AgraFlora Organics Could Explode Over The Next Year

Sep. 24, 2019 11:47 AM ET

|

18 comments

|

About: AgraFlora Organics International Inc. (AGFAF)

Gary Bourgeault

Long only, research analyst, portfolio strategy, media

(11,051 followers)

Summary

Many of the pieces for long-term growth are close to being put in play.

Successful submission of its evidence package to Health Canada - last step before being issued its standard cultivation license.

Its 2.2 million square foot Delta Greenhouse Complex will be one of largest in the world.

A non-binding cannabidiol letter of intent has been entered into with one of the largest Canadian food retailers.

The company has also acquired stake in Hong Kong-based Eurasia Infused Cosmetics Inc.

source: USA Today

source: USA Today

AgraFlora Organics (OTCPK:AGFAF) has been quietly building out a strong cultivation base that will result in it being one of the market leaders in production capacity in the cannabis industry when completed.

The market hasn’t caught wind of the narrative yet, as it has been recently trading on average at about only $.20 per share. While most companies at this price point are essentially worthless, AgraFlora is a real company that is aggressively expanding at a significant pace.

In this article we’ll look at the near-term potential of its giant new facility, its possible deal with an unnamed giant retailer in Canada, and how this may play out in the Canadian cannabis market over the next year or so.

Delta Greenhouse Complex

By far the most important part of AgraFlora’s business is its joint venture with Propagation Service Canada to build a 2.2 million square foot greenhouse in Delta, BC, Canada. At completion, it’ll be one of the largest in the world. AgraFlora’s stake in the joint venture is 70 percent.The companies have already submitted their evidence package to Health Canada concerning its Phase One build-out. The package confirms Delta Greenhouse is in compliance with the Cannabis Act and Cannabis Regulations. When approved, it’ll be issued a cultivation license.

The facility shouldn’t have any problem being approved because AgraFlora worked with 3|Sixty Secure as a consultant on the project. 3|Sixty Secure has worked with over 60 percent of the Canadian LPs to ensure they’re compliant and will be awarded their cultivation licenses.

AgraFlora expects to receive its a standard cultivation license in four to six weeks. Phase 1 of the retrofit should be completed “on or before October 31st, 2019.”

After receiving the license the company will quickly import “a portfolio of high-end cultivars.” The first harvest is expected to arrive in the first quarter of 2020.

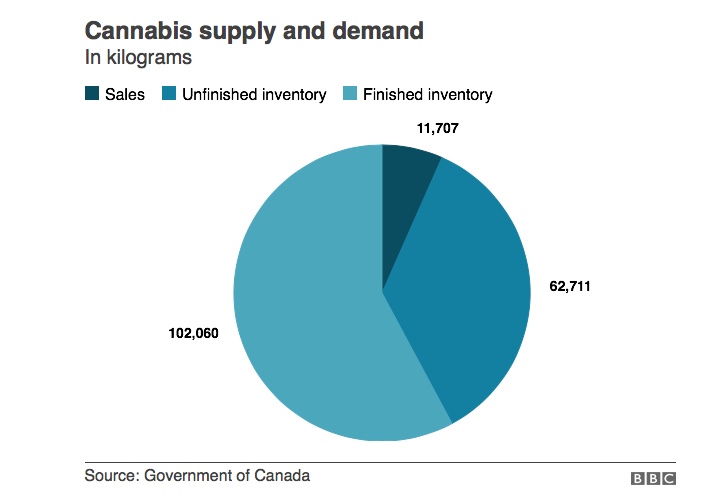

After the Phase 1 retrofit, the facility will have about 431,000 square feet of cultivation/processing space to work with. That will produce an estimated 160,000 kilograms of drived flower, or approximately 15 million grams annually. AgraFlora also believe it will be able to recapture more than 1 million grams of premium cannabis trim on an annual basis that will be turned into high-value products.

At the launch of Phase 2 of the project, included with that retrofit will be ten flower rooms with more than 1 million square feet of canopy, and another 40,000 square feet designed for post harvest and processing.

In negotiations with large Canadian retailer for CBD distribution

In August 2019 AgraFlora announced it had entered into a non-binding agreement, dated July 31, 2019, with a large Canadian retailer for the distribution of CBD products across the nation.

Among the products being considered to be supplied to the retailer are edibles, cosmetics, beverages, CBD performance products, and pet products, among others.

Brandon Boddy Chairman and Chief Executive Officer of AgraFlora said this:

Following a protracted assessment of the Canadian cannabis marketplace as well as the associated Health Canada regulations we are elated to announce that this prominent Canadian Food Retailer has selected AgraFlora as a potential partner of choice for CBD commercialization and distribution due our assets human capital and manufacturing capabilities.

The importance of this and/or similar deals is the company must develop a distribution network in order to sell its products. That’s obvious, but the company must prove it has the capabilities to do so, or it’ll be sitting on a lot of pot. Keep in mind the negotiations with major food retailer isn’t a done deal yet.

Eurasia Infused Cosmetics Inc.

Another deal announced in August was the agreement by AgraFlora Organics to acquire 50 percent of the “issued and outstanding shares of Eurasia Infused Cosmetics Inc.”

Eurasia Infused, via a CBD Group Asia Limited, based in Hong Kong, has control of a distribution agreement with the Hong Kong Special Administrative Region and the People’s Republic of China.

Citing Regent Pacific Group from Hong Kong, CEO Brandon Boddy said the CBD market in China alone is forecasted to be worth $15 billion by 2024, citing beauty and wellness as the primary catalysts."

The Chinese cosmetics market will be primarily served through its wholly owned subsidiary Canutra, which manufactures and sells premium personal care and cosmetic products. It’s located in New Brunswick.

Needless to say, this is potentially a predictable and sustainable market AgraFlora can expand in for many years.

Uncertainty and risk

The major caveat for the potential of an extraordinary run for AgraFlora in the near future is the enormous amount of competition in Canada from entrenched and large players, and the slow licensing process that has severely limited the number of retail outlets that can be sold through.

Some of that would be mitigated if it does land the deal with the large retailer, but if not, the company will have to scramble to find ways to distribute it product at scale. I think this this is the biggest risk for AgraFlora at this time.

There is no doubt in my mind it’s going to be awarded a cultivation license, and that it’s going to generate some serious product in the not-too-distant future.

Having enough product doesn’t seem to be a problem to me, and even in Phase 1 of its project it’ll catapult ahead to be in the top ten in Canadian production capacity.

While AgraFlora has an outlet into the Chinese and Hong Kong markets, along with a presence in Colombia, it will need to find more distribution channels in Canada to do really well. I think it will find a way to do so as it proves it can deliver on its supply estimates.

One last thing is AgraFlora does need more markets to compete in in order to sell what is going to become a large amount of pot. Eventually the Canadian market will have more than enough supply to meet demand, and those without an international presence are going to struggle to grow at that time.

Conclusion

I think AgraFlora is an extraordinary bargain at $.20 per share, when taking into consideration the production capacity it’s going to have in the near future, the inevitable cultivation license it’ll receive, and the growing number of outlets it can distribute its product in.

If it lands the deal with the large retailer, or something similar, this stock will take off. Even without that it may take off once it gains approval for the cultivation license, and the market sees the potential of China and the Canadian market.

How fast and high it goes will continue to be determined in part by market sentiment, but this is going to be a stock that has a lot of emotion attached to it when it’s discovered, and that will drive the share price up in the short term far more than the fundamentals. After the initial run it’ll settle down and perform more in align with its underlying potential.

When considering you can buy 1,000 shares in the company for $200 at this time, it’s a no-brainer to me to take some cash allocated to risky investments and take a position in AgraFlora. I don’t think it’s going to take too long before it starts to reward shareholders.

For now, I wouldn’t think in terms of holding long term, but once the big run slows down and profits are taken, it would be worth considering it more for the long term once there is more clarity on the potential retail deal, and it secures more distribution deals based upon its production capacity.

https://seekingalpha.com/article/4293264-agraflora-organics-explode-next-year

source: USA Today

source: USA Today