People with street smarts know to go out and bring in people with the specialized skills they may not have, or need to beef up on their team. Sprott and Rule a case in point (IMO). I always take note of what Rick Rule has to say…follow the smart money is my motto

@TexHorn this is just my opinion but I would be extremely doubtful of an interest rate hike in June.

With BREXIT on the horizon, corporate earnings down and semi fabricated jobs/employment numbers, raising rates in June would be the equivalent with playing Russian roultette with 5 bullets. Look what a mere .25 raise did in December? Add to that many of the other countries are at zero or negative interest rates, and it’s an election year in which the democrats are trying to get re-elected it seems like the status quo is almost a full gone conclusion. I guess never say never with the fed though.

I’ll take a bet that they flap their gums some more and say they will probably look at it later in the year (with a caveat Ofcourse)

Based on my thesis I’ll be accumulating more of companies like MUX, AG, BRIZ etc in this “indecision period” as I think the metals will move after the fed renegs again. I think if rates are raised the metals will drop initially along with equities and then move even higher as institutions reduce positions in conventional equities and allocate more funds to metals.

I’m also betting on Britain exiting. The country is fed up (no pun intended) with immigration issues and holding the bag for weak nations.

My opinion only after listening to arguments from many much smarter than I

seriously this MXSG went up from $0.0015 on 1/21/2016 to $0.058 today? Man, just like our mdmn LOL

I don’t know how to link something, but go back 29 days, on this board, I suggested MXSG, I think HR played with it a bit as well.

Yes, that’s when I put it on my watch list. But I only watched it and did not do anything else with it.

You what they, a blind squirrel…

Been debating about unloading some MDMN and play the other PM stocks for a quick buck, then maybe come back in towards fall. Been flipping some PM stocks on their moves and adding to my positions with the increase…anyone else thinking along these lines?

I don’t have much MDMN, but then again, not a big penny player. Had a nice run with Mexus, well more than a nice run. I have been in Hecla for a while, missed MUX, but open to throwing out thoughts. There is well know mining group that has a very nice grade development project going in Mexico. They are doing reverse merge into a OTC shell, don’t know which one. If I hear anything, will post it.

This just hit my email. Lithium continues to be active, Clayton Valley is the holy land, although a buddy of mine thinks he found a similar deposit further north.

Noram Ventures (TSX-V: NRM) Acquires Additional Lithium Additional Lithium Claims in Nevada’s Clayton Valley

Thanks MiguelAU,

Is this the same podcast as found here:

Do you have a direct link?

It appears your podcast is considerably shorter!

First time I’ve ever heard Pierre Lassonde saying we’re going to get $10,000 gold and he even predicted a timeframe. Man’s a very astute company builder and investor. In the past he’s always appeared to me to be a moderate voice in those who own gold and mining companies. Can’t even imagine what that do too PM company valuations…bring on the crazy phase!

Easy, just go to the “podcast” app on your iPhone and search “wealth purpose show” and it’s the second or third episode down from the top. It’s around 3 hours. Some really interesting info including the legalities to carrying gold internationally.

Another interview of Pierre Lassonde and his investments in Gold and mining stocks, only 18 minutes long on KWN:

Another good read for anyone following silver ETF …

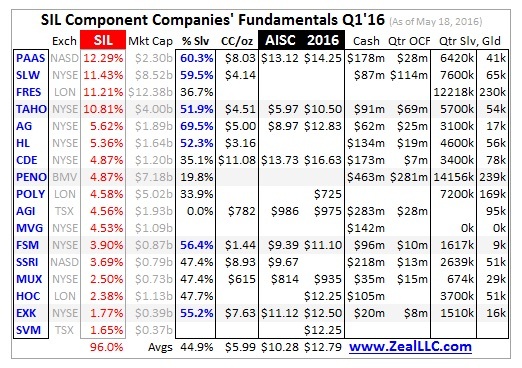

So SIL’s silver-bull-market performance is going to seriously lag that of the best of the elite silver miners.

Silver Miners’ Q1’16 Fundamentals

Are those typos on MUX and AGI cc/on and AISC?

I'm guessing those are their cash costs for gold equivalent. MUX I know states it that wayRick Rule:

The Difference Between Being Wrong and Being Early

Good watch.

I think it’s safe to say that anybody who bought this stock more than 3 years ago, myself included wasn’t early but wrong. Even though my initial entry point was 1.6 cents, 6 years ago, I certainly don’t feel “flat” on the investment. Opportunity cost is a bitch. Certainly feels like anybody who’s bought over the past 24 months might be early but not wrong