You are so right on bringing this one to the attention of the forum, Rick. Not a producer, but very promising drill results keep defining/expanding the deposit. I managed to squeeze a few more shares into my position based primarily on their drilling program and results.

Vancouver, BC, April 20, 2021: New Found Gold Corp. (“ New Found ” or the “ Company ”) (TSXV: NFG, OTC: NFGFF) is pleased to announce assay results from an additional seven holes drilled at the Keats Zone (“ Keats ”). These holes were drilled as part of the Company’s ongoing 200,000m diamond drill program at its 100%-owned Queensway Project (“ Queensway ”), located on the Trans-Canada Highway 15 km west of Gander, Newfoundland.

Highlights

· Highlights include:

- The outstanding interval of 261.3 g/t Au over 7.2m in Hole NFGC-21-137 yields a grade x width of 1,882 mg/t Au which is the highest result to date from the Keats drilling in terms of this metric, exceeding the 1,761 mg/t Au from the 92.7 g/t Au over 19.0m intersected in NFGC-19-01.

- Holes NFGC-21-137 and NFGC-20-57 provide further confirmation of the vertical extent of high-grade mineralization at shallow depths above the interpreted south-plunging dilational zone (Figure 1).

- Holes NFGC-20-60, 103, 106, and 114 continue build definition of high-grade gold mineralization to depth within the host Keats baseline fault zone (Figure 1).

- The Company has decided to increase the drill count at Queensway North from 8 to 10 drills. The 8th and 9th drills are on site and scheduled to start by the end of April, with the 10th drill anticipated to start by mid-May.

(Keats Infill Drilling Returns 261.3 g/t Au over 7.2m, Queensway Program Expanded to 10 Drills - New Found Gold Corp.)

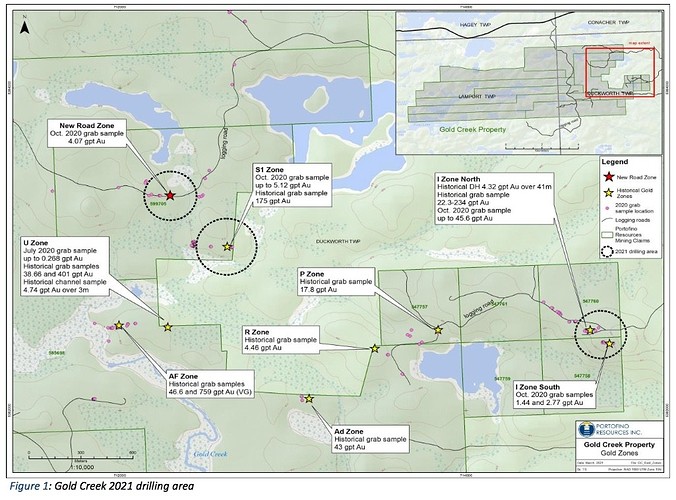

Anyone with a longer time horizon (or a quick flip?) may be interested in taking a look at Portofino Resources (TSX-V: POR | FSE:POTA | OTCQB: PFFOF). This is a very high-risk speculative nano cap company with a market cap of only about $10M. I will definitely have to re-evaluate the potential of this company by the end of the summer. It was added to the OTCQB in February of this year, but has been in existence since 2011. It could eventually develop into what is commonly referred to as a micro-cap (>$50M), but is quite far from that goal. It did a PP of only $140K a few weeks ago and an over subscribed financing of $630.5K last Nov (both at 0.10). I took a small starter position yesterday and today (basically a “watchlist” position), mostly to keep an eye on it, FWIW. Although I expect it to drift lower until mid-late summer, I may not be adding to it unless something really good develops. This company is a real long-shot that is being heavily promoted with frequent PRs. It had recent highs in the mid 0.20s in Feb and may repeat that. I expect there will be future financings to further exploration. Here are the the headlines for the PRs it has so far for this year:

2021

Apr 20, 2021

Portofino Resources Expands Lithium Focus; Acquires Allison Lake North Property, East of Red Lake, Ontario

Apr 9, 2021

Portofino Provides Drilling Update on the Gold Creek Project

Apr 6, 2021

Portofino Reports on Successful Geophysical Survey and Surface Sampling at Its Yergo Lithium Project, Catamarca, Argentina

Mar 30, 2021

Portofino Receives Encouraging Phase 2 SGH Gold-in-Soil Anomalies at the South of Otter, Red Lake Property

Mar 24, 2021

Portofino Closes $140,000 Private Placement

Mar 23, 2021

Portofino Reports Drill Crew Mobilized to Site - Gold Creek Project

Mar 19, 2021

Portofino Announces $140,000 Private Placement

Mar 18, 2021

Portofino Common Shares Now DTC Eligible

Mar 16, 2021

Portofino Receives Drill Permit, Engages Drill Contractor- Gold Creek Project

Feb 17, 2021

Portofino Completes Geophysical Survey - Yergo Lithium Project

Feb 4, 2021

Portofino Receives Approval to Commence Trading on the OTCQB

Feb 4, 2021

Portofino Receives Encouraging Phase 1 SGH Silver-Copper-VMS-in-Soil Anomalies at the South of Otter, Red Lake Property; Completes Phase 2 Program

Feb 2, 2021

Portofino Mobilizes Geophysical Survey Crew To Its Yergo Lithium Project

Jan 19, 2021

Portofino Plans Geophysical Survey on Its Yergo Lithium Project

Jan 13, 2021

Portofino Provides 2020 Summary And Early 2021 Plans

Jan 5, 2021

Portofino Receives Encouraging SGH Gold-In-Soil Anomalies At The South Of Otter, Red Lake Property

Share Structure as at April 1, 2021

· Issued and Outstanding Common Shares - 79,066,243

· Options - 4,233,750

· Warrants - 20,963,219

· FULLY DILUTED - 104,263,212

(https://portofinoresources.com)