It was a good Bayhorse day.

INTERESTING: Bob Moriarity’s Opinion as to why the sell-off on Novo the other day (from an interview on the Hedgeless Horseman website):

Goldfinger: So the market’s response to it, I guess, is typical, right? It rallied into the news, and then it sold off on the news. And it seems like that C$4.00 price level that Kirkland Lake bought in at is now a big level of resistance overhead. What’s it going to take for Novo to have a sustained move above that C$4.00 level? And is Kirkland Lake going to be a long-term shareholder of Novo, or are they looking to possibly exit?

Bob Moriarty: I think they will be a long term shareholder. What you’ve got is you’ve got the issue of the warrants that are going to expire soon. And Novo’s got several alternatives. Now one of the things that you said was not true, that Novo declined on the news, and that’s not actually the case. The price of Novo declined because people who intended to participate in the placement sold shares so they could get into a placement. And that’s very typical, but that’s not a buy the rumor to sell the news story. That’s a hey you’ve got stock at $3.80. And you can buy stock at $3.25 if you sell your stock at $3.80, so that’s exactly what they did.

I’m not sure, I don’t talk to anybody at Kirkland Lake. I don’t know what their intent is. But they’re some pretty smart guys, and they’ve got a lot of money, and I certainly see them sticking around for the ride. And one of the alternatives, of course, is Novo could extend the warrants. So if Novo feels like making a good deal for Kirkland Lake, they certainly could do it. Now I don’t know, I’ve never discussed this with Quinton or anybody else. Maybe they will and maybe they won’t, and maybe Kirkland liked carats, and maybe they don’t. Kirkland likes making a lot of money. It’s an extremely profitable company. But from Kirkland Lake’s point of view, Novo is not a big investment.

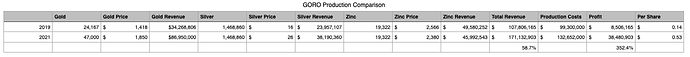

Gold Resource Corp - GORO - worth some research.

More gold than silver now but still moves with silver

Just hitting the higher grade portion of their first Nevada open pit

Been in production in Mexico since 2006. In Nevada since 2019.

Low share count (73M)

Long history of dividends which are mentioned regularly in conference calls with intention to raise as Nevada ramps up

Lots of exploration upside in Nevada

It has been a pet project of mine for a long time. They seem to be being punished because of the Mexico COVID mining shutdown for 2 months in April / May. So they have not responded to the recent PM price improvements. But assuming they continue executing as they have the last 2 years and PMs retain most of their recent gains, the spreadsheet above demonstrates how their results are going to improve.

Wow…I remember Goro from years ago. What was their gimmick for shareholder participation? Was it something like they would distribute gold coins rather than dividends? I forget, but it was something like that.

That program is still active. And it is sort of a gimmick. But it doesn’t receive much air play these days. Basically if you want to participate you have to move your shares to the transfer agent and then sign up for an account with a particular bullion dealer. Your dividend is still issued in USD of course, because that is a U.S. govt requirement. Then the bullion dealer automatically issues you a Gold Resource silver or gold 1 Oz coin once your dividends add up to enough. And it is actual gold / silver mined by the company. So … still USD to gold/silver. Kind of a gimmick.

But for the last 4 or 5 years the son of the original CEO has taken over as CEO and he has more polish yet is very straight forward and believable and they pretty much do whatever they say they will do, in my experience. But it takes a while as they have self funded two mines so far. No debt. 47Koz of gold / year. 73M shares. Lots of Nevada acres. $1B in revenue so far out of Mexico since 2006. Only a $300M market cap. $4 - $5 share price.

Thank you chg. Much appreciated. Will look at that one as well.

Another Novo upsize of the private placement…

Picked up some GAU Galiano Gold Inc this morning at 1.56. Gold producer. Originally picked up some at 1.21 about a month ago but was not sure how it would go. It has since hit just over $2 and come back down. Do your own DD as usual.

SILVER ELEPHANT INTERCEPTS 1,565 G/T SILVER, 8.25% PB, 3.85% ZN (1,825 G/T AGEQ) OVER 5 METERS WITHIN 102 METERS…

Did anyone else note that MTA Royalty did a RS a while back and came back very nicely. I did replace the oversold position I exited yesterday. Had a fill @8.55 today, so that worked out well. I anticipate Korora’s consolidation will do well also. Picked up more shares today KRRGD@2.65 as it is a core position with “seasoned” shares I’ve held more than a year. Anyone else have a strategy of trading around a core. I’ve found it takes patience and can be rewarding if you replace shares incrementally on dips.

I picked up more NSRPF @ 2.55 another core position. These core positions may all have volitility, but over time they are true growth stocks. I’m not much into day trading, but some stocks present very favorable profits on short term trades, especially in this mining sector. Today should have been a buying opportunity for those who have built up cash in their accounts and are employing a long-term strategy, IMO.

I also have a good core with KRR should have picked up extra shares today but waiting to see what gold does tomorrow after a $100 decline today, I have a good core with GTII after first purchase at $8.32 and now hitting $20.00 yesterday did well moving in and out all the way up, hoping to sell everything at $30.00 patience worked well on this trade. AZUL was a gut buy at $7.45 sold a good position today at $13,11. Also hold a good core in CD Cantex mining Yukon sitting at $1.30 should go back up nicely was at $7.00 a while ago.

Brutal sell off in the PMs.

Looks like $SILVER may just go right down and test the top of the box around $19.20. If it gets that far I would expect it is a buying opportunity and will bounce. It is hard to believe it is going back in the box unless this is a precursor to a much broader larger market selloff.

Silver and gold chart updates are up. Nothing fancy, but possibly useful. For the past couple weeks any time I have a decent window of time to post more charts, something or someone comes along and eats it up (I don’t mean you Rick). Sorry Richard, that’s my excuse. My intentions are good, I’m just not often able to fulfill them lately.

Wanted to share these posts from a poster on ceo.ca regarding Novo’s prospective Egina conglomerate gold property. For those who don’t know, the Egina project is ~1,000 sq km of barren gravel in Australia’s Pilbara region that contains at-surface nuggety gold that mostly individual prospectors have worked (usually illegally) over the years. Because it is an alluvial gold project with the “nuggety effect”, conventional drilling doesn’t provide an accurate resource estimation. Instead, Novo has to dig trenches and do bulk sampling.

https://www.novoresources.com/projects/pilbara/egina/

I forget the grade of the samples, but generally speaking it is has been estimated as anywhere from .3 g/t to 1.5 g/t depending upon the location of the sample. Normally such a low grade deposit draws very little excitement and is not economical with traditional hard rock mining. This is also why there isn’t the typical excitement from gold enthusiasts who are looking for drill intercepts above 10 g/t. Novo’s other alluvial are similarly boring, but the properties are massive.

The key to Novo’s success at their properties in the Pilbara are because the gold is all at surface and dirt cheap to extract and process. CEO Quinton Hennigh has stated that he wants to have the lowest cost extraction (i.e. highest margins) in the world. And from what I’ve been learning and understanding, I believe that is not only the key to Novo’s success, but also, combined with the shear size of Novo’s alluvial deposits, it is what will potentially make Novo one of the largest gold companies in Australia.

All that preamble aside, here are the posts that touch on just how cheap it will be to process the gold:

@fingerprint42 @gurken I’m not sure you are asking the question in the right way. The sorter costs about $1 million Aussie pesos. You need more than that, probably $4 million in yellow gear. I have been told it costs$.10 a ton to process through the machine with the biggest expense being producing the air to blow the nuggets. But in an alluvial setting it costs you $1 every time you move a meter of material. So shoving it in the machine costs a buck, taking it off the other end costs a buck, moving it back to where it came from costs a buck, putting the weeds back in place costs a buck. Keith Barron and I have both operated alluvial projects and we think $5-$6 a cubic meter is about right for cash costs. If you have 2 gram material today with a value of $62 a gram, every cubic meter contains about $125 worth of gold. Your total cash costs are 31.1 divided by 2 times $6 or about $94 an ounce to produce. Obviously there are other corporate expenses that Keith and I both ignored but basically it will give you the lowest cost gold in the world. And my point to

@fingerprint42 QH, HH, RH and anyone else is that the low grade crap at Egina is .3 g/m so it costs about$600 to $700 an ounce to produce. And there is a whole bucketful more low grade than high grade but who cares?

Now for some head-spinning really back-of-the-matchbook calculations, let’s apply that cubic meter-level calculation further, Egina has 948 sq km which equates to 948,000,000 square meters (actually cubic meters, but we’ll keep it calculated in square km).

948,000,000 * .3 = 284,400,000 grams of gold if we assume the entire property averages .3 g/t per cubic meter (we’ll change that assumption later, but we’ll keep it for sake of calculations). Divide that by 31.1 grams per oz and that comes to 9.1 million oz of gold.

At $2,000/oz that comes to $18 billion of gold. If Novo can process the alluvial gold at Egina for $600/$700 oz, that is $1,200 - $1,400 an ounce into Novo’s coffers not including taxes. Rough math puts Novo’s take at around $12 billion for Egina.

Now that assumes that all 948 square kilometers grade out at .3 g/t (the low estimate). Let’s say that only half of the property is mineralized and you’re still looking at over $6 billion to Novo after subtracting mining costs. Let’s say only 1/4 has that kind of mineralization, now we’re still looking at $3 billion.

And Egina is only one of Novo’s conglomerate gold properties that comprise 13,000 sq km of their current land holdings.

Yes it’s pie-in-the-sky at this point, but this kind of potential is why the likes of Keith Barron, Eric Sprott, Mark Creasey, Jay Taylor, Bob Moriarty et al believe that Novo could become one of the largest gold companies in Australia.

1 hr KRRGD chart. Circled is an adam & eve bottom formation which formed on top of the 130 MA. Breakout is at 2.89, the current HOD, and target is to 3.17. (3.20 is the Fib retracement from the recent 2.61 low to the last high at 3.57). Keep in mind it may or may not play out. There is no guarantee that this is anything more than a short term bottom. The formation could play out and we could still continue the correction to new low prices and still be in an overall uptrend. This all may sound full of contradictions. You have to keep the time frame of the chart in mind. ![]()

And speaking of Karora we investors with Ameritrade have now received our Karora shares

Thanks Rick - that puts it in great perspective, and you used .3 g/t, as opposed to 1.5 g/t (which is what I think Quinton has said).

Right now it’s not looking like the adam & eve is going to play nice. Eve is being difficult. The 130ma is still holding, but if it goes lower we’re looking at the 2.60 - 2.50 range first.

On the charting page I posted a break of the descending wedge on the hourly chart of NSRPF. Now it’s flagging and looking like it could head to around 2.77 - 2.80.

Mostly good news for miners in Australia and the Pilbara (bolded text for emphasis):

Australia’s Job Market Absorbs Victoria’s Virus Relapse

By Michael Heath And Sybilla Gross

August 12, 2020, 6:41 PM PDT Updated on August 12, 2020, 7:02 PM PDTAustralian employers added almost four times as many jobs as forecast in July as the economy’s recovery in areas with the virus under control withstood Victoria’s renewed lockdown and concern about the infection spreading.

Employment surged by 114,700 from June, when it advanced an upwardly revised 228,400, vs an expected 30,000 gain, data from the statistics bureau showed Thursday in Sydney. The jobless rate edged up to 7.5% from 7.4%. Economists’ median estimate was 7.8%. The participation rate rose to 64.7%, compared with an estimated 64.4%.

The data set the scene before Melbourne moved to Stage 4 restrictions and a curfew and surrounding Victoria to Stage 3 to try to contain a rapidly spreading outbreak. The central bank last week predicted that Victoria’s intensified lockdown would cut economic growth this quarter by at least 2 percentage points and the jobless rate would climb to around 10% later this year.

Australia is showing increasing signs of a three-speed labor market: Victoria began to collapse as surging infections forced the reintroduction of tough restrictions; New South Wales flatlined as Sydney contended with outbreaks; and Western Australia, virus-free and sealed off, kept improving.

This was reinforced in household confidence data for August released Wednesday. Sentiment tumbled in Victoria but was far worse in neighboring New South Wales, Australia’s most populous state, amid fears that Sydney would follow Melbourne back into lockdown.

Virus Free

Yet outside of that, states that are virus free are often returning to levels last seen pre-Covid. Western Australia is also enjoying a windfall from booming commodity prices with miners hiring to help maintain production. Iron ore, the nation’s biggest export, is trading above $100 as China’s demand for steel surges in response to Beijing’s post-Covid stimulus plan.

The Australian dollar advanced following the data, before retracing its gain to trade little changed at 71.71 U.S. cents at 12:01 p.m. in Sydney.

The Reserve Bank of Australia has kept its benchmark interest rate near zero since March and last week resumed buying government bonds to ensure the three-year yield remained around 0.25%, as it tries to lower borrowing costs across the economy.

The RBA says it’s unlikely to adjust rates higher until inflation and unemployment are comfortably within their targets of 2%-3% and under 5%, respectively. That’s likely at least a couple of years away.

Governor Philip Lowe said last week that under the RBA’s baseline scenario, the jobless rate climbs as there are “further job losses in Victoria and more people elsewhere in Australia looking for jobs. Over the following couple of years, the unemployment rate is expected to decline gradually to around 7%.”

Among other details in today’s jobs report:

- · Monthly hours worked rose 1.3% in July, and increased more for females – 2.3% – than males --0.6%

- · Under-employment decreased 0.5 percentage point to 11.2% and under-utilization dropped 0.4 percentage point to 18.7%

- · Full-time jobs rose by 43,500 and part-time roles jumped by 71,200

- · The employment to population ratio increased by 0.5 point to 59.8%.

The initial closure of swathes of the economy in March and April had a dramatic impact on consumer and business confidence, with both plummeting. They recovered ground in the ensuing months but business confidence slipped in July and August consumer sentiment plummeted back toward April’s lows.

Australia is at a crossroads as optimism that the worst has passed gives way to rising anxiety of another infection wave. Lowe summed this up last week.

“A stronger recovery is possible if progress is made in containing the virus in the near future,” he said. “On the other hand, if Australia and other countries were to experience further widespread lockdowns, the recovery in both output and the labor market would be delayed.”

( from Bloomberg)