Double post

Karora Announces Further Discoveries at Beta Hunt Mine: New High Grade Larkin Gold Zone and 30C Nickel Trough Driving Increase to 2020 Exploration Budget

Photos(3)

Highlights:

- “Larkin Gold Zone” – New broad, high-grade gold discovery south of Alpha Island Fault1.2.:

- BE30-003: 8.2 g/t over 3.9 m

- BE30-004: 3.3 g/t over 15.8 m

- BE30-007: 3.9 g/t over 11.0 m

- BE30-010: 15.3 g/t over 3.5 m

- BE30-011: 7.4 g/t over 8.9 m

- Wall Sample (BD40ACCLHW_002): 5.0 g/t over 14.4 m, including 22.7 g/t over 2.6 m

- “30C Nickel Trough” - First new nickel discovery at Beta Hunt in 13 years1.2:

- BE30-007: 3.8% Ni over 2.3 m

- BE30-009: 7.7% Ni over 1.3 m

- BE30-010: 8.6% Ni over 1.0 m

| 1. | Result show downhole thickness. True thickness cannot be estimated with available information |

|---|---|

| 2. | Tables showing complete results and drill hole locations can be found at the end of this news release. |

- Increased Exploration Budget – As a result of drilling success year to date and the multiple high quality exploration targets at both Western Australian operations, the 2020 exploration budget has been increased by ~50% to A$15M from the previous A$9.5-A$10M

Bob Moriarty Interview yesterday on the J Taylor Show:

Starting at 49:00.

MY SYNOPSIS: Let’s just say Bob is a very “colorful” character. He talks about monkeys being smart enough to invest in Novo and suggests the other mining professionals who couldn’t figure out the Pilabra for 140 years as “idiots”. Entertaining. That being said, he shares a bit of the backstory behind Novo Resources and why they don’t seem to be getting that much publicity (only he, the Hedgeless Horseman, and J. Taylor seem to talk about it). The gist of it is that all these people (suggesting the pundits and other mining professionals) are very JEALOUS of Quinton Hennigh, who has taken the Beaton’s Creek project and proved that it is in fact economic using unorthodox methods. Therefore, nobody wants to talk about it. Bob predicts that Novo will be producing at the rate of 125,000 ounces per year at the 18-month mark. He also says Quinton set back the beginning of production from December, 2020 to January, 2019 because they didn’t want to hire a bunch of people and then immediately give them 2 weeks of vacation (makes sense to me). Bob says Quinton is his best friend and is writing a book about the Novo story, set to be released the day they start pouring gold.

Cash flow out the gazoo. LOL

DEG raises $100M. Yikes.

“Commitments received for a Placement of approximately 83.4 million shares priced at A$1.20 per share to raise $100 million (before costs)”

Money is definitely flowing into the sector now. DEG has had an unbelievable year.

Novo Settles Millennium Minerals Limited’s Debt to IMC

VANCOUVER, British Columbia, Sept. 14, 2020 (GLOBE NEWSWIRE) – Novo Resources Corp. (“ Novo ” or the “ Company ”) (TSX-V: NVO; OTCQX: NSRPF) is pleased to announce that Novo’s recently acquired wholly-owned subsidiary, Millennium Minerals Limited (“ Millennium ”), has today settled all debts (the “ Debt Settlement ”) it owed to IMC Resources Gold Holdings Pte Ltd and IMC Resources Investments Pte Ltd (collectively, “ IMC ”). Please see the Company’s news releases dated August 4, 2020, and September 8, 2020 for further details.

All amounts are in United States dollars unless indicated otherwise.

Millennium has repaid IMC’s secured debt of approximately $50.3 million (A$69 million) by way of payment of $43.7 million (A$60 million) in cash and the balance by procuring the issuance by Novo of 2,656,591 units of Novo (each a “ Unit ”) issued to IMC at a price of C$3.25 per Unit (the “ Debt Consideration ”). Each Unit is comprised of one common share of Novo (a “ Share ”) and one-half of one transferable Share purchase warrant (a “ Warrant ”), with each whole Warrant entitling the holder to acquire one Share at a price of C$4.40 for a period of 36 months after the closing of the Debt Settlement. Novo has provided funding to Millennium to ensure Millennium had sufficient cash to allow repayment of the cash portion of the Debt Settlement.

Immediately subsequent to the issuance of the Units comprising the Debt Consideration, IMC holds 9.67% of the issued and outstanding common shares of Novo.

The Units issued to IMC pursuant to the Debt Consideration are subject to statutory and TSX Venture Exchange hold periods expiring on January14, 2021; in addition, a further contractual hold period will apply to half of the Units issued to IMC, increasing the hold period for those Units to 12 months.

About Novo Resources Corp.

Novo is advancing its flagship Beatons Creek gold project to production while exploring and developing its highly prospective land package covering approximately 14,000 square kilometres in the Pilbara region of Western Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its shareholders. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com.

On Behalf of the Board of Directors,

Novo Resources Corp.

“Quinton Hennigh”

Quinton Hennigh

President and Chairman

Artemis finally finished selling its shares of Novo. Perhaps will start to see a recovery in Novo’s share price?

A guy writes the following on Novo on Stockhouse:

September 15, 2020 - 12:38 PM

98 Reads

Post# 31560370

@AUinvestor on Novo

@AUinvestor Excellent… spot on. However, I’d describe the current set-up a bit differently… I wouldn’t say that Novo is transitioning form explorer to producer (although I’m certain that it’s viewed that way), instead I view Novo transitioning from an explorer, to an explorer-producer with emphasis on an explorer in the very initial stages… an “explorer-producer” in the initial stages with decades more of exploration and expansion of production… many explorers that prove up resources, are captive to the Lassonde curve as they do transition from explorer only to producer only… not Novo Resources. Furthermore, (and here’s the kicker in my view)… Novo Resources is being priced in with a lot of risk as only an average potential producer in the pre-production phase/trajectory of the Lassonde Curve… not as an explorer with huge blue sky potential. As one that studies their bulk samples at various properties… one realizes that Gold just doesn’t jump 12 clicks from sample to sample… the Gold is potentially continuous between those bulk samples. That is where the potential for the Gold resources to quickly grow. Most successful producers have average size deposits, but few have the potential for a world class high-margined deposit or even a Grasberg or Muruntau style freak deposit given Novo’s huge land package and/or QH’s Witwatersrand Gold precipitation theory.

1) This potential for a world class deposit is not even remotely being priced in.

2) Novo’s rapid advancement of technological methods for mining this course nuggety Gold is not being priced in either as it has not been proven yet.

3) Novo’s ability to become a producer (in addition to its continued proven status as an explorer) is not being factored in either… it won’t be until QH unveils his team of experts to run the mill and until they prove their abilities starting the 1st Qtr 2021.

4) Once all these realizations come together in synergistic fashion that in fact Novo continues as a successful explorer proving up ever more Gold resources in a favorable mining jurisdiction (perhaps one of the best when compared to most others), continues to work well with the aborigines and Australian government to secure the permissions and mining permits, demonstrate their abilities to expand Gold production year after year, and bottom line produce large profits that grow each year, the market will price in low cost Gold production decades into the future sending the price soaring.

I don’t view this like I did many of my stocks that I purchased in late 2000 for pennies that later proved up a multi-million ounce Gold/Silver deposit and then later were bought out by a producer or in rare cases transitioned into a producer from an explorer. Novo will be both, an explorer proving up ever more Gold ounces in the ground, and a producer expanding production year after year. So I think that there are enough people that think the Lassonde curve applies here to Novo Resources, but soon enough will see the bigger picture described above.

2021 appears to be the time frame that Novo will accelerate in price as a profit curve is developed and extrapolated upon… I know, because I’ve gone through the process many times attempting to evaluate a company’s share price based on a projection of its Gold production curve. As uncertainties are removed, doubts dispelled, knowledge gained, confidence built, the share price will continue to rise in exponential fashion.

Anyway, that’s my take… back to letting it all unfold in Novo’s own unique manner.

More on Novo for those following Novo Resources.

QH interview starts at 17.15 mark

Kudos to @Freddybaler001 for this link

NOVO starting to recover nice - up 13 cents so far today - I guess it’s true the Artemis selling was a somewhat of a drag on the stock price.

Hi Mike, do you know anything about First Mining Gold Corp (FFMGF) ?

No but I see that they have a decent website: https://firstmininggold.com/

I have somewhat lost interest in Canada and focusing on Australia instead but no doubt there are still a few gems found elsewhere.

Novo sells their Blue Spec property/mine to Calidus Resources for $19.5 million. Novo coincidentally owns 5.6 million shares of Calidus (2.56% ownership).

From July 2

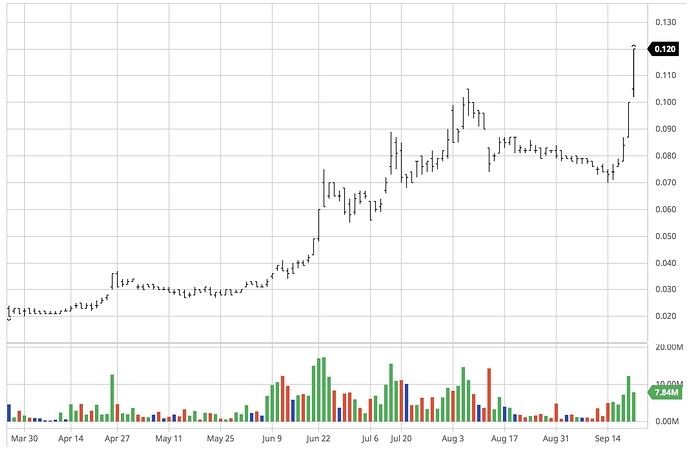

Thank goodness this one is finally waking up! Here is 6 month Daily chart.

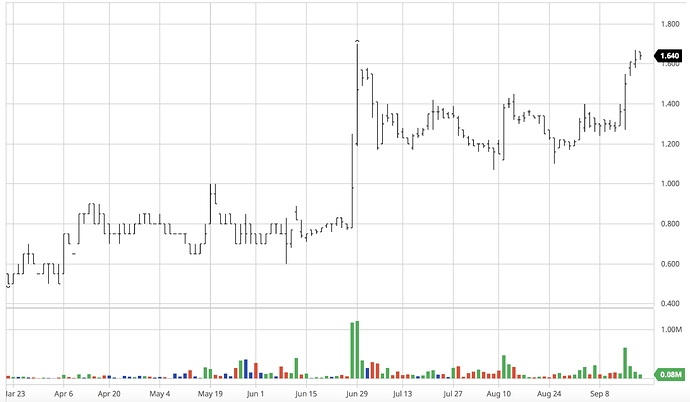

Anyone else still in this one? Used to be a Pilbara darling. Regrettably, Artemis had to sell it’s 50% stake in Novo (gave up Beaton’s Creek) to raise $5.78M to move forward. Sad to see, but glad to have shares in the current trending Pilbara plays I started with (DRG, KRR, NVO). These three all did reverse split restructuring to get share structure “right sized”, as did Pacton Gold recently. Must be what was needed as even Pacton Gold (also a long-time hold from early days) is starting to wake up and coming to life, much to my pleasure. For Artemis, Carlow Castle drilling and Paterson mining license covering the Havieron is making a difference.

6 month daly chart for Artemis (ARV.AX)

… and 6 month daily chart for Pacton Gold (PAC.VN) for anyone interested.

Easy,

Still have some Artemis. Have to check, might even be in the green on that now?!! I figured it would recover when the others in the Pilbara recovered.

ES and Gold futures updated tonight… CEO.CA | ~charts by louie

Novo Acquires Option Over Kalamazoo Resources Limited’s Queens Project

September 22, 2020 08:24 ET | Source: Novo Resources Corp.

VANCOUVER, British Columbia, Sept. 22, 2020 (GLOBE NEWSWIRE) – Novo Resources Corp. (“ Novo ” or the “ Company ”) (TSX-V: NVO; OTCQX: NSRPF) is pleased to announce that it has been granted an option and an additional earn-in right to acquire an initial 50% interest in ASX-listed Kalamazoo Resources Limited’s (“ Kalamazoo ”) Queens gold project (the “ Queens Project ”) located in the Bendigo zone of Australia’s Victorian goldfields (collectively, the “ Transaction ”) ( please see Figure 1 and Figure 2 below for map s of the Queens Project ), with the possibility of an increase to an 80% interest, as described below. The Transaction is subject to approval of the TSX Venture Exchange and other customary regulatory approvals for transactions of this nature. Novo holds a 7.64% undiluted / 11.60% fully diluted equity interest in Kalamazoo pursuant to an investment made on January 14, 2020.

Queens Project Description

The Queens Project encircles the core of ASX-listed GBM Resources Limited’s Malmsbury gold field and covers multiple structural extensions of the primary lode Au deposits of this important high-grade gold camp. The Malmsbury gold field is situated in the eastern part of the prolific Bendigo Zone approximately 55 km south of Kirkland Lake’s high-grade Fosterville mine. Given the similar geologic setting of Malmsbury and its history of high-grade gold production, Novo thinks Malmsbury has potential to host similar mineralization to that at Fosterville. Novo holds an option to purchase-joint venture the Malmsbury Project with GBM Resources Ltd. With the addition of the Queens Project Transaction, Novo will hold an interest in the entirety of the Malmsbury gold field.

Queens Project Terms

Novo will have a six-month period (the “ Initial Period ”) to conduct due diligence on the Queens Project by issuing to Kalamazoo 24,883 common shares of the Company (the “ Initial Shares ”) which will be subject to a statutory hold period of four months from the date of issuance. At any time during the Initial Period, Novo will have the right to exercise its option (the “ Option ”) to earn a 50% interest in the Queens Project by issuing A$2 million-worth of common shares of the Company to Kalamazoo at a deemed price per share equal to the volume-weighted average closing price of the Company’s common shares for the five trading days immediately prior to Novo’s exercise of the Option (the “ Option Shares ”). The Option Shares will also be subject to a statutory hold period of four months from the date of issuance.

If Novo exercises the Option, it will have the right to earn an additional 20% interest in the Queens Project and form a joint venture with Kalamazoo by incurring AUD $5 million in exploration expenditure (the “ Earn-In Amount ”) over a five-year period (the “ Earn- I n Period ”), as to a minimum of AUD $250,000 during the first year, AUD $1 million during each of the second, third, and fourth years, and AUD $1.75 million during the fifth and final year of the Earn-In Period. Any expenditure incurred during any year of the Earn-In Period which surpasses the minimum required amount will be credited against the subsequent year’s commitment.

If Novo satisfies the Earn-In Amount by the expiry of the Earn-In Period, it will have 30 days to elect to either (i) earn an additional 10% in the Queens Project by delivering a preliminary economic assessment (the “ PEA ”) which must include a minimum 1 million ounces of gold of which at least 60% must be comprised of indicated mineral resources within three years of the Company’s election (the “ PEA Conditions ”), or (ii) maintain its 70% interest in the Queens Project. If the Company elects to maintain its 70% interest in the Queens Project, Kalamazoo must elect to either (i) contribute to 30% of exploration expenditure, or (ii) automatically convert to a 2% net smelter returns gold royalty.

If the Company elects to complete the PEA but fails to satisfy the PEA Conditions, Novo will retain a 70% interest in the Queens Project and Kalamazoo can elect to contribute to 30% of exploration expenditure or dilute at a rate of 1% for every AUD$100,000 not contributed. If Kalamazoo’s interest dilutes below 10%, Kalamazoo’s interest will automatically convert to a 2% net smelter returns gold royalty.

If Novo does not satisfy the Earn-In Amount during the Earn-In Period, Novo’s interest in the Queens Project will decrease to 49%.

Dr. Quinton Hennigh, P. Geo., the Company’s president, chairman, and a director, and a qualified person as defined by National Instrument 43-101, has approved the technical contents of this news release.

About Novo Resources Corp.

Novo is advancing its flagship Beatons Creek gold project to production while exploring and developing its highly prospective land package covering approximately 14,000 square kilometres in the Pilbara region of Western Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its shareholders. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com.

On Behalf of the Board of Directors,

Novo Resources Corp.

“Quinton Hennigh”

Quinton Hennigh

President and Chairman

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-looking information

Some statements in this news release contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, the expected consummation of the Transaction and that Malmsbury has the potential to host similar mineralization to that at Fosterville. Forward-looking statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the receipt of TSX Venture Exchange and other customary approvals and customary risks of the mineral resource exploration industry.

PDFs accompanying this announcement are available at:

http://ml.globenewswire.com/Resource/Download/863af531-614e-4f98-b4a2-7bb128f53fd3

http://ml.globenewswire.com/Resource/Download/b4272c42-0e83-463a-85dd-f78985df9fa1

Quinton Hennigh on the option exercise yesterday (appeared in Globe Newswire article today):

“We are pleased to exercise our option over the Malmsbury project,” commented Quinton Hennigh, Chairman and President of Novo. “Although early stage, Malmsbury hosts one of the closest geologic analogues to the high-grade Fosterville gold deposit situated approximately 50 km to the north. Like Fosterville, Malmsbury is situated along the eastern margin of the prolific Bendigo zone. Mineralization is of classic epizonal orogenic style displaying high-level vuggy quartz veins, elevated antimony and finely disseminated high-grade gold. Novo believes that it now holds one of the most prospective high-grade gold projects in the Victorian gold fields.”

FOOD FOR THOUGHT: Professor Hennigh sure does seem to be a very industrious and motivated individual. I wish I could say the same about some other CEOs.