Dipped my toes in Royal Nickel today at .515 ©. I like this price point better than what it was a month ago.

Inventus Mining Drills Up To 62 g/t Gold on Surface at 007

These are excellent results for Inventus that bode very well for the subsequent bulk sample program at 007. Amazing that all of thiese holes are right at surface and just 3 meters deep. The low cost of extraction makes 007 VERY economical.

Using the ore sorting techniques for the early Trench 1 bulk sample program, the head grade improved from 1.2 to 3.4 g/t - an improvement of 223%.

The company states they expect a similar improvement in grade for this latest 007 bulk sample. With the weighted average grade of 3.4 g/t, this means the expectation is approximately 11 g/t. That is an excellent grade for at surface extraction.

I’m definitely stoked about Inventus. I’ve been buying in the .12 © range over the past few months (Along with insiders) and will continue to so with an elevated level of confidence. Can’t wait for the bulk sample program this Spring.

Maybe Rich could take another look at the KL chart if he has time. I added a few more shares today - FWIW.

An interesting end of the year - A look ahead to next year:

Pacton up big (36%) on almost 10x average volume. No news that I can find.

Yes, I was in the red until today, something positive in my portfolio lol

Are you even with APHA yet? Not sure what to make of everything. I believe they have a legit core business in Canada, but some insiders tried to pull a fast one in LATAM.

I was very green at $8 plus but end of day took a dip, I’m still green after averaging down at $6.40 yesterday, I have many friends that have been with this company for a while and at $15 plus it was out of my comfort zone at the time. However after these accusations I thought it could be a good entry level , these guys still stand strong that this is a legit company. Be an interesting play for a while with a tone of volume, thoughts?

Inventus…for those that haven’t looked into this one…I suggest you do. Few things with this investment that make it a shinning star in my mind in a sky full of black holes!

Some patience will be required but next year should be a good one for this company.

https://www.bnnbloomberg.ca/video/high-grade-gold-find-boosts-royal-nickel~1561499 Sometimes all that glitters is gold

KL been looking good of late!

To add…

a) Share structure looks excellent and current share price appears to represent good value. Price appears to be low due to the rest of the mining sector but also because some major holder selling a position over the last year. (110 Million Outstanding-share price 12 cents Canadian or about 10 1/2 cents US.)

b) The Company’s principal shareholder and main financier is none other than Robert McEwen.

c) Located in mining friendly Canada with property access via main road with year round exploration taking place.

d) The gold deposit is a paleo placer style at surface similar to the historically world’s richest gold deposits in S. Africa. (But at surface!) It appears to be first deposit of this type to be exploited in Canada.

e) High grade gold is located at or near the surface in 1 to 3 meter thick layers that often are stacked on top of each other. The aerial/horizontal dimensions are miles in all directions. The deposit can be strip mined.

f) The gold is free milling.

g) Exploration/mining costs will be below average.

h) Exploration is ongoing and active with exciting developments expected near term. http://www.inventusmining.com/

Thanks Mike,

Nice summary! A few here have been following progress on Pardo for quite a while. Below is a citation describing the region and also in depth geological information of the the Kirkland Lake properties. (FYI - I hold positions in both Kirkland Lake (KL) and Inventus.) Refer back to the Ontario Geological Survey document for more detailed information, tables and maps.

Guindon, D.L., Farrow, D.G., Hall, L.A.F., Daniels, C.M., Debicki, R.L., Wilson, A.C., Bardeggia, L.A. and Sabiri, N. 2016. Report of Activities 2015, Resident Geologist Program, Kirkland Lake Regional Resident Geologist Report: Kirkland Lake and Sudbury Districts; Ontario Geological Survey, Open File Report 6318, 106p.

SUDBURY DISTRICT—2015

The coarse and poorly sorted nature of both the Mississagi and Matinenda clastic rocks is interpreted to represent depositional environments that are proximal upper fan at both Trench 2 and the 007 Zone. At Silver Lake, however, the Mississagi Formation rocks are primarily well-sorted sandstones with numerous 5 cm to 30 cm thick pebble horizons (Photo 1d). This type of deposit is consistent with a more distal depositional environment, part of the lower mid-fan environment. The 6 km distance between the Trench 2 and Silver Lake gold occurrences, with very limited bedrock exposure, could offer good potential of additional significant mineralization. In the Witwatersrand placer deposits, gold is most abundant in the upper mid-fan conglomeratic sandstone environment (Pretorius 1975). At the Pardo Property, this environment is interpreted to occur between the Trench 2/007 Zone area and the Silver Lake area.PARDO PROPERTY GEOLOGY

Bedrock of the Pardo JV Property includes small inliers of Archean metasedimentary and metavolcanic rocks unconformably overlain by clastic sedimentary rocks of the Paleoproterozoic Huronian Supergroup. All of these rocks are intruded by Nipissing diabase intrusions (Figure 10).

On this property, the clastic rocks of the Huronian Supergroup appear to host paleoplacer-style gold mineralization. The Huronian Supergroup’s potential for this style of mineralization was first put forward by Robertson (1976). The world’s most prolific gold mining district is the Witwatersrand, a (modified) paleoplacer. On the Pardo JV property the Huronian rocks that are gold mineralized belong to the Matinenda and Mississagi formations (W. Whymark, Investus Mining Corp., personal communication 2015; see Figure 10).PROPERTY HISTORY

Endurance first found gold on the Pardo Property in 2006. Gold has been identified in both the Matinenda and Mississagi formations both outside the property (Long and Lloyd 1983) and within it (W. Whymark, Investus Mining Corp., personal communication, 2015). To date, the most abundant gold accumulations found on the property are in the conglomerate near the base of the Mississagi Formation just above the unconformity that separates this formation from the older, underlying Matinenda Formation. In the Mississagi Formation, gold has been found over a 6 km strike length.

In 2011 Endurance entered into a joint venture agreement with Ginguro Gold Corporation (now Inventus) wherein Ginguro could earn percentage ownership of the property by conducting exploration activities on the property. At the time of the property visit and the writing of this report, Endurance owned 35.5% interest in the property and Inventus owned 64.5% interest in the property. Inventus also owned 100% interest in other mining claims outside of and contiguous with the Pardo JV Property (see Figure 11).PROPERTY VISIT

On August 24, 2015 staff from the Sudbury District Geologist and Kirkland Lake Resident Geologist offices were given a tour of the Pardo JV Property by Inventus geologists Wesley Whymark and Mark Hall. The tour began at the Trench 2 stripped area in the northern part of the property (Stop 1 in

Figure 10), proceeded to the ‘007 Zone’ stripped area (Stop 2 in Figure 10) and concluded at the Silver Lake stripped area located south of the Pardo JV Property in the wholly Inventus-owned Pardo Property (Stop 3 in Figure 10).The Trench 2 area of the ‘Eastern Reef’ at the north end of the property (Stop 1 in Figure 10) is where gold was first identified. Originally, all the mineralization was interpreted to be hosted in the Mississagi Formation. Drilling, stripping, grid-mapping and stratigraphic studies were completed on the outcrops. As a result, the stratigraphy of these rocks has been refined showing that both the Matinenda and Mississagi formations contain highly anomalous gold values in some of the stripped areas. These formations are in unconformable contact for much of the Trench 2 area (Photo 1a). At the south end of the stripped area, however, the Matinenda Formation is absent, leaving the Mississagi Formation in unconformable contact with the underlying Archean-aged metavolcanic and metasedimentary rocks (Photo 1b).

A few hundred metres to the south-southwest, the 007 Zone stripped area was the location of the second stop (Stop 2 in Figure 10). The Mississagi Formation conglomerates exposed in the 007 Zone host consistently high-grade (ranging up to 67 g/t) gold throughout the exposure. At this location, the

31Mississagi Formation is approximately 2.5 m thick and is exposed in an area of approximately 1000 m2. A late brittle thrust cutting the stripped area juxtaposes more pyritiferous (and rustier looking) conglomerate on the east and upthrust side against somewhat less pyritiferous rocks on the western downthrown side (Photo 1c). The fault strikes 010o and dips 60oE. Both sides of the fault are gold mineralized, however the eastern (less pyrite rich) side of the fault yields slightly higher gold grades. A grab sample, 15DLG021A, was taken from the pyritiferous zone and submitted to GeoLabs for analysis. Results returned a value of 1.007 g/t gold.

The Silver Lake stripped area (Stop 3 in Figure 10) exposes bedrock over an area 130 m long and 15 m wide. The exposures dip close to 10o south at approximately the same orientation as bedding. Surface irregularities reveal different beds. Most of the exposure comprises well-sorted, planar-bedded sandstone of the Mississagi Formation. Narrow (5 cm to 15 cm) conglomerate interbeds within the sandstone (Photo 1d) host interpreted detrital gold mineralization. Conglomerate beds run a fairly consistent 10 g/t (±3 g/t) gold (W. Whymark, Investus Mining Corp., personal communication, 2015). Between 15 and 20 distinct conglomerate horizons have been identified in this thick sequence of interbedded sandstone and conglomerate. A grab sample, 15DLG022A, was taken from one of these conglomerate horizons and submitted to GeoLabs for analysis. Results returned a value of 1.315 g/t gold.

Mississagi Formation is approximately 2.5 m thick and is exposed in an area of approximately 1000 m2. A late brittle thrust cutting the stripped area juxtaposes more pyritiferous (and rustier looking) conglomerate on the east and upthrust side against somewhat less pyritiferous rocks on the western downthrown side (Photo 1c). The fault strikes 010o and dips 60oE. Both sides of the fault are gold mineralized, however the eastern (less pyrite rich) side of the fault yields slightly higher gold grades. A grab sample, 15DLG021A, was taken from the pyritiferous zone and submitted to GeoLabs for analysis. Results returned a value of 1.007 g/t gold.

The Silver Lake stripped area (Stop 3 in Figure 10) exposes bedrock over an area 130 m long and 15 m wide. The exposures dip close to 10o south at approximately the same orientation as bedding. Surface irregularities reveal different beds. Most of the exposure comprises well-sorted, planar-bedded sandstone of the Mississagi Formation. Narrow (5 cm to 15 cm) conglomerate interbeds within the sandstone (Photo 1d) host interpreted detrital gold mineralization. Conglomerate beds run a fairly consistent 10 g/t (±3 g/t) gold (W. Whymark, Investus Mining Corp., personal communication, 2015). Between 15 and 20 distinct conglomerate horizons have been identified in this thick sequence of interbedded sandstone and conglomerate. A grab sample, 15DLG022A, was taken from one of these conglomerate horizons and submitted to GeoLabs for analysis. Results returned a value of 1.315 g/t gold.

http://www.geologyontario.mndm.gov.on.ca/mndmfiles/pub/data/imaging/OFR6318/OFR6318.pdf

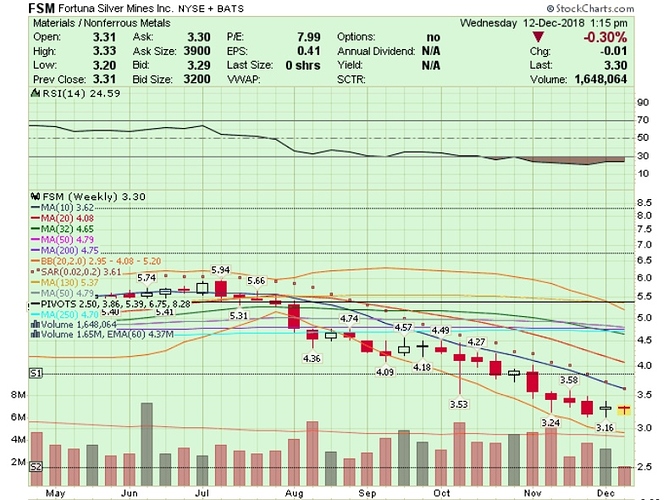

FSM declined sharply with the decline in silver prices and has been oversold a while. Peaked at $9.75 back in 2016. Looks to me that it may be forming a bottom and worth keeping an eye on. (FYI - I recently added to my long position.) Below is a weekly and daily chart.

Thanks for that additional info on Inventus/Pardo. To give those explanations of the property more perspective, here is a video from 2012 when Inventus was called Ginguro. It is a great tutorial of paleo-placer deposits as well as the specific Pardo property, narrated by Dr. Lawrence Mintner, the foremost authority on paleo-placer deposits, expert on the Witswatersrand deposit in South Africa, and Special Advisor to Inventus since 2011.

The Kirkland Lake connection is most likely why Eric Sprott took a position in Inventus a couple years back. As I’ve always maintained, when you have a company/property with investors of the likes of Rob McEwen, Eric Sprott and Osisko Mining, it’s probably a safe bet to hitch your wagon to theirs. I know I have.

HR, isn’t this the one that’s tough to trade due to being on foreign exchange?

Yes. It trades on Toronto Venture exchange with the symbol IVS. US investors can buy it through the pink sheets as GNGXF. The stock is thinly traded so it isn’t the type of stock you trade or flip. It’s definitely a buy-and-hold. In the past I’ve had to call in my trades on GNGXF to a broker. I opened up an Interactive Brokers account so that I could trade Canadian issues.

My out play on this one is when Inventus is purchased by a larger junior (most likely McEwen Mining, Osisko or Kirkland Lake) and the shares are converted into the acquiring company. There are reasons that any of those 3 would be interested, but most likely MUX.

First, the company has to validate the economic feasibility of the Pardo project with the next phase of a 50k tonne bulk sampling program combined with ore sorting in Spring 2019. From my email exchanges with Stephan Spears, he described the ore sorting as a “game changer” as ore sorting improved the head grade by 225%.

In last years’ bulk sample program at “Trench 1”, the original gold grade from drilling was 1.3 g/t. But after ore sorting the bulk sample, the head grade improved to 4.2 g/t. This is all at surface and less than 3 meters deep. In the recent drilling at the “007 Zone” in preparation for the expanded 50k tonne Spring 2009 bulk sample program, the gold grade had a weighted average of 3.4 g/t. Inventus is expecting similar results from this bulk sample program which would equate to a head grade of over 11 g/t. An announcement of a bulk sample of 11 g/t at surface will certainly turn heads. I believe that is when MUX will pounce on Inventus.

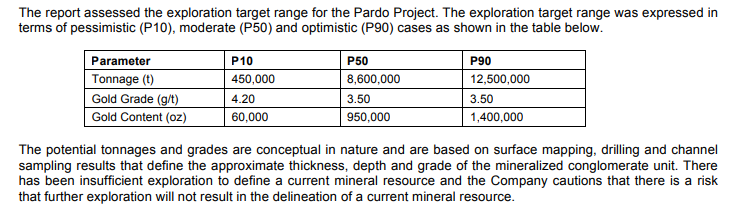

In Inventus’ recent technical report, they hypothecated the following:

In the pessimistic case of 60k oz, that equates to $72 million at $1,200/oz.

In the moderate case of 950k oz, that equates to $1.14 billion at $1,200/oz.

In the optimistic case of 1.4m oz, that equates to $1.68 billion at $1,200/oz

If the moderate case is viable, then that it is over $1.14 billion at surface. The all-in sustaining costs to extract an ounce of gold on the property will be extremely attractive even for a moderately sized deposit.

Thanks, HR! That was a helluva lot more detailed answer than I was expecting but much appreciated. I’ll look into it ASAP.