Exactly. When they switched focus to a different target, that generally is a red flag. I lost interest and simply waited for a good point to exit worrying about dilution getting out of hand. Overall, I moving away from miners that don’t actually generate supporting cash flow or no prospects in the foreseeable future. Just too much downside risk. I haven’t yet expanded my position in Novo for that reason. I may wait till production is imminent on that one. Still little sore over being stung by sudden Kirkland departure and I tend to never see these types of risks till after the fact. On the opposite end is somebody like KRR with cash pouring in and are in a position to protect their share price if need be.

Article on Karora Resources - this guy names his top 5 minerals stocks for 2021 and Karora is number 1. Freeport is number 5.

https://seekingalpha.com/article/4396842-top-5-mining-stocks-to-watch-in-2021

A poster on CEO.CA interestingly opines that Karora is not as much of a long-term miner as Novo Resources will be - see the following:

“This is why I don’t follow anyone, the author of this article supposedly has 5k follows. His number 1 pick for the year is Karora. Karora is a very interesting company, in many metrics a clone a Novo. Proven deposit in western Australia, a mill,large land package, nuggeting gold, 400M market cap. The author even says ore sorting could unlock the gold. I’m sure his guy is loaded to the gills with stock and can’t pump it enough. The story is great on the surface or skin deep. But Karora doesn’t have a Quinton Hennigh or a Rob Humphryson leading the company. And that’s the difference, Novo is building a great company that will be mining in the next century. Karora is a pump and dump. Pumpers never tell you what’s happening under the surface or skin, they never tell you when the dump is coming, it’s all just a game of chicken until it’s over and they move on the next stock or next crypto.”

Karora is currently mining 100,000 oz per year with a cost to mine of $1000 per oz.

Novo is basically mining 0 oz per year.

They both has similar market caps.

Which is the better buy? The CEO.ca poster calling KRR a pump and dump but glowing praise for Novo is bit over the top, me thinks.

Methinks too.

All of these plays should do quite well this year. Reposting, just in case anyone is short on ideas of where to reinvest after taking some profits off the table. If you haven’t taken a look at BRC.V (BKRRF) you may want to do your own DD on it. This Tonapah project is on previously mined claims that have been inactive since the 1920s and has not been drilled on before. Back then, they just followed the surface veins down until water was reached and halted production. The silver hits they’ve drilled are being measured in kg/ton! It is in the area of Nevada second only to the Comstock lode for silver mining. I bought a few more shares this morning, FWIW, adding to build my core position. I really like the Nevada plays I have now, and anticipate more on the way.

I did take some profits from IVS the day after MG and HR brought it up on the forum. I still kept a core position on it, though. I really like the Sudbury 2.0 prospect, but as HR mentioned, some bulk sampling on the Pardo claims would do a lot to heighten interest in the company. My two favorite plays are still Novo and Karora. The guy that called Karora a pump and dump likely sold too early and reinvested everything riding on Novo. I would disagree with his approach as Karora is clearly producing ahead of Novo, but when Novo hits it’s stride later this summer they may well be in toss up category with production. Karora is accelerating at a measured pace, but Novo has yet to put it’s claims into production.

Novo heralds ore sorting developments as it lines up Steinert …

im-mining.com › 2019/11/27

Nov 27, 2019 — Novo heralds ore sorting developments as it lines up Steinert and TOMRA trials. Potential to significantly reduce capital and operating costs compared to conventional ‘wet’ processing schemes; Potential to reduce construction timeframe compared to conventional ‘wet’ processing;

The way one poster expressed it is that the proven technology used in recycling and waste reclamation has been adopted to profitably dry process the nuggety material found in the Pilbara and especially found at Egina and Purdy’s reward. There are actually two types of dry separators being utilized and tested to be scaled up. The Eddy Current Separator (ECS - TOMRA sorters) and the Steinert KSS 100F LIXT fine mechanical sorting unit are both being used to field test various field conditions. When scaling up production it is likely a hybrid solution involving equipment from both suppliers will be employed.

2021 is truly shaping up to be an exceptional year for many of the mining plays out there.

EZ

As a matter of disclosure, I sold at .16 on U.S.; few days later it is trading at .254. Conclusion-I have always been much better at buying than the selling part!

I’m just posting here to make you feel better Mike!

I took more profits on GNGXF today and on 12/31. I still hold a core position…mostly in the Canadian-traded IVS because GNGXF is not as liquid. I’m OK holding what I’ve got, but if GNGXF moves higher, I may liquidate the rest of it and just let IVS ride. The run up seems exaggerated from the news on the 29th would dictate, so I’m somewhat suspicious of the run. In the past Inventus stock has run up prior to a financing or Sprott cashing out. I’m wondering if that is the same, or if there is more to the last news release that hasn’t been revealed publicly. We’ll see.

Regarding the liquidity on GNFXF…trust me- it is more liquid than you might think. One of the reasons I sold was worried about liquidity and having a position on the grey market for a long time. It ate up my sell order in a fraction of a second at above my bid much to my surprise!

Picking up NOVO NSRPF down here today in the 1.88 and 1.89 range to add to my holdings. Me things something should come out soon. Just my Spidey sense. LOL.

I got some more at $1.86 :-). That completes my position…unless there is a significant buying opportunity.

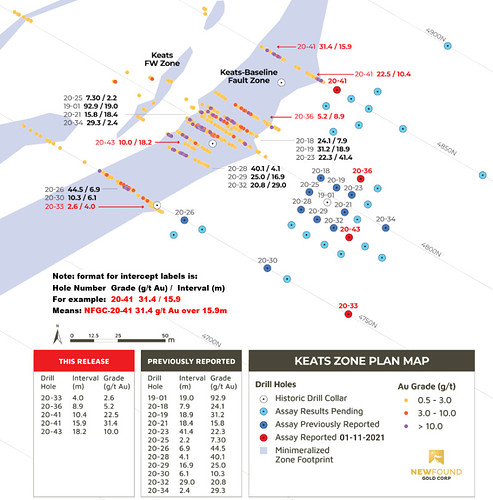

50 Meter Step-Out Hole at Keats Intercepts Broad, Shallow, High-Grade Intervals: 22.5 g/t Au over 10.4m and 31.4 g/t Au over 15.9m

January 11, 2021

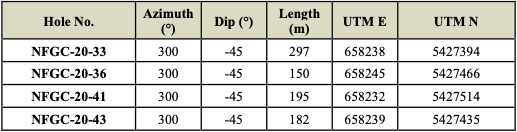

Vancouver, BC, January 11, 2021: New Found Gold Corp. (“ New Found ” or the “ Company ”) (TSXV: NFG, OTC: NFGFF) is pleased to announce partial results from four diamond drill holes recently completed at the Keats Zone (“ Keats ”) and six initial holes drilled at the Little-Powerline Zone (“ Little-Powerline” ), drilled as part of the Company’s ongoing 200,000 m diamond drill program at its 100% owned Queensway Project (“ Queensway ”), 15 km west of Gander, Newfoundland.

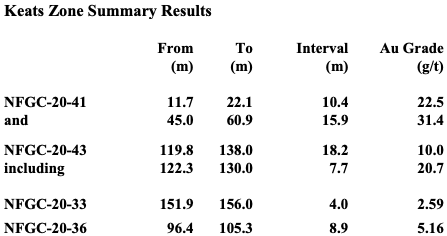

Keats Zone Highlights

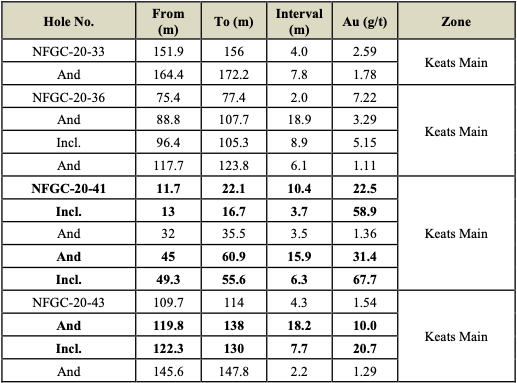

- Intervals displaying significant quartz veining, sulfide mineralization and/or visible gold are assayed on a rush basis. Recent results received for four holes at Keats are summarized below and in Figure 1.

- Two shallow high-grade intervals in hole NFGC-20-41 (22.5 g/t Au over 10.4m and 31.4 g/t Au over 15.9m) have extended the Keats Zone 50m to the north of discovery hole NFGC-19-01 (Figure 1).

- Importantly, high-grade mineralization in NFGC-20-41 starts just 12m down hole at the bedrock surface.

Greg Matheson, P.Geo., Chief Operating Officer of New Found, stated: “Veining in drilling to date at the Keats Zone is characterized by quartz and sulfide mineralization displaying consistent broad thicknesses in the range of 10m to 40m. Intervals of visible gold have been consistently encountered within broader mineralized vein intervals with assays to date returning consistent high-grade Au tenors. Good continuity is evident between holes with approximately 100m of strike now confirmed on this exciting high-grade zone. The zone remains open along strike and to depth, with geophysics, surface sampling, and wide-spaced drilling indicating at least 300m of prospective strike. Increasing our drill count from four to eight drills early in 2021 will help us to ramp-up the grid drilling at Keats and to also test multiple other high-grade targets along 5 km of strike on the Appleton Fault Zone and 3 km of strike on the JBP Fault Zone.”

Note that the exact orientation of the veins is uncertain but believed to be steeply dipping thus implying true widths of the high-grade zone to be in the 70% to 80% range of reported drill lengths.

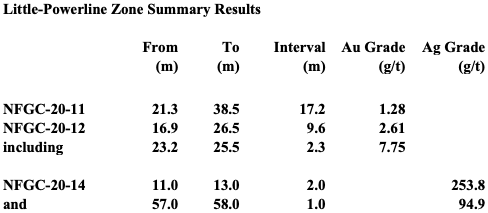

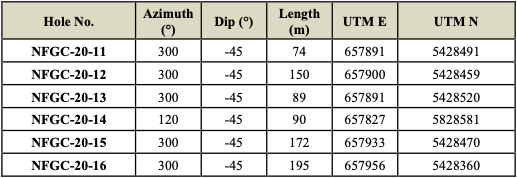

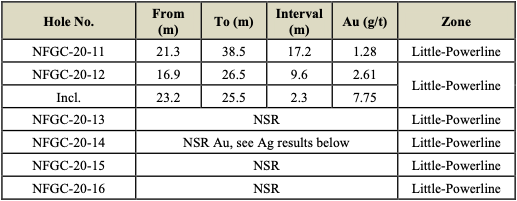

Little-Powerline Zone Highlights

- First pass drilling at the Little Powerline Zone, located on the west side of the Appleton Fault approximately one km northwest of the Keats Zone, has returned early promising results including:

- Holes NFGC-20-11 and NFGC-20-12 returned significant intervals of near surface gold mineralization including 1.28 g/t Au over 17.2m and 2.61 g/t Au over 9.6m, respectively. The latter interval includes a high-grade interval of 7.75 g/t Au over 2.3m.

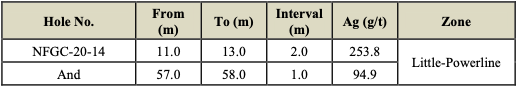

- Interestingly and unexpectedly, hole NFGC-20-14 returned two intercepts of high-grade silver mineralization including 253.8 g/t Ag over 2.0 m. This is the first instance of high-grade silver being identified on the Queensway property.

- Silver mineralization is located proximal to the Little-Powerline gold bearing structures but is believed to be a separate, earlier mineralizing system. Further geological investigation is ongoing to determine the significance of these intervals and to develop a follow up plan for additional drilling.

Note that the exact orientation of the veins is uncertain but believed to be steeply dipping thus implying true widths of the high-grade zone to be in the 70% to 80% range of reported drill lengths.

Keats Zone Drill Collar and Interval Summaries

Little-Powerline Zone Drill Collar and Interval Summaries

NSR = No Significant Au Results

Anomalous Ag results from Little-Powerline

QA/QC

True widths of the new exploration intercepts reported in this press release have yet to be determined but are estimated to be 70% to 80% of reported core lengths. Assays are uncut, and calculated intervals are reported over a minimum length of 2 meters using a lower cutoff of 1.0 g/t Au. All HQ split core assays reported were obtained by either whole sample metallic screen/fire assay or standard 30-gram fire-assaying with ICP finish at ALS Minerals in Vancouver, British Columbia. The whole sample metallic screen assay method is selected by the geologist when samples contain coarse gold or any samples displaying gold initial fire assay values greater than 1.0 g/t Au. Any samples that returned over-limit values (>100 g/t silver) were analyzed with the Ag-OG62 procedure (Ag by HF-HNO3 -HClO4 digestion with HCl leach, ICP-AES or AAS finish). Drill program design, Quality Assurance/Quality Control and interpretation of results is performed by qualified persons employing a Quality Assurance/Quality Control program consistent with National Instrument 43-101 and industry best practices. Standards and blanks are included with every 20 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. Approximately 5% of sample pulps are sent to secondary laboratories for check assays.

Qualified Person

The technical content disclosed in this press release was reviewed and approved by Greg Matheson, P.Geo., Chief Operating Officer and a Qualified Person as defined under National Instrument 43-101.

About New Found Gold Corp

New Found holds a 100% interest in the Queensway Project, located 15 km west of Gander, Newfoundland, and just 18 km from Gander International Airport. The project is intersected by the Trans-Canada Highway and has logging roads crosscutting the project, high voltage electric power lines running through the project area, and easy access to a highly skilled workforce. With working capital of approximately C$67M the Company is well financed to continue its current 200,000m program, with a planned increase from the current four drills to eight drills by February 2021. New Found has a proven capital markets and mining team with major shareholders including Palisades Goldcorp (33%), Eric Sprott (18%), Novo Resources (11%), Rob McEwen (7%), other institutional ownership (8%), and management, directors, and insiders (4%). Approximately 65% of the Company’s issued and outstanding shares are subject to escrow or 180-day lock up agreements.

Please see the Company’s website at www.newfoundgold.ca and the Company’s SEDAR profile at www.sedar.com.

New Found Gold at the 2021 Cordilleran Roundup

New Found Gold will be attending the 2021 AME Remote Roundup with a Core Shack booth January 18-22. Visit New Found Gold’s virtual booth for the following presentations: Greg Matheson, P.Geo., our Chief Operating Officer, will be presenting the Queensway Project on January 18 and 21 at 10:30 am PST, and Denis Laviolette, P.Geo, President, and Craig Roberts, P.Eng., Chief Executive Officer, will provide a corporate presentation on January 20 at 10:30 am.

I gotta tell you, Rick - if the Steinert sorter works out as testing has shown and Novo’s new mill is able to accommodate increased head grades, then Novo Resources is gonna be one heckuva ride. In addition, Novo owns significant stakes in companies like New Found Gold (your post above).

Vancouver, British Columbia (January 12th, 2021) – Vizsla Resources Corp. (TSX-V: VZLA) (OTCQB: VIZSF) (Frankfurt: 0G3 ) (“ Vizsla ” or the “ Company ”) is pleased to provide results from two new holes at the Tajitos vein zone at the Panuco silver-gold project (" Panuco " or the " Project ") in Mexico. Vizsla completed fourteen holes at Tajitos in 2020 and has received results from six holes, the Company has resumed drilling at Tajitos in 2021.

Drilling Highlights

CS-20-06

-

910 g/t silver equivalent (536 grams per tonne (“g/t”) silver and 4.35 g/t gold) over 13.5 metres (“m”) from 96.0 m including;

-

1,607 g/t silver equivalent (946.8 g/t silver and 7.68 g/t gold) over 7.55m from 96.0m including

-

3,157g g/t g/t silver equivalent (1,870.0 g/t silver and 15.00 g/t gold) over 1.5m from 99.0m

Well I just bought more novo today at 180 and 181

Thanks Hurricane. Nice to know that I own some of New Found with my shares of Novo. Hope they rock it too.

Could not help picking up more Novo at 1.805 today. Every time I think I am done then I realize the unrest could cause Gold and Silver to go ballistic along with any PR from Novo and I pick up more. Also picked up more Silver coins from my local Gold and silver shop on Monday.

Summary

- Karora achieves record gold production of 99,249 ounces and gold sales of 98,646 ounces in 2020

- Year-end consolidated cash balance of C$79.5 million, an 18% increase vs. the third quarter, net of a $2 million early debt repayment during the fourth quarter.

-

Consolidated 2021 Guidance:

- Production of 105,000-115,000 ounces, an increase of over 20% when compared to 2020 production guidance.

- All-in-sustaining-cost (AISC)1 of US$985-$1,085 per ounce, an 8% reduction compared to 2020 cost guidance (at mid-point) following a robust year of significant cost reductions across Karora’s Australian operations and corporate offices.

-

A 25% increase in drilling and exploration expenditures for 2021:

- Drilling and exploration budget of A$20 million to be allocated across HGO, Beta Hunt and Spargos.

TORONTO, Jan. 19, 2021 /CNW/ - Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to announce consolidated gold production of 99,249 ounces for 2020 from its Beta Hunt and Higginsville mines in Western Australia, exceeding the mid-point of 2020 production guidance of 90,000 to 95,000 ounces by 7%. Gold sales for the 2020 totaled 98,646 ounces. For the fourth quarter of 2020, production was 25,637 ounces, the strongest quarter of production in 2020.

Karora’s consolidated cash balance increased to $79.5 million as at December 31, 2020, an 18% increase from $67.3 million on September 30, 2020. The increase in cash was net of a $2 million early payment to reduce the Corporation’s debt.

Karora is also pleased to announce that for the full year 2021, the Company is targeting consolidated production of between 105,000 to 115,000 ounces of gold at an average all-in-sustaining-cost (AISC)1 of US$985 to US$1,085 per ounce.

The high-end of 2021 production guidance represents a 21% increase over the high-end of 2020 guidance (19% mid-point to mid-point). The mid-point of 2021 cost guidance represents an 8% reduction when compared to the mid-point of 2020 guidance. The reduced AISC guidance reflects Karora’s continued focus on cost reduction initiatives following a very successful year of reducing AISC during 2020.

Consolidated HGO, Beta Hunt and Spargos drilling and exploration expenditures for the full year 2021 are targeted to be approximately A$20 million, double the initial 2020 guidance and 33% higher than revised 2020 drilling and exploration guidance (see Korora news release dated September 10, 2020). The budget will be allocated towards further resource definition drilling and exploration across all three properties. The increase in the drilling and exploration budget was driven by Karora’s success in 2020 of increasing consolidated Proven and Probable Mineral Reserves by 334% to 1.33 million gold ounces and Measured and Indicated Resources by 167% to 2.52 million ounces (see Karora news release dated December 16, 2020 for further details). Karora has a number of high-quality exploration targets slated for exploration drilling in 2021 across its +1,800 km2 land package.

Paul Andre Huet, Chairman & CEO, commented: "I am extremely pleased to report full year 2020 production of just under 100,000 ounces, beating the top end of our 2020 production guidance by a substantial margin in our first full year of production with our Higginsville mill. I am also excited that we ended 2020 on a very strong note, producing 25,637 ounces which was our best quarterly result in 2020.

During the fourth quarter we added over $12 million to our cash position, net of a $2 million early debt repayment, bringing our total to $79.5 million in cash as of December 31, 2020.

For 2021, we are guiding to gold production approximately 20% higher than 2020 guidance and for AISC1 to be approximately 8% lower. We expect gold grades will increase over the course of the year as we begin to move into higher grade areas at Higginsville Central and with the anticipated start-up of mining at the high grade Spargos project in the second quarter. As a result, the increase in 2021 gold production and grades is expected to be weighted towards the second half of the year.

During 2020, Karora focused on stabilizing both operations and building a reliable, long term production base. With a successful base established, we are now poised for significant production growth and look forward to rolling out our organic growth plan in the coming months. 2020 was certainly a transformational year, but we believe we are only just scratching the surface of our growth potential and I am looking forward to an even better year for Karora in 2021."

VIZSLA EXPANDS NAPOLEON FURTHER TOWARDS SURFACE, TO DEPTH AND TO THE NORTH AT PANUCO PROJECT, MEXICO

Vancouver, British Columbia (January 19th, 2020) – Vizsla Resources Corp. (TSX-V: VZLA) (OTCQB: VIZSF) (Frankfurt: 0G3 ) (“ Vizsla ” or the “ Company ”) is pleased to provide results from ten new holes at the Napoleon prospect at the Panuco silver-gold project (“ Panuco ” or the “ Project ”) in Mexico. These results continue to expand the discovery and it remains open to the north and beneath wide intercepts at depth.

Drilling Highlights

NP-20-42

-

422 g/t silver equivalent (180.1 grams per tonne (“g/t”) silver, 2.27 g/t gold, 0.44% lead and 1.31% zinc) over 11.02 metres (“m”) true width from 149.15 m including;

-

2,383 g/t silver equivalent (974.8 g/t silver, 13.88 g/t gold, 1.63 % lead and 5.83% zinc) over 1.09 m true width from 163.8 m and,

NP-20-31

- 569 g/t silver equivalent (181.2 g/t silver, 3.75 g/t gold, 0.59% lead and 1.52% zinc) over 3.54 m true width from 47.05m

NP-20-13

- 561.6 g/t silver equivalent (262.3g/t silver, 2.57 g/t gold, 1.26% lead and 2.0% zinc) over 3.23 m true width from 130.35m

Good to see some guidance starting to flow:

Pan American Silver announces 2021 guidance and preliminary 2020 production results

Published: Tuesday, January 19th, 2021

All amounts are expressed in US$ unless otherwise indicated. Results are unaudited and could change based on final audited financial results. This news release contains forward-looking information about expected future events and financial and operating performance of Pan American. Readers should refer to the risks and assumptions set out in the “Cautionary Note Regarding Forward-Looking Statements and Information” at the end of this news release.

VANCOUVER, BC, Jan. 19, 2021 /CNW/ - Pan American Silver Corp. (NASDAQ: PAAS) (TSX: PAAS) (“Pan American”) today announced its preliminary production results for the fourth quarter (“Q4 2020”) and full year 2020 (“FY 2020”), and provided its guidance for production, costs and certain expenditures in 2021.

“We are expecting a 35% increase in silver production relative to 2020 and record gold production in 2021, despite our assumption that COVID-19 will continue to have an impact on operations,” said Michael Steinmann, President and Chief Executive Officer of Pan American. “Under our 2021 guidance assumptions, we expect to be generating robust levels of free cash flow. Our ability to overcome the extraordinary challenges over the past year while managing our nine operations, generating substantial free cash flow, advancing our La Colorada skarn project, and re-paying all our bank debt is a testament to our team and the benefit of having a diversified portfolio of quality assets. I anticipate 2021 being a much stronger year across all our operations.”

During 2020, Pan American repaid the remaining $275.0 million outstanding on its corporate credit facility and distributed $46.2 million in dividends to shareholders, with the quarterly dividend being increased twice during the year. As at December 31, 2020, Pan American had no bank debt, while the cash and short-term investment balances increased to approximately $279.1 million. …

https://www.panamericansilver.com

Hopefully this kind of good news will continue from other producers, and by summer the explorers and drillers will have the results to make all investors/traders happy.