Anyone want to comment on the disconnect between gold/silver prices and stock prices of PM companies?

First the PMs, then the producers as they show results from selling metals at higher prices, then the juniors that look to be decent take over targets by the producers who now have money (just starting IMO), and then ultimately if it goes on long enough, the junior mania as people speculate on the next great thing (not there yet).

I noticed Hecla just now reported Q2 earnings: “HECLA REPORTS 24% HIGHER REVENUES ON HIGHER PRODUCTION AND PRICES IN SECOND QUARTER 2020”

Now in the PR read this: "The average realized silver price in the second quarter was $18.44 per ounce, 23% higher than the $15.01 in the second quarter of 2019. "

What do you think that PR will look like at the end of Q3 if silver prices hold even at $25+ levels? But that’s the question: will they hold. And that is why there is a delay in the stocks: money wants to see if the PMs will hold. 9 years of bear market memories are burned in the brain.

By the way folks, I haven’t seen anyone comment about the following from Novo’s news release:

" Cautionary Note to U.S. Readers Regarding Estimates of Inferred, Indicated and Measured Resources

This news release uses the term “inferred mineral resources”, “indicated mineral resources” and “measured mineral resources”. We caution U.S. investors that while these terms are recognized and required by Canadian regulations, they are not recognized by the U.S. Securities and Exchange Commission (the “ SEC ”). “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimates of “inferred mineral resources” may not form the basis of a feasibility study or prefeasibility studies. U.S. investors are cautioned not to assume that any part or all of an “inferred mineral resource” exists or is economically or legally mineable . The terms “indicated mineral resources” and “measured mineral resources” are not defined under SEC Industry Guide 7 and are not normally permitted to be used in documents filed with the SEC. U.S. investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into SEC Industry Guide 7 reserves .

This news release does not constitute an offer for sale, or a solicitation of an offer to buy, in the United States or to any “U.S Person” (as such term is defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “ 1933 Act ”)) of any equity or other securities of Novo. **The securities of Novo have not been, and will not be, registered under the 1933 Act or under any state securities laws and may not be offered or sold in the United States or to a U.S. Person absent registration under the 1933 Act and applicable state securities laws or an applicable exemption therefrom."**

Pretty interesting stuff, especially considering the fact that I’m trying to buy shares of NVO in an investment account I have in Switzerland and was just informed my orders were turned down this morning.

TR,

Keep in mind that Novo’s gold is basically in a type of placer deposit. Simply small gold nuggets found in variable concentrations over a wide area near the surface in a thin bed. Erosion has created areas where it is a little more concentrated. Typically, placers are very hard to define into a resource with conventional techniques. (One drill hole may show zero while the next one will show a lot. There is a LOT of nothing in a placer.) Generally, mining companies just mine them and hope they are profitable. (Think Gold Rush show.) Lots and lots of bulk sampling really is the only way one can get a true sense of their value. Based on the numbers so far, profitability appears to be assured; it is not even close. Novo would likely ending up being the lowest cost miner in the world.

Inventus in the news. Not quite sure of the significance but perhaps HR can fill us in?

Ah ok. Thanks Mike!

Novo still melting down …

A buying opportunity for me today

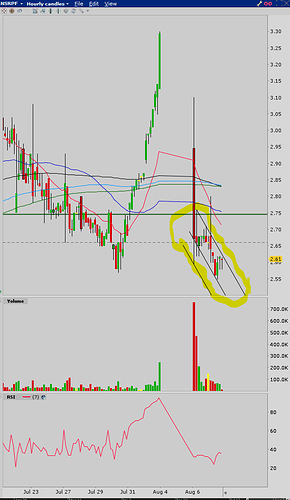

In regards to NSRPF so far, for anyone who uses charts and has some basic understanding of charting lingo, if you look at an hourly interval chart and the trading that has occurred since the end of the halt yesterday, the first candle is a big red one with what looked like a bear flag forming by the end of yesterday’s trading. But, because of today’s trading so far, that bear flag is no longer a bear flag. It’s the beginning of a downward moving channel. Over the past two or so years I have noticed that at the end of trend moves, be they up or down, these channels sometimes form at the end of the trends and they often mark the start of what turns out to be a reversal of the trend. As usual there is no guarantee that’s what this is, but it’s something to pay attention to. If it is one of these end of trend channels we’ll see price break up out of the channel and start what in this case would be a continuation of the uptrend.

In the meantime silver and gold futures have both so far bounce off of intraday MA support that gives me reason to believe the strong uptrends are continuing, although the day is not over. I’ll explain on the charting forum…

For NSRPF, 2.56 and 2.52 are key levels imo today. If we close above 2.56 there is a chance, but not necessarily a certainty, that we have seen the bottom. Below 2.56 then a better chance that we see lower prices next week. Just my opinion. You all know I’ve been wrong plenty of times.

Thanks very much for your thoughts on this!

With so many better performing gold companies out there, it might be time for me to cut bait on MUX. This Seeking Alpha article does a good job making that case:

McEwen Mining: Avoid The Laggards

Aug. 8, 2020 6:13 AM ET

About: McEwen Mining Inc. (MUX)

Long/short equity, momentum, gold & precious metals

(18,723 followers)

Summary

McEwen Mining announced its Q2 results on Thursday and has had a rough start to FY2020, with year-to-date gold-equivalent ounce production down nearly 35%.

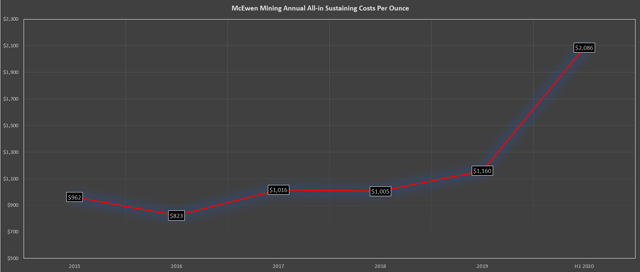

Given the significantly lower gold production, costs have also taken a massive hit, with H1 2020 all-in sustaining costs of $2,068/oz, up over 70% from the year-ago period.

Given these unimpressive year-to-date results, McEwen Mining is expected to be one of the only gold producers to post net losses for FY2020 as well.

I continue to see the stock as an Avoid above $1.50 in favor of gold producers that are profitable at $1,500/oz gold and have delivered on their long-term plans.

We’re now more than halfway through the Q2 Earnings Season for the Gold Miners Index (GDX), and while many miners have had a tough start to the year, few have bombed their results as bad as McEwen Mining (NYSE:MUX). The company produced 19,200 gold-equivalent ounces (GEOs), down 58% from last year, and costs sky-rocketed at an even faster pace than the gold price, with all-in sustaining costs (AISC) of $2,719/oz in the quarter. While a good chunk of this performance was related to COVID-19-related headwinds, this trend of poor performance has been in place for several quarters now, so chalking this up to a challenging quarter due to COVID-19 is hardly accurate. Based on the company’s continued weak performance, non-existent margins at $1,700/oz gold (GLD), and inability to generate earnings, I continue to see the stock as an Avoid above $1.50 in favor of producers that have actually delivered shareholder value.

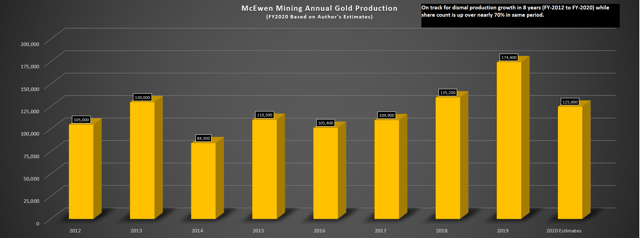

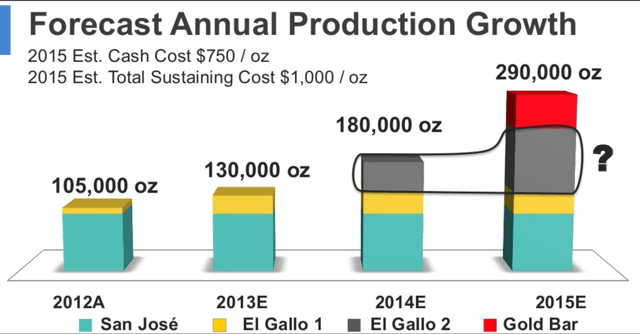

McEwen Mining released its Q2 results on Thursday with yet another tough quarter, little surprise for those following the stock the past couple of years. The company reported quarterly production of 19,200 GEOs, down 58% year over year, with H1 2020 production of 54,200 GEOs, down from 82,200 GEOs in H1 2019. This disastrous performance was a result of operational issues as well as COVID-19-related headwinds, with the company’s newest Gold Bar Mine still performing nowhere near expectations. Based on the economic study, Gold Bar supposed to produce 63,000 ounces of gold per year at $843/oz, but the company has struggled to get costs below $1,200/oz. The most recent goal in the Q2 release is to become a 300,000-ounce producer eventually, a goal discussed in the 2013 presentation with the expectation to achieve this by FY-2015. Obviously, the company has failed miserably on achieving this goal as it’s now been restated a new goal nearly a decade later.

(Source: Company Presentation)

(Source: Company Presentation)

As we can see from the chart above, the closest McEwen Mining ever got towards its 290,000-ounce per year goal was 174,400 GEOs produced last year. However, we’re on track for a significant decline this year with continued underperformance at Gold Bar, in addition to COVID-19-related closures. Year-to-date, the company has produced 54,200 GEOs, and my estimate is for 125,000 GEOs for FY2020, which would translate to a nearly 30% drop in production year over year. Assuming this is the case, we have seen a 65% increase in the share count since 2012 and less than 20% production growth eight years later. This is pitiful considering that Kirkland Lake Gold (KL) just used 30% of its shares to grow production by over 50% in 18 months with the Detour Lake acquisition. Let’s take a closer look at McEwen’s first-half results below:

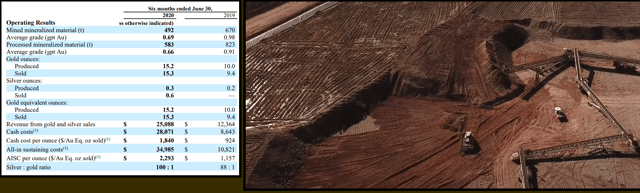

(Source: Company Video, Management Discussion & Analysis)

(Source: Company Video, Management Discussion & Analysis)

Beginning with the company’s Gold Bar Mine, we saw H1 2020 production of 15,200 GEOS at all-in sustaining costs of $2,293/oz. While these results were up year over year from the 10,000 GEOs reported in the year-ago period, they pale in comparison to the 60,000 ounces of production expected relative to the Feasibility Study, and are coming in at more than double the expected costs. The reason for the much lower production was that the company lost one month of operations with mining activities stopped on April 1st and not ramped up again until May 4th. However, during May, the company chose to operate only on day shift, which was a further headwind, resulting in much lower production. The hope is that the mine will be back to regular operations by September, and a new resource estimate and mine plan is expected by Q4, after we saw a massive write-down in Q1 of $83.8 million on the mine due to a significant reduction in ounces relative to the mine plan.

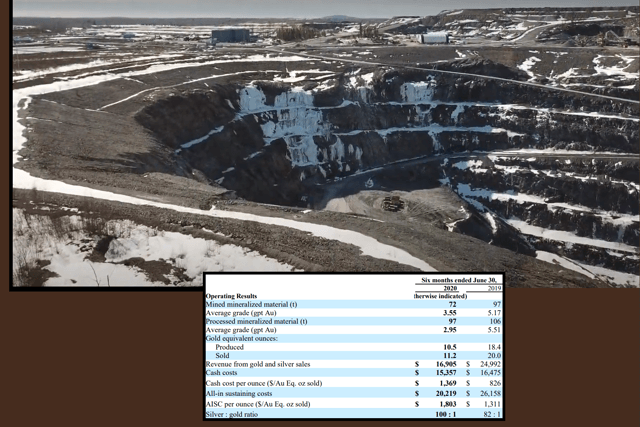

(Source: Company Video, Management Discussion & Analysis)

(Source: Company Video, Management Discussion & Analysis)

Moving over to the company’s Black Fox Mine, it was also a difficult quarter with operations suspended from March 26th to mid-April due to government-mandated shutdowns. The company’s year-to-date production at Black Fox is sitting at 10,500 GEOs, down significantly from the 18,400 GEOs produced in H1 2019 due to significantly lower grades and slightly lower throughput. During H1 2020, we saw throughput of 97,000 tonnes vs. 106,000 tonnes, a 9%~ decrease, but grades were down over 45% from 5.51 grams per tonne gold to 2.95 grams per tonne gold. This massive drop in gold-equivalent production led to a surge in all-in sustaining costs, with H1 2020 AISC coming in at $1,803/oz vs. $1,311/oz in the same period last year.

McEwen Mining discussed the potential for Black Fox to incorporate multiple deposits into a Preliminary Economic Assessment with the hopes of turning the mine into a 100,000-ounce per year producer by FY2024. I believe this is very ambitious as the company has struggled to even operate the mine at a profit since acquiring it, and the mine life has now dwindled to less than one year unless McEwen can replace reserves. Therefore, while this plan to turn Black Fox into a significant operation sounds great, I wouldn’t put too much weight into this project at this time. Just over a year ago, it was Gold Bar that was supposed to be the game-changing asset for the company, and shareholders know how that has turned out since.

Finally, at the company’s 49% owned San Jose Mine, it was not a great start to the year either as the mine continues to operate well below normal levels due to travel restrictions. The Argentinian Mine was initially hit with a suspension in March that was cleared by mid-April, but travel restrictions have made it difficult for the mine to ramp up fully, so attributable GEOs came in at just 23,800 for McEwen Mining, down from 43,100 in H1 2019. This is disappointing as this has been the only mine operating well for McEwen as Black Fox and Gold Bar have seen continued underperformance. The hope is that we will see a ramp-up to more normal production in the second half, but this depends on travel restrictions being lifted in Argentina.

(Source: Company Presentation)

(Source: Company Presentation)

Given the extremely high costs at Gold Bar and Black Fox and much lower production from McEwen’s one solidly performing asset, San Jose, it’s no surprise that all-in sustaining costs swelled in the quarter. However, the amount that they’ve increased is quite alarming, as H1 2020 costs came in at $2,086/oz, well above the company’s average realized selling price of $1,645/oz. This contributed to a significant net loss in the quarter of $19.8 million, well above the $13.0 million net loss at the same time last year, and bringing the year-to-date net loss to $119.0 million, including last quarter’s write-down. These are ghastly results for a miner that should be benefiting from near-record gold prices. Obviously, these results are much worse due to COVID-19, but most miners skated through COVID-19 with some headwinds and a 10% increase in costs. In McEwen Mining’s case, we’ve seen costs skyrocket across the board from already unacceptable levels.

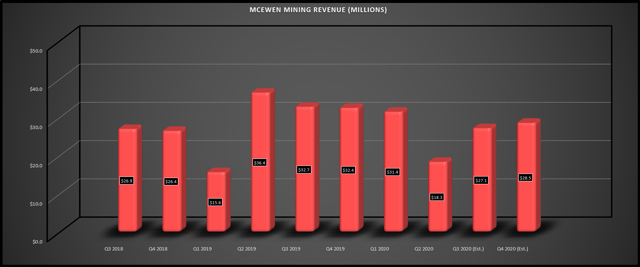

(Source: YCharts.com, Author’s Chart)

(Source: YCharts.com, Author’s Chart)

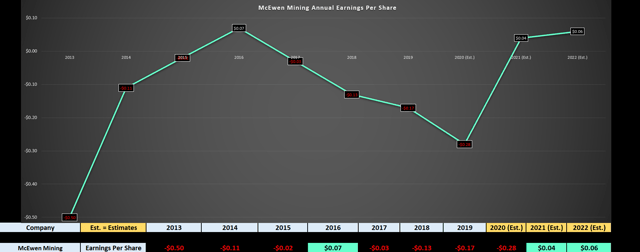

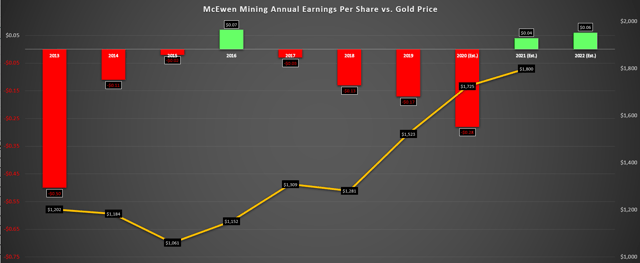

Given the weak operating results, McEwen Mining is projected to post yet another net loss per share this year, with FY2020 annual EPS estimates currently sitting at (-) $0.28. This would translate to the company’s fourth year of net losses in a row despite rising gold prices in the same period, and it would make McEwen Mining one of the only gold producers posting a net loss this year. In my opinion, there is absolutely no reason to own any gold producer unless it can generate positive earnings, and this is especially true in a rising gold price environment. Given that McEwen Mining is incapable of achieving this, I don’t see any investment thesis here, which is why I’ve rated the stock as an Avoid for over a year now.

(Source: YCharts.com, Author’s Chart)

(Source: YCharts.com, Author’s Chart)

Gold has gone from $1,200/oz to $1,800/oz, yet McEwen Mining has found a way to continue posting net losses. One of the reasons for this is that revenue has gone essentially nowhere the past two years, with revenue coming in at $18.3 million in Q2 2020, down 50% year-over-year. While Q3 2020 and Q4 2020 estimates are projecting a significant bounce back to $27.1 million and $28.5 million, this would still translate to negative revenue growth year over year if these estimates are met. At a time when we have some of the best gold producers like B2Gold (BTG) posting 65% growth in revenues year over year, it’s very difficult to justify investing in a laggard like McEwen Mining.

While some investors will chalk up this quarter to COVID-19-related headwinds, I would argue that COVID-19 is merely the straw that’s further injured McEwen Mining’s back. Even before COVID-19 came, we already had steady net losses, a massive write-down on Gold Bar, underperforming assets, and anemic growth. Therefore, while COVID-19 certainly hasn’t helped matters, it’s not like we would have seen a sharp turnaround here absent the pandemic. Given that McEwen Mining remains one of the only gold producers that can’t generate positive earnings and margins remain anemic even if costs do come down, I continue to see the stock as an Avoid above $1.50. This doesn’t mean the stock can’t go higher if gold remains above $2,000/oz, but I see no reason to own an underperformer when we have several miners firing on all cylinders and beating their goals consistently.

https://seekingalpha.com/article/4366269-mcewen-mining-avoid-laggards

Anyone have recommendations on undervalued silver companies they like?

Karora Announces Strong Second Quarter Financial And Operating Results, Reiterates 2020 Guidance

Karora will host a call/webcast on August 10, 2020 at 10:00 a.m. (Eastern Time) to discuss the second quarter results. North American callers please dial: 1-888-231-8191, international callers please dial: (+1) 647-427-7450. For the webcast of this event click [here] (replay access information below).

TORONTO, Aug. 10, 2020 /CNW/ - Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to announce its financial results and review of activities for the three and six months ended June 30, 2020. All amounts are expressed in Canadian dollars, unless otherwise noted. For additional information please refer to Karora’s Management’s Discussion & Analysis (“MD&A”) and unaudited condensed interim consolidated financial statements for the three and six months ended June 30, 2020 and 2019.

Karora Resources Inc–Fig1

Highlights

- Second quarter 2020 consolidated gold production of 24,078 ounces, 2020 gold production guidance of 90,000 to 95,000 ounces is maintained (assuming no significant interruption in operations as a result of the COVID-19 virus).

- Second quarter 2020 consolidated all-in-sustaining-costs (“AISC”)1 of US$1,065 per ounce was at the lower end of the 2020 guidance, US$1,050-$1,200 per ounce. The Corporation continues to target AISC costs of approximately US $1,000 per ounce by the end of 2020.

- Net earnings of $9.8 million, or $0.07 per share for the second quarter of 2020, up $9.3 million from $0.5 million in the first quarter of 2020.

- Adjusted earnings1 of $16.6 million, or $0.12 per share for the second quarter of 2020, up $4.0 million from $12.6 million in the first quarter of 2020.

- Adjusted EBITDA1 was $17.3 million or $0.13 per share for the second quarter of 2020, up $3.7 million from $13.6 million in the first quarter of 2020.

- Strengthened cash position and balance sheet: Karora ended the second quarter of 2020 with a strong cash position of $50.2 million, and working capital of $43.8 million, improvements of $11.8 million and $13.1 million respectively from March 31, 2020. The second quarter cash balance is net of payments into gold hedge agreements totalling $3.5 million.

- Fully leveraged to gold price: Gold hedge agreements were concluded during the second quarter. Karora gold sales are now fully exposed to market gold prices.

- Closed acquisition of the Spargos Reward high-grade open pit gold Project in Western Australia on August 7, 2020.

- Royalty reductions: Eliminated the Morgan Stanley NSR gold royalty on the Higginsville (HGO) properties and have reached an agreement with Maverix Metals to reduce the Beta Hunt gold royalty by 2.75% (subject to certain conditions precedent).

- Eric Sprott share investment: In connection with the agreement to reduce the Beta Hunt gold royalty, Eric Sprott increased his ownership in Karora by 26 million shares (prior to share consolidation) and, along with an additional institutional investor, effectively took up the entire planned share issuance announced June 30, 2020 as part of the agreement with Maverix Metals to reduce the Beta Hunt gold royalty.

- Sale of remaining interest in Dumont Nickel Project: on July 27, 2020, Karora closed the sale of its 28% interest in the Dumont Nickel Project for proceeds of up to $47.6 million. Karora immediately received $10.7 million in cash, comprised of $7.4 million from Waterton for its interest and a $3.3 million refund of Karora’s share of the cash held within the Dumont Joint Venture. On a future sale or other monetization event, the Corporation will be entitled to receive 15% of the net proceeds from the transaction (net of certain agreed costs and deductions) up to a maximum of an additional $40.2 million.

- Effective July 31, 2020, the corporation completed a consolidation of its outstanding common shares on the basis of one (1) post-consolidation common share for every four point five (4.5) pre-consolidation common shares (the “Consolidation”). The exercise price and the number of common shares issuable under any of the Corporation’s outstanding share-based securities such as warrants, stock options and restricted share units, as applicable, have been proportionately adjusted.

- Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section 14 of this MD&A.

Paul Andre Huet, Chairman & CEO, commented: "We have been extremely busy at Karora since the start of the second quarter, with yet another strong operational performance of sustainable gold production and steadily reducing costs, despite challenges associated with COVID-19. Not only did we return a strong financial quarter, but we also achieved several major corporate objectives which have transformed the Corporation into a top tier junior producer and have laid the foundation for the next stage of Karora’s growth as a business.

As always, our success begins with delivering on our production results and the second quarter continued the trend of strong results since we acquired the Higginsville mine and mill one year ago. During the second quarter, we produced 24,078 ounces, bringing our total production during the first six months of 2020 to 48,895 ounces, or 54% of the lower end of our 2020 guidance. Not only did we deliver strong production, but we also continued our downward trend in AISC despite the elevated costs associated with important COVID-19 precautions we have initiated across our operations in Western Australia. AISC of US$1,065 per ounce sold during the quarter was a US$36 per ounce improvement over the first quarter of 2020 and continues our trend towards our gold of US$1,000 per ounce by the end of 2020.

On the corporate front, we have completed a number of actions that will further strengthen our position as a gold focused producer and which leave us well positioned to deliver exceptional operational and financial performance in the second half of 2020. We eliminated the Morgan Stanley NSR gold royalty on the Higginsville properties and announced an agreement with Maverix Metals to reduce the Beta Hunt gold royalty by 2.75%, essentially unlocking HGO and Beta Hunt for renewed exploration growth. We also recently announced the closing of the Spargos high-grade gold project acquisition, which we expect to fast track into our production profile 2021.

Further bolstering our financial position and focus on gold, we announced the sale of our remaining 28% stake Dumont Nickel Project providing immediate cash of nearly $11 million that can be re-invested in growing our gold business, while retaining significant upside exposure to the value of Dumont upon a potential future sale.

All these initiatives have already and are expected to continue to drive substantial value for our shareholders. Looking ahead, we expect to update the market with a resource and reserve update for our Australian operations during the fourth quarter of 2020.

With a quarter end cash balance of $50.2 million, Karora is rapidly improving on an already strong financial position. I am pleased to announce that we are now unhedged on 100% of our gold production moving forward and we look forward to full exposure to the excellent gold prices in today’s market."

COVID-19 Preparedness

Karora has continued to maintain strict control measures at its operations in response to the COVID-19 pandemic. Procedures are in place to ensure operating sites remain as prepared and responsive to the situation as possible. While the situation in Western Australia with respect to COVID-19 has broadly improved, Karora continues to actively monitor the advice of local health authorities and has employed a full-time nurse and supporting medical staff to monitor the status of individuals entering and leaving site. Furthermore, the company has adjusted rotations for personnel on site and has chartered Karora-only flights where prudent to ensure the health and safety of its employees and stakeholders, which remains the company’s top priority.

Results of Operations

Table 1 - Highlights of operational results for the periods ended June 30, 2020 and 2019

Three months ended, Six months ended,

For the periods ended June 30, 2020 2019 2020 2019

Gold Operations (Consolidated)

Tonnes milled (000s) 326 89 640 139

Recoveries 92% 93% 93% 93%

Gold milled, grade (g/t Au) 2.26 3.32 2.30 3.17

Gold produced (ounces) 24,078 8,418 48,895 13,196

Gold sold (ounces) 23,185 8,482 47,811 14,857

Average realized price (US $/ounce sold) $1,609 $1,335 $1,549 $1,310

Cash operating costs (US $/ounce sold)1 $935 $1,264 $950 $1,107

All-in sustaining cost (AISC) (US $/ounce sold)1 $1,065 $1,316 $1,084 $1,193

Gold (Beta Hunt Mine) 1

Tonnes milled (000s) 186 82 372 132

Gold milled, grade (g/t Au) 2.64 3.32 2.61 3.17

Gold produced(ounces) 16,818 8,114 33,988 12,892

Gold sold (ounces) 16,024 8,187 33,102 14,562

Cash operating cost (US $/ounce sold)1 $982 $1,026 $963 $970

Gold (HGO Mine)

Tonnes milled (000s) 140 7 268 7

Gold milled grade (g/t Au) 1.75 1.38 1.87 1.38

Gold produced (ounces) 7,260 304 14,907 304

Gold sold (ounces) 7,161 295 14,709 295

Cash operating cost (US $/ounce sold)1 $829 N/A2 $923 N/A2

- Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section 14 of Karora’s MD&A dated August 10, 2020.

Higginsville (“HGO”)

During the second quarter of 2020, 140 kt of HGO material was milled at a grade of 1.75 g/t for production of 7,260 ounces of gold.

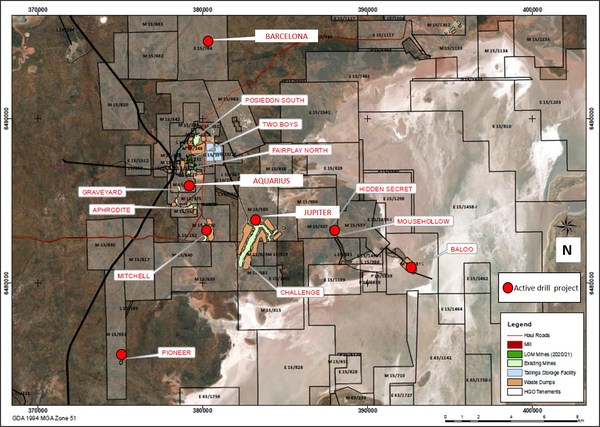

Production from Baloo continued throughout the second quarter with mining now at the 226RL north end and 228 RL south. The lower mined grade during the second quarter when compared to the first quarter was a result of processing of lower grade stockpiles due to heavy rainfall restricting access to mill feed from Baloo and Beta Hunt during the start of the second quarter. Despite these heavy rains and increased ground water inflows into the Baloo pit, the mining team performed exceptionally well by effectively managing the dewatering activities and limiting its impact on productivity, as reflected in the second quarter numbers. Recent grade control drilling has intersected additional high grade +2 g/t material at depth leading to a re-optimization of the entire pit. The re-optimization is expected to deliver further mineable ounces to the Baloo resource inventory. Completion of this work is expected during the third quarter of 2020.

The Fairplay North pit is currently being mined in two stages to optimize mining activities with final production originally expected to be completed by the end of the third quarter 2020. However, recent drilling has raised the potential for this to be extended.

As originally announced on February 27, 2020, Karora drilling has extended mineralization at the Hidden Secret and Mousehollow projects. Subsequent to the end of the second quarter, the corporation began pre-stripping and mining at Hidden Secret which will provide a third source of mill feed from HGO for the Higginsville plant along with additional operational flexibility. Additional metallurgical test work has also been received confirming recoveries in excess of 90%.

An updated mineral resource estimate for the Hidden Secret and Mousehollow projects is expected to be delivered in fourth quarter of 2020 as part of the planned update for the Australian operations.

Beta Hunt

During the second quarter of 2020, 186 kt of Beta Hunt material was milled at a grade of 2.64 g/t for production of 16,818 ounces of gold.

Beta Hunt production continues to focus on the Western Flanks and A Zone mining areas. Mining areas within the Western Flanks have shown widths up to 20m wide which help underpin the increase in Beta Hunt mined production to approximately 65,000 tonnes per month compared to budget 50,000 to 55,000 tonnes per month.

Consolidated Milling

On a consolidated basis, 326 kt were milled in the second quarter of 2020 at an average gold grade of 2.26 g/t, to produce a total of 24,078 ounces of gold. Mill availability remained in a stable range, averaging over 95% which was consistent with prior quarters. Milling operations had a third consecutive quarter of improved cost performance with processing costs decreasing to $21 per tonne compared to $27 per tonne in the first quarter of 2020. This is despite wet and clayey oxide material from Fairplay North causing some throughput issues during the quarter. To overcome this issue, a number of mitigation methods have been put in place. These include the addition of a temporary screening plant which allows the fines to bypass the crushing circuit.

For the second quarter, the HGO mill feed was approximately 60% Beta Hunt and approximately 40% at HGO open pits. Longer term, the aim is a mill feed ratio of approximately 50:50 Beta Hunt to HGO, which will assist in fully optimizing the HGO plant.

Cash operating costs1 and AISC1 were US$935 and US$1,065 per ounce sold respectively on a consolidated basis for the second quarter of 2020.

Outlook

Following the strong first half of the year, Karora is maintaining its consolidated production and cost guidance for its Australian operations (Beta Hunt and HGO) of 90,000 to 95,000 ounces of gold at an average AISC1 of US$1,050 to US$1,200 per ounce sold. Karora continues to target AISC1 costs of approximately US$1,000 per ounce sold by the end of 2020.

1. Reference is made to the Non-IFRS Measure section 14 of Karora’s MD&A dated August 10, 2020.

HGO Royalty Elimination

On May 11, 2020 the Corporation announced it had reached an agreement with Morgan Stanley Capital Group Inc. (“Morgan Stanley”) to acquire the remaining 1.75% NSR royalty for US$9 million in cash which covers a large number of tenements at Karora’s Higginsville Gold Operations. This transaction removed the remaining NSR royalty obligations in respect of the affected tenements, with the exception of the mandatory Western Australia state royalty of 2.5%. The current participation payment arrangement with Morgan Stanley remains in place. See Karora news release dated December 19, 2019 for details of the arrangement.

HGO Exploration

During the second quarter, resource, infill and extensional drilling at the current Baloo and Fairplay North open pit operations continued to support ongoing mining activities of both pits. Grade control drilling has also commenced at the Hidden Secret open pit, to be closely followed at Mousehollow. Mining of these pits is expected to commence in the third quarter of 2020 with all necessary approvals now in place. Both pits are within 10 km of the HGO treatment plant.

Resource definition drilling at the Pioneer deposit continues with the aim of advancing the project to mine ready as part of Higginsville pipeline of open pit projects. The HGO production pipeline strategy is to maintain a minimum of two open pits operating in tandem at any time, to ensure flexibility with production and fully optimize the feed blend into the HGO plant.

The Eundynie area which surrounds the Hidden Secret and Mousehollow pits has been identified as having significant exploration potential with particular interest around the old historic Eundynie mining centre located only 500m north of the planned pits. Last known mining at Eundynie occurred in 1915, with records showing multiple historic shafts, some extending to depths of up to 120m and grades as high as 210 g/t over approximately 0.9m. The exploration potential below these workings is yet to be tested and could provide an opportunity for additional high-grade mineralization. Drilling is planned for later in the year.

Figure 1 below shows some of the areas where Karora is either actively advancing or evaluating as high-priority exploration targets at HGO. In addition to ongoing exploration at Baloo and Fairplay North, a number of tenements covered under the now eliminated Morgan Stanley NSR royalty are now considered high priority. These areas include Aquarius, Hidden Secret, Mousehollow, Pioneer, the Two Boys extension, Paleochannel extensions and Barcelona.

Given the large number of exploration brown field and greenfield targets within close proximity of the HGO plant, the corporation is considering options to fast track exploration. A review to re-prioritize exploration targets is currently underway.

Preliminary observations from the work completed to date show significant and well-recognised structural trends associated with known economic primary mineralization plus substantial paleochannel systems. Karora plans to undertake a targeting study as the basis for a drill program.

Beta Hunt Royalty Reduction

On June 30, 2020, Karora and Maverix Metals Inc. (“Maverix”) announced an agreement to reduce the gold royalty at Karora’s Beta Hunt mine through the creation of a strategic partnership which align both parties in unlocking the significant value at Beta Hunt for their respective shareholders. Karora reached an agreement with Maverix to reduce the royalty on Beta Hunt gold production from 7.5% to 4.75% effective July 1, 2020, subject to certain conditions. The reduced royalty burden on the Beta Hunt mine will allow both Karora and Maverix shareholders to benefit from a renewed focus on exploration, development and potential future production growth at Beta Hunt. As consideration for the reduction, Karora will pay US$18 million in cash to Maverix.

In connection with this transaction, which was to be paid in cash and shares issued to Maverix as previously announced (see Karora news release dated June 30, 2020), Karora worked alongside Maverix to effectively place the entire planned share issuance with Eric Sprott and one other institutional investor (see Karora news releases dated July 14 and July 17, 2020). Karora issued a total of 36.5 million common shares at $0.506 per pre-consolidation share, which is the same price per share that had been agreed with Maverix Metals Inc. (see Karora news release dated June 30, 2020).The proceeds of the share issuance will be used to complete the Maverix transaction. As a result, no common shares of Karora will be issued to Maverix.

Spargos Reward Project Acquisition

On August 7, 2020, Karora completed the acquisition of the Spargos Reward Gold Project for A$4 million, which the corporation elected to pay for in cash. Karora is subject to a minimum spending commitment of A$2.5 million on exploration and development at the Spargos Reward project during the two-year period from the closing date. The seller is entitled to an additional (i) A$1.5 million in Karora shares on commencement of gold production from Spargos, and (ii) A$1.0 million in Karora shares if a new additional indicated gold resource of at least 165,000 ounces is delineated at the Project.

Spargos, located approximately 65 km from our Higginsville mill, is expected to provide a new high-grade source of feed for the HGO mill. Karora intends to fast tract Spargos into our growing production pipeline beginning in 2021. Follow up is planned on the exciting exploration upside at Spargos, as demonstrated by RC drillhole 19SPRRC004 intersection of 37.1 g/t over 18m (62m to 80m), including 93.1 g/t over 2m from 78m downhole1,2. (See Karora news release dated August 7, 2020).

- Historical drill information for hole 19SPRRC004, as provided in Corona Resources Limited news release (www.coronaresources.com.au), December 6, 2019.

- Downhole thickness. True thickness cannot be estimated with available information.

Financial Highlights

Table 5 - Highlights of Second Quarter Financial Results

(in thousands of dollars except per share amounts)

For the periods ended June 30, 2020 Three months ended, Six months ended,

2020 2019 2020 2019

Revenue 56,100 17,249 110,382 28,112

Production and processing costs 25,775 14,044 53,061 20,542

Earnings (loss) before income taxes 17,242 (14,348) 18,126 (15,925)

Net earnings (loss) 9,818 (14,452) 10,357 (16,029)

Net earnings (loss) per share - basic 0.07 (0.13) 0.08 (0.15)

Net earnings (loss) per share - diluted 0.07 (0.13) 0.07 (0.15)

Adjusted EBITDA1,2 17,348 (6,613) 30,929 (6,779)

Adjusted EBITDA per share - basic1,2 0.13 (0.06) 0.23 (0.06)

Adjusted earnings (loss)1 16,579 (7,033) 29,179 (7,406)

Adjusted earnings (loss) per share1 0.12 (0.06) 0.22 (0.07)

Cash flow provided by (used in) operating activities 21,822 (4,255) 33,298 (8,014)

Cash investment in property, plant and equipment and mineral property interests 10,523 5,651 18,225 13,394

| 1. | Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of Karora’s MD&A dated August 10, 2020. |

|---|---|

| 2. | Earnings before interest, taxes, depreciation and amortization (“EBITDA”). |

Adjusted EBITDA and Adjusted Earnings of $17.3 million and $16.6 million, respectively, were up from $(6.6) million and $(7.0) million in 2019. During the second quarter of 2019, bulk mining was temporarily ramped down at Beta Hunt for drilling and there was no contribution from HGO which was acquired in June 2019.

Table 6 - Highlights of Karora’s Financial Position

(in thousands of dollars) :

| For the period ended | June 30, 2020 | December 31, 2019 |

| Cash and cash equivalents | 50,167 | 34,656 |

| Working capital1 | 43,759 | 26,506 |

| PP&E & MPI | 147,831 | 98,955 |

| Total assets | 231,699 | 177,777 |

| Total liabilities | 128,152 | 85,495 |

| Shareholders’ equity | 103,547 | 92,282 |

1 Working capital is a measure of current assets (including cash and cash equivalents) less current liabilities.

Karora ended the second quarter of 2020 with a strong cash position of $50.2 million, an increase of $11.8 million compared to March 31, 2019. As of June 30, 2020, the Corporation has zero gold ounces remaining in the hedge program and Karora is now hedge free. As at June 30, 2020, Karora had a working capital surplus of $43.8 million compared to a $26.5 million surplus as at December 31, 2019 for an improvement of $17.3 million.

For a complete discussion of financial results, please refer to Karora’s MD&A and unaudited condensed interim financial statements for the three and six months ended June 3, 2020 and 2019.

Conference Call / Webcast

Karora will be hosting a conference call and webcast today beginning at 10:00 a.m. (Eastern time). A copy of the accompanying presentation can be found on Karora’s website at www.karoraresources.com.

Live Conference Call and Webcast Access Information:

North American callers please dial: 1-888-231-8191

Local and international callers please dial: 647-427-7450

A live webcast of the call will be available through Cision’s website at:

Webcast Link (https://produceredition.webcasts.com/starthere.jsp?ei=1348439&tp_key=97f01a6d91)

A recording of the conference call will be available for replay through the webcast link, or for a one-week period beginning at approximately 1:00 p.m. (Eastern Time) on August 10, 2020, through the following dial in numbers:

North American callers please dial: 1-855-859-2056; Pass Code: 7790889

Local and international callers please dial: 416-849-0833; Pass Code: 7790889

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Vice-President, Exploration & Growth, Salt Lake Mining Pty Ltd, a 100% owned subsidiary of Karora, a Qualified Person for the purposes of NI 43-101.

About Karora Resources

Karora is focused on growing gold production and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations (“HGO”) in Western Australia. The Higginsville treatment facility is a low-cost 1.4 Mtpa processing plant which is fed at capacity from Karora’s underground Beta Hunt mine and open pit Higginsville mine. At Beta Hunt, a robust gold mineral resource and reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial historical gold resource and highly prospective land package totaling approximately 1,800 square kilometers. Karora has a strong Board and management team focused on delivering shareholder value. Karora’s common shares trade on the TSX under the symbol KRR. Karora shares also trade on the OTCQX market under the symbol KRRGD.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains “forward-looking information” including without limitation statements relating to the liquidity and capital resources of Karora, production guidance and the potential of the Beta Hunt Mine, Higginsville Gold Operation and Spargos Gold Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora 's filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com .

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Cautionary Statement Regarding the Higginsville Mining Operations

A production decision at the Higginsville gold operations was made by previous operators of the mine, prior to the completion of the acquisition of the Higginsville gold operations by Karora and Karora made a decision to continue production subsequent to the acquisition. This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

SOURCE Karora Resources Inc.

For further information: Rob Buchanan, Director, Investor Relations, T: (416) 363-0649, www.karoraresources.com

I closed my entire position in MUX today at $1.40 for a loss. My average was $2.10 and I’ve been holding for some 6 or 7 years. Even though I hold Rob McEwen in high esteem, I’ve been disappointed with MUX’s inability to control AISC over the long term and that, along with declining production, has contributed to their share price struggles even with the price of gold rocketing over $2,000. As I mentioned previously, there are other companies that have brighter futures, higher upside and are executing…which is reflecting in their share price.

Appreciate your honesty/transparency Rick. After reading the article you posted I decided to liquidate 2/3 of my position first thing this morning. Ended up getting 1.43, a .16 per share loss for me. Maybe the other third will eventually get positive and at least make up the loss, but based on all you and others have shared here on other companies, I’m sure I’ll make that up and more.

Well, I’m still hanging in there with MUX, FWIW. I don’t need a tax write off right now, but likely will next year! ![]() My main reasons are outlined in what I had posted before in a Red Cloud interview with Rod McEwen. My all in cost is somewhere around $1.76. And Rick, I fully agree, “As I mentioned previously, there are other companies that have brighter futures, higher upside and are executing…which is reflecting in their share price.” I hold many of them, many that were bargains due to the recent distress in the markets. Drilling season underway should be rewarding for many, if not all of my newer acquisitions.

My main reasons are outlined in what I had posted before in a Red Cloud interview with Rod McEwen. My all in cost is somewhere around $1.76. And Rick, I fully agree, “As I mentioned previously, there are other companies that have brighter futures, higher upside and are executing…which is reflecting in their share price.” I hold many of them, many that were bargains due to the recent distress in the markets. Drilling season underway should be rewarding for many, if not all of my newer acquisitions.

I have one more that I did sell a few shares today. I had put the sell order in for MTA @ $9.75 a while back. Probably would not have sold if I’d seen this video clip 1st, but it was hard not to sell a few shares at better than a 200% profit:

E.B. Tucker correctly predicted $2,000 gold price; he now sees this year-end target

E.B. Tucker, director of Metalla Royalty and Streaming and author of “Why Gold, Why Now? The War Against Your Wealth and How to Win It” said that this current bull rally has not run out of control, and is in fact, still going to going to continue at a measured pace.

Oh, this is a core position (long-term investment) for me and many of the others

in my portfolio I have held less than a year. I’ll buy back if it retraces. Many had been picked up mid-December, so I’m reluctant to be trading them. This is turning into quite a year! Most posting here on this forum will do very well. Be sure to check TR’s new thread. Hope he has time to post a few more charts!!! Well done Rich…

I’ll post when I can Richard. Have a few things pulling me in different directions lately, but I should have time to post a couple charts a day.

I’ll post an update on gold and silver futures and NSRPF/NVO and KRRGD/KRR this evening as long as I don’t get diverted. If anyone has requests I’ll get to them if I can. So far looks like I’ll have some time tonight.