Kirkland Lake Gold Announces Sale of Osisko and Novo Shares, Company Repurchases Additional Shares Through Normal Course Issuer Bid

TORONTO, Aug 13, 2020 (GLOBE NEWSWIRE via COMTEX) – TORONTO, Aug. 13, 2020 (GLOBE NEWSWIRE) – Kirkland Lake Gold Ltd. ( “Kirkland Lake Gold” or the " Company ") (TSX:KL) (NYSE:KL) (ASX:KLA) today announced that it has filed two early warning reports in connection with the disposition of 32,627,632 common shares of Osisko Mining Inc. (“Osisko”) and 748,700 common shares of Novo Resources Corp. (“Novo”). The Company also announced today that it has purchased an additional 863,500 common shares of Kirkland Lake Gold for cancellation under its normal course issuer bid (“NCIB”). To date in 2020, the Company has purchased a total of 11.9 million common shares for US$388.4 million (including 2.2 million shares for $58.6 million since the renewal of the Company’s NCIB on May 28, 2020 for an additional year).

On August 10, 2020, the Company disposed of 32,627,632 common shares of Osisko (the “OSK Shares”) through the facilities of the Toronto Stock Exchange at a price of $4.45 per OSK Share for total consideration of $145,192,962. Following the disposition of the OSK Shares, Kirkland Lake Gold no longer holds any shares of Osisko. Immediately prior to the disposition, Kirkland Lake Gold held 32,627,632 OSK Shares, representing approximately 9.57% of the issued and outstanding OSK Shares on a non-diluted basis.

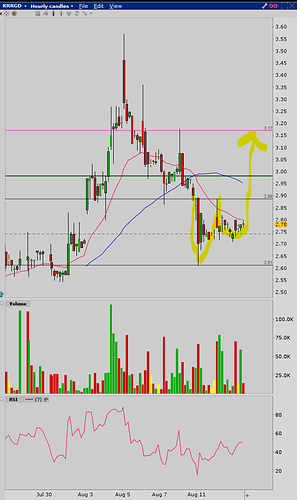

Between August 7, 2020 and August 12, 2020, the Company disposed of 538,700 common shares of Novo (the “NVO Shares”) through the facilities of the Toronto Stock Exchange at an average price of $3.52 per NVO Share for a total consideration of $1,894,786. In June 2020, the Company disposed of 210,000 NVO Shares at an average price of $3.28 for a total consideration of $689,024. Prior to the dispositions, the Company held 29,830,268 NVO Shares and 14,000,000 warrants of Novo (the “NVO Warrants”) representing approximately 15.81% of the issued and outstanding NVO Shares on a non-diluted basis and 21.62% on a partially diluted basis, assuming the exercise of the Novo Warrants. The completion of these dispositions has resulted in a 0.4% decrease in the Company’s holdings in Novo. Immediately following this disposition, the Company now holds 29,081,568 NVO Shares representing 15.41% of the issued and outstanding NVO Shares on a non-diluted basis and 21.25% on a partially diluted basis, assuming the exercise of the Novo Warrants.

Tony Makuch, President and CEO of Kirkland Lake Gold, commented: “The sale of Osisko and Novo shares further enhances our already industry-leading financial strength, which will support our efforts as we pursue our key strategic priorities, including investing in our three cornerstone assets and returning capital to shareholders. Macassa, Detour Lake and Fosterville are three highly-profitable, cash-flow generating operations, each of which has outstanding exploration upside. There remains significant value creation potential at all three of these assets and unlocking that value is our overriding priority. Also important to us is rewarding shareholders which, in addition to share price performance, also involves buying back stock and paying dividends. So far in 2020, we have repurchased 11.9 million shares for US$388.4 million, which represents approximately $1.40 per share based on our current shares outstanding, and also doubled our quarterly dividend to US$0.125 per share. If we combine the amount of cash used for share repurchases and dividend payments in the first half of 2020, it represents approximately $645 per ounce of gold produced during the period. We announced earlier in the year a goal of repurchasing 20 million shares over a 12 to 24-month period and we are making excellent progress towards achieving that target.”

Both the OSK Shares and the NVO Shares were sold for investment purposes. Kirkland Lake Gold may, depending on market conditions, increase acquire or dispose of additional common shares or other securities of either Osisko or Novo in the future whether in transactions over the open market or through privately negotiated arrangements or otherwise, subject to a number of factors, including general market conditions and other available investment and business opportunities.

This press release is being issued in pursuant to National Instrument 62-103 - The Early Warning System and Related Take-Over Bid and Insider Reporting Issues , which also requires a report to be filed with the regulatory authorities in each jurisdiction in which the Issuer is a reporting issuer containing information with respect to the foregoing matters (the " Early Warning Reports "). A copy of the Early Warning Reports will be filed on the Issuers profiles of both Osisko and Novo on SEDAR and may also be obtained by contacting the Company at 416-840-7884 or by email at info@klgold.com. Osisko’s head office is located at 155 University Avenue, Suite 1440, Toronto, Ontario, Canada, M5H 3B7 and Novo’s head office is located at c/o 595 Burrard Street, Suite 2900, Vancouver, BC, Canada, V7X 1J5.