Does anyone expect the Okanadian lawsuit to be dropped?

The amended answers, counter claims and cross claims were filed and granted earlier this year.

Of note is that discovery does not close until August 10, 2017 (pg 10).

Even though the original complaint by Okanadian states it is exempt from arbitration and a jury demand is requested I don’t think this is likely. Justification for no arbitration is because the amount of the controversy exceeds $50,000. After re-reading the amended filings including exhibits A and B it is hard to imagine that the case will go to a jury trial. It is well worth reviewing the amended answers.

2016-02-26 — Initial Complaint by Okanadian against Medinah Minerals, Les Price, MMC Mines, et al.

2017-01-19 — Medinah and Goodin Motion for Leave to Amend Answers and Add Counter / Cross Claims (granted)

Jak167 (and HR) gave eloquent and long analyses shortly after the fillings were posted if anyone cares to review 1st impressions.

Was this simply Medinah’s attempt to circumvent the requirement and expense of a jury trial? The amended answers and response clears this up. Medinah is demanding judgement in favor of Medinah on all claims and be awarded attorney’s fees, and disgorgement of any funds received by Price and MMC, compensatory damages, punitive damages and exemplary damages.

Medinah never received $100,000 Canadian from Okanadian, it was received by MMC (pg 12)

Note that Medinah’s wholly owned subsidiary was an entity known as Medinah Mining Chile (or Sociedad Contractual Minera Medinah Mining Chile), not MMC Mines, Inc. which is a Canadian entity and Les Price is the sole owner and President of MMC.

MMC is not and never has been a subsidiary of Medinah.

The $100,000 was sent directly to MMC Mines.

Okanadian had purchased shares of Medinah on 30 other occasions, none of which had the impossible discounts alleged in this lawsuit.

As stated by Jak167, one of the strongest arguments in favor of Medinah (there are too many to briefly enumerate) is the impossibility requiring the tendering of 14 billion shares after conversion.

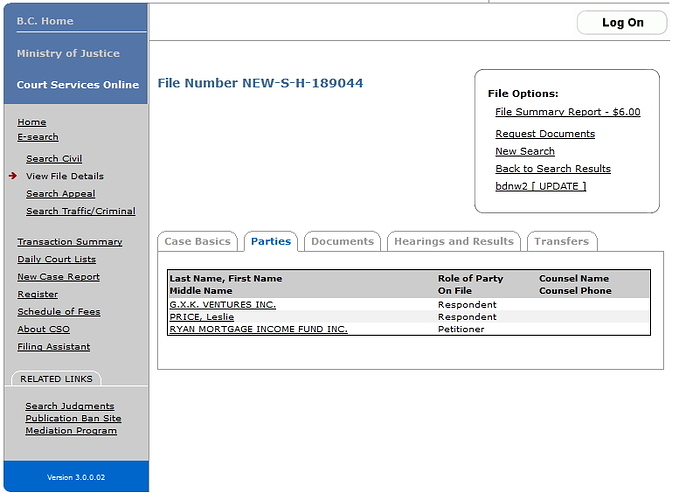

I expect discovery in this Okanadian case was very beneficial in not only filing for the removal of Kowarsky as counsel in the three suits filed in British Columbia, but may also result in dropping of the suits brought by GXK Ventures and Les Price for obvious reasons. I would hope that Medinah’s suit “Medinah Minerals vs. Les Price, Pamela Fitzpatrick, MMC Mines, GXK Ventures, et al.” would carry on and result in a judgement in favor of Medinah.