This company is making some positive moves and with gold climbing this should have a great future.

I bought some of this one right around the current price back in late Feb. I bought the RNKLF ticker.

TODAY: SPOT PM fix - approx $1716, May Futures Contrat approx $1740

The LBMA in London historically provides the morning and afternoon fixes each day which represent the official “spot” prices: - LBMA Precious Metal Prices | LBMA

The futures price is set by various futures exchanges but COMEX is probably the primary one.

The diff between these two prices has been a recent earnest topic of discussion among many people / “experts” of late.

-

Retail gold (coins, bars etc.) have seen premiums go up due to high demand / shortage. But this is a retail / small gold issue.

-

But even at the LBMA spot price (the price you would pay to get gold in the form of 400Oz LBMA bars has in recent days been $25 to $60 below the near COMEX futures contract. As TR points out normally there is little more than a few dollars difference between the current futures contract and spot. But right now this is not the case. Why?

You can see a good nearly real-time physical spot price in various places but I conveniently look at it here:

Gold Price Chart, Live Spot Gold Rates, Gold Price Per Ounce/Gram | BullionVault (I am not advertising for them)

Bullionvault buys LBMA bars in London and can distribute them to multiple vaults in multiple places. And you can trade small quantity gold on that platform so it is actually a pretty good look into current physical spot price. If you look at their WARNING at the top of the page you will see that there are issues right now transporting gold from London to places like Zurich due to COVID19. This makes spot in London lower than spot in Zurich by a little bit. But this too does not explain why spot everywhere is below the futures price.

There is also a lot of chatter about the “paper price” disconnecting from the “physical price” which has long been a prediction of gold / silver bugs. Unfortunately for that theory this is the exact opposite: spot is below the futures price.

So all that is left is speculation. I have heard some say there are large COMEX shorts that are trying to reduce their short position by end of May (contract expiration) so they need to buy COMEX long futures and they have failed to cause a cascading sale of current longs by smashing the price like they have for years so this buying driving up the price as they buy to close their shorts. Maybe, but not provable.

Ultimately, it seems unlikely it is an issue disconnected from all the other crazy financial things happening. It means something. But by the time we know for sure, it may be obvious to everyone. Or maybe it just goes away with time.

Novo Reports Broad Gold-Bearing Gravel Swales Discovered at Egina

VANCOUVER, British Columbia, Apr 16, 2020 (GLOBE NEWSWIRE via COMTEX) – VANCOUVER, British Columbia, April 16, 2020 (GLOBE NEWSWIRE) – Novo Resources Corp. (" Novo " or the " Company ") (TSX-V: NVO; OTCQX: NSRPF) is pleased to announce the discovery of broad gold-bearing gravel swales near Paradise, part of the Company’s extensive Egina gold project, Western Australia. Discovery of gold-bearing gravels at the Paradise and Road to Paradise targets was first announced in Novo’s news releases dated December 17, 2019 (https://www.novoresources.com/news-media/news/display/index.php?content_id=371) and February 13, 2020 (https://www.novoresources.com/news-media/news/display/index.php?content_id=379), respectively. In addition, Novo has made a further discovery of gold-bearing gravels at a new target called Clarke approximately 10 km northwest of the test area worked in 2019.

Highlights:

- Two broad gold-bearing gravel swales, or shallow channels, have been discovered southwest of the Paradise terrace gravel target at Novo’s Egina gold project (Figure 1). The first, situated immediately southwest of Paradise, measures approximately 700 metres wide. The second, located approximately 1.5 kilometres southwest of Paradise, measures approximately 450 metres wide. Both are interpreted to trend northwest and are open for several kilometres in both the southeast and northwest directions. Gold-bearing gravels in both swales range up to approximately 2 metres thick and bear a resemblance to gold-bearing gravels explored on the Egina mining lease, situated approximately 14 kilometres southwest of Paradise, during 2019.

- The Paradise area was first identified as prospective through Novo’s terrace targeting program in which terrace gravels were categorized and prioritized by their geology and lateral extent. Although this area has been subject to prospector activity, mainly metal detectorists focused along the hilly margin of the terrace, recent work done by Novo is the first indication that gold is much more widespread across the greater terrace.

- Ground penetrating radar indicated prospective swales might be present and helped focus follow-up pit sampling across the target area.

- In February, Novo personnel began digging pit samples approximately every 50 metres along a linear corridor extending across the target area. Although pit sampling was halted in March due to a reduction in staffing at Egina resulting from the COVID-19 pandemic, a skeleton crew has been at work at Novo’s Station Peak camp processing numerous approximately one-tonne pit samples stockpiled before pit sampling ceased. These one-tonne samples are being put through Novo’s mobile alluvial Knudsen (" MAK ") concentrating plant. Concentrates generated by the MAK plant are carefully panned down to a point that gold grains can be counted and studied.

- MAK samples from both swales at Paradise have yielded gold grain counts in line with those seen across the 50 metres wide swale at the Egina mining lease, subject of much of Novo’s 2019 exploration program in which the Company’s exploration protocols were established. Also important is that approximately half of MAK samples collected from swales at Paradise have yielded gold nuggets, defined as gold particles larger than 1 millimetre (Figure 2). Although MAK samples provide indicative data only, Novo is optimistic that the similarity of gold occurring in samples from Paradise to that in MAK samples collected at the Egina mining lease bodes well for discovery of nuggety gravel mineralization like that discovered at Egina in 2019. Five bulk samples collected from the swale at Egina yielded approximately 1-1.5 grams gold per cubic metre of gravel. Novo plans to undertake similar bulk sampling of gravels from the newly discovered swales at Paradise during the 2020 field season, once it resumes.

- The broad nature of swales at Paradise may be a function of being situated well north of eroding headlands to the south. Novo thinks that gold-bearing swales potentially become wider and more established the further they extend northward onto the terrace.

- A new gold-bearing gravel discovery has been made at a target called Clarke located approximately 10 kilometres northwest of the Egina mining lease. Several MAK samples collected from this target yielded gold grain counts exceeding 50 particles with one yielding approximately 600 particles. More systematic evaluation of this target will be conducted once the 2020 field program resumes.

“We are very happy with the discovery of two extensive gold-bearing gravel swales at Paradise,” commented Dr. Quinton Hennigh, Chairman and President of Novo. “We are getting our first look at how these gold-bearing channels evolve further onto the terrace. Although much more work is needed, including bulk sampling to evaluate grade, swales appear to broaden as we head northward. This is what we need to see to generate volume. Given that we have numerous areas planned for systematic MAK sampling in 2020, promising results from the first area to be methodically tested gives us high hopes the geologic model will quickly foment across the greater terrace.”

Description of MAK sampling

MAK samples are collected from pits spaced at approximately 50 metres across target areas. Pits are dug by track hoe and range up to 3 metres depth. Targeted sample size is approximately one tonne. Samples are placed in wooden crates lined with bulka bags and transported to Novo’s Station Peak camp where they are processed through a mobile alluvial Knudsen centrifugal concentrator. Concentrates are panned down to reveal gold for point counting and further study.

Dr. Quinton Hennigh, P. Geo., the Company’s president, chairman, and a director, and a qualified person as defined by National Instrument 43-101, has approved the technical contents of this news release.

Love the names of the 2 new gravel swales - Road to Paradise and Paradise! Yes, I have a long position on this one.![]()

Great article from Bob Moriarty on Irving Resources, Liion One and Novo. Below is the Novo excerpt:

The most interesting pick I have ever made, and it’s one few investors would be able to duplicate, was that of Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX). And my rationale would be out of the box for just about everyone.

Let me tell you a little story. . .(that used to start, “Meanwhile back at the ranch. . .”)

In 1976 I was making a living delivering small planes built in the U.S. all over the world. I ended up with about 240 trips of Cessnas and Pipers and Beech aircraft over every ocean. I was working for a slave driver based in Lakeland, Florida. One day he sent me out to California to pick up a used Rockwell 685 aircraft previously owned by a Las Vegas singing star who needed to have his wife flown to LA for medical treatment once a month.

In technical terms, the 685 aircraft was a piece of crap. But it was a high-wing piece of crap. A fellow in Australia named Lang Hancock wanted a pressurized aircraft with a high wing so he could play prospector all over Australia and Southeast Asia. Hancock just happened to be the fellow behind turning the Pilbara into the world’s richest iron deposit.

I ended up flying the plane from the U.S. to Australia. It was an adventure all by itself. Did I mention that the 685 aircraft was a piece of crap? Worse, the slave driver I worked for forced me to bring along on the flight as copilot the son-in-law of Lang Hancock, who was married to his only daughter, now Gina Rinehart.

Now given a choice between a copilot and a wet soggy sandwich, I would opt for the wet soggy sandwich in a heartbeat, but we had an interesting and adventurous flight. For about forty hours of flying over a period of about ten days he regaled me with tales of how rich the Pilbara region of Western Australia was in both grade and quantity of iron.

You see, the iron that had been dissolved in a saltwater basin covering the Pilbara region 3 billion years ago came out of solution when single cell creatures began to produce oxygen.

And the funny thing is that when Quinton and I were driving up to Rattlesnake in October 2008, he sorta told me a similar story. Except Quinton said gold would do the same thing in the presence of carbon as oxygen increased. You see, minerals will precipitate out of solution when the right combination of temperature or pressure or chemistry takes place.

Hmmm!

We met with Mark Creasy in June 2009 and chatted out the theory. Mark believed the Pilbara had a “shit pot” of gold. That’s the technical term for it. And then we went up and spent some time in the field with Mark’s geos swigging $1,200 a bottle wine. (That’s another story all by itself.)

Mark and Quinton finally came to terms on a deal. Quinton formed the company, raised some money at $0.25/share for those who were believers and I did my first story on them seven years ago.

When we did our tour in late 2009, Quinton found me a piece of carbon and in that instant I became a believer. You see, you cannot have the world’s biggest and richest iron deposit without having the world’s richest and biggest gold deposit if the metals come out of solution in the same way.

Everything since then has done nothing for me except convince me I had it exactly right when I said, “You are getting 700 square miles of a Wits model deposit for about $5 million. It doesn’t get any better than that. It is easily a ten-bagger. It could be a 100-bagger. It’s going to be big.”

There is no question; there have been some exceptional technical issues to sort out. The company actually had three totally different deposits: one more or less conventional at Beaton’s Creek with just short of a million ounces of gold; a hard-rock deposit at Karratha that is impossible to measure because of the nature of the nuggety gold; and a near-surface, nuggety, alluvial deposit that might extend from Egina all the way into the Indian Ocean.

I knew in 2009 the gold was there. I said so in 2012 and those who listened, as I was a lone voice in the wilderness, have made a lot of money.

From a technical point of view, Quinton has made incredible progress in a district that everything was known about 135 years ago. Well, almost everything.

He has brought in Newmont Mining; Mark Creasy is still a major investor, as is Eric Sprott and Kirkland Lake Gold, and there is a joint venture (JV) with Sumitomo at Egina. Just lately he has made an announcement that is so giant that it should be on banners being towed behind aircraft over every major city in North America. Mr. Yoshikazu Ishikawa, general manager of the Non-Ferrous Metals Business Department of Sumitomo, has just become a member of the board of directors.

Sumitomo has never done a deal with a junior before.

I like Novo a lot and I understood there was a boatload of gold there ten years ago.

LOL - God bless you Rich. I gave it up for good about 6 months or so ago. I prefer www.stockhouse.com, and ceo.ca nowadays. Some stocks are very popular in those forums and some are desolate.

I’ll check that out Rick, thanks. ![]()

Hey, how about that call sometime?

Nevermind. I had only been back for two weeks and already being reminded why I left 8 years ago. ![]()

Nice results in a trying quarter. Now if they can just get those royalties worked out on the underground mine and mine some more course gold ![]()

Indeed! Very pleased with what is going on there and maintain my position.

And wow…did I just see 19 cents(EDIT zeros cents, EDIT below zero!) a barrel for West Texas Crude? Crazy!!!

Another good talk by Rick about the oil oversupply & the future of metals:

Enjoy,

Rod

A couple of years ago NAK ran pretty hard until Kerrisdale Capital ran a short and distort campaign against Northern Dynasty.The published negative opinion piece, at the time, centered on Northern Dynasty’s massive copper/gold project in Alaska as being uneconomic. A collection of anti-Pebble activist groups (like the Natural Resources Defense Council) filed lawsuits concerning environmental concerns. The permitting process stalled until recently:

April 20, 2020 Vancouver – Northern Dynasty Minerals Ltd. (TSX: NDM; NYSE American: NAK) (“Northern Dynasty” or the “Company”) reports that, on Friday April 17, a US federal district court judge in Alaska granted the US Environmental Protection Agency’s (“EPA”) ‘Motion to Dismiss’ a case brought by a collection of anti-Pebble activist groups.

Also, about that same time I was favoring NG over SA. Now, that is changing:

UPDATED PEA STUDY ENHANCES SEABRIDGE GOLD’S KSM PROJECT

A LARGER IRON CAP MINE IMPROVES PRODUCTION AND DRAMATICALLY BOOSTS ECONOMICS - Monday, 27th April 2020 **

I still have favorable positions in NG. I’ve been long a very long time on account of the Donlin project. In August 2018 the Donlin Project received a decision for going ahead with major Federal permits. NG is up over 60% on the monthly chart. I’ve taken a little off the table as it’s has risen greatly since it’s low last year in the mid threes.

I currently have no positions in NAK or SA, but definitely have put them both on my “watch list” for now. Both have run hard and fast the past few weeks. I will be looking for a pullback, and maybe, a possible entry into a “starter” position, FWIW.

I guess I would avoid NAK unless a major mining partner shows up again. Its doubtful that a major would want to be associated with such a controversial project especially since they are trying to portray a more environmentally friendly image. Every single step in what is normally a very drawn out process will be challenged. In particular, much of the progress on environmental matters that has been made over the last several years could simply be overturned/halted with the next administration. As you know, there is simply a lot less risky gold investments out there.

With gold projected to hit $3000 plus what are some good mining companies to get into now?

Thanks- that’s the same advice I Gave backwoods a couple of years ago. NAK does have potential and a huge asset in the ground. It’s cleared it’s EPA hurdle, for now. Just keeping an eye on it. NAK is looking good long term - overbought on the daily chart. Expect volatility. NAK is still a ways off until it will be producing with a huge 30 year mine life. 5.7 m oz AU measured, 64.6 m oz indicated, 37.3 m oz inferred. Anglo and Rio Tinto may return. NAK does need a deep pocket partner. 5-10 years will be what it takes.

NG’s Donlin has been worth waiting for. It may be due for a pullback soon before heading up again. SA is a very “tradeable” stock and has 3 major projects of incredible size. The SA chart seems to indicate SP will continue at a measured pace, month by month. Starter positions if indicated in both SA and NAK while keeping an eye on progress. I missed the recovery over the past few weeks because I had taken these off my “watch list”. Now worth keeping an eye on.

Next week is a big week for miners reporting earnings.

MUX, NEM, FNV, GOLD, KL, PAAS, RGLD, WPM, SAND, and EXK are a few that come to mind.

Anyone else keeping an eye on some other PM miners reporting soon? I think FSM and AG report earnings the following week.

This is a long article well worth reading .

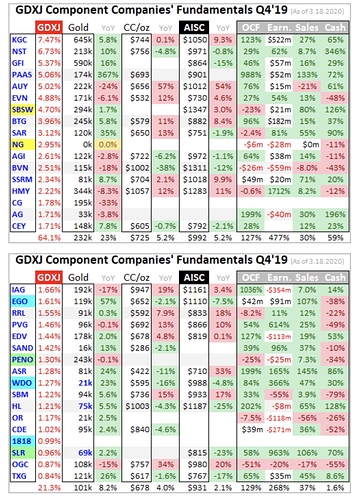

The article notes that the GDXJ has 73 stocks, but the top 34 stocks in the GDX comprise 84% of this ETF! These same 34 stocks are actually the same as the top GDX ETF without the GDX’s 8 largest major gold mining stocks. The yellow highlighted stocks in following table are not in the GDX:

Gold Mid-Tiers’ Q4’19 Fundamentals

http://wallstreetwindow.com/2020/03/gold-mid-tiers-q419-fundamentals-adam-hamilton-03-23-2020/

I couldn’t do more than 3 posts in a row, so I have edited this last one. For those still doing DD … or may be looking to rebalance:

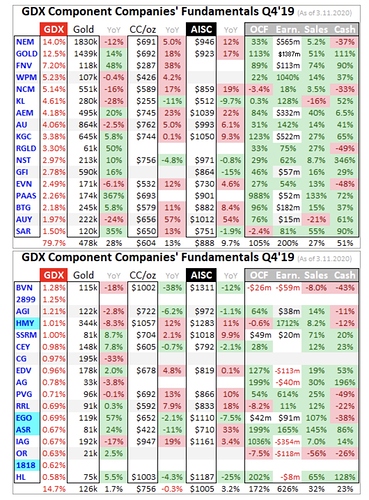

Gold Miners’ Q4’19 Fundamentals

…Q4’19’s $1483 average gold less $942 average AISCs yields major-gold-miner earnings of $541 per ounce. That skyrocketed a staggering 59.6% YoY compared to Q4’18’s $339 derived from $1228 average gold and $889 average GDX-top-34 AISCs!

…The gold miners’ stocks are ultimately just leveraged plays on gold.

Gold Miners� Q4�19 Fundamentals - GoldSeek.com

If one trades around a core position and ends up priced out this is quite useful information for new DD and a watch list while looking for an entry point.

RNC (Royal Nickel) doing well. Very pleased!

Nice end of week breakout on RNX! I averaged down a week or two ago (.475 is my average now) and now I’m back to being green! This is not a flip for me though. They are building a strong, profitable company that I believe is still way undervalued at this time.