Karora Resources Announces Share Consolidation Effective as of Market Open on July 31, 2020 and Partial Monetization of Orford Mining Position

News Release Issued: Jul 30, 2020 (5:10pm EDT)

TORONTO, July 30, 2020 /CNW/ - Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to report, further to its news release dated July 22, 2020, the previously announced consolidation of the common shares in the capital of the Corporation (the “Common Shares”) will come into effect as of the open of trading on July 31, 2020 on the basis of one (1) post-consolidation Common Share for every four and a half (4.5) pre-consolidation Common Shares (the “Consolidation”). Prior to the Consolidation, approximately 648,700,031 Common Shares were issued and outstanding. Following the effective date of the Consolidation, approximately 144,155,562 Common Shares will be issued and outstanding. No fractional Common Shares will be issued as a result of the Consolidation. Any fractional Common Shares resulting from the Consolidation will be rounded up to the next higher whole number if the fraction is a half (0.5) Common Share or greater, and rounded down, without compensation, to the next lower whole number if the fraction is less than a half (0.5) Common Share. As a result of the Consolidation, the Corporation’s outstanding warrants will be proportionately adjusted such that four and a half (4.5) warrants are now exercisable for one post-Consolidation Common Share at an exercise price of $2.25 per Common Share. Proportionate adjustments will also be made to the Corporation’s other convertible securities.

The Consolidation has been approved by the Toronto Stock Exchange. The Corporation’s symbol remains KRR. Computershare Investor Services Inc. (“Computershare”) has mailed letters of transmittal to the Corporation’s registered shareholders providing instructions on exchanging share certificates and DRS advices representing pre-Consolidation Common Shares for share certificates and DRS advices representing post-Consolidation Common Shares. Shareholders are encouraged to send their completed letter of transmittal, together with any share certificates representing pre-Consolidation Common Shares, to Computershare in accordance with the instructions in the letter of transmittal.

Sale of shares of Orford Mining Corporation

The Corporation also announced today that it has agreed to sell, directly and through a wholly-owned subsidiary, 11,251,456 common shares (“Shares”) of Orford Mining Corporation (“Orford”) at a price of $0.09 per share for aggregate consideration of $1,012,631. The Corporation currently owns or controls 22,502,911 common shares and warrants to purchase up to an additional 1,095,505 common shares of Orford representing an approximate 23.6% interest in Orford on an undiluted basis and 24.5% on a partially diluted basis. Immediately following the completion of this sale, the Corporation will own or control 11,251,455 common shares and warrants to purchase up to 1,095,505 common shares, representing an approximate 11.8% interest in Orford on an undiluted basis and 12.8% on a partially diluted basis. The Corporation disposed of the Shares of the Orford for investment purposes only. The Corporation intends to review, on a continuous basis, various factors related to its investment, including (but not limited to) the price and availability of the securities of Orford, subsequent developments affecting Orford or its business, and the general market and economic conditions. Based upon these and other factors, the Corporation may decide to purchase or sell securities of Orford. For additional information, an early warning report will be filed on SEDAR under Orford’s profile or may be obtained by contacting the contact person listed below for the Corporation.

About Karora Resources

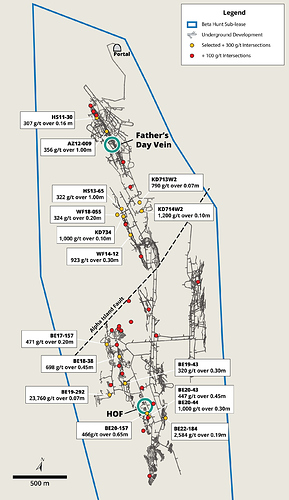

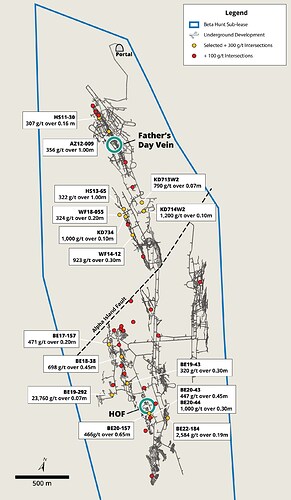

Karora is focused on growing gold production and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations (“HGO”) in Western Australia. The Higginsville treatment facility is a low-cost 1.4 Mtpa processing plant which is fed at capacity from Karora’s underground Beta Hunt mine and open pit Higginsville mine. At Beta Hunt, a robust gold mineral resource and reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial historical gold resource and highly prospective land package totaling approximately 1,800 square kilometers. Karora has a strong Board and management team focused on delivering shareholder value. Karora’s common shares trade on the TSX under the symbol KRR. Karora shares also trade on the OTCQX market under the symbol KRRGF.