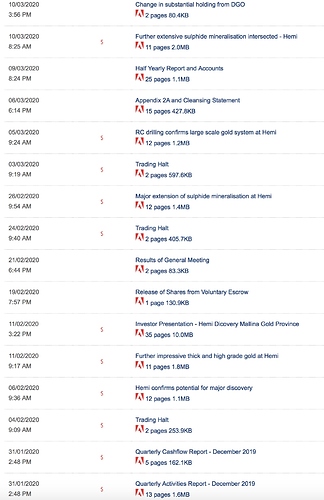

Many of us jumped on Pilbara much too early back in 2017-2018. I know I did. News was prominently promoting finds in such companies as Artemis, de Grey Mining. Kairos Minerals, DGO Gold and a few other others. I picked up sizeable positions in Artemis and de Grey. More recently, I have acquired sizable positions in NOVO and RNX. I have kept my positions in both ARV and DEG, but regrettably have a very large paper loss with ARV. DeGrey Mining however, has become a favorite of mine for some the reasons shown below:

De Grey Mining (ASX:DEG)

Only those that have been living under a rock for the past few months (we understand if it’s to avoid coronavirus) would not know that De Grey Mining is onto something big at its Mallina gold project in the Pilbara.

The first signs of a discovery at the Hemi prospect at Mallina emerged in December last year, but it wasn’t until early February, when thick, high-grade gold intercepts were returned from two zones, now known as Brolga and Aquila, 640m apart, that its potential size truly became apparent.

In early March, after another round of mouthwatering drilling results had dropped (including 93m at 3.3 grams per tonne (g/t) gold from 39m from the Brolga Zone), Argonaut analyst Matthew Keane estimated that the combined Brolga and Aquila zones could already contain 1.7 million ounces of gold at a grade of 2g/t plus.

Giving some sense of how fast the discovery is evolving, Keane upgraded his estimate to 2.8 million ounces in a note to clients yesterday.

Add those 2.8 million ounces to the 1.7 million ounces at 1.8g/t in resources that De Grey has defined in the greater Mallina project area and there is easily the critical mass to support a significant gold operation.

The company has indicated it could be in a position to announce a maiden resource for Hemi within six months and given that the mineralisation remains open in most directions, there is a good chance it will surpass Keane’s latest estimate.

There is also thought to be strong potential for more Hemi-style discoveries in the greater project area.

(Stockhead site 3-26-2020)

Surprisingly, given recent developments at Engina, Novo wasn’t mentioned here in the above write-ups at Stockhead. It is not a website I use or have seen before writing this post, so don’t consider it an endorsement of the site. The staff writer did have a good summary of my thoughts in considering de Grey mining.

Admittedly, it’s going much slower for Novo Resources than many expected, but the long-term prospects for a large pay day look good to me. Here are the PRs listed in reverse chronological order from most recent on their website for this year. This PR list may be found here (press company search to select DEG):

https://www.asx.com.au/asx/share-price-research/

De Grey is really onto something at Hemi and Mallina. Unfortunately (fortunately?), I sold around .13 for a small profit after being down thousands for a couple of years. I was happy to make back that money and poured that into more Novo. I still follow De Grey though.

Dumb question here, what is the correct spot price of gold? Kitco charts have one price, Apmex has another price, Monex lists a third price, etc

The spot price is basically the price of the currently trading futures contract, which right now is the June '20 contract. I just looked up all the sites that advertise “real-time” spot price of gold and they are all around $1722, while the current futures contract is about $40 higher, so I don’t know what’s up with that. I think the best thing to do is call whatever dealer you buy the physical metal from and ask them. You could also go to www.tradingview.com and set up a chart with the gold futures on it. Although there is a 10 min delay on that free feed, it’s much closer to the actual gold price than any of the sites I went to.

Thank you, TR.

Thank you TraderRich

I would have posted this on the “Other Non-Mining Stocks” forum, but it won’t let me put up more than 3 posts in a row, so if someone feels compelled to post there from time to time just to allow me to keep going that would be swell. ![]()

Hi Folks. I would do some chart updates but there’s nothing all that interesting right now. If you scroll up to the last oil chart I posted, the price is still sitting just under the bottom red line of the big wedge formation. This doesn’t nullify it, but if the price goes to $15 like a lot of reports are saying, it kinda does, although the formation could still play out with the drop to $15 just being a fakeout bull-trap kinda move. On the daily interval there is a little inverted head and shoulders potentially forming. It needs up to a week of trading for me to see if it’s actually going to be a formation, so if it’s confirmed I’ll post it.

On the “Other Non-Mining Stocks” section of this site I posted the gold chart breakout of an inverted head and shoulders formation. It’s had its first move and appears to be consolidating. The measured move (target) of the complete move is to about $1943 or thereabouts.

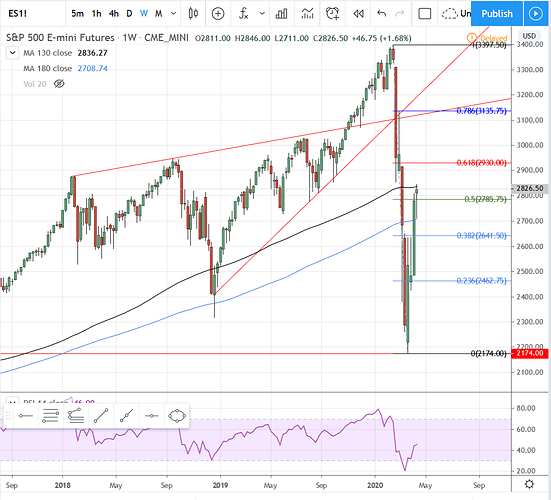

There is something interesting here on the S&P 500 futures (ES) weekly chart. Today it moved up and tagged the 130 weekly MA and pulled back. It has retraced just over 50% of the drop now but needs to bust up through that 130 MA to hit the 62% retracement. So, watch for potential pullbacks starting tomorrow or for resistance at the 2930 area if it pushes higher. I think there is a very high possibility of a pullback from one of those two places.

Rick,

Inventus back in the news. Like how they suddenly announce that they have already completed a new drill program and are awaiting results. It appears some new IP surveys inspired them to quickly drill. https://static1.squarespace.com/static/56d987d21bbee076a4c0be7f/t/5e95f882a0c7801af17caa51/1586886835902/IVS-Apr-14-2020.pdf

TORONTO, April 15, 2020 /CNW/ - Royal Nickel Corporation dba. RNC Minerals (" RNC " or the " Company ") (TSX:RNX) announced today that it has received the approval of the Toronto Stock Exchange (the " TSX ") for a normal course issuer bid (the " Bid ") to purchase up to no more than 30,415,198 of its issued and outstanding common shares (the " Common Shares ").

Purchases under the Bid may commence on April 17, 2020. The Bid will expire no later than April 16, 2021.