Frequent sensational PRs on this truly sensational clump of nuggets certainly affected the perceived value of this company’s stock price. Eric Sprott buying an additional 561,000 shares of RNC stock also gave a substantive boost of credibility for the future prospects of this find. Artemis closed up at 0.23 AUD on volume of 2,240,160.

RNX man she blew out of the gate this morning! Was hoping for a pullback…wonder if this is the mania stage (on a sidenote stockhouse is down to big volume. lol irrational exuberance comes to mind)

This guy does not like Artemis’ chairman !

Interesting read.

Artemis Resources, One Man Band and Flavor of the Week

Sounds like Brent doesn’t think RNX has enough gold to be worth investing in.FWIW

Novo - Quinton Hennigh Presentation

This was live streamed - 16:23

I think this opinion of the chair is partly why Artemis market cap is very low compared to say Novo. But Artemis has a new CEI and as far as I can tell he is getting things done and DL has faded into the background

TDid not live up to the hype. The Novo board on CEO.CA is so much like TMP was up to two years ago. They are squealing over there because they thought they were going ‘to the moon’ today. Some were discussing their new Ferrari’s etc they were going to buy etc.

You want to see a gong show at it’s finest…just go over to the RNX/RNKLF board on Stockhouse. Stocks on a tear, over $1 Cdn now…pumpers, shills, shorts the works. Kinda interesting case study

Up 104 % for the day

… Up +1,337.50% in one month and you are wondering? ![]()

Yes, irrational exuberance does come to mind!

Thanks for link CHG. Good cautionary post by @F6:

$RNX Major Red Flags

… The solution is for GFI to allow processing of the BETA Hunt gold ore at their St. Ives mill, without an NSR. But $RNX will still have to pay $MMX royalties, part of which goes back to GFI anyway. Obviously $RNX needs to table a mine plan and reverse split its shares 10:1. $RNX so far has strenuously avoided any declaration they have a mine. They have also kept drilling programmes completed under wraps.In addition to whether GFI will allow or simply refuse a toll milling agreement, there is no production coming out of the BETA Hunt mine, that was presumably having its ore toll milled at the South Kalgoorlie Operation, belonging to Northern Star Resources. Northern Star recently purchased the SKO from Westgold Resources in a cash and shares deal. The filings for RNC Minerals are impossible to sort out since the South Kalgoorlie Operation was bought outright.

CONCLUSION: What seems obvious under the circumstances is that the company had run out of money, not being able to rely on toll milling, and unable to sell ore boulders, because the specimen rock was deemed an artifact by the Australian Government. They were out of money completely, but should the considerable number of warrants be cashed, they will have available money to continue as a going concern. What was reported in the quarterly MD&A as production numbers were presumably pro-forma, probably in the same amount expected to be raised by warrants being cashed.

Just a stock of interest - FYI:

CHG - Quite a while ago you commented on Seabridge.

SeaBridge has 40M Oz formally delineated. Unfortunately it is all typical lower grade porphyry stuff. Mkt Cap of $10 / Oz!!

It moved up today 15.5%, mostly because it has over 7M shares short, IMO. I sold half my position today at a small profit. It looks to me as though it could move higher, eventually. Mkt Cap of $19 / OZ now?

TR- a chart if you have time. TIA

Their resource is immense and part of the incredible district / region that includes Pretium Resources deposit. Their problem is that their current PFS requires $5B to build a mine in the remote location, and only shows an 10.4% IRR at a gold price of $1250.

That $5B price tag for a mine is too much for any gold company. They have been looking for a partner for some time among the copper giants. But no one will take such a risk within an ongoing 7 year commodity bear market.

They really need considerably higher metals prices or to find a high grade zone somewhere like Pretium did and make a starter mine from that. Their news today was about the “Iron Cap” portion of their deposit which is somewhat higher grade, but still a rather deep porphyry.

Eventually some day it will be mined but not with prices where they are today. During the next copper bull market, potentially years off yet, this will probably go somewhere.

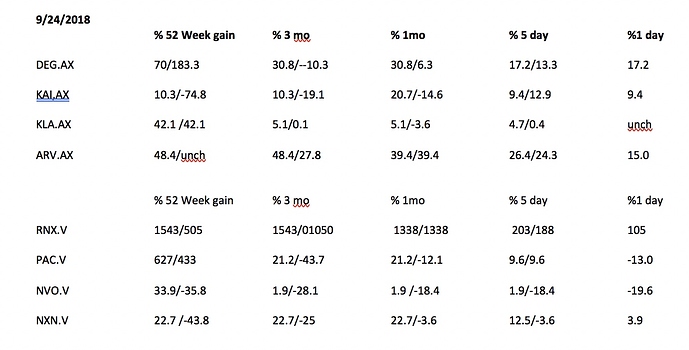

As a group, overall, the Canadian Pilbara plays did not fare well today.

The outlier exception was Royal Nickel RNX. After first day of Denver Gold Forum not much else to get excited about. NOVO Resources (NVO.V) had a rather dismal day.

note: %Gain or %Loss show below is computed from the period Low & period High (designated below as “gain or loss from period low/ gain or loss from period high”)

MUX at 3 min mark.

It’s The Invisible Bull Market, Says McEwen

Sep 24, 2018

(http://www.kitco.com/news/video/show/Precious-Metals-Summit-2018/2101/2018-09-24/Its-The-Invisible-Bull-Market-Says-McEwen#_48_INSTANCE_puYLh9Vd66QY_=http%3A%2F%2Fwww.kitco.com%2Fnews%2Fvideo%2Flatest%3Fshow%3DPrecious-Metals-Summit-2018)

“The S&P’s up 45% since the beginning of 2016, the Dow’s up 50%, and our own gold stock’s up 80%. And that’s the invisible bull market in gold because we’re not alone, there are other gold stocks that have been moving but the broad market isn’t paying attention to this, McEwen ”

All the Pilbara plays got whipsawed today. In the morning Artemis, Pacton, De Grey, et al were up in anticipation of news coming from Novo’s Quinton Hennigh’s presentation…expecting a PR or some bullish information. Instead they got a more cautious presentation which disappointed and spooked investors…Novo down 20% and dragged the others with it, though not as harshly.

MUX Weekly…

Repeating a familiar pattern…

It may take a while but I believe MUX will be back between 2.10 - 2.40 by the end of the year. Pure speculation based upon the similarity to the previous occurrence of this formation.

SAND Weekly

Appears to be in a bear flag, although holding a new uptrend line fairly well so far. If the bear flag plays out watch for tests of support around 3.47 and 3.20.

OROCF on the daily interval broke up out of a bullish wedge but is still in a downtrend. The first step for trend reversal is to overcome resistance at it’s previous swing high of 3.30 and get support above it…

Then it needs to break through both the downtrend line and the weekly 130 MA, currently at 3.41.