My NVO average is still a little underwater, but not by much at 2.12. My last couple of share traunches was like HR’s @ 1.75 back in December. Looking sweet today, indeed! ![]()

I’ve done much better with Karora with an overall average purchase price of 1.84. I think I’ll be very happy with these two by year’s end and beyond.

Rich, great to see you have some good luck! That MUX was just a heart breaker - I empathize, because it’s happened to me before. Glad to see it!

I think McEwen is a great CEO, thinking outside the box. I was reading a story the other day about how back in 2005 he was PRODUCING GOLD in GoldCorp but decided to NOT remit his production to the market and store it instead for when gold, as he predicted, would go from about 400.00 to 800.00 per ounce. It happened - smart guy.

I actually think Quinton Hennigh is out of the same mold - that guy ain’t messing around. There will be some ups and downs along the way, but Novo is looking really good. We’ll see.

Does anyone here follow RMRDF Radisson Mining Resources. I started buying it a year ago around .15 it ran to .30 and then back off to below .25 where I started buying it again the last few days. This stock came to my attention when I heard Rob McEwen was directly investing in this stock and also via a charitable trust repeatedly. Radisson also has been announcing very interesting drilling results repeatedly and made another announcement today. They also have been repeatedly raising funds for their ongoing drilling programs mostly via private placements. Today they announced the following: https://www.radissonmining.com/press-releases/24gt-au-gold-3-metres-resource-boundary-high-grade/

Any input from anyone that follows this one would be appreciated.

Would Radisson Mining Resources be considered a grey market stock ? yes

Looks like Karl talked me into buying a smattering of it at .23252. I had to call Ameritrade for the ask price otherwise you’re flying blind when you place your order.

P.S. Thanks Karl. I believe we’re gonna make some money on this one

I believe it is Bulletin Board, it says OTC markets.

I hope I did not talk you into anything. I am actually somewhat amazed how their drilling results have been going that is why I was asking if anyone follows this stock . I wanted to get more opinions since I was wondering why it has not been moving faster. I am guessing it is not on too many radar screens.

Actually Karl I did a quick study on it before buying. Very impressed with their drilling results, and their management. When I said you talked me into buying it I just wanted someone to blame if the stock goes south.

That is what I was afraid of, lol

Novo up another 13% so far today. Knowing that they’d be pouring their first gold bars this quarter (and more specifically/likely this month), averaging down over the past several weeks was one of the easiest and stress-free financial transactions I can recall in recent memory. Most of the time you have to hold your nose or just hope/pray that you’re not making a mistake, but in this case the only thing holding me back from buying more was just that I didn’t want to overweight my portfolio into one stock. Otherwise it was a complete no-brainer. This should run to $3,00 (NSRPF) on the news or leading up to it.

I have an “old” existing position in Oceanagold that is “underwater” that I added to yesterday averaging down. It had a recent news release that caught my eye for those that may find it of interest. A detailed NR can be found at the link cited below:

OceanaGold Intersects Additional High-Grade Gold Mineralisation at WKP in New Zealand

Mr. Michael Holmes reports:

BRISBANE, Australia, Jan. 25, 2021 /CNW/ - OceanaGold Corporation (TSX: OGC) (ASX: OGC) (the “Company”) announces several additional significant intersections of high-grade gold and silver mineralisation at the Company’s WKP (Wharekirauponga) prospect in New Zealand. The drill results reported herein are exclusively from the Company’s 2020 drill program along the East Graben vein zone.

Significant Intersections (true widths)

- 22.8 g/t Au and 39.0 g/t Ag over 48.9 metres

- 169.0 g/t Au and 164.2 g/t Ag over 3.1 metres

- 45.6 g/t Au and 81.5 g/t Ag over 2.2 metres

- 41.4 g/t Au and 81.6 g/t Ag over 9.0 metres

- 52.2 g/t Au and 28.8 g/t Ag over 3.6 metres

Some more Karora news. As been the case lately, nothing seems to happening share price wise. I’m guessing somebody has been unloading a large position for awhile now?

Oceanagold Corp Price Target Raised to C$2.85/Share From C$2.65 by CIBC World Markets

C$2.85 ='s $2.24. It’s $1.76 as we speak.

I thought this interview interesting and worthwhile to listen to, but I’m very biased, largely due to my overweight position in this equity. What I really like about this company is that it is well run and produces doré bars. This has an advantage over companies producing concentrate which is most commonly contracted out and not tied to the spot price of silver. AG can store doré bars for future sale when prevailing market price is favorable.

(https://youtu.be/FavUc6kojTs)

In this no holds barred exclusive interview with our Daniela Cambone, Keith Neumeyer, CEO of silver miner First Majestic ($AG), speaks out for the first time since the silver squeeze. “I don’t like seeing that happen, it’s not healthy,” he says, referring to the share price’s explosion through the $30 mark. Neumeyer also emphasizes the insufficiency of the metal to meet the demand of popular silver ETFs such as the $SLV, calling it “a complete joke.” Back in November, the investor had forecasted a collapse of the gold/silver ratio. Since then, it has shrunk from over 100 to 67— and now he predicts it will come down even more.

The stock was recently heavily shorted, presently at about 10%. The interview touches upon the recent GME short squeeze. Keith Neumeyer then goes on to state the inflow to SLV recently was 110 million OZ over a couple of days. Neumeyer emphatically makes the point there is no horde of that size on which to draw that amount of physical silver. There is too much of a paper silver market to have a fair pricing mechanism. He explains for every 8 ounces of silver mined there is one ounce of gold mined, yet the gold to silver ratio has been trading around 70:1. The natural occurring ratio is actually more like 16:1, but because miners are not fairly rewarded, the actual amount of silver mined to gold is holding about 8:1.

‘

This was also an interesting and informative interview:

(https://youtu.be/mnnOpf218pM)

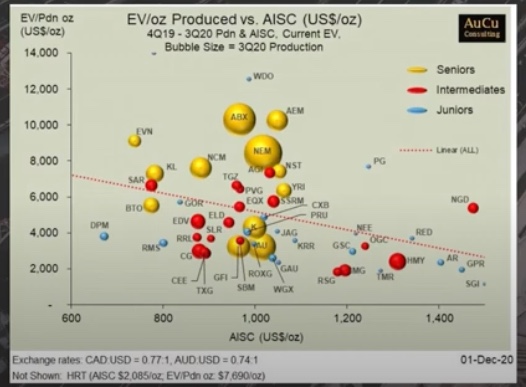

This simple graphic chart appears at about the 18:50 minute mark and is explained in the interview.

It captures a great deal of information. The annulized all in sustaining costs using Q4 2019 to Dec 2020 shows the worth of each ounce of gold produced specific to each company.

Novo Announces Inaugural Commissioning Gold Pour at Beatons Creek Gold Project

11:09 am ET February 16, 2021 (Globe Newswire) Print

Novo Resources Corp. (“Novo” or the “Company”) (TSX: NVO & NVO.WT; OTCQX: NSRPF) is pleased to announce that it has poured its first gold bar from the Company’s Beatons Creek gold project (the “Project”) in Nullagine, Western Australia (Figure 1 and Figure 2).

The Company’s inaugural commissioning gold pour was achieved following refurbishment of the Golden Eagle mill and rapid development of the Project, both of which have been completed on time and under budget.

Fortitude Gold - FRTT - started trading today. They only have 20M shares outstanding. They have stated they expect to focus on a bold dividend policy as GORO did at their founding (around 2009/2010).

Data Points:

- FRTT is a spin off from Gold Resource Corp of their Nevada mine and operations.

- The Nevada mine consists of an small open pit gold mine that GORO built in 2019 and started operating and ramping up in 2020.

- In Q3 2020 they mined 7847 Oz of gold (a 31,388 Oz / yr rate) in the Nevada operations. But GORO has already stated expect to produce 40,000 Oz from the Nevada mine in 2021 and for about 5 or 6 years following.

- In Q3 2020 their ASIC was $945 for the Nevada operations.

This implies 40KOz @ ($1800 - $945) in profit = $34M in profit approximately, or $1.70 / share. A 50% dividend payout would be $0.85 / share dividend. It is unknown what their payout rate will actually be. Their land package is large but they should be able to expand resources with modest exploration. And you can only expend so much exploration money at a time and not waste it.

Closing today was $3.28 for a market cap of $66M, for a 40 KOz producer with dividend expected.

Right now FRTT is in a quiet period since they just started trading. They will be out of this period in late March when they will start issuing news again.

Not a recommendation. Just bringing it to the attention of fellow travelers on the Alto ship.

Anyone in or looked at USA.T…think it might be USA symbol in states to? I see Pierre is in for 5% and Sprott for 20%

Elrac ,

American Gold and Silver Corp. ( USAS ) seems to me to be one of the better values out there. It’s listed on the American Exchange and is currently priced at $2.89 per share. I own a few shares of it. Wish I owned more.

****Silver Elephant Major New Silver Discovery: Sunawayo SWD001 drills 137 meters of 36 g/t silver from 0 meters depth; **; D002 drills 31m of 67 g/t AgEq

A lot more to come.

Karora: According to Ameritrade their P/E is now 7.25 with earnings of .40 per share.

Drilling at Spargos Reward Extends High Grade Gold Plunging Shoot to Over 300 metres Down-Plunge With Intersection of 6.1 g/t Over 14 metres as Resource Definition Drilling Completed Ahead of Resource Update