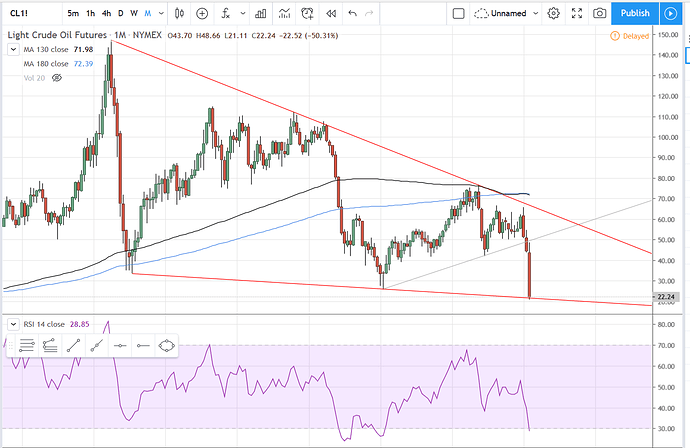

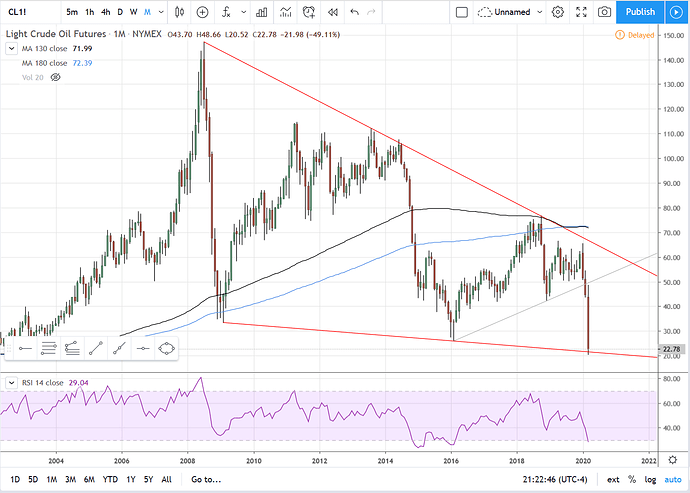

I’m watching for a bottom on oil today at the 20.52 low. Note the RSI divergence at the bottom of the chart. Price hit a new lower low from the previous while the RSI is hitting a higher low than the previous price low. Note the red triangular pattern on this monthly interval chart. Looks a lot like a bullish wedge to me… a giant one. I’m thinking oil will be back to all time highs within ten years, and back to $70 within four… probably less. Just a guess though. I never thought I’d see oil at this price again, so I guess my track record sucks. Take it fwiw. ![]()

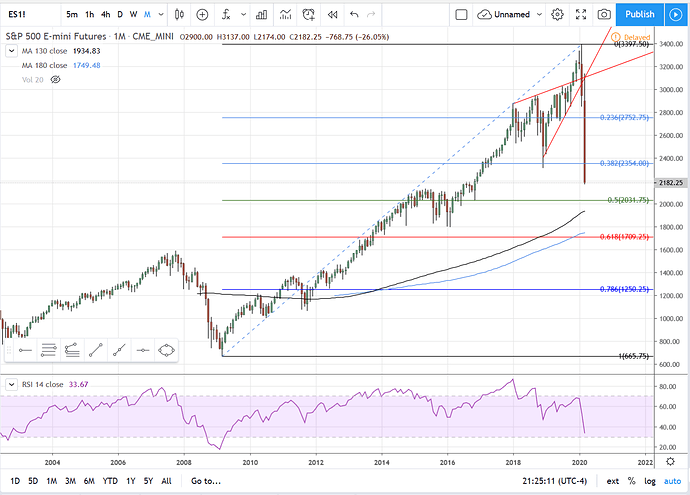

Here’s an update on the S&P 500 futures contract. Still watching for comments made in the last post.

Here’s a comment OUCH! Hope you’re doing well and staying safe Rich!

The bottom holds thus far for oil. Keep in mind this is a monthly interval chart, so the candle is not complete until the end of this month. If the price dips lower I don’t care, what’s important is that the body of the candle closes within the formation. I think this has a possibility of being the last best opportunity for buying oil we ever see, but then of course I thought that last one at $24 was so…

I am well and safe, thanks DoneDeal. I hope the balonavirus isn’t freaking you out too much. ![]()

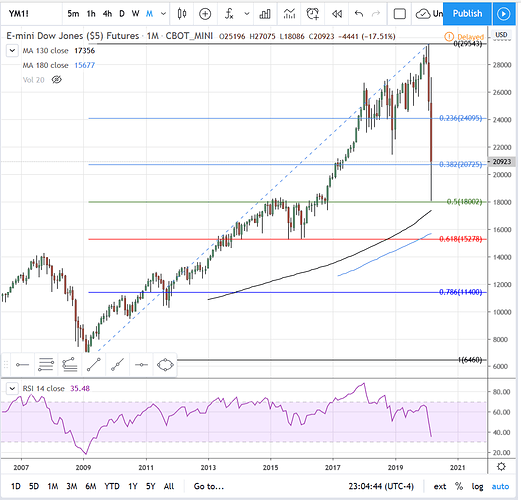

The DOW so far has retraced 50% of the move from the lows of 2009, almost tagging the monthly 130 MA. Is that it? I don’t think so, but will update. I still wouldn’t be surprised for the S&P futures to hit one of the MA’s or the 62% retracement. I don’t think the balonavirus panic/political nonsense is done yet. Oil is still staying within the lower line of the bullish wedge. 4 more trading days until that monthly candle finishes and starts a new one. Will update then at the latest.

AgraFlora’s Delta Facility FINALLY receives its Cultivation License from Health Canada, as posted on the Health Services website. Company announcement will probably come Monday or Tuesday. This has been delayed by over 9 months and the stock price has been deservedly crushed by the delay and subsequent dilution and mothballing of facilities until its approval. It will probably take 2 quarters before revenues start to come in, but this should mark the turning point for the company and stock.

Cannabis bell-weather Aurora Cannabis (ACB) announced better than expected results with the stock running 68%. That lifted the whole sector today and bodes well for the sector going forward.

MDMN & AUMC are flops. AgraFlora seems to be a flop. I got out at .32, .27 & .17. Still have 4000 shares with a .15 basis. I invested what I have left into AMD last July. I held until January and sold 500 shares with a an 80% gain. Then invested into Jan 2022 leaps with a $50 strike price. Am up 100% on that. I have become a true believe and a true long.

If you don’t know anything about AMD, do some DD on it. I believe it can still be a 10 bagger based on current PPS. With the stock options, it could be a 100 bagger by 2024. It has strong potential to grow to a trillion dollar market cap. If you don’t know anything about Intel’s trouble’s, they are real and ripe for the picking. AMD has better products now in the CPU market and are taking market share at a good pace, which has excelled due to Intel troubles. They have new releases (Big Navi) coming soon that will make a dent in Nvidia’s market share.

Data centers will be the next market that they will gain market share with already some big wins.

In September, Samsung will hopefully announce that they will use AMD APU’s in there Galaxy S21 phones. The most exciting is new technology they will be introducing. A tech guy I follow from another MB has broken it down. I have included it. It is very techie, but do some DD about AMD, and you may see that it can be a very good investment over next 5 years.

Here is word from Tom:

"Critical to the future AMD’s significant PPS jump is to understand that new TAMs will be created out of its technology. Such aren’t in place today but are in the making and work is ongoing with partners as disclosed by Mark Papermaster webinar. Maybe we’ll hear more about such future at the ER.

It’s very important to understand how the scalable Infinity Fabric enables such new TAMs and partnerships. It’s not equivalent to any current product development. It allows to create custom efficient designs way cheaper and faster than any other methodology such as SOC - System on a Chip.

Understand the unique scalability the infinity fabric has from the same protocol used within a SOC APU single chip, to multiple chiplets direct connect fabric without an IO chiplet as in first gen EPYC through a switched fabric second Gen Rome. Then between sockets on the same board, and perhaps but not needed yet, between boards in a rack and between racks in a datacenter, like Ethernet or Intel’s attempt with OmiPath but such wasn’t scalable.

It’s very important to use same protocol structure without translations like into Ethernet or PCIe from infinity fabric, which add latency lower bandwidthand consume power.

Fabrics and networks have a physical layer that faciliyates the electrical driving circuits. Such depends on the distance travelled. Obviously on a single chip distances are short and the power to push such interconnect is much lower than between sockets. But the protocol is compatible that’s the key.

This in contrast with the old ring based on chip interconnects of the past that would be translated to differentiate protocol once going outside of the socket etc.

It’s beyond the scope of this post to fully explain the unique AMD’s technology. No $intc doesn’t have it nor $nvda NVLink. It’s not like CCIX, CXL, Gen-Z, OpenCAPI etc.

The chiplets use was first thought of within AMD’s only domain. Using small chiplets allow to use newest fab node because the yield doesn’t have to be optimized for big area chips. That’s the past Intel’s monolithic approach hence small laptop chips made before servers.

But the chiplets allow customization at a level of fully optimized CPUs circuits without redoing and reinvestment all from scratch like with SOCs.

The first example I think, ofva partnership and chiplet to match could be for Machine Learning aka AI. The circuits for such do not need be in GPUs at all. GPUs used to be accelerators for certain computations but nVidia’s put those Tensor Cores inside it’s datacenters GPUs simply because it doesn’t have an x86 CPU.

You can see Google using ASIC around an x86 with pure Tensorcores circuits no GPUs. But as ASIC isn’t power efficient noe area efficient.

A chiplet connected to the infinity fabric at the CPUs side will make a lot of sense. I believe AMD is preparing such. Microsoft, Google, Amazon and all cloud datacenters will be instant customers. This is developed with a partner, maybe Google or Microsoft. But as with consoles, the derivative will be offered as a standard chiplet.

Nothing can match this performance, power or cost wise. No GPUs outside of the CPUs domain can.

Look at the Google TPUs Tensor Processing Units to understand.

This is one example. Many others.

This is the chiplets ecosystem new TAMs to propel AMD’s PPS to $1000 within 3-5 years."

I am hopeful with AMD I can recover all my pathetic losses from MDMN and AGFAF.

Good informative post, C3PO.

Thanks, this is an exciting new area for this technology. NVDA was a big gainer for many. Advanced Micro looks to be a great addition to this sector in a powerful portfolio.

Here is another post from Tom if you are skeptical of the 166% rise in this stock from a year ago.

“No, NO … ,you have NOT missed the train to invest in AMD and if you are $intc long and wonder, at least you should sell part of your holdings if not all and switch to AMD.

What’s coming soon and in the next 12 to 18 months is an unbelievable growth with substential technical and technology leadership. Margins over 50% with 50% market share of current datacenters, PCs CPUs and GPUs tightly codesigned. In addition to new markets not yet factored with new applications. ARM mobile devices, chiplets design ecosystem and even schools entry laptops for all in a corona live at home life will get AMD to $100B revenues per year! No typo. Yes could take a few years maybe 3 but we’ve seen BoA raising CURRENTLY CONSIDERED AMD MARKET SHARE to 50% in 18 months alone.

$100B at 50% margins is huge. Remember that the larger the quantities of chips the hogher the margins.

Net EPS of course will be less. Say just 20%… that means $20 EPS … which easy can justify a 50X PE due to meteoric revenues growth hence even 100X is possible if you look at Amazon Tesla and Netflix examples.

Yes a $1000 PPS if you’re long not tempted to trade just hold buy ASAP no pullback waiting. Pullback of a few $$ in %s wise at $100s of dollars PPS doesn’t matter. While jumping can occur higher at anytime.

Example consider leaks of Zen3 engineering sample reaching already 4.9GHz clock and instructions per clock improvement of 15% or more. Consider leaks talking about individual per core voltage adjustment and clock adjustment to enable single or few cores over 5GHz clocks as power use is focused on them. Consider patent published on big little cores design showing possibility to get substentially higher densities with 100s of cores chiplets based future processors. Then we have seens leaks of big Navi and future Navi 3X and Navi 4X as well as datacenters cDNA Arcturus GPUs with 120 CUs achieving huge FP32 performance vs nVidia’s. Just examples. Not to mention the Samsung rDNA ARM partnership and leaked mediatek ARM Ryzen APUs C7 …

Take this seriously and do your own research never go by analysts articles and MB posts including mine! Of you don’t deeply understand the technology don’t invest as you will be nervous to hold long and get to a theory that tries to tempt you to trade by claiming to provide the future PPS based on patterns of the past like charts TA, waves, maxpain etc.

Don’t be fooled. …the best is yet to come!”

AMD has been a nice trading stock. It’s currently in a formation that looks soon to breakout at $84. (Possibly as soon as today/tomorrow). From there the target is $92… new highs.

Hi Rich. Based on the volatility of the stock, I suspect many trade it. You obviously spend a lot of time studying charts and over the years it seems to have done well for you. I have full time job and don’t have time for charts and trading the ups and downs. I have spent a lot of my free time at nights studying the stock and truly believe in the plan that Dr. Lisa Su has laid out. She has laid out a great long term plan and she is an engineer with a great vision for the future. I only wish I had discovered the stock back in 2016. Oh well, I am invested now and I am strictly a long. I used to follow your posts diligently back in the MDMN / CDCH days. I have much respect for you. Good luck to you in your trading.

I hope you make a mint from it!

I appreciate the sentiment.

Just watched this interview of Quinton Hennigh, dated June 18, 2020 (about 40 minutes), and even though Quinton seems to be squirming in his seat at a few points, the interview is probably the best one I’ve seen. My biggest take-away is that conglomerate deposits like Novo is dealing with in the Australian Pilabra are not as susceptible to a NI 43-101 report because the deposit is more nuggety. Quinton makes the point that quite a few reputable investors have done their own due diligence, so there must be a lot of good stuff there (e.g. Sumitomo, Kirkland Lake, Sprott, etc.). The thing he clarifies for me is that once Beaton’s Creek gets cranking, then they’ll be able to get the Karatha going - and then Egina is already proceeding independently of both of them. Lots of good stuff here.

Wow, the US Dollar is going to the basement - down 66 cents today to 92.19, well below the 93.00 threshold a pundit was recently talking about and was saying that a breach of that threshold would open the door to 80.00. Quinton Hennigh himself made the comment that we might not WANT to live in a world where gold is valued at 3,000.00 or 5,000.00. Probably a good point - if the price of gold simply would stay at about 2,000.00 we make money over the short and long run anyway, as profit margins will be nice either way.

You may want to watch this whole thing if you haven’t already seen it Bubba, but as it pertains to your comment above, start at 22:30 and listen at least until you get to 26.25.

Thanks Rich as always - will view later today (probably tonight) when have the opportunity, flipping hamburgers and the grill is full!

Excellent! The entire interview is well worth listening to.

This is an incredibly insightful interview on the global currency crisis. Sinclair explains the transition occurring right now in global currencies as a new monetary system is formed and the role of gold. Derivatives and debt cannot be rebalanced without this worldwide reset. My understanding is that the IMF’s basket of reserve currencies (SDRs), will be the 1st manifestation that is concretely visible. This is due to rebalance October 1 of next year. The allocation is largely determined by the “officially declared” amount of gold reserves held by the 5 countries comprising the basket of currencies used in the settlement of international trade. (The current basket is comprised of: US Dollar 41.73%, Euro 30.93%, Chinese renminbi 10.92% Japanese yen 8.33% and Pound sterling 8.09%). This interview with Jim Sinclair puts some context as to why parts of the markets behave irrationally (algorithms) and what happens when bubbles and currencies collapse. The current “reset” has already begun and is just the 1st of at least two eventual tumultuous waves over the next decade. The 1st wave is predicted to last until 2025 and the 2nd to 2032. The consequences are long lasting.

Di-yam - Gold Price (low end) 50,000.00? More likely 87,500.00?

According to his mathematical formula, which he says he has used to anticipate the future gold price:

US Debt

(US Assets) (see federal reserve balance sheet)

=Total Value of Gold

/ Total ounces owned by the United States

= Price per Ounce

Therefore:

26,655,576,000,000 Debt

(6,990,636,000,000) Federal Reserve Balance Sheet Assets

= Approx $20 Trillion

/ 261,498,926 Ounces Held by Federal Reserve (Assume Correct)

76,482.00 per Ounce

Just about what the guy said (per above).

Scary.

But, I don’t care WHO walks in with the Hope Diamond around her neck - even if Melania Trump walks in wearing a smock, I’d still be looking at her.

Thanks Trader Rich For posting Jim Sinclairs Video…

I have always liked his commons mans way of explaining complicated issues.

His comparison on how the markets will react to the monetary reset coming over the horizon soon to, Melania Trump and Ruth Buzzy from S.N.L. at the formal ball, was priceless.

I’ve sent this video to all that don’t have a clue beyond “Hay I got my stimulus money” so I went out and put a down payment on another toy"…

Some still and warm and fuzzy to China did nothing wrong !

“just Look” how they are helping everyone… ( Dah people! more goods out- more money in to buy gold)…

I am reposting a post I did a while back. It kinds of goes some what along with what Jim Sinclair talked about.

*** May 1

.... global-health-effects-on-markets-and-mining-stock .....

**“In the midst of chaos, there is also opportunity.” – **Sun Tzu**

Who ever, among the large nations, comes out of this virus problem the fastest,

will be top dog.

If they hold little debt, are flush with gold, and hold others debt, will help …

…Or hold the patent on this virus (which is patented). you might hold the vaccination to it. $$

May you stay healthy, and wise.

C.S.