Karora Provides Update on 2020 Drilling Program and Announces New Regional Mining Strategy for Higginsville Area

Highlights:

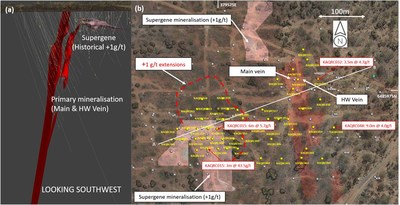

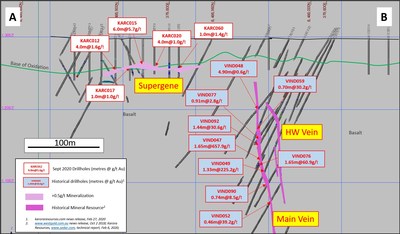

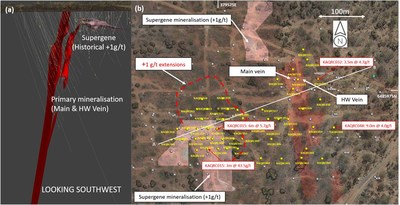

- Recent drilling has extended both near-surface supergene and primary high grade mineralization at the Aquarius Project, outlining a potentially economic starter pit ahead of mining higher grades underground

- Supergene mineralization1

- KAQRC039: 43.5 g/t over 3.0 metres

- KAQRC015: 5.7 g/t over 6.0 metres, including 14.6g/t over 2.0 metres

- Primary mineralization1

- KAQRC032: 4.7 g/t over 3.5 metres

- KAQRC048: 4.0 g/t over 9.1 m, including 12.3g/t over 1.4 metres

1. Estimated true width

- Six drill rigs are now deployed across Karora’s properties reflecting Karora’s expanded exploration budget

- Fourth quarter drilling of 50,000 metres planned across Beta Hunt, HGO and Spargos is well underway

- Air core drilling has commenced at Lake Cowan to test multiple Regional Gravity targets

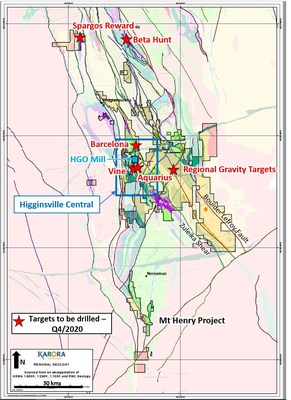

- A new regional mining strategy is being developed to optimize Karora’s feedstocks into the Higginsville mill

TORONTO, Nov. 9, 2020 /CNW/ - Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to provide an update on near surface drilling at Aquarius and on planned drilling across the Corporation’s properties during the fourth quarter. Karora is also in the process of completing a new Central Higginsville mining strategy that will be rolled out during the fourth quarter. The strategy will allow Karora to prioritize resource conversion and production scenarios to optimize mill feed blend rates into the Higginsville plant.

At Aquarius, analysis is underway to outline a potentially economic starter pit following a successful near surface drill program that was completed during the third quarter. Recent drilling identified high grade supergene gold mineralization including 43.5 g/t over 3.0 metres and 5.7 g/t over 6.0 metres. Expected cash flow from the proposed starter pit would offset some of the development costs to access the higher grade underground gold mineralization. Development of the Aquarius starter pit could commence as early as mid-2021.

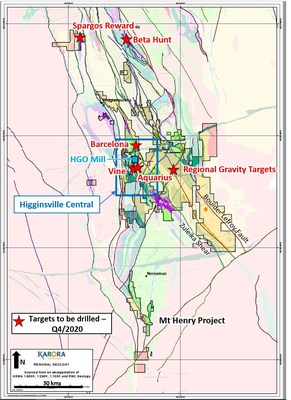

With the increasing number of current and planned production sources from Higginsville, Beta Hunt and Spargos all competing for a share of the feedstock for the 1.4 Mtpa HGO treatment plant, a new regional mining strategy aimed at optimizing mine-to-mill feed is being developed. The new strategy divides Karora’s regional operating and near-term mining areas into four main mining centres:

- Higginsville Central – This area is the main focus for resource definition and conversion of resources to reserve drilling and includes multiple existing and potential future open pits and underground mines (including the Aquarius deposit) contained within an approximate 10 kilometre radius of the HGO treatment plant.

- Higginsville Greater – This area covers all remaining projects and deposits outside Higginsville Central. However, given its vast tenement area and large number of existing and potential resource targets, this area may be further sub-divided over time. Deposits such as Baloo and the Lake Cowan prospects fall within Higginsville Greater.

- Beta Hunt – The Beta Hunt underground mine.

- Spargos – Acquired in August 2020 and a potential source of short term, high grade mill feed to HGO.

The aim of the strategy is to achieve the optimum blend of fresh oxide and hard rock material from the four regional centres to feed into the 1.4 Mtpa HGO plant in order to maintain maximum throughput rates and ensure continued strong recoveries. A more comprehensive update of the Higginsville Central mining strategy will be outlined after the announcement of a new reserve and resource estimate expected later in the fourth quarter.

With respect to drilling during the remainder of the year, Karora is well underway with a 50,000 metre drill program across the Western Australian operations to be completed during the fourth quarter. The drill program consists of resource definition drilling aimed at supporting the upcoming reserve and resource update as well as exploration drilling across multiple targets.

Paul Andre Huet, Chairman & CEO, commented: "In September we announced an aggressive 50% increase to our 2020 drilling budget to A$15 million and I am very pleased to announce some of the very strong initial near surface results at Aquarius as well as outline our targeted drilling over the remainder of the fourth quarter. This drilling will focus both on converting resources to reserves in our upcoming maiden company-wide reserve and resource update, our top priority, as well as targeting the exciting new exploration targets we have identified.

With drilling paused due to COVID-19 precautions for several months earlier this year, we are now drilling at an accelerated pace with six drills across Higginsville, Spargos and Beta Hunt. In fact, a large part of our 2020 drilling program is being undertaken in the fourth quarter as a result of these delays. Given the current challenges associated with sourcing both highly skilled workers and equipment in Western Australia, due to COVID-19 and State border closures, I am extremely proud of the resourcefulness of our operations team and their ability to execute on our expanded program. Once again, despite the numerous challenges faced, they continue to deliver on our aggressive corporate targets in our very first year of consistent, strong gold production.

At Higginsville, our Aquarius project has taken an important step forward with new drill results to support the planning of a potentially economic starter pit. The identification of near-surface, supergene style mineralization is expected to provide the opportunity to partially fund a staged approach to development at Aquarius as we continue to fully assess and define the potential of the known historical high grade (19.5 g/t) gold mineralization which forms part of a larger laminated quartz vein system.

The conceptual underground access at Aquarius could also serve as a conduit to accessing the underground potential of the nearby Fairplay project, which is part of our upcoming Central Higginsville mining strategy. We expect to outline more details of this strategy to the market following our resource and reserve update for our Western Australian operations."

Aquarius Project Update

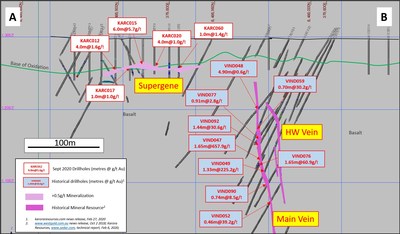

A total of 54 holes, totaling 5,079 metres have been completed at Aquarius. The aim of the drilling was to assess the opportunity of defining significant, near-surface mineralization to support a potential starter pit ahead of accessing the deeper, high grade Aquarius primary mineralization.

Historical intersections from the primary mineralization include drill holes VIND047, 657.9 g/t over 2.3 metres downhole from 181.1 metres (Estimated true width “ETW” of 1.6 metres) and VIND049: 225.2 g/t over 1.9 metres downhole from 201.5 metres (ETW of 1.3 metres) previously reported in Karora news release, dated February 27, 2020 ( karoraresources.com ).

The recent drilling at Aquarius was designed to test the continuity of supergene mineralization above, and adjacent to, the main Aquarius quartz vein as well as extend the near-surface position of the existing historical mineral resource1

Results returned from the drilling show the supergene mineralization to extend over a footprint covering approximately 120 metres by 200 metres (see Figures 1 and 2). The supergene footprint is located east of the main Aquarius vein mineralization within multiple horizons. Drilling was also successful in extending primary mineralization along strike and closer to surface. Highlights from drilling program are listed below:

Primary2.

- KAQRC032: 4.7 g/t over 3.5 metres from 123 metres;

- KAQRC026: 11.7 g/t over 0.7 metres from 162 metres;

- KAQRC048: 4.0 g/t over 9.1 metres from 131 metres

Supergene2

- KAQRC039: 43.5 g/t over 3.0 metres from 49 metres;

- KAQRC015: 5.7 g/t over 6.0 metres from 30 m, including 14.6g/t over 2 metres;

- KAQRC040: 1.5 g/t over 16.0 metres from 37 metres, including 4.5g/t over 2 metres

1… Aquarius is the renamed and previously reported “Corona” deposit. The Corona Historical Mineral Resource consists of - Measured and Indicated 19,600 t @ 19.5 g/t (12,300 oz) and an Inferred 43,100 t @ 4.2 g/t (5,900 oz) - and is part of the Corona (now Aquarius)-Fairplay Historical Mineral Resource (see Karora news release, Feb 7, 2020, karoraresources.com) See Westgold 2018 Annual Update of Mineral Resources & Ore Reserves dated October 2, 2018, which is available to view on the ASX (www.asx.com.au) A qualified person has not done sufficient work on behalf of Karora to classify the historical estimate noted as current mineral resources and Karora is not treating the historical estimates as current mineral resources.

2. Estimated true width

Drilling Update

The increase in the 2020 Karora exploration budget to A$15 million is now reflected in accelerated drilling programs across all Karora’s projects. Planned fourth quarter drilling is expected to total 50,000 metres with 36,000 metres allocated to Higginsville/Spargos and 14,000 metres to Beta Hunt. A total of six drill rigs are currently engaged to meet the expanded drill schedule: two underground rigs at Beta Hunt, two surface RC rigs at Higginsville as well as one lake aircore rig and one lake diamond rig at Higginsville.

An overview of key drilling targets is listed below:

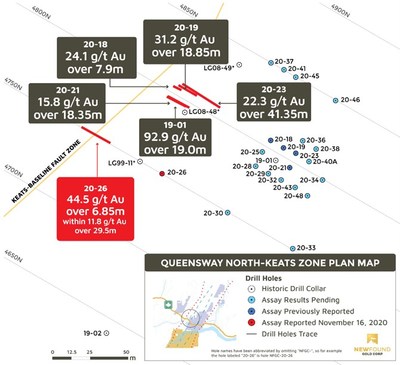

Beta Hunt – 14,000 metres of diamond drilling: Drilling is targeting extensions and upgrading of the existing gold resource as well as extension of the Larkin Zone, A Zone North and Western Flanks South. As demonstrated in Karora’s announcement of the 30C nickel trough discovery (see Karora news release dated September 10, 2020), nickel mineralization is located proximal to the targeted gold shear zones. As such, drilling will also target the 30C, 40C and 50C nickel troughs. Nickel is expected to provide potential by-product credits to future gold mining at Beta Hunt.

Lake Cowan Regional Gravity Targets - 18,000 metres of lake aircore drilling: Drilling is comprised of reconnaissance drilling of 640 by 160 metre spaced lines across regionally prospective shear zones to test priority targets identified from the recently completed regional gravity desktop study.

Higginsville Central – 2,000 metres of diamond drilling: Drilling will include the Vine and Barcelona prospects. The drill program is designed to test and extend primary shear hosted mineralization analogous to the Trident gold deposit and related to near surface mineralization associated with historical drilling.

Spargos Reward – A total of 12,000 metres reverse circulation and 1,000 metres diamond drilling: Infill and extensional drilling designed to support an updated mineral resource and mineral reserve has commenced. Drilling will target the high grade main lode and adjacent interpreted mineralization.

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

Higginsville: All RC drill sampling is conducted by Karora personnel. Samples for gold analysis are shipped to Bureau Veritas Laboratories of Kalgoorlie and Perth for preparation and assaying by 40 gram fire assay analytical method. All drilling samples submitted for assay include Certified Reference Material (“CRM”) and coarse blank every 25th down hole metre. Duplicate samples are taken every 50th metre. The lab is also required to undertake a minimum of 1 in 45 wet screens on pulverised samples to ensure a minimum 90% passing at -75µm.

Where problems have been identified in QA/QC checks, Karora personnel and the Bureau Veritas laboratory staff have actively pursued and corrected the issues as standard procedure.