Today was a very good day for the PMs. I’m sure everyone trading noticed the VIX was over 30. Many are familiar with Bob Moriarity, but I thought I’d post the following excerpts from a recent blog for those who are not familiar with his blog posts. These are excerpts that caught my eye. On second thought, all 11 are useful, so after the 1st one, I’ll just outline the subject line:

Navigating Tumultuous Markets: 11 Lessons Learned Over Three Decades Of Trading

1 Mar 2022

- You don’t have to trade. Despite the always present temptation to trade, sometimes the best move is no move at all. Being patient and waiting for market conditions to improve can oftentimes be the most effective choice. Taking a step back can also help us to clear our mind and work on improving our trade setups, our trading psychology, and our trade criteria. You don’t have to catch every market move or buy every stock that’s making 52-week highs. In fact, you simply can’t. Being ok with ‘missing out’ is critical to an optimal trading mindset.

- Risk management is everything.

- Reduce your position sizing.

- The bigger your positions, the less room for error you have.

- Hold more cash than normal.

- Increase your focus by reducing noise.

- Commit to spending at least one hour of your trading day moving your body and getting outside.

- … respect your stops!

- You don’t need to know what’s going to happen next.

- Fundamentals don’t matter in the short term.

- Never trade on margin!

Greed kills. Margin kills. Just don’t do it.

The full blog is available here:

(Navigating Tumultuous Markets: 11 Lessons Learned Over Three Decades Of Trading, by @Goldfinger)

While gold and silver are central focus to everyone here, do pay attention to other sectors and commodities that are having excellent performance that have already been mentioned or overlooked (ev metals, oil, commodity etfs). I’m sure others have some in mind and perhaps can post favorite picks on this thread and make use of the Charts for Metals and Stocks 2022 thread.

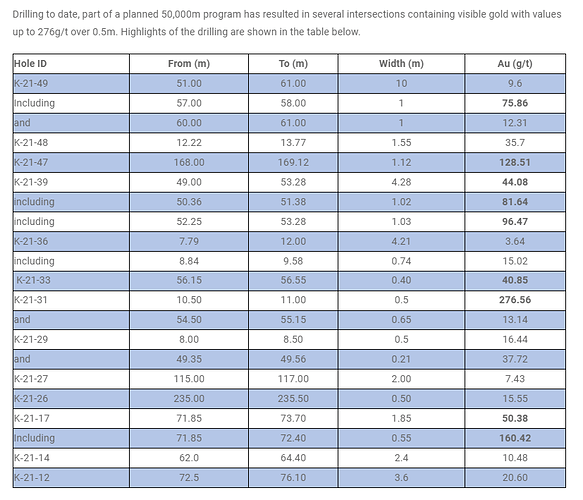

Labrador Gold (LAB) chart looking like a breakout is near with 5x recent volume traded yesterday. LAB holds properties in Newfoundland immediately adjacent on the northside of NFG’s spectacular Queensway gold project and are drilling (50,000 meters) on the same Appleton Fault. The last drill results were release Jan 15 and shareholders are expecting more drill results soon. I bought in at .87 a few weeks ago and I’m considering adding to my position.

2 Likes

Holy crap! Nickel halted by LME…now trading over $100,000

LME Suspends Nickel Trading After Prices Soar Past $100,000 | Investing News | US News

This is the nickel chart after yesterday…and it more than doubled since.

2 Likes

It’s better than that; after all KRR use to be strictly a nickel mine(previous name Royal Nickel) even when nickel was worth a small fraction of the price that it is now. I suspect they will start promoting the nickel aspect of it shortly. (They have 900,000 tons at almost 3% Nickel reserves all adjacent to existing mining tunnels so what $2.7 billion worth gross?) Upside potential here has more than doubled for sure. I’m inclined to just sit on my position for a bit longer. Expect a Major to either take a position or attempt to take over KRR.

4 Likes

Definitely Mike. I will continue to hold and just trade around a core position. Looks like KRR is gapping up again today. $6.60.

I have a large long position on this one as I’ve been accumulating since last year. Lots of DD on the website (https://blackrocksilver.com). I’m not trading this one because of it’s potential. It was very volatile with a range of (low 1.02)( hi 1.19) (BRC.V) and low - 0.8095 and hi - 0.9153 (BKRRF) today. Anyone daytrading this one? I’m not into day trading, but this stock had a lot of exposure on the old Other Mining Thread. Blackrock Silver is funded for the drill season. I may be swing-trading this a little later as drilling results come in throughout the summer.

TR, Chart when you have time please.

Please post chart on the Charts for Metals and Stocks 2022 thread.

Thanks,

EZ

1 Like

I don’t know how many noticed that the 11.6% nickel isn’t even in that 400 Meter extended length which was the main focus of the announcement HR posted. It is 1 kilometer away from the current reported drill results! It has yet to be explored and drilled.

The potential growth of the 50C and 10C nickel mineralization is not capped at the current strike length. A historic drill intersection of 11.4% Ni over 9.5 metres is located approximately 1 kilometre southeast of our current drilling, supporting our hypothesis that nickel mineralization may be significantly more extensive – an exciting prospect.

Karora is going to be a very profitable and exciting investment for many years at the rate it’s going.

For those who have been waiting for Novo to break out of its slump it looks like today will be the day. I bought some Novo on Tuesday. I believe there’s a chance for a tenfold gain in Novo over the next 12 weeks and a threefold gain in the next 6 weeks. . . very few stocks with valuation ratios like NOVO.

Wow! I’m really going out on a limb on this one

Valuation Ratios

Price/Earnings (TTM)

4.43x

Price/Sales (TTM)

3.43x

Price/Book (MRQ)

0.66x

Price/Cash Flow (TTM)

3.65x

Why today? I remain underwater on this but plan on sticking it out for better times ahead. Thanks.

If you look at the linear regression line on the weekly chart for Novo it looks simularly oversold as it did back on March 16 of 2020. Also, if you look at all the main technical indicators on the weekly chart they are all on the rise. Add to this a big difference between the bid and ask and it all made sense . . . at least to me

It is oversold or at least based on the info provided by the Company. One way or another, they do still need show that their mining operations is profitable which will validate their model for development for all the rest of it.

2 Likes

Metallurgical coal companies are getting some love lately.

HCC $41.53, METC $19.21, AMR $131.00.

The USA and Canada ships a lot of this type of coal out of country?

You guess where most of that goes…

History of metallurgical coal peaks have been during industrial expansion,

and in times of war.

So far, KRR has held up nicely even with gold price tanking. Any nice news surprises or some more positive movement of gold next week should help the cause. Still sitting on my position for a little longer.

1 Like

Remember Monday, March 14, 2022 (10:00am - 11:00am EDT):

Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to announce senior management will host a conference call / webcast on March 14, 2022 at 10:00 a.m. (Eastern Time) to discuss the Corporation’s fourth quarter and full year 2021 results.

Webcast Link

(https://produceredition.webcasts.com/starthere.jsp?ei=1532514&tp_key=a7ec892a2f)

Karora plans to issue a news release containing fourth quarter and full year 2021 results before markets open on Monday, March 14, 2022.

Expecting good news regarding Karora’s future rapid growth of nickel production with an increase of nickel by-product credits. This should reduce overall AISC gold production costs in future years.

EZ

1 Like

There are so many good mining companies to choose from as drilling season gets under way it is hard to highlight just one or two. Blackrock Silver Corp is certainly one of my favorites that I’m looking forward to doubling before the end of the year. See the chart I posted yesterday on the Charts for Metals and Stocks 2022 thread. First Majestic Silver clearly has an early interest as evidenced by a C$2.0 million Private Placement last year (part of a C$7M private placement). Earlier this month Eric Spott followed with a C$5M private placement.

With 110,00 metres of drilling completed at their flagship Tonopah West silver-gold project, the Company plans to deliver a maiden resource estimate by April 15th, 2022.

(Blackrock Silver Announces Inclusion Of The Victor Vein System Into Upcoming Maiden Resource Estimate At Tonopah West - blackrock silver)

Also read this summary from today, March 25, 2022 by Red Cloud:

1 Like

Have to mention Hot Chili again. They just delivered a large resource upgrade after some 50K+m of drilling and are at over 900M tonnes. They are on course for a PFS in late 2022. They have $30M+ in cash. And after their share consolidation their SP took a hit as is typical and they are sitting at only about $150M AU. If you are a long term copper investor this is starting to hit the size and likelihood of production that it is potentially good opportunity. They have Glencore and Chile’s PMP a investors.

HCH is an Australian company but the reosource is just up the coast from MDMN/AUMC. I am always surprised how little following they have received from the crowd here since it is at least in broad strokes, the very process the Alto would follow if ever it were to turn into a large copper mine.

The strike against the resource has been the relatively low grade which once was mostly around 0.5% CU. They’ve made good progress on defining a “high grade core” of the resource. And with the higher copper pricing, and the advantages of being near the Chilean coast at low altitude are probably going to overcome this complaint. But that is probably why the MC is only $150M Au at this point.

3 Likes

This is nice, but not really a surprise!

Karora Announces Updated Consolidated Gold Mineral Resource Highlighted by Maiden Gold Resource for the Larkin Zone at Beta Hunt; Consolidated Mineral Resource Now Totals 2.71 Million Measured and Indicated ounces and 1.21 Million Inferred ounces

Highlights:

- Beta Hunt Gold Measured and Indicated Mineral Resources increased by 7% to 1.12 million ounces and Inferred Mineral Resource increased by 46% to 786,000 ounces

- Significant Beta Hunt additions include:

- Maiden Larkin Mineral Resource comprising Measured and Indicated 1.44 million tonnes @ 2.6g/t for 119,000 ounces and Inferred 2.17 million tonnes @ 2.3g/t for 162,000 ounces

- On a consolidated basis Karora’s Gold Measured and Indicated Mineral Resource inventory increased by 8% to 2.71 million ounces net of mining depletion

- On a consolidated basis, Karora’s Gold Inferred Mineral Resources increased by 43% to 1.21 million ounces

- The expanded Mineral Resource further supports Karora’s Growth Plan to increase production to a targeted 185,000 - 205,000 ounces per annum by 2024

TORONTO, April 7, 2022 /CNW/ - Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) (“Karora” or the “Corporation”) is pleased to announce its Consolidated Gold Measured and Indicated (“M&I”) Mineral Resource, net of depletions, has increased by 8% and the Consolidated Inferred Mineral Resources have increased by 43%. The update is highlighted by the addition of the maiden Larkin Zone Mineral Resource at Beta Hunt which contributed 1.44 million tonnes @ 2.6 g/t for 119,000 ounces in the M&I category and 2.17 million tonnes @ 2.3 g/t for 162,000 ounces in the Inferred category.

(https://www.karoraresources.com/2022-04-07-Karora-Announces-Updated-Consolidated-Gold-Mineral-Resource-Highlighted-by-Maiden-Gold-Resource-for-the-Larkin-Zone-at-Beta-Hunt-Consolidated-Mineral-Resource-Now-Totals-2-71-Million-Measured-and-Indicated-ounces-and-1-21-Million-Inferred-ounce)

2 Likes