Hi EZ,

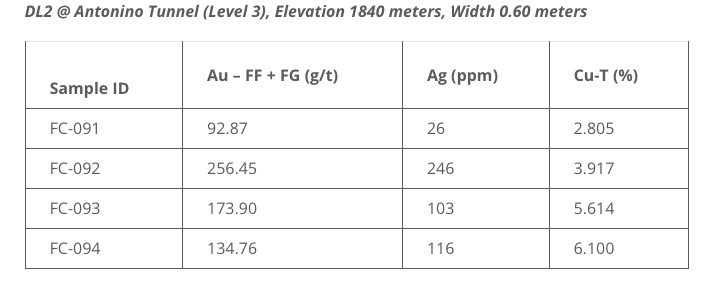

Thanks for the re-post of the initial assay results from the intersection of the Antonino Adit and the DL2 Vein. There’s an absolute TREASURE TROVE of information encased in those assay results ESPECIALLY IF YOU INTEGRATE THEM WITH THE HISTORICAL FINDINGS. The toughest part of doing due dili on this project is the constant need to take in the new information and then go back in time to review the older information in order to provide some CONTEXT. Great assay results on a single vein with a strike length of 100-meters and a depth of 30-meters is quite a different thing than great assay results on a vein that is one of 6 main parallel veins that has a 1,000-meter strike length, a 700-meter known depth and HISTORICAL SHIPPING GRADES that are through the roof in the same area this is about to be mined at a time when the POG is 57-times what it was when the previous production ceased.

The highlight of the historical findings at the DL2 Vein was that the artisanal miners mined a 350-meter stretch of the DL2 Vein down to a depth of about 100-meters. In the watch dial analogy, this mining occurred along that 1,000-meter stretch in between the 5 o’clock and the 11 o’clock marks at the center of the watch dial (with 12 o’clock representing due north).

The artisanal miners removed 2,000 tonnes of ore that averaged an insanely high SHIPPING GRADE of 64 gpt gold. The actual DL2 VEIN GRADE would have been considerably higher because what is “SHIPPED” is a combination of EXTREMELY HIGH-GRADE VEIN MATERIAL and lesser grade wall rock material found in the footwall and hanging wall of the vein. The combination of VEIN MATERIAL plus wall rock material is scooped up post-blasting, sorted, which involves discarding clearly unmineralized material, crushed to a specific mesh size and then “beneficiated” to remove as much waste material as possible via a variety of methodologies.

With the DL2 Vein, what’s critical to understand is that the “beneficiation” methodologies deployed by the artisanal miners was so inefficient that their tailings/discards still weigh-in at 14 gpt gold. Half of the gold contained in the upper level of the DL2 Vein structure had a lot of extremely small-particled “fines” less than .02 mm in diameter. We’ll soon know how much MORE EFFICIENT today’s beneficiation methodologies are than that deployed approximately 75 years ago. Auryn tried out a gravimetric beneficiation system sold by Sepro/Falconer a couple of years ago that was able to recover over 90% of “even the fines”.

As a reference, the average grade being mined worldwide TODAY is 4.15 gpt gold. Unfortunately for the artisanal miners, the price of gold at the time was $35 per ounce and the economics were probably so-so. Since then, the price of gold (POG) has moved up 57-fold to about 2,000 per ounce. The saying in the industry is that “around the world, all of the high-grade gold i.e. ‘low hanging fruit’ has already been plucked/mined”. That’s obviously not the case in regards to the DL2 Vein and probably the other 5 main veins that surround it. The geological report tendered by ACA Howe Mining Consultants on the ADL Mining District vein structures cited that nobody has even scratched the surface on these veins yet.

We’ve known about those stellar SHIPPING GRADES provided by Enami, for a very long time but until Auryn finally intersected the DL2 Vein via the Antonino Adit, on December 23 of 2022, they had never been CORROBORATED. This RISK needed to be mitigated by any interested parties in the mining industry or some potential investors. EZ, that assay report you printed, as well as the second round of samplings from the same intersection (which came in at 150 gpt gold), PROVIDED THE MUCH-NEEDED CORROBORATION OF THE STELLAR HISTORICAL GOLD “SHIPPING GRADES” (not just VEIN GRADES) AS WELL AS A SIGNIFICANT AMOUNT OF “DERISKING”.

Prior to this intersection of the DL2 Vein, Auryn had already completed a 12-sample survey near this “level 3” at about the 1,840 meters above sea level elevation, that of the Antonino Adit, about 100-meters (towards the 11 o’clock position) NNW of the center of this “watch dial”/intersection point. These DL2 “VEIN GRADES” also came in at an average of about 150 gpt gold.

This gave management a heads-up as to what to expect once they intersected the DL2 Vein and that’s exactly what they got. But the assay reports taken from the samplings done at the intersection of the Antonino Adit and the DL2 Vein revealed a lot more than stellar gold grades. The copper grades came in at an average of 4.5% Cu. The average grade of copper mined worldwide today is 0.6% Cu. The artisanal miners, mining the DL2 Vein higher up in the vein structure, found NEGLIGIBLE amounts of copper. Something had clearly changed and you can easily see it in the ore presentation. In the “old workings” involving levels 0, 1 and 2, there was little to no “visible gold” or evidence of copper.

We knew to expect high copper grades because since the very beginning of the Antonino Adit when Maurizio hustled up the mountain to do an interview inside the adit, we could see the ubiquitous presence of a very high-grade form of copper known as BORNITE. This is the bluish-tinged stuff you see at the Auryn website photo gallery. BORNITE is known as a “secondary” form of copper. It is formed from the most common form of copper, known as “chalcopyrite”. When “chalco-“ dissolves in an acidic environment (from the oxidation of pyrite) it travels downwards in solution through the rock structure until it hits the historical water table. There it piles up in what is referred to as a SUPERGENE ENRICHMENT ZONE or SGE “blanket”.

These SGE zones are often HUNDREDS OF METERS THICK. In the case of the ADL Mining District, the rock is 91-million-years-old. During that long of a timeframe, the water table would have been all over the map (vertically) during levels of drought or high rainfall. The presence of BORNITE pretty much diagnoses the existence of an SGE zone. There aren’t that many SGE zones left in the world because the miners that discover one will exhaust these zones in the first 5 or 10 years of production by a process known as “high-grading”. Two other high-grade forms of copper known as chalcocite and covellite also tend to inhabit these SGE zones. You cannot understate the ECONOMIC SIGNIFICANCE of this SGE process. It’s Mother Nature’s version of a copper smelter. It is the sometimes enormous VERTICAL WIDTHS of these SGE “blankets” that needs to be appreciated. This bodes well for what Auryn might (no promises) encounter as they exploit progressively lower sub-levels. As they open up levels 4 through 7, you want to keep an eye out for the gold and copper grades at the intersection of the vein and the “decline spiral” as well as the widths and look for the presence of a “porphyritic texture” to the ore. This involves somewhat rounded larger fragments/”phenocrysts” surrounded by a much-finer groundmass.

The significance of firstly corroborating the stellar HISTORICAL SHIPPING GRADES of the gold present at a time when the POG is near (or exceeding) its all-time high needs to be appreciated. Of course, this also applies to the TIMING of the commencement of production. The potential profits of simultaneously mining this grade of gold from multiple levels are OBSCENE but certainly not a sure thing as there is a lot of work yet to be done. The potential long-term profits of mining copper of this grade from a newly discovered SGE zone (if confirmed), is equally OBSCENE especially keeping in mind the worldwide move to the electrification of pretty much everything. TIMING IS EVERYTHING.

One needs to appreciate the mechanics involved in the SUPPLY OF and DEMAND FOR bimetallic GOLD AND COPPER deposits. With the lack of many significant new discoveries in EITHER metal over the last 35 years, the SUPPLY of these deposits is de minimis. At the same time, the DEMAND for these types of deposits has probably never been this robust. Again, it’s the TIMING for these SUPPLY and DEMAND mismatches, that is critical when it comes to the ability to attract the attention of the majors or hopefully institutional investors.

You also have to keep in mind what else was discovered during the drifting of the Antonino Adit from the 2 o’clock position of the watch dial to the center point of the watch dial. The geoscientists encountered hundreds of meters of solid ALTERATION at the 1,840 meters above sea level elevation of this adit. “Alteration” (essentially pressure cooking) of the host rock is caused by the same ore-bearing ultra-hot hydrothermal fluids that carries the gold and the copper. When you combine this with the findings Auryn made during the “ridge crest” sampling completed at the Pegaso Nero, which suggested the presence of a copper-moly porphyry structure due to anomalies associated with both high-grade copper and moly, the evidence builds up suggesting this diagnosis is appropriate.

As an aside, when doing due diligence on a project like this, we need to practice HUMILITY. No matter how hard any of us have studied this sector for multiple decades, the professional geoscientists (P. Geos) and Professional Mining Engineers (P. Engs) can run circles around any of us. They’ll recognize the truth before any of us. FOLLOW THEIR LEAD. What happened immediately after Auryn successfully intercepted the DL2 Vein and corroborated the HISTORICAL SHIPPING GRADES and found all of that gold and copper? Auryn received MOUs with term sheets attached from parties wanting to purchase the ore. They also had Chilean Mining officials touring through the adits speaking the praises of the job Auryn had done. You also had 2 new deal cutters with impeccable credentials joining the BOD. None of us know the exact timing for things to play out but I assume that people can start putting some puzzle pieces together.

Think of it from a statistical probability point of view. What are the odds that events A,B,C,D,E, etc. would come to fruition if there WERE NOT some kind of breakthrough behind the scenes? Again, there can be no guarantees. FOLLOW THE SMART MONEY BECAUSE IN A SECTOR AS COMPLEX AS THIS, THEY ARE A HECK OF A LOT SMARTER THAN THE REST OF US. The parties submitting MOUs with TERM SHEETS, need to be assured of certain levels of production before submitting TERM SHEETS.

The ridge crest sampling program at the Pegaso Nero prospect revealed an enormous, 3.6 Km (N to S) by 1.2 Km (E to W) area of high-grade moly and copper on the southern downslope off of the plateau. This is right next door to a 2 Km North to South swath, revealed by the road cuts associated with constructing the “South Road”, which is analogous to trenching, of veinlets and “stockworks of veinlets”. This is what porphyries are constructed of.

This is the same area where CS Perez’s hyperspectral satellite imaging survey detected a “7 km swath of about a dozen intrusives oriented in a SW to NE direction along the southern downslope off of the ADL plateau.” His reported cited evidence of 2 porphyry structures being present that represented a “world class deposit” consisting of hundreds of millions of tonnes of ore in just the more superficial areas. Porphyry structures consist of massive halos of alteration (like that discovered in the Antonino Adit) surrounding a centralized core of moly, like the “moly anomaly” discovered by Auryn on the southern downslope off of the plateau, in the case of “copper-moly” porphyries.

EXPANDING UPON THE WATCH DIAL METAPHOR

Earlier I related how things might make more sense if you envision a watch dial in which the Antonino Adit is oriented from the 2 o’clock position to the center of the watch dial (oriented to the SSW). Meanwhile, the DL2 Vein is oriented from the 11 o’clock position to the 5 o’clock position. It “strikes” at surface from the NNW to the SSE.

What I didn’t tell you is that this watch dial sits about 150-meters below the ADL plateau surface. So, metaphorically remove the top 150-meters of the mountain. The Antonino Adit is kind of like a giant straw with a diameter of about 3.5-meters. The DL2 Vein, on the contrary, is like a gigantic sheet of plywood, standing on its longest dimension and reaching from the plateau surface to at least 700-meters below the surface. The length of this sheet of plywood is at least 1,000-meters as measured at surface. Thus, this gigantic “straw” has penetrated through this gigantic sheet of plywood and sampling of the sheet of plywood was done at the intersection.

Another thing I didn’t tell you is that there are about 5 other gigantic sheets of plywood present next door that are oriented parallel to the DL2 Vein. One is oriented from about the 10 o’clock position to the 6 o’clock position. It does not go through the center of the watch dial. Another is oriented from about the 9 o’clock position to the 7 o’clock position. Yet another one is way to the west/left of the watch dial. It is called the Merlin 1 Vein. Interestingly, I SHOULD ACTUALLY SAY EXTREMELY INTERESTINGLY, is the fact that it too showed the same types of “bonanza” gold grades that are being found at the DL2 Vein located back on the watch dial, AT THE SAME ELEVATION OF ABOUT 1,840 METERS ABOVE SEA LEVEL but at a significant distance to the west.

What’s also interesting is that there are 2 major veins that run from east to west across the watch dial, that join together all of these veins into one common “NEXUS” of veins. You might picture the Merlin 2 and Merlin 3 Veins as going from 10 o’clock to 2 o’clock or so and from 8 o’clock to 4 o’clock or so on the watch dial.

It’s also very interesting that all of these veins were sampled during Auryn’s exhaustive surface trench sampling program and all were determined to carry “anomalous” grades of gold. Two were actually much wider than the DL2 Vein which we know the most about. When you have a NEXUS of veins like this, some might call them “en echelon veins” or “sheeted veins”, the grades and widths tend to be somewhat similar at similar elevations. We already saw this with the Merlin 1 Vein’s “bonanza” gold grades in 3 separate adits previously drifted there. The question becomes, can we tentatively, subject to lots of more work needing to be done, assume that all of these major veins are going to be similarly mineralized at similar elevations.

Recall what Luis de la Tierra, P. Eng said in an interview. This is the Professional Geoscientist/Mining Engineer/Professor of Mining Engineering at San Sebastian University (an Auryn collaborator) that is intimately familiar with the ADL Mining District. He also served as the Head of Underground Operations for Yamana Gold (a major miner) at its massive “El Penon Mine” for about 5 years.

He predicted that the vein projects at the ADL Mining District would end up featuring similar “operations” to that at the El Penon Mine. At El Penon, they are simultaneously mining 38 different working faces. There is very little copper there and the grades being mined are somewhere around the worldwide average of 4 gpt gold. However, when the mine first went into production, after its discovery by Meridian Gold, it was producing much higher-grade gold for the first 10 or so years. That’s how things go in mining. You grab the “low hanging fruit” first and make a fortune for your shareholders, and then go after the less desirable fruit later and then hopefully become a boring old major miner.