Another interview of Pierre Lassonde and his investments in Gold and mining stocks, only 18 minutes long on KWN:

Another good read for anyone following silver ETF …

So SIL’s silver-bull-market performance is going to seriously lag that of the best of the elite silver miners.

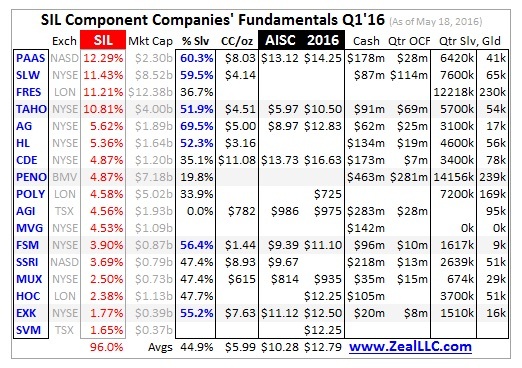

Silver Miners’ Q1’16 Fundamentals