If they get rid of the MMX royalty on the Beta Hunt mine, I think RNC would be all set?

Yes agreed but I believe they are working most the royalties (pretty good podcast last week) and are putting themselves in a pretty good position, I have slowly been adding to my portfolio and hoping they can to get a $1.00 short term.

Well, the royalty issue remaining is still a very significant distraction and unfortunate. It doesn’t help that the government of Australia piles on a 2.5% royalty as well. (2.5% royalty, plus the MMX royalty plus the extra payments for the first 10,000 ounces per year…yuck!) It makes it very difficult for underground mining to be profitable or otherwise worth the bother. RNC is now likely deliberately avoiding all the bonanza grade in the Beta Hunt indefinitely until they work out something with MMX. (It is the high grade stuff that generates excitement; without it the stock will likely continue to under perform on where it should be.) I do like how they will be able to completely move away to other ore streams besides Beta Hunt to squeeze MMX into some sort of deal so it is probably just a matter of time till this resolves. There appears to be other good properties and mills near RNC that they could absorb in the near future especially if the stock price continues to go up which they could leverage into yet more deals.

EDIT: Company has a shareholder meeting scheduled for June 11. Will be deciding on a reverse split. Not a fan of that.

Novo Recommences Exploration at Egina; Discovers Yet Another Broad Gold-bearing Swale at Paradise

VANCOUVER, British Columbia, May 15, 2020 (GLOBE NEWSWIRE) – Novo Resources Corp. (“ Novo ” or the “ Company ”) (TSX-V: NVO; OTCQX: NSRPF) is pleased to announce it has recommenced its 2020 exploration program at its Egina gold project and quickly identified another broad gold-bearing swale at Paradise.

Summary:

Recommencement of 2020 field program

- Following a self-imposed isolation period due to COVID 19, Novo has recommenced its 2020 exploration program at its Egina gold project. The Company has implemented work and hygiene protocols to ensure a safe workplace for its field staff. Its Perth head office has reopened on a managed, lower-density basis.

Discovery of new gold-bearing swale

- Novo has identified another gold-bearing channel, or swale, in an area southwest of the Paradise prospect. This swale measures at least 750 m wide, is open to the southwest, and brings the total number of swales discovered in this area to three (Figure 1). Identification of gold-bearing gravels comes from processing approximately 1 tonne bulk samples using Novo’s mobile alluvial Knudson (“ MAK ”) test plant. Gold particle counts from MAK samples collected in this new swale, S3, range up to 210 per tonne, the highest yet seen in this area. Gold-bearing gravels were found at Paradise earlier this year, and the Company announced discovery of two broad gold-bearing swales, S1 and S2, last month ( please refer to the Company’s news releases dated April 16, 2020 and February 13, 2020 ).

-

Novo plans to undertake bulk sampling of gravels from the newly discovered Paradise swales during the 2020 field season. Novo also plans to expand the heritage survey footprint in this area once the Kariyarra Aboriginal Group has deemed it safe to come out of quarantine.

-

In addition to the Paradise area, Novo has approximately 20 high priority target areas it plans to explore utilizing MAK sampling in 2020. The goal of this work will be to demonstrate proof of concept that the Egina terrace has potential to host an extensive, shallow gold-bearing gravel deposit.

Complete data from 2019 large bulk samples

- In February, before cessation of work at Egina due to COVID 19, Novo completed processing of two large bulk samples from a test area within the Egina mining lease ( please refer to Novo’s news release dated February 13, 2020 ). All gold assay data has returned from these samples (Figure 2). Bulk samples from trenches 6A and 6B (Figure 3), both collected from the general trend of the swale and swale margin corridor, yielded a total of 592.6 grams of gold from 413.6 cubic metres and 393.8 grams of gold from 763.2 cubic metres, respectively ( please refer to table below ). Collectively, this totals 986.4 grams of gold from 1,176.8 cubic metres of gravel, or 0.84 grams gold per cubic metre. Conventional alluvial gold projects commonly display grades of 0.2-0.3 grams gold per cubic metre.

Rehabilitation program

- Because of the extensive nature of gold-bearing gravel mineralization at Egina, Novo views environmental rehabilitation of disturbed areas as a critical component to gaining acceptance for potential future commercial operations. Figure 4 and figure 5 depict recent examples of Novo’s environmental stewardship whilst undertaking exploration activities, each area displaying impressive rates of vegetative regrowth. Novo’s in-house environmental team has used best practices including stockpiling and rapid re-establishment of topsoil and regrowth after the wet season. Data collected from these rehabilitation efforts will help underpin Novo’s case that this style of ground disturbance can be managed such as to restore the land to its original state.

“We are very happy to get back to work at Egina,” commented Quinton Hennigh, President, Chairman, and a Director of Novo. “We are very excited by the continued exploration success with the immediate discovery of yet another broad gold-bearing swale at Paradise. Our MAK sampling approach clearly delivers quick results showing us where gold-enriched gravels are situated, and we plan to aggressively use this technique to test a multitude of targets across the terrace this field season. As we identify these gold-bearing gravels, we plan to follow up MAK sampling with bulk sampling and processing that will allow us to assess gold grades of these gravels. Bulk sampling has clearly demonstrated robust grades of gravels in the swale within the 2019 test area, and we aim to similarly evaluate grades of gravels in these new areas. Also exciting are the spectacular results of our environmental rehabilitation efforts. Our in-house team has done a great job showing that we can reclaim disturbed areas to their former state, a critical step for Novo in its efforts to move Egina toward a commercial operation.”

Large-Scale Bulk Sample Results Table

Coarse Gold Fine Gold Total Gold

Large Scale Bulk Sample* Volume (cubic m) Gold Nuggets Metal Detected While Excavating Bulk Sample (grams)A Gold Nuggets Metal Detected in plus 5 mm Oversize Material (grams)A Gold Nuggets from Sluice plus 1 mm (grams)A Gold Nuggets Recovered by IGR 3000 plus 1 mm (grams)A Total Coarse Gold Nuggets, plus 1 mm (grams)A Gold in Shaker Table Concentrate (grams)B Gold in Shaker Table Tailings (grams)C Gold in IGR 3000 Tailings (grams)C Total Fine Gold, sub 1 mm (grams) Total Gold from Coarse and Fine Fractions (grams)

19EGTR006A 413.6 324.9 0 138.3 99.1 562.3 10.9 0 19.4 30.3 592.6

19EGTR006B 763.2 210.9 0 40.9 53.5 305.3 26.6 0 61.9 88.5 393.8

Total 1176.8 535.8 0 179.2 152.6 867.6 37.5 0 81.3 118.8 986.4

Notes:

A – Gold purity has been assessed at Egina and falls within a range of 89% - 95%.

B – Based on whole sample assays.

C – Back-calculated from assayed sub-samples.

*These bulk samples are from the swale and swale margins and are not necessarily representative of mineralization over the entire project area.

Description of bulk sampling process:

Large-scale bulk samples discussed in this news release were collected from trenches approximately 4 metres wide under the supervision of Novo personnel. Trench 19EGTR006A extends for 52 metres, and trench 19EGTR006B is 86 metres in length. Trench depth varies from about 1 - 1.5 metres. Sandy soil overburden was stripped prior to gravel extraction. Some underlying bedrock material was excavated along with gold-bearing gravels to ensure capture of gold on the bedrock interface. Each sample was excavated in lifts approximately 20-30 cm thick. Novo personnel detected every lift for gold nuggets prior to removal, and the location and weight of each nugget was recorded without limitation prior to being securely stored. Trench bulk sample gravel material of the entire excavated trench length is transported to Novo’s Station Peak camp and processed through the Company’s IGR 3000 gravity gold plant. Various concentrates and tailings from the IGR 3000 plant are currently being analyzed to evaluate fine grain gold. Once these results have returned, the fine gold contribution will be added to the coarse gold tally. X-ray fluorescence analysis of nuggets indicates purities ranging from 89-95%. Densities of gravels vary widely generally ranging between about 1.4-2.1 tonnes per cubic metre. Unlike hard rock gold deposits, alluvial gold deposit grades are commonly reported in grams per cubic metres.

Description of MAK sampling process:

MAK samples are collected from pits spaced approximately 50 metres apart across target areas. Pits are dug by track hoe and range up to 3 metres depth. Targeted sample size is approximately one tonne. Samples are placed in wooden crates lined with bulka bags and transported to Novo’s Station Peak camp where they are processed through a mobile alluvial Knudsen centrifugal concentrator. Concentrates are panned down to reveal gold for point counting and further study.

Dr. Quinton Hennigh, P. Geo., the Company’s President, Chairman, and a Director, and a qualified person as defined by National Instrument 43-101, has approved the technical contents of this news release.

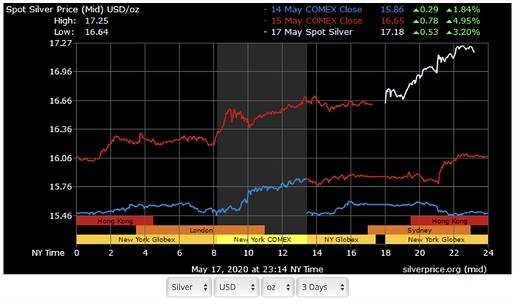

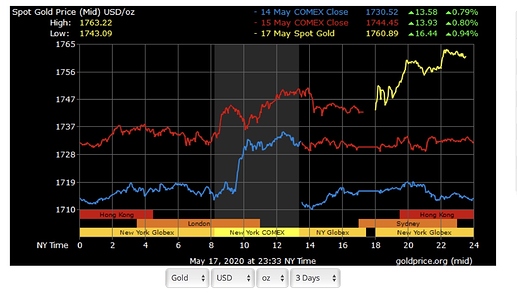

Looks like gold has begun the next leg up to around 1930. Silver has started a breakout that I see going to just about $21. IMO

Yeah, I think I saw last week BOA is predicting 3,000.00 per ounce over next 18 months. Wouldn’t surprise me with all the “sovereign debt” that seems to be increasing.

Eric Sprott on RNX on Sprott Money News Weekly Wrap-up May 15th '20:

“In a category of very cheap stocks and you can buy these stocks 3,4,5 times earnings […] RNX reported I think it was 2 cents US, their stocks at 4.5 times earnings […] they have good fundamentals, kicking out the cash. One of the great things about these companies. When you start kicking out cash at the rate these guys are kicking it you’ve got to do something with the cash flow. What are the choices? We can have a stock buy back. We can have a dividend increase. We are going to acquire somebody. These are very positive factors for stock prices.”

HUI is at a 7 year high, starting to climb the hill related to the 2011 high in GOLD.

GDXJ is almost at its 7 year high.

Performance in gold stocks has been very good for the last couple of months. But I think this is still primarily through index investing and money coming into the majors. That is, almost all the out performance has been in producing companies, and larger ones at that, which stand to benefit the most in the short term from higher PM prices.

Once these have performed for a while money should come farther down the stack to the juniors / exploration companies.

Gold really looks like it is determined to make a run to new USD highs. And now silver in the last week looks like maybe it is finally ready to start following gold up. If so, this implies the next sub-phase of a bull run as some of the more speculative money starts moving to silver to try and capture the bigger upside potential of silver compared to gold from here. Spot silver looks to break $17 here very soon.

“The play is silver. The play is silver now.” - Eric Sprott 5/15/2020

Other bullish statements on silver from the 16:00 minute mark

Trade Alert: Eric Sprott at Ely Gold Royalties Inc. (CVE:ELY), Has Just Spent CA$8.0m Buying 122% More Shares

Sprott might like silver, but I think he likes ELYGF too, which is a gold streamer. I’m enjoying one heckuva ride since .28.

RNC Minerals Announces High-Grade Gold Results at HGO and Drilling Program at Paleochannel Targets

Summary

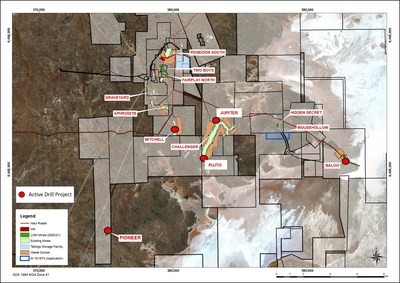

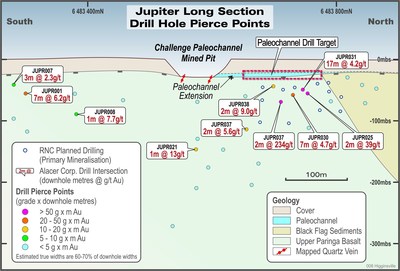

Paleochannel Project

- The paleochannel project is an integral component of HGO’s expected Life of Mine Plan, with drilling to date focused on two priority areas within the paleochannel system – Mitchell and Jupiter.

- The paleochannel system extends for over 7 kilometres south of current mining operations (Fairplay North) and provides multiple exploration targets along its length including extensions of the paleochannel and the hard rock potential at depth.

- Planning for the first of the high-grade primary gold mineralization targets is underway which will test the continuity of the mineralization below the Jupiter paleochannel.

- This mineralization, first identified by historical drilling in 2012, had not been followed up because of the prior onerous royalty attached to the tenement, which is now being eliminated (see RNC news release dated May 11, 2020).

- Drill intersection1, 2 highlights from the Jupiter primary mineralization are listed below:

- JUPR037: 234.0 g/t over 2 m downhole from 90 m

- JUPR025: 39.2 g/t over 2 m downhole from 64 m

- JUPR031: 4.2 g/t over 17 m downhole from 54 m

- JUPR030: 4.7 g/t over 7m downhole from 70 m

- Drill intersection1, 2 highlights from the Jupiter primary mineralization are listed below:

- Estimated true widths are 60%-70% of downhole widths

- Intersections previously reported by Alacer Gold Corp. (news release, March 26, 2013).

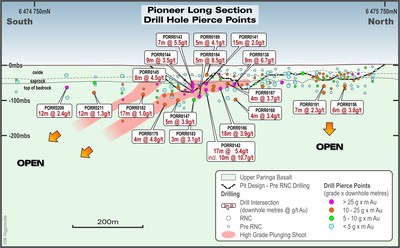

Pioneer Deposit

- New drilling by RNC has extended gold mineralization at Pioneer and outlined a high-grade shallow, south plunging shoot which shows clear potential for underground development. Pioneer is part of HGO’s near term mine plan.

- Highlights from the 2020 drill program include1:

- PORR0142: 5.4 g/t over 17.0 m from 67 m, including 10.7g/t over 6.0m

- PORR0186: 3.9 g/t over 18.0 m from 60 m

- PORR0184: 8.5 g/t over 5.0 m from 97 m, including 16.0g/t over 2.0 m

- PORR0138: 6.7 g/t over 9.0 m from 57 m

- Highlights from the 2020 drill program include1:

- Estimated true widths (Note: true widths approximate downhole widths).

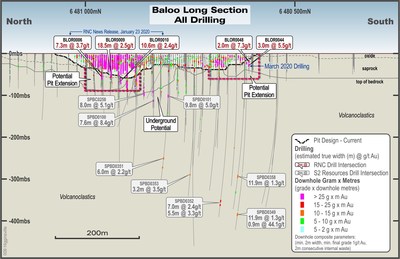

Baloo Mine extended to South

- Grade control drilling in the Baloo pit has extended high-grade gold mineralization beyond the pit design at the southern end of the pit.

- Six follow-up RC holes testing the extension of the mineralization at depth were completed and confirmed the presence of mineralization below the current pit.

- Highlights from the 2020 drill program include1:

- BLOR0044: 5.5 g/t over 3.0 m from 21m

- BLOR0048: 7.3 g/t over 2.0 m from 16 m

- Highlights from the 2020 drill program include1:

- Drillhole intervals are estimated true widths.

- The deeper extensions of the Baloo mineralization, below the current pit design, will be tested with infill diamond drilling later in 2020. The historical highlights summarized below underscore the underground potential of this deposit.

- Highlights of historical gold drill results1, 2 from S2 Resources:

- SPC0258: 5.1 g/t over 8.0 m from 106 m

- SPD0100: 8.4 g/t over 7.6 m from 125.2 m

SPD0101: 5.0 g/t over 9.8m from 111.5 m

- Highlights of historical gold drill results1, 2 from S2 Resources:

- Drillhole intervals are estimated true widths. (Note: true widths approximate downhole widths).

- Intersections previously reported by S2 Resources Ltd. (ASX news releases, February 10, 2016 and December 8, 2016).

Note: Tables showing complete results and drill hole locations can be found at the end of this news release.

TORONTO, May 19, 2020 /CNW/ - RNC Minerals (TSX: RNX) (“RNC” or the “Company”) is pleased to announce positive results from ongoing drilling at Higginsville and a further update of our review of historical drill records. As part of the Company’s open pit pipeline development strategy, drilling is now underway at the Jupiter project to be followed by Mitchell, two of the Company’s paleochannel deposit targets.

Paul Huet CEO and Executive Chairman RNC said, "Following the announcement of the elimination the Morgan Stanley NSR royalties last week (see RNC news release dated May 11, 2020), we are excited to be seeing further strong examples of the potential at Higginsville. Not only are we seeing further potential additions to open pit resources, but our ongoing technical review of the historical database has revealed another excellent high-grade target for us to pursue at the Jupiter project.

At Jupiter, the presence of historical drilling grades in excess of 230 g/t over two metres at relatively shallow depths (approximately 60 metres from the surface) highlights the tremendous upside potential at Higginsville. These results follow on from the historic drill results from the Aquarius deposit (see RNC news release date February 27, 2020) which are also high-grade and close to the surface. With the elimination of the Morgan Stanley NSR royalty, these projects will be free of this long-standing burden, which held back exploration and mining at Higginsville for over a decade.

Over the course of 2020, we will continue to aggressively target these new areas as we also test our existing pits for additional ore body extensions. The commencement of drilling on the paleochannel deposits is exciting and we look forward to continuing to build upon the outstanding results that we have delivered thus far at Higginsville in 2020."

Pioneer

The Pioneer gold deposit is located 13 km south south-east of the HGO processing plant (Figure 1). RNC commenced drilling at Pioneer late last year with the aim of upgrading and increasing the Historical Mineral Resource. The work involved a two-stage reverse circulation (“RC”) drill program totaling 86 drill holes for 7,953 metres. Results from the 2019 - 2020 drilling have extended the mineralization along strike to the south and down dip and identified a shallow, south plunging high-grade shoot (Figure 2). Further drilling is planned through the second half of 2020 to test continuity of the mineralization at depth and test the potential for an underground operation by drilling the interpreted high-grade shoot extensions.

Highlights1 of gold results from the drilling are listed below:

- PORR0138: 6.7 g/t over 9 m from 57 m

- PORR0141: 2.0 g/t over 15 m from 50 m

- PORR0142: 5.4 g/t over 17 m from 67 m, including 10.7 g/t over 6 m

- PORR0143: 5.5 g/t over 7 m from 59 m

- PORR0144: 3.5 g/t over 9 m from 66 m

- PORR0145: 4.6 g/t over 8 m from 80 m

- PORR0184: 8.5 g/t over 5 m from 97 m, including 16.0 g/t over 2 m

- PORR0186: 3.9 g/t over 18 m from 60 m

- PORR0209: 2.4 g/t over 12 m from 64 m

- Drillhole intervals are estimated true widths (Note: true widths approximate downhole widths).

Mineralization at Pioneer is interpreted to dip approximately 30° towards the east and is hosted within a mafic package comprised mainly of silicified basalt with narrow, cherty interflow sediments. Mineralization is interpreted as bounded by steeply east dipping, north northeast trending regional shears.

Baloo

Grade control drilling and follow-up RC drilling (6 holes for 262 metres) in the Baloo pit has extended the high-grade mineralization beyond the pit design at the southern end of the pit (Figure 3). Results from the grade control drilling and the deeper follow-up holes will be used to extend the existing pit design. Potential to extend the northern end of the pit at depth is also under review as supported by earlier released drill results (see RNC news release, Jan. 23, 2020). Drill intersection1 gold result highlights from the March RC program are listed below:

- BLOR0044: 5.5 g/t over 3.0 m from 21 m

- BLOR0048: 7.3 g/t over 2.0 m from 16 m

- Drillhole intervals are estimated true widths .

The deeper sections of the Baloo historical resource are planned to be tested with infill diamond drilling later in 2020. A review of previous exploration work completed by S2 Resources (“S2”) shows that mineralization extends over 300 m below surface with a number of significant intersections just below the current pit design highlighting the potential to extend the mine life of this deposit with an underground operation (Figure 3). Highlights of gold results from the S2 drill intersections1 (S2 Resources Ltd., ASX news releases, February 10, 2016, December 8, 2016 and February 13, 2017) are listed below:

- SPC0258: 5.1 g/t over 8.0 m from 106 m

- SPD0100: 8.4 g/t over 7.6 m from 125.2 m

- SPD0101: 5.0 g/t over 9.8m from 111.5 m

- Drillhole intervals are estimated true widths (Note: true widths approximate downhole widths).

Mineralization at Baloo is located on the Buldania Fault, a north north-west striking fault dipping shallowly approximately 30° to the east. Alteration comprises biotite +/‐pyrite‐arsenopyrite with multiple generations of veining present within the Fault zone. Gold mineralization is associated with quartz‐arsenopyrite‐pyrite veining.

Paleochannel Project

The paleochannel deposits at Higginsville are an integral part of the expected HGO mine plan. RNC is focused on three primary Paleochannel deposits: Mitchell, Jupiter and Pluto. Jupiter and Pluto belong to the Challenger paleochannel system which lies 3 kms east of the Mitchell paleochannel (Figure 1).

Historical mine production totaled 2.1 Mt @ 3.4 g/t (232,000 contained gold ounces). The existing Historical Indicated Mineral Resource of 1.5 Mt @ 2.2 g/t for 102,000 contained gold ounces and a Historical Inferred Mineral Resource of 0.3 Mt @ 2.1 g/t for 14,000 contained gold ounces (see technical report dated February 6, 2020 under Royal Nickel Corporation’s profile at sedar.com) was part of the acquisition of Higginsville . A qualified person has not done sufficient work on behalf of RNC to classify the historical estimates as current mineral resources or mineral reserves and RNC is not treating the historical estimates as current mineral resources or mineral reserves.

The remaining paleochannel historical resources were assessed and prioritized for follow-up drilling. This work resulted in all three areas (Mitchell, Jupiter and Pluto) being targeted for infill and extensional drilling, with the objective of upgrading and adding to the historical mineral resources. Drilling will also test the continuity of primary mineralization previously intersected at the Jupiter prospect, with the objective of producing a Mineral Resource estimate for this mineralization.

Drilling of an expected total of 4,060 m is planned in two stages. Stage one will comprise 33 drill holes for 2,140 m, targeting both the Jupiter primary and overlying paleochannel mineralization and infill the Mitchell 3 and 4 Historical Mineral Resources. Stage two will comprise 32 drill holes for 1,920 m, targeting an upgrade and extension of the Pluto Historical Mineral Resource.

RNC’s initial focus will be to improve confidence in the historical high-grade intersections with the objective of defining a Mineral Resource for mine evaluation. This will be driven in tandem with results from the paleochannel which overlies the primary mineralization. Highlights of historical drill intersection1 gold results from the primary mineralization are listed below (see Alacer Gold Corp. news release, March 26, 2013):

- JUPR037: 234.0 g/t over 2 m downhole from 90 m

- JUPR025: 39.2 g/t over 2 m downhole from 64 m

- JUPR031: 4.2 g/t over 17 m downhole from 54 m

- JUPR030: 4.7 g/t over 7m downhole from 70 m

- Estimated true widths are 60%-70% of downhole widths.

Paleochannel Deposits at Higginsville

Paleochannel gold deposits comprise both ancient placer gold, normally near the base of the channel-fill sequences, and chemically precipitated secondary gold within the channel-fill materials and underlying saprolite. These gold concentrations commonly overlie, or are adjacent to, primary mineralized zones within Archaean bedrock. At Jupiter, the primary mineralization, discovered by Alacer in 2012, begins approximately 50 metres below surface and is associated with a north-south steeply dipping shear structure hosted within Paringa basalt (Figure 4). Mineralization is associated with tensional quartz-(chlorite-carbonate) veining and sulphides (pyrite) with visible gold occurring in some intersections. The structure is variably mineralized for over 1 km of strike.

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Vice-President Exploration & Growth, Salt Lake Mining Pty Ltd, a 100% owned subsidiary of RNC, a Qualified Person for the purposes of NI 43-101.

At the Higginsville Gold Operation reverse circulation chip sampling was conducted by RNC personnel. Samples are transported to Bureau Veritas Minerals Pty Ltd of Kalgoorlie and Perth for preparation and assaying by 40gram (approx.) fire assay analytical method. Analytical accuracy and precision are monitored by the analysis of duplicates, additional blank material and certified standards inserted in the sample stream. Samples are weighed as received, dried and split to less than 3kg then pulverised by LM-5 to ensure a minimum 90% passing at -75µm.

The historical data referenced in this release has been reviewed under the supervision of Stephen Devlin, Vice-President, VP Exploration & Growth, Salt Lake Mining Pty Ltd, a 100% owned subsidiary of RNC, a Qualified Person for the purposes of NI 43-101, and is supported by relevant monthly exploration reports and historic mineral resource reports which detail the QA/QC procedures used on drill samples and provide analysis of the results of all associated QA/QC samples including blanks, standards (CRM samples), check assays and duplicates. All drilling from 2004 to present followed industry standard practices, with pre-2004 historic drilling not detailed but assumed to be similar to current practices (sources for such historical drill results are identified where applicable above). A qualified person has not done sufficient work to classify the historical estimates as current mineral resources and RNC is not treating the historical estimates as current mineral resources.

Can anyone explain how MUX is sinking like a stone while the rest of the mining world seems to be on fire (minus mdmn and aumc of course).

You’ll probably find your answer here…

I’ve had a standing order in at .76 for about two weeks in anticipation of a retracement. ![]()

Well, BOA said gold would go to 3,000.00 within 18 months - the trend seems to be in that direction.