MINERAL PROPERTY EVALUATION PROCESS

There is a pretty well-established process in evaluating the economic prospects of a mineral property. Some familiarity with this process might help Medinah and Cerro investors assimilate the information that management has already released. The overall concept of mineral exploration is actually fairly straightforward although the execution of it can be highly technical and confusing especially for those without a background in chemistry and physics.

First of all, no matter how you sugarcoat it, the reality is that any management team’s exploration efforts are probably going to fail. Thankfully this bullet has already been dodged in the case of the ADL Mining District. [As an aside, from the discussions I witness on “TMP” I don’t sense that AMC is getting the recognition deserved for contributing the Caren Mine into the portfolio of properties assimilated by Medinah and Cerro. The importance of extremely high grade near surface early production opportunities cannot be overstressed in regards to the potential catalytic effect for developing the entire ADL Mining District.]

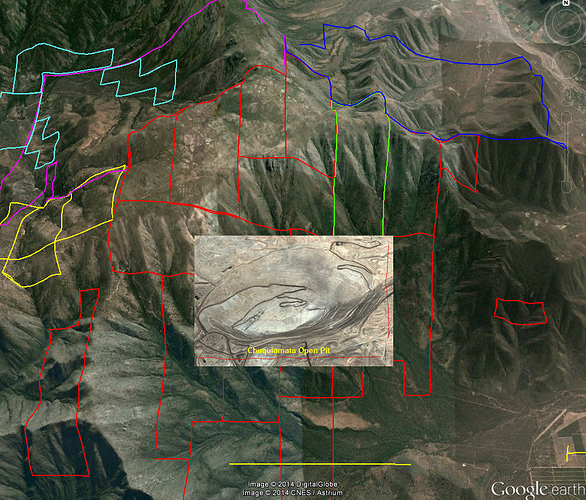

What the mineral exploration team does is start on a broad scale and implements the lesser expensive “screening” techniques at first in order to determine if further expenditures are justified. These initial efforts include studying the history of the property and making a topographical grid of the surface and doing geological mapping, geochemical sampling, using satellite imaging techniques as well as more localized geophysical techniques like IP/IR.

This process helps to “define” potential targets perhaps worthy of spending larger amounts of money on usually via the more expensive drilling process. Drilling is very spendy so the preliminary data will help guide not only whether or not to drill but also where to target the drilling in order to get the best bang for the buck. Half of the battle in mineral exploration is losing the minimum amount possible before deciding that a mineral prospect has very little economic potential. This is because of the overwhelming odds against any mineral explorer not only making an ECONOMIC discovery but successfully accomplishing the tasks needed to get it into production. This overall first phase of evaluation is referred to as COLLECTING GEOLOGICAL INFORMATION AND BUILDING A “GIS DATABASE”. This information is then assimilated into an easy to draw from computerized format i.e. the “GIS database”. Layer upon layer of information is catalogued and as new information comes in the geoscientists are constantly referring back to previously acquired information in order to connect the puzzle pieces.

The second phase is to take that information and BUILD A COMPUTERIZED 3-D GEOLOGICAL MODEL. This will identify the suspected “mineralization envelope” which roughly delineates the outer boundaries of the mineralization under evaluation.

The third phase is to superimpose a 3-D BLOCK MODEL upon the 3-D geomodel. There might be hundreds of thousands of individual “blocks” all with their own computerized “address” within the 3-D block model.

The fourth phase involves extrapolating the data obtained from outcrop sampling, drilling, adit workings and trenching in order to construct a GRADE MODEL within the 3-D block model. Each “block” is assigned an average grade. This is a highly technical process utilizing a branch of statistics known as GEOSTATISTICAL ESTIMATION usually based on a process called KRIGING. The problem in mineral exploration is that even an exhaustive drilling program only samples perhaps one one-hundredth of 1% of the orebody. The computer software does an awful lot of highly technical extrapolation in order to fill in the blanks and recognize patterns.

“Geostatistics” allows the geologists to roughly estimate the grades of the ore in between the drill holes in a 3-D fashion. In regards to the Caren Mine which involves very high-grade narrow veins that are steeply dipping “bulk sampling” of the ore recovered from adit drifting can be substituted for a lot of the drilling typically needed in more disseminated deposits like porphyries and IOCG deposits. In an epithermal vein setting like at the Caren Mine, “bulk sampling” methodologies provide a much larger and more trustworthy sample to evaluate. At the Caren Mine the first truckload shipped contained 12.4 tonnes of ore. The next four truckloads added another approximately 64 tonnes.

The “grade model” then allows the geoscientists to calculate MINERAL RESOURCES which occurs in the fifth phase. “Mineral Resources” are defined as the portion of a mineral deposit having REASONABLE PROSPECTS for ECONOMIC EXTRACTION (RPEE). Note the subjectivity involved in determining “REASONABLE PROSPECTS”. Calculating Mineral Resources mandates the establishment of a “cut-off grade” below which the ore is not to be counted as a part of the ounces contained in the Mineral Resource. The optimal “cut-off grade” is based on costs and dictates the grade level at which the economics are maximized.

The sixth phase involves acquiring yet more data concerning issues like economics and metallurgy during a PRE-FEASIBILITY STUDY or PFS. The completion of a PFS then allows the team to move on to phase 7 which is the CALCULATION OF MINERAL RESERVES. Reserves are defined as the “ECONOMICALLY MINEABLE” portion of MINERAL RESOURCES based on today’s metals prices and cost structures. The statistical accuracy of “Mineral Reserves” is superior to that of “Mineral Resources” because the ECONOMICS are thoroughly scrutinized.

Phase 8 typically involves the drafting of a BANKABLE FEASIBILITY STUDY or BFS. These can cost several million dollars. A “positive BFS” is often the document dropped on the desk of a banker in conjunction with seeking a financial commitment from that banker to develop the property. A “positive BFS” does NOT represent a guarantee that any given banker will comply with your request for finances. If a bank is not involved, then a “positive production decision” is what signals that the project is a “go” and is deemed by the check writers to be ECONOMIC. In a situation like that at the Caren Mine, a formal BFS might not have been necessary but most of the information contained in a BFS needs to have been accessed in order for a “positive production decision” to have been made by prudent business people.

If money becomes available then phase 9 typically involves yet a deeper delving into engineering issues and more economic and environmental studies. In an open pit scenario, any overburden removal needed to gain access to the ore needs to be engineered. In an underground process, access to the desired ore is done by drifting adits or “declines” and often the sinking of vertical shafts from above or vertical “raises” from below. At the Caren Mine it appears that this phase has been completed no doubt as mandated by SERNAGEOMIN for safety reasons.

Throughout this entire process there are a series of “studies” being conducted. The initial study is referred to as a “Preliminary Economic Assessment” (PEA) or “Scoping study”. This transcends into the “Preliminary Feasibility Study” (PFS) which then transcends into the BFS or “Bankable Feasibility Study”.

In an extremely high-grade prospect like the Caren Mine, some of these “phases” can be circumvented due to the nature of the steeply dipping veins and the thoroughness of the trenching and sampling program already completed to date. In an intermediate sulphidation epithermal vein deposit like this one with narrow veins and the presence of several preexisting adits, extensive (and expensive) drilling often does not represent a prudent allocation of financial resources. The intersections might be too small to offer statistically viable information because of issues like the “nugget effect”.

“Bulk sampling” of the material from adit drifting often takes precedence in conjunction with surface trenching results. At the Merlin 1 Vein/Caren Mine we know that surface trenching revealed gold running at about 3 gpt along a 1.8 Km stretch from north to south. We also know that as the plateau descended onto the northern and southern downslopes of the mountain the grades received were in the 10 gpt gold range. The sampling of adit #2 at about 140 meters below the plateau level revealed the much heralded “bonanza” grades in between 100 and 200 gpt gold. So we’re starting to get a decent look at this sheet of plywood-shaped Merlin 1 Vein in 3 dimensions.

The sources of data to be used in the calculation of mineral reserves/mineral resources (MR/MR) can legally come from any combination of 4 methodologies. They include the direct sampling of any rock that outcrops, surface trenching and sampling, the drifting of adits/tunnels and R/C or diamond drilling. It appears that at the Caren Mine a “positive production decision” was made with or without a formal PFS or BFS in hand.

The days of blocking out MR/MR for the sake of blocking out MR/MR are pretty much over. The markets no longer place a value on MR/MR commensurate with the costs of blocking out an excessive amount of MR/MR especially if those ounces of MR/MR are not going to be mined for many years. Shareholders have made it clear that they would prefer to share directly in the profits as opposed to management plowing all profits back into blocking out more MR/MR. Nowadays miners often block out MR/MR for a couple of years down the line only.

Recall that qualifying as a “MINERAL RESOURCE” mandates the determination that there are REASONABLE PROSPECTS FOR ECONOMIC EXTRACTION. With the “run of mine” ore at the Caren Mine being projected by Bocanegra at averaging 34 gpt gold and with the superior infrastructure present at the ADL and keeping in mind that the average gold operation worldwide is mining 1.6 gpt gold the REASONABLE PROSPECT FOR ECONOMIC EXTRACTION threshold probably wasn’t very tough to meet.

AMC 's Luciano Bocanegra’s work calculated a “MINERAL RESOURCE” of 664,000 ounces of gold in just the top 200 meters of the 1.8 Km long Merlin 1 Vein and an 1,100 meter stretch of the Fortuna Centro Vein also down to 200 meters of depth. These are two of the 6 main veins present in the area. As noted, the projected “run of mine” average grade for the Merlin 1 Vein was projected to be 34 gpt gold and 19.5 gpt gold for the Fortuna Centro Vein. The average projected width was 0.5 meters for each vein. I think it would be wise to review the formula for calculating MR/MR and be ready to plug in any new findings in order to detect if that 664,000 ounce RESOURCE in a portion of the Caren/Fortuna vein complex figure was a bit on the “conservative” side as Bocanegra warned us it was on his PowerPoint slide.

Basically what you do is to first calculate the “volume” of the vein material being studied. This equals the strike length times the average width times the projected depth all measured in meters. The volume will then be projected in cubic meters. Since grades are expressed in grams per tonne we need to convert cubic meters into tonnage. This is done by multiplying the cubic meter figure by the density of the rock (2.5 tonnes per cubic meter in this case) which will give us total in terms of grams of gold. If you divide this figure by 31.1 grams per ounce you’ll have the amount of gold expressed in ounces i.e. 664,000 “ounces” of Mineral Resource.

If the actual depth encountered was twice that 200 meter figure then one would have to double that 664,000 figure to about 1.3 million ounces. If the vein widens with depth (which is the norm)and ends up averaging, let’s say, 1 meter in width then one would have to double that 1.3 million ounce figure to 2.6 million ounces. All of a sudden, the 3.2 million ounce threshold to determine a “world class deposit” figure (Singer) isn’t too far out of sight just for these two veins.

If a large amount of new veins are found during the development/production phase then this too needs to be factored in also. Remember also that Bocanegra only factored in two of the 6 main veins seen at surface. A total of 5,000 meters of veins were detected at surface and remain “open” in all directions. I’d keep an open mind about that admittedly “conservative” 664,000 figure. Use it as a benchmark and as developments proceed keep an eye on how deep the mineralization actually goes, the average width of the veins as a function of depth, the lineal measure of veins in total and, of course, the average grades.

Time will tell us just how “conservative” Bocanegra’s assumptions are. I wouldn’t worry too much about the 2.5 density figure, it’s not going to change much. The grades are just fine if not stellar. However, I feel that the projected depth of 200 meters might be a bit conservative. The “boiling zones” that typically feature these “bonanza” grades in epithermal deposits (found in Adit #2) average about 300 meters in vertical width and most epithermal zones are A LOT thicker than 200 meters. The “average width” figure might also be subject to being upgraded or downgraded. Epithermal veins tend to widen with depth similar to how a tree trunk is thicker than the peripheral branches.

Also we need to keep in mind that the Merlin 1 Vein/Caren Mine features a “lenticular” vein style with dilated “lenses” of vein material being found. Maurizio described this at the Las Vegas “informational meeting” as being like “rosary beads” on a chain. The first “bead/lens” they encountered was 28 meters in length and averaged 11.5 gpt gold and 1.6% copper. This represents $600 per tonne “rock”. You might study some mining press releases in order to gain an appreciation for those grades. Then the vein pinched off for 4 meters and reappeared with the second “bead/lens” being 42-meters in length and of “about twice” the grade of the first lens.

After encountering the second lens Maurizio made the comment to an interviewer that they felt they were within 20 meters of even higher grade vein material. Geologists use “vectors” to guide their efforts. When the quartz hosting the ore converts into “milky” quartz or “cryptocrystalline” quartz wherein you can’t make out individual crystals of quartz this often signifies that you are in an historical “boiling zone” which is where “bonanza grade” ore tends to accumulate. What is atypical of this vein system is that it is very well preserved (non-eroded) and even the carbonate layer is still intact. That’s another reason that I feel that the 200 meter depth level might be extremely “conservative”. I do, however, admire management for their conservatism. I sense that they are clearly from the “underpromise and overdeliver” school of thought.

ACTUALLY ABOUT A YEAR AFTER THAT 664,000 OUNCE FIGURE WAS RELEASE AND CITED AS BEING ADMITTEDLY “CONSERVATIVE”, IN AN INTERVIEW WITH THE MINING JOURNAL “CER” MAURIZIO CITED 1.5 MILLION OUNCES AS BEING THE MORE UP TO DATE MINERAL RESOURCE FIGURE. It is not clear to me if that 1.5 million ounce figure referred to the entire ADL Mining District or just the Caren and Fortuna Mines. That interview is now one year old and Maurizio noted recently that AMC had identified a total of 300 meters of the Larissa Adit within the Caren Mine. At the time of the 1.5 million ounce citation they had only drifted 130 meters of the “Larissa” adit and didn’t intersect the vein for the first 80 meters.

Many years ago Medinah’s Gordon House and ACA Howe’s rep projected the PRELIMINARY MINERAL RESOURCE at the Gordon breccia alone to be about 1.5 million ounces. AMC later stated that they were fine in projecting at least a 1 million ounce MINERAL RESOURCE being present in the brecciated region even though they successfully traced the breccia complex outlined by Medinah and ACA Howe further to the south and west. Again, keep in mind for reference purposes that the standard threshold needing to be met for a deposit to be considered a “World Class Deposit” (WCD) is 3.2 million ounces of gold equivalent (Singer). This puts a deposit into the upper 10th percentile worldwide. Also keep in mind that from a preliminary glance the ounces of gold equivalent to be found in the Pegso Nero will probably (no guarantees) dwarf the ounces found in either the epithermal or brecciated areas. This doesn’t count the contribution from the stratabound deposit over at the LDM.

DON’T BE INTIMIDATED BY A LITTLE BIT OF PHYSICS AND CHEMISTRY!

You’re smarter than you think. Hydrothermal fluids arise and cool and assume the shapes of the cracks that they fill. When metal bearing superheated hydrothermal fluids and gases arise through the cracks and faults within rocks if they hit a dilatation or cavern like space (like a lens in a lenticular vein system) they will RAPIDLY COOL and be able to “boil”. Since gold usually travels in association with sulfur in these things called “thiosulphate” complexes the energy from the boiling frees the gold from the sulfur and allows the gold to precipitate out of solution and park itself in that “cavern”.

Likewise when silicates like QUARTZ rapidly cool in one of these caverns/lenses/“rosary beads” it crystallizes QUICKLY and doesn’t have the time to be laid down in fancy layers which exhibit their crystalline structure. This flash cooling results in chalcedony or “milky quartz” without any crystals to observe. Thus high grade gold and milky quartz are found in the same area i.e. “boiling zones” where rapid cooling took place. When Maurizio told the interviewer from that mining trade journal that he felt that they were within 20 meters of higher grade gold I assume that it was because the quartz in that adit was starting to convert from crystalline/“dog tooth” quartz to “milky quartz”. These “boiling zones” range from around 200 meters to a maximum of 850 meters in vertical thickness worldwide. I threw in the number 300 meters to be conservative. MOTHER NATURE REALLY DOES FOLLOW PATTERNS AND SHE FOLLOWS THE RULES OF PHYSICS AND CHEMISTRY. Is it AMC’s job to teach us this stuff? No, it’s our job when we knowingly invest in what’s probably the most ultra-high risk offset by ultra-high reward industry on the planet.