I agree with Drifter that a open pit mine is just to close to the groups that appose or want to change such a thing.

The political activists who had mining in their sight last election are just starting to settle down. May be best for time being to keep mining underground.

Im not a fan of of that slower process, but it is progress.

Im going back to sleep for now. Wake me if something big happens … C.s.

Could be yet another reason MC is joining forces with the local university, to prove “public purpose”. I see a lot of pieces to the puzzle coming together.

Mr B. ; I agree…

It was a very thoughtful thing for Maurizio to have done, especially in and for, the country he will be doing business in.

You could also call it a good business move.

Never under estimate the power of having students and possibly some faculty members on your side,.

This will be a rich education for all of us. Some of these students could very much go on to be some of the next advisers if not leaders of their country.

And no matter how business was run in the past, there is a new dawning to Chiles outlook on mining. :: just go look at the category “Other Mining Stocks” and Lithium mining.

I want to add a tad-bit to Trader Riicks text from a while back.

It was common practice in the old gold rush years to at times go far away for your analysis, to throw off the competition. Makes one wonder, who? and from what country will be buying the concentrate?

[quote="TradeRich, post:312,

The analysis will be carried out in special laboratories in Peru since they offer the most complete set of gold tests we have been able to find. The labs that we use in Chile are unable to perform all the metallurgical tests required to satisfy the requirements of the terms sheet.

[/quote]

This is very surprising to me. Im not questioning the validity of it, just seems strange that a mining powerhouse country such as Chile wouldn’t have this.

Well, all I could say is either (1) there is indeed no outfit in Chile that can perform the requisite tests, or (2) the potential purchaser of the concentrate trusts Peruvian testers more than it does those from Chile. Maybe they’re worried that MC has too many connections in Chile? Don’t know - but yes it is rather odd. A friend of mine who has done lots of business in South America talks of rampant fraud down there. So, maybe it’s just them being careful … don’t know.

Hi coldsnow,

As far as the need to use 2 labs in Peru capable of performing tests that the labs that Auryn usually uses in Chile aren’t quite as capable to perform, I think this has to do with the specific metallurgy of the concentrate. With the 4.5% copper aspect detected from the assays performed at the intersection of the Antonino Adit and the DL2 Vein, I think it’s safe to assume that the “concentrate” being sold will be a gold/copper concentrate.

These are almost always destined for a copper smelter after any on-site gravimetric beneficiation is performed. Since the potential purchaser that signed the MOU and submitted the TERM SHEET prescribed the use of (ultra-environmentally friendly) gravimetrics, they’re probably practitioners of “GREEN MINING”. There are a bunch of funds out there that can only invest in or do business with miners using GREEN TECHNOLOGY.

Producing a “GREEN” gold-copper concentrate, keeps the miner in good stead with the environmentalists. They don’t like mining in general, but they sure will make an exception for GREEN COPPER MINERS and miners producing the battery metals.

The metallurgy can get kind of complex, but the copper smelter will first harvest the copper. It ends up on the copper “anodes” which are refined with an “SXEW” process. Instead of the gold hopping onto the “cathode” it drops down to the floor of the tanks and gets incorporated into the “slimes”. These are then processed to fine gold.

Sometimes the concentrate will be treated with PRESSURE OXIDATION (POX) or BIO-OXIDATION (BIOX) to remove the sulfides. These are “hydrometallurgic” processes. In other cases, the concentrate will be “ROASTED” in order to oxidize the sulfides. This is a “pyrometallurgic” process.

Historically, the ore from the DL2 Vein has responded well to various beneficiation methodologies. The artisanal miners deployed a 4-cell flotation process and got the 64 gpt figure up to 92-gpt gold. In their last year of production, the artisanal miners used an unspecified beneficiation methodology (probably gravimetrics), and got the SHIPPING GRADE up to 102.7 gpt gold.

What’s interesting to me is that the off the chart HISTORICAL SHIPPING GRADES (averaging 64 gpt gold) achieved by the artisanal miners of the DL2 Vein was achieved even though the recovery process 75 years ago was so inefficient that the tailings/discards ended up carrying 14 gpt gold. This is because half of the ore processed way back then involved very tiny (less than .02mm) particles of gold. Nowadays, there are a variety of gravimetric concentrating methodologies that successfully recapture these “fines”. Auryn already tested the Sepro-Falconer model of gravimetric separators and got excellent results “even with the fines” netting over a 90% recovery rate. It will be interesting to learn what kind of SHIPPING GRADE we can generate with whatever technologies are being tested in Peru. By reference, the average grade being mined worldwide in an underground vein operation is 4.15 gpt gold.

I agree BB, the first gold extraction exploitation will use a crushing circuit and Gravimetric Concentrators and provide profitable cash flow. I expect expanded permitting at an accelerated pace after first shipments.

Back in Nov 2016 as part of management’s conservative, methodical approach AURYN announced, “We are engaging independent consultants to conduct a full granulometric analysis and finalizing the paperwork necessary to begin ore shipments for processing.” The early test runs in 2016 served the purpose to determine terms of the contract based on the complexity of the processing and a minimum gold content of the “raw” ore accepted at ENAMI. Thus, early exploitation will be direct gold concentrate shipments to ENAMI for maximum positive cash flow. This is work that was already completed explicitly for direct shipment to ENAMI.

The additional gravimetric and chemical assays being sent out to the labs are necessary for meeting the terms of the agreement with the minerals trader for a high copper/lower grade gold concentrate. This provides crucial information needed for a different complex refining process for the copper smelter to extract both metals. Discarded material left over from the gravimetric gold extraction sent to ENAMI will be stockpiled for any further preparation needed to meet term sheet conditions of the copper smelter. Smelter shipments will likely be undertaken sometime later after full mining has been undertaken.

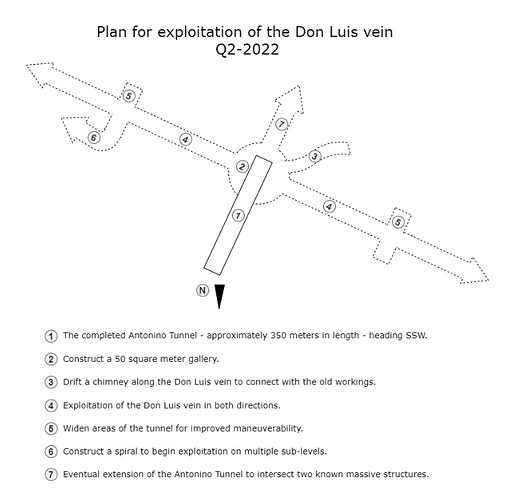

I had a relative stop by yesterday that wanted an update on Auryn/Medinah. He found it helpful when I presented the DL2 Vein operation in terms of a watch dial. The DL2 Vein runs in a NNW to SSE direction as if it ran from the 11 o’clock position to the 5 o’clock position on a watch dial. The distance from the 11 to the 5 on the watch dial is about 1,000-meters.

The Antonino Adit runs from 2 o’clock to the center of the watch dial where it bisects the DL2 Vein. It is about 400 to 500-meters long. The “North Road”, which the trucks will use, is located handily at the portal to the Antonino Adit at the 2 o’clock position. At the intersection point of the Antonino Adit and the DL2 Vein (the center of the watch dial), is the new “gallery” where the wheel loaders can back into and either jockey themselves around in order to aim back out the Antonino Adit (towards 2 o’clock) or dump their load into a transport vehicle that will carry the ore out the Antonino Production Adit to the crushers and then probably to a gravimetric plant. This second approach would allow the wheel loaders to quickly return the site of the previous blast.

Each level of the mine will have 2 working faces being simultaneously mined. One will orient towards 11 o’clock (NNW) and the other towards 5 o’clock (SSE). Approximately 20-meters from the center of the watch dial towards the 11 o’clock position will be located the “decline spiral” which will access the lower sub-levels that will also be simultaneously mined. The combination of the Antonino Adit bisecting the DL2 Vein and thereby creating 2 working faces to simultaneously mine per level and the “decline spiral” providing access to more levels, give the project “scalability”.

If you look into the future and assume that levels 3 through 7 are in operation, there would be 10 working faces being simultaneously mined. The key to being able to mine this many levels simultaneously, and in a safe manner is plenty of fresh air ventilation and a “ventilation/safety egress chimney” from the level of the Antonino Adit (level 3) to the plateau surface. This “chimney” will be located very close to the center of the watch dial and the “decline spiral”.

The ”old workings” containing levels 0,1 and 2, feature 7 vertical shafts and 5 vertical chimneys leading to the plateau surface. These are in alignment with the long axis of the vein striking from 11 o’clock to 5 o’clock. The artisanal miners mined a 350-meter stretch of the DL2 Vein, aiming from 11 o’clock to 5 o’clock and centered on the center of the watch dial, down to a depth of about 100-meters. It was critical to intersect the DL2 Vein underneath these “old workings” so that the now empty “stopes”, where the vein material has been removed, can be accessed to provide fresh air as well as a passageway to the surface, for any miners to take in case of an emergency like a cave-in.

Theoretically, the production levels of extremely high-grade ore, initially achieved on level 3, which does not need to use the decline spiral to access the ore, should be doubled when level 4 is operable. Putting level 5 into operation should triple this initial production level, etc.

You can see why Auryn didn’t opt to develop any of the 25 or so “veins/structures” they intersected on the way from 2 o’clock to the center of the watch dial along the course of the Antonino Adit. There were no “old workings” offering a series of shafts and chimneys to provide airflow or an emergency exit located above the Antonino Adit. Therefore, there was no “scalability”. Management knew from the HISTORICAL SHIPPING GRADES what grade of ore to expect when they successfully intersected the DL2 Vein.

The significance of intersecting the DL2 Vein underneath these “old workings” and accessing ore that is assaying out at 150 gpt to 164 gpt at the very same location where the artisanal miners averaged an off the chart 64 gpt gold SHIPPING GRADE, cannot be over-emphasized. The importance of having built-in SCALABILITY cannot be overemphasized nor can the completion of the Antonino Production Adit which will provide a means to transport the high-grade ore to the surface. The fact that this is all occurring when the price of gold is breaking out to the upside and near its all-time high is also noteworthy.

SO, WHAT’S NEXT?

Next would be getting the results of the gravimetric analysis being done at the 2 labs in Peru. This will tell us what kind of SHIPPING GRADES to expect from the ore being mined. We’re also waiting on confirmation that the miners successfully completed the 30-meter “ventilation/safety egress chimney” which will allow management to develop the various sub-levels.

Below is a link to an article explaining why ore with high levels of BOTH gold and copper will tend to attract interest from a universe of potential suitors or investors over and above the amount attracted by a project with only gold or copper.

Germany to dedicate $2.2 billion to secure supply of critical commodities - report | Kitco News

Very helpful analogy, thank you!

Thanks, BB. You make it clear why AUMC did not begin developing all the previous veins they found before reaching the DL2 sweet spot, and for multiple reasons. At the DL2, artisanal miners left a void where minerals were mined, and that will provide emergency ventilation, a pathway for miners to safely reach the surface; and allow new levels of production to be developed. So now Auryn will save time, money and eventually achieve higher productivity. I sure hope that it will be as easy as it sounds.

So let’s see here, BE has long time specified in fundamentals and AUMC will take a miracle/lifetime to reach a certain price let’s say 12.00/share. Browsing this morning on Yahoo finance I stumbled on this Nasdaq listed stock TOP (TOP Financial Group Limited) with 35 mln shares outstanding half of Auryn’s. Until 2 days ago the stock was trading at 6.59 then yesterday on heavy volume of 31,500,000 (average daily volume 900,000) the stock closed at 20.00. Premarket this morning the stock has traded up to 135.00/share from yesterdays close of 20.00.

Their last earnings report : Revenue:

Revenue: US$5.16m (up 61% from 1H 2022).

Net income: US$1.84m (up 112% from 1H 2022).

Profit margin: 36% (up from 27% in 1H 2022). The increase in margin was driven by higher revenue.

EPS: US$0.055 (up from US$0.029 in 1H 2022)

I am still a believer that Auryn at some point will become the talk of the town especially with the mining Government connections it has established. Go Auryn!!

MDMN Bid at .0016 hard to believe with all these positive developments going on

Must have been very awkward.

The scary thing about Jim, when you read his posts, it sounds like he actually speaks to management to gain “inside” insights to what is going on behind the scenes. He doesn’t, which explains why he’s always optimistic and never right. To reiterate, over a 20 year period, never right on a single prediction. There should be a disclaimer on all of BB posts that his dialogues are entirely built on wild speculation. Keep in mind that he attacked myself and others for claiming that Les may have been “shady.” Constant attacks and defense for Lester the Molester until it became public that he had issued an extra billion+ shares into the float.

Scary stuff

So your investment discipline goes something lke this: “if Shibu and Tops can go up 10,000% so can AUMC” and/or a bag or Doritoes you just bought.

Sound logic.

Who said anything about logic? Please re read my post. Explain the fundamentals (because you claim investing is always on fundamentals) on both tickers, why one went up 10,000 % that has nothing but air and one that most likely will have production income not too far in the distant future. The reason I posted Shiba is that your fundamentals some times DON’T EXIST and the market dictates the price. It seems that I touched a soft point??

There is a Analyst on Seeking Alpha that specifically analyzes on fundamentals and in 2020 He was advising his followers to sell any rally on the ticker EXK (Silver miner) towards 1.30. I tell you that even though I am not a professional trader deep in my gut I knew this was a good stock and I needed to be patient. I purchased the stock at .99 in 2020 and sold at 6.39 in June 2021. Yeah so much for fundamentals!

MDMN Jaded,

Thank you for the kind words. Make no mistake, nothing in this industry is “as easy as it sounds”. The one statistic from the World Gold Council that impressed me the most over the years is that even for the 1-in-1,000 junior explorer that successfully puts a project into production, it takes an average of 24 years from the commencement of exploration to the first day of production.

If this is the reality, why in the heck do some many people invest/speculate in this sector? The answer is that we’ve all heard about the 20-, 30-, and 40-baggers that become a reality EITHER once production has commenced OR outstanding exploration/development results were realized.

What do the 30-baggers in this industry usually have in common? The answer is EXCEPTIONALLY HIGH GRADES and/or the PROXIMITY TO COMMENCING PRODUCTION. Why is this? It’s because of “MINING MATH” and the formula used to compute the DAILY PROFITS of a PRODUCING mining operation. What “the market” wants is irrefutable proof that a junior explorer has BOTH extremely high grades and THAT THEY’RE ON THE BRINK OF COMMENCING PRODUCTION. “The market” demands proof that you’re not just another one of the other 999 out of 1,000.

It’s nice to be able to say that Auryn/Medinah are going into high-grade gold production at a time when the price of gold is approaching its all-time high. It’s also nice to be able to say that it appears that the grade of the ore about to be mined by Auryn is many, many times the grade of the average grade of gold being mined worldwide. However, what’s missing from those facts is the QUANTITATIVE RELATIONSHIP between those parameters and what really matters in the investment world i.e. PROFITS. Until you get an appreciation for how PROFITS are calculated in this industry, and how the various parameters that determine PROFIT LEVELS interact with each other to determine the level of PROFITS, then you’ll never be in a position to determine the importance of the news flow coming out of a mining producer.

THE FORMULA FOR CALCULATING TOTAL DAILY PROFITS

TOTAL DAILY PROFITS=DAILY PRODUCTION RATE (tonnes of ore mined and processed per day) X AVG. SHIPPING GRADE (in ounces per tonne) X (GROSS PROCEEDS PER OZ SOLD minus AISC per oz)

OR

TDP=DPR X SG X (GP-AISC)

There are 4 variables in the TOTAL DAILY PROFITS equation. One of them is SUPER-POWERFUL and that is SHIPPING GRADE. Why is this? It’s because the “ALL IN SUSTAINING COST” AISC (variable #4) is extremely dependent on the SHIPPING GRADE (variable #2) in an inverse fashion. The AISC (per ounce) to produce ore whose grade is in the top decile (10%) of all mineral producers will typically have an AISC in the lowest decile of all mineral producers.

That (GP-AISC) figure is also called the MARGINAL PROFIT per ounce produced. This will be a big number when the AISC is super-low i.e. when the SHIPPING GRADE is super-high, like that of the ore at the DL2 Vein. When calculating TOTAL DAILY PROFITS, if you get to multiply a super-high number like a super-high SHIPPING GRADE times a super-high MARGINAL PROFIT figure (per ounce), you’re going to get a “super-duper” high (dare I say “Super-Duper”?) TOTAL DAILY PROFIT when compared to a miner mining average grade ore (4.15 gpt gold).

If you have excellent “SCALABILITY”, due to the ability to mine multiple sub-levels at the same time (due to superior ventilation), then you’re DAILY PRODUCTION RATE (variable #1) can ramp up rapidly to much higher levels. This allows you to go to the FORMULA and multiply an already “SUPER-DUPER HIGH TOTAL DAILY PROFIT” by a greatly enhanced DAILY PRODUCTION RATE in order to calculate the new, post-production ramp up, TOTAL DAILY PROFIT.

Here’s the catch, this “MINING MATH” phenomenon is only accessible to miners with EXTREMELY HIGH SHIPPING GRADES (and therefore extremely low AISCs). The key is that extremely high SHIPPING GRADES are a component of 2 of the variables present in the TOTAL DAILY PROFIT equation.

“GRADE IS EVERYTHING”

You could easily make the case, that an extremely high SHIPPING GRADE variable (#2) is actually a component of the other 3 variables on the right-hand side of the equal sign of the TOTAL DAILY PROFIT equation including the PRODUCTION RATE variable. Why is this? It’s because the “SUPER DUPER HIGH TOTAL DAILY PROFITS” (in comparison to the miners of average grade ore) can, in turn, be redeployed back into the mining operations in order to ramp up the PRODUCTION RATE (variable #1). What happens when DAILY PRODUCTION RATE goes up? The AISC goes down EVEN MORE after it already went down due to the extremely high grades. Why is this? It’s because the TOTAL GROSS COSTS to mine and produce an ounce of gold will be divided by that many more ounces. This “MINING MATH” phenomenon is why the old saying in this industry is “GRADE IS EVERYTHING”. “MINING MATH” explains the WHY of “grade is everything”.

Let’s say that a “jumbo” drill rig cuts in half the time needed to drill the blast holes and fill the blast holes with explosive. A “jumbo” does both much more efficiently than human beings with “jack-leg” drills. The DAILY PRODUCTION RATE is going to go WAY UP if management can deploy a “jumbo”. This, in turn, will drive down the AISC (per ounce) even further since more ounces are being produced and many costs in mining are pretty much fixed and independent of PRODUCTION RATE, property taxes for example. Technological advances, like “jumbo” drill rigs, can vastly increase the DAILY PRODUCTION RATE, but it is the high profit levels that can make a “jumbo” affordable. You might be able to appreciate how the COMMENCEMENT OF PRODUCTION creates access to all of these interactions between the variables that determine TOTAL DAILY PROFITS.

The result of being able to mine extremely high-grade ore, is the ability to create and access POSITIVE FEEDBACK CYCLES as well as other SYNERGIES. This is how, 20-, 30-, and 40-baggers get justified in this sector. Most of these 30-baggers in this industry are not “one hit wonders” whose share price is destined to crash back to the ground. The ramp up in production levels experienced by new gold producers is fairly predictable. Positive cash flow brings the ability to redeploy that cash back into operations without resorting to predatory financiers.

It’s right there in the EARNINGS PER SHARE equation ESPECIALLY IF MANAGEMENT WAS ABLE TO MAINTAIN 100% OWNERSHIP OF THE ENTIRE ADL MINING DISTRICT THIS ENTIRE TIME AS WELL AS MAINTAIN ONLY 70 MILLION SHARES OUTSTANDING. These last 2 variables, % OWNERSHIP and a small number of SHARES OUTSTANDING, inject yet another layer of EXPLOSIVITY to the already EXPLOSIVE mix.

SUPER DUPER HIGH EARNINGS in the numerator of the EPS formula divided by a low number of SHARES OUTSTANDING, will result in a SUPER DUPER DUPER high EPS ratio (again, in comparison to the miners of gold ore with an average grade) which is typically multiplied by an industry standard “EPS multiple” (30.21 in the case of the mining industry) in order to estimate the appropriate share price. In reality, a corporation that can achieve an extremely dynamic production growth profile, is usually accorded a higher “EPS multiple” than a corporation with a normalized growth profile.

THE BIGGEST EYE-OPENER YOU’LL EXPERIENCE IN INVESTING IN THIS SECTOR IS RIGHT IN FRONT OF YOUR NOSE-MAKE PROFIT PROJECTIONS IF YOU CAN JUSTIFY THE INPUT VARIABLES ESPECIALLY USING HISTORICAL PRECEDENTS

The tendency is to say to yourself that it’s way too early to try to plug in some numbers in the TOTAL DAILY PROFITS equation for the DL2 Vein Project. BALONEY. It’s the very act of plugging in some well-researched numbers and noticing HOW the various INPUT VARIABLES interact with each other which is where the learning is done. “MINING MATH” is something that you have to play with a bit in order to appreciate its strength.

Many people might assume that they have no idea what number to plug in to Auryn’s upcoming DAILY PRODUCTION RATE. Using the watch dial analogy, Auryn drifted the Antonino Adit from the 2 o’clock position to the center of the watch dial. The sought after vein, the DL2 Vein, runs from the 11 o’clock position to the 5 o’clock position through the center of the watch dial i.e. it “strikes” from NNW to SSE.

Let’s start by changing the phraseology to DAILY MINING RATE instead of DAILY PRODUCTION RATE. The Auryn miners have been “MINING” for a very long time while drifting the Larrissa and Antonino Adits. They just haven’t been “PRODUCING AND SHIPPING” anything yet but the intra-adit mining process is the same whether producing ore or drifting an adit to access the ore. Everything “MINED” to date is being stockpiled at surface. It is of an inferior grade to the ore contained in the DL2 Vein itself.

In a recent quarter, Auryn “MINED” a 95-meter length of the Antonino Adit on their way from the 2 o’clock position on the watch dial to the center of the watch dial. Since the adit dimensions are approximately 3.5-meters in both width and height this means that Auryn “MINED” 1,163 cubic meters of rock. Since the SPECIFIC GRAVITY of our granodiorite ore is 2.7 tonnes per cubic meter, this means that Auryn mined 3,142 tonnes of rock in that quarter. Based on 13-week quarters and 5-day work weeks, this means that it took 65 workdays to “MINE” 3,142 tonnes of rock. This represents a “DAILY MINING RATE” or DAILY PRODUCTION RATE” of about 50 tonnes per day during these 9-hour workdays. This “MINING RATE” was pathetically low, partially due to Covid slowdowns, no backup for a wheel loader that was constantly breaking down and the use of handheld “jack-leg” drills. In management’s words, they were “bootstrapping” their way along.

Auryn has already announced that they will be implementing 24-hour workdays. Let’s CONSERVATIVELY estimate that in a 24-hour shift, Auryn’s miners will be able to “PRODUCE” 100 tonnes of ore for each working face that they are simultaneously mining. Does that seem conservative? If we go by mining “levels”, each of which will have 2 working faces, this means that they will be able to “PRODUCE” about 200 tonnes per day per level. This is obviously a pathetically low DAILY PRODUCTION RATE but let’s go with the 200 tpd DAILY PRODUCTION RATE for now. So, variable #1 in our equation will be 200 tpd per level BASED ON RECENT HISTORICAL PERFORMANCES. Despite what we may have thought, we really do have a pretty reliable historical index of the minimum rate that Auryn might soon be mining at. WARNING: If you read a press release that they are deploying a “jumbo” drill rig, then please throw that number out the window. What if the numbers come out that purchasing a “jumbo” might only cost a few days of daily profits?

PROJECTED AVERAGE SHIPPING GRADE (VARIABLE #2)

The artisanal miners of the DL2 Vein, while mining the exact same area where Auryn is about to commence production from, averaged a HISTORICAL SHIPPING GRADE of 64 gpt gold. Their gold recovery rates were pathetic because the tailings/discards after processing still averaged 14 gpt gold. This was using the technology available 75 years ago. Let’s CONSERVATIVELY pencil-in a projected AVERAGE SHIPPING GRADE OF 70 GPT GOLD AGAIN BASED ON HISTORICAL REALITIES. Write this figure “in pencil” because we should soon have the results from the samples sent to the 2 labs in Peru using state of the art GRAVIMETRIC BENEFICIATION technologies.

LET’S DO SOME PRELIMINARY MATH

Producing 200 tonnes per day of ore carrying an average grade of 70 gpt gold represents 14,000 grams of gold production per day. Since there are 31.1 grams of gold per troy ounce of gold, this represents 450 ounces of gold per day. If there are 250 workdays per year, this represents an annual production rate of 112,540 ounces of gold. The next question becomes, how much profit per ounce, can Auryn realize, when the price of gold is about $2,000 per ounce.

The AISC to produce an ounce of gold is highly, highly, highly inversely related to the SHIPPING GRADE of that gold. Auryn has zero COST OF CAPITAL because of Maurizio’s generosity. Auryn has zero profits being skimmed off to fund drill programs. They have zero ROYALTIES owing. These are all constituents of “AISC”. Auryn’s “bootstrapping” approach was painful for shareholders while it lasted, but it really did achieve the intended result i.e. the retention of a 100% ownership stake in the entire ADL Mining District and the retention of a share structure with only 70 million shares issued and outstanding.

The average underground vein mine worldwide, is mining 4.15 gpt gold. The average AISC per ounce of gold mined worldwide is $1,200 per ounce. This means that the miners mining 4.15 gpt gold have an AISC averaging about $1,200. Across the border in Peru, the average AISC is $700 per ounce for all mining operations.

I am going to CONSERVATIVELY estimate that Auryn should be able to NET about $900 per ounce of gold produced in a concentrate form once the mining of level 3 is “hitting on all cylinders”. Again, write this “in pencil” for now because we’ll have fresh data soon. If you multiply this $900 net profit per ounce figure by 112,540 ounces per year in gold production, this represents ANNUAL PROFITS of a little over $100 million FROM EACH LEVEL BEING SIMULTANEOUSLY MINED AT THE DL2 VEIN PROJECT.

Management has made it very clear that their intent is to simultaneously mine from “multiple levels”. This is possible because of the superior ventilation made available by management’s mining immediately beneath the “old workings” of the artisanal miners. In mining ventilation, a series of fans will be utilized. Some will direct fresh air from the plateau surface through the series of shafts and chimneys already in place, while others will redirect post-blast contaminated air back to the surface.

NOTE: THIS IS NOT A PREDICTION. I’M SIMPLY FOLLOWING THE FORMULA AND GOING WHERE THE HISTORICAL FACTS LEAD US. Let’s agree on something, these figures result in “SEEMINGLY INSANELY HIGH EARNINGS ESTIMATES. Based on Medinah’s 24% ownership of the entire ADL Mining District, as well as their number of shares issued and outstanding, and their current share price of $0.0017, “the market” says that the ENTIRE ADL MINING DISTRICT is currently worth less than $20 million.

Clearly, there is a gigantic DISCONNECT between what the formula and the historical facts say and what “the market” has been saying. Don’t “the market” participants know this formula and the ADL Mining District historical facts and therefore know about the extent of the DISCONNECT? Of course they don’t, there are about 8,000 other junior explorers in existence most of which are much more promotion-oriented than Auryn.

WHAT JUST HAPPENED HERE?

Let’s go back to the concept of gaining some familiarity with the formula used to determine profits in the mining sector and how EYE OPENING it can be to simply take some HISTORICAL FACTS and insert them into the equation. It really is an eye-opener. Until you do this somewhat basic exercise everything seems so confusing and so complicated. The default assumption is often that UNTIL earnings are generated and quantified, it’s best that we not use our brains and study history.

WHAT IS IT ABOUT THE AURYN/MEDINAH SCENARIO THAT MAKES IT SO MUCH EASIER TO PROJECT POTENTIAL EARNINGS THAN SO MANY OTHER MINING JUNIORS I’VE ATTEMPTED TO DO THE SAME TO?

In the case of Auryn/Medinah, I had 2,000 tonnes of HISTORICAL SHIPPING GRADES (variable #2 of 4) dumped into my lap for free by Enami and SERNAGEOMIN. The key here is that this production came from the same location that Auryn is about to commence production from. I also had the recent “DAILY MINING/PRODUCTION RATE” (variable #1 of 4) in hand from the recent Auryn quarterly updates. I’m not used to having either of these in making projections like this. As far as the “MARGINAL PROFIT PER OUNCE MINED” variable (a combination of variables #3 and #4) goes, the projected SHIPPING GRADE is so dominant in determining this calculation that it’s not that difficult to estimate.

I don’t think many of us even realized that AURYN HAS BEEN “MINING” FOR A VERY LONG TIME AND THAT WE DO HAVE THE ABILITY TO MAKE PRELIMINARY PROJECTIONS AS TO DAILY PRODUCTION RATES. Again, make sure you write them “in pencil” and be ready to amend the INPUT VARIABLES as the facts become apparent. ALL OF THESE FIGURES ARE VERY PRELIMINARY. Think of it as an IF………THEN, proposition. IF, IF, IF Auryn can produce 200 tpd and if the SHIPPING GRADES average 70 gpt THEN…… Management still has to perform.

The INPUT VARIABLES you use with this equation will differ from mine. I’ve been tweaking these INPUT VARIABLES for many months. No matter how much I round things down, the result is always “SEEMINGLY” INSANELY HIGH PROFIT PROJECTIONS. The question I keep asking myself is, are these projections “INSANE” or just “SEEMINGLY INSANE”. If it’s the latter, then WHY do they “SEEM” INSANE.

The formula itself is pretty straight forward; it is what it is. Are the various INPUT VARIABLES “seemingly insane”? Whether it’s the HISTORICAL SHIPPING GRADES of the artisanal miners or the HISTORICAL MINING RATES of Auryn, they are what they are. The PRICE OF GOLD (POG) is what it is. The irrefutable fact is that the POG is 57-times higher now than when the artisanal miners ceased operations. That’s kind of “INSANE”. It’s not my fault that the POG is nearing an all-time historical high. The relationship between AISC and SHIPPING GRADES is what it is.

ARE THERE A LONG LIST OF “SUB-INSANITIES” AT PLAY HERE THAT, WHEN COMBINED, RENDER THE PROFIT PROJECTIONS “SEEMINGLY INSANE” BUT PERHAPS NOT ACTUALLY “INSANE”?

- I’ll admit, being able to mine ore with an approximate grade of 70 gpt gold, during a time when the average grade of gold being mined in a similar underground vein operation is 4.15 gpt, is pretty much an INSANE opportunity.

- The power of this phenomenon known as “MINING MATH” is indeed, pretty much INSANE, for miners able to mine extremely high-grade ore.

- Being able to recommence the mining of an exceedingly high-grade structure like the DL2 Vein, at the same site where the artisanal miners ceased operations, and AFTER THE PRICE OF GOLD HAS GONE UP 57-FOLD IN THE INTERIM TIMEFRAME (from $35 to $2,000 per ounce) is indeed INSANE.

- Having a CEO willing to advance all of the funds needed to get the project into production while charging zero interest and inducing no DILUTION of the ownership interest or share structure, is indeed pretty much INSANE.

- Going into extremely high-grade production while maintaining 100% ownership of the entire ADL Mining District is pretty much INSANE.

- Housing not only this 100% owned DL2 Vein Project but also the 100% owned ENTIRE ADL MINING DISTRICT in a share structure with only 70 million shares O/S, 60% of which are owned by management in a semi-restricted format, is pretty much INSANE.

- Having a VENTILATION INFRASTRUCTURE composed of 7 vertical shafts and 5 chimneys leading to surface which will allow for the simultaneous safe mining of many sub-levels is if not INSANE, at least pretty darn fortunate.

- Having access to 30 years-worth of SHIPPING GRADES (not just VEIN GRADES), from the same cite where production is about to recommence after an extended amount of time, from sources as reliable as Enami and SERNAGEOMIN, is INSANELY fortunate.

- We are investing in an industry characterized by assuming ULTRA-HIGH RISKS that are offset by ULTRA-HIGH REWARDS. Maybe I should rephrase this as assuming “INSANELY HIGH RISKS” in search of “INSANELY HIGH REWARDS”. If the World Gold Council statistics are accurate and only 1-in-1,000 junior explorers will ever get a mineral discovery into economic production, why wouldn’t the ULTRA-HIGH REWARDS accorded to one of these 1-in-1,000 lucky juniors, be “SEEMINGLY INSANE”, when earnings projections are initially made? Shouldn’t ULTRA-HIGH REWARDS be the expectation and not the exception for a junior successfully making it into production?

- After wrestling with these INPUT VARIABLES and attempting to tweak them downwards in order to come up with more credible EARNINGS PROJECTIONS, why didn’t somebody like me, aware of these various “sub-insanities”, realize a long time ago that the EARNINGS PROJECTIONS would, at first glance, obviously be “SEEMINGLY INSANE” to many that were unaware of the various “sub-insanities”.

Flipping a coin can lead to good results as well. If you are simply hoping MDMN/AUMC goes up “because some stocks go up” that’s a pretty pathetic strategy.

Baldy,

With all due respect, why do you persist on posting here? Clearly you took your money off the table here years ago. Are you trying to educate new investors? I’ve clearly stated here I’m already “fully invested” and may just be wearing the badge of “optimistic stuckholder” for a very good reason. I couldn’t take the tax loss write off like you did years ago, which obviously was the wise thing for you to do. Realize not everyone shares the same financial circumstances or goals as you have in your multiple investments portfolio.

I had many shares of both CDCH and MDMN in an IRA. Too many shares to take that kind of tax loss you so wisely took, so I paid taxes to move them into a ROTH account as shares fell to an even more ridiculously lower price. In case you can’t understand that failed investment decision I made years ago, most of my shares are “in the sock drawer”. I’m responsible for my decision, it was a high risk investment then, and still is, at least until we see production and free cash flow. I’d venture to guess most shareholders here already know how we arrived here and fully appreciate what progress has been made up until now. No one here doubts you have great expertise based on traditional investment metrics. I don’t see why you waste your time trying to explain why they apply here. Applying those metrics to a highly speculative equity such as this simply do not apply. Is it possible they will sometime in the not too distant future? I like to think so.

So I ask, are you still waiting to get back in based on derisking once free money flow begins after initial production? Bravo, if that is your intention! Clearly that is not a decision I need to make, or a goal I have for this investment. A week ago you said it sounds like BB actually speaks to management to gain “inside” insights to what is going on behind the scenes. Do you have trouble understanding what a relative is? Maybe the reason you misunderstood can be found in your reply to mrbubba a couple of weeks ago:

Maybe you should stop assuming and look to what is being said.

What BB was explaining, apparently to a relative, maybe a family member interested in the progress AURYN is clearly making is this diagram of planned development nearing completion.

Is it possible you are blinded, or maybe just jealous, by the fact BB is very knowledgeable in geophysics and has a keen in-depth knowledge of mining methods.

I do agree with you he’s almost always optimistic, but strongly disagree as many posts appearing here in the forum, including BB’s explanatory ones are not only correct, but show management’s planning and foresight. Although quite futuristic and visionary, I liked this post by coldsnow!

It shows a shallow (200 meter?) open pit mine on top. Looking far to the right I see what could be the Fortuna underground mine complex stairstepping deep underground. I can envision not only the shallow open pit mine shown in coldsnow’s “dream mine plan” extending across the entire ADL, but also the Merlin 1 mines matching the success that started with the humble bootstrapped beginning in the Don Luis Vein system. Further to the left, underground mining may even extend into the LDM.

THINK BIG and DREAM BIG!

Envision success if you ever wish to attain it. ![]()

![]()

EZ

Wow man, you have issues.

Baldy and family/friends lost a lot of money on this play which BB introduced his family to. This is very sour for him. He stills knows this has a high potential, but he’s pissed that BB has been so optimistic throughout decades of failures. Baldy is not wrong on some very important points, i.e. Les. Baldy was the most vocal in diagnosing his fraud.

BB has outstanding knowledge and insight but his optimism and failure to see the scam has unfortunately burned some of his credibility. Thats not to say that his current optimism isnt spot on, because I tend to think it is and that the timing is finally right on this. Baldy’s strict intention of highlighting BB’s misappropriated optimism in the past without objectively looking at how relevant it is to the now, makes himself lose credibility at the moment, imo. When you have a decades long saga like this one, none of this shareholder bickering and frustration is surprising.

Thank you for sharing your in-depth knowledge of MINING MATH; you almost make it sound fun, lol! BB, It’s clear to see you are not making ‘over-the-top’ projections here. You made it known that your calculations reach potential projections. You state that you are NOT trying to sell predictions for shareholders to bank on; instead, you give us formulas we can use to make our own estimates. Auryn has a huge advantage with very high SHIPPING GRADES (variable #2), compared to other juniors, which, along with other promising variables, will deliver the “insanely high rewards” even though you try to keep estimates low. ![]() For those who haven’t read BB’s latest posts (in full), you’re missing some valuable insights.

For those who haven’t read BB’s latest posts (in full), you’re missing some valuable insights.

Super Duper Insane? Your list of “SUB-INSANITIES” keeps projections wide open for that, too. Everything you mentioned here tells me Auryn will not likely be just another lost junior. You’ve logically revealed that we have — or will have — the best possible variables to work with that most juniors don’t have. You post insightful knowledge regarding the mining industry, including the geological processes that form rocks & minerals. I will always appreciate them. Although you tend to be verbose, you do not write empty words. I can relate to that. It’s sad how younger generations are NOT being taught how to read or write - they only want two-sentence soundbites and emojis. They rarely read everything because it seems to be too tedious for them imo — but that’s their loss.

I also appreciate many of Baldy’s posts with his perspectives & knowledge of the market & mining industry. Among some others here, you both make some of the best contributions to TMP. The friction between you & baldy has been painful to read, though. It’s not transparent to the rest of us here, and quite frankly, it’s a big bummer. Most of us value what you offer here, BB. I have many of your posts saved for future reference. All the variables and “sub-insanities” you mentioned make perfect sense, imo.