Inventus Mining Files Technical Report on Pardo Project

August 07, 2018 16:15 ET | Source: Inventus Mining Corp.

TORONTO, Aug. 07, 2018 (GLOBE NEWSWIRE) – Inventus Mining Corp. (TSX VENTURE: IVS) (“Inventus” or the “Company”) is pleased to announce that it has received an updated technical report prepared in accordance with National Instrument 43-101 (“NI 43-101”) on the 100% owned Pardo Paleoplacer Gold Project located 65 km northeast of Sudbury, Ontario (the “Technical Report”).

The Technical Report dated August 3, 2018 is entitled “Technical Report on the Pardo Paleoplacer Gold Project Ontario, Canada” and was prepared by independent Qualified Persons (as the term is defined in NI 43-101) at Nordmin Engineering Ltd. in Thunder Bay, Ontario. The Technical Report is available for download on the Company’s website (inventusmining.com) and SEDAR (sedar.com).

Project Milestones

The previous technical report on Pardo was completed in 2015, and since then Inventus has accomplished six important milestones which are highlighted in the new Technical Report, including:

Consolidating 100% property ownership in Inventus,

Converting the core claims to a mining lease and upgrading the project to advanced exploration,

Completing the first 3D geological model of the property,

Processing the first one thousand tonne bulk sample that returned a calculated head grade to 4.2 grams per tonne gold,

Submitting the first mining permit application for the project in support of a 50,000 tonne bulk sample scheduled to begin later this year, and

Conducting the first quantitative risk assessment and estimation of the exploration target range.

Exploration Target Range

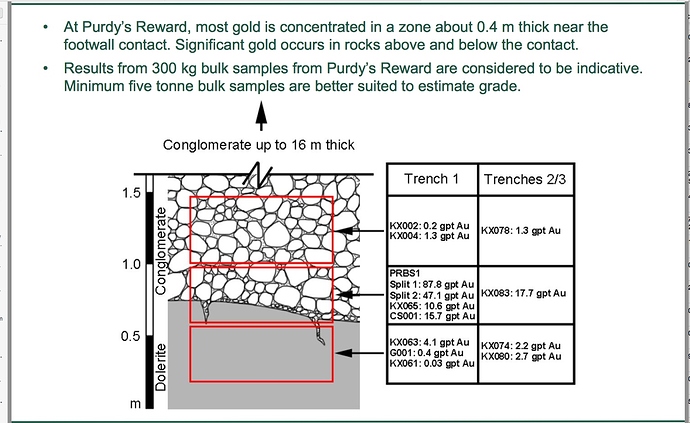

The Technical Report provides an assessment of the exploration target range for the Pardo Project using a quantitative approach that integrated the available drill holes, channel sampling, bulk sampling and geological information.

The exploration target range is expressed in terms of pessimistic, moderate and optimistic cases. Following the conventional use of such distributions, the 10th percentile (P10) defines a pessimistic case, the 50th percentile (P50) defines the moderate case, and the 90th percentile (P90) defines an optimistic case for the mineralized Mississagi Boulder Conglomerate unit.

The pessimistic case (P10) assumes that the mineralization is only confined to the zones that were bulk sampled and/or have extensive channel sampling and drilling at the Trench 1, Trench 2, 007, Godzilla, Eastern Reef and High Grade occurrences.

The moderate case (P50) assumes that approximately 50% of the mineralization defined is continuous within the boundaries of the mineralized Mississagi Boulder Conglomerate unit.

The optimistic case (P90) assumes that the mineralization between these zones is continuous and extends to the currently known boundaries of the mineralized Mississagi Boulder Conglomerate unit.

The P10, P50 and P90 range for the exploration target at the Pardo Project is rounded to reflect the inherent uncertainties and is shown in table 1-1.

Table 1-1: Exploration target P10, P50 and P90 ranges for the Pardo Project.

Parameter P10 P50 P90

Tonnage (t) 450,000 8,600,000 12,500,000

Gold Grade (g/t) 4.20 3.50 3.50

Metal Content (oz) 60,000 950,000 1,400,000

The tonnage, grade and contained ounces are conceptual in nature and are based on previous detailed surface mapping and drilling and channel sampling results that define the approximate thickness, depth and grade of the mineralized conglomerate unit.

These ranges are conceptual in nature since the Pardo Project requires further drilling and surface sampling to validate the geological and statistical assumptions used. Although all the technical assumptions are supported by the spatially limited drilling and available geological data at the time, further drilling may challenge these assumptions. As such, there has been insufficient exploration to define a current mineral resource and the company cautions that there is risk that further exploration will not result in the delineation of a current mineral resource.

About Inventus Mining Corp.

Inventus is a mineral exploration and development company focused on the world-class mining district of Sudbury, Ontario. Our principal asset is a 100% interest in the advanced exploration stage Pardo Paleoplacer Gold Project located 65 km northeast of Sudbury. Pardo is the first important paleoplacer gold discovery found in North America. Inventus has 106,971,069 common shares outstanding (117,265,235 shares on a fully diluted basis).